Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need done asap The bookkeeper of Cinnamon Ltd. who is usually responsible for the bank reconciliation is on holiday. Before she left she asked you

need done asap

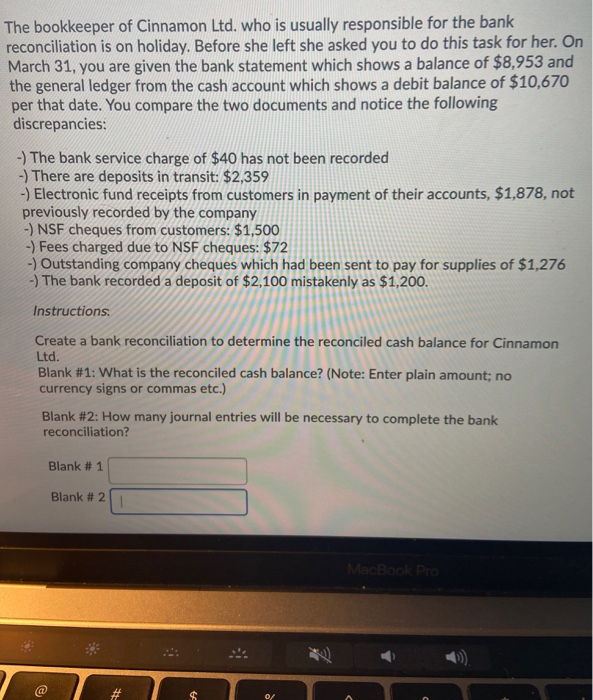

The bookkeeper of Cinnamon Ltd. who is usually responsible for the bank reconciliation is on holiday. Before she left she asked you to do this task for her. On March 31, you are given the bank statement which shows a balance of $8,953 and the general ledger from the cash account which shows a debit balance of $10,670 per that date. You compare the two documents and notice the following discrepancies: -) The bank service charge of $40 has not been recorded -> There are deposits in transit: $2,359 -) Electronic fund receipts from customers in payment of their accounts, $1,878, not previously recorded by the company -) NSF cheques from customers: $1,500 -) Fees charged due to NSF cheques: $72 -) Outstanding company cheques which had been sent to pay for supplies of $1,276 -> The bank recorded a deposit of $2,100 mistakenly as $1,200. Instructions: Create a bank reconciliation to determine the reconciled cash balance for Cinnamon Ltd. Blank #1: What is the reconciled cash balance? (Note: Enter plain amount; no currency signs or commas etc.) Blank #2: How many journal entries will be necessary to complete the bank reconciliation? Blank # 1 Blank #2 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started