Answered step by step

Verified Expert Solution

Question

1 Approved Answer

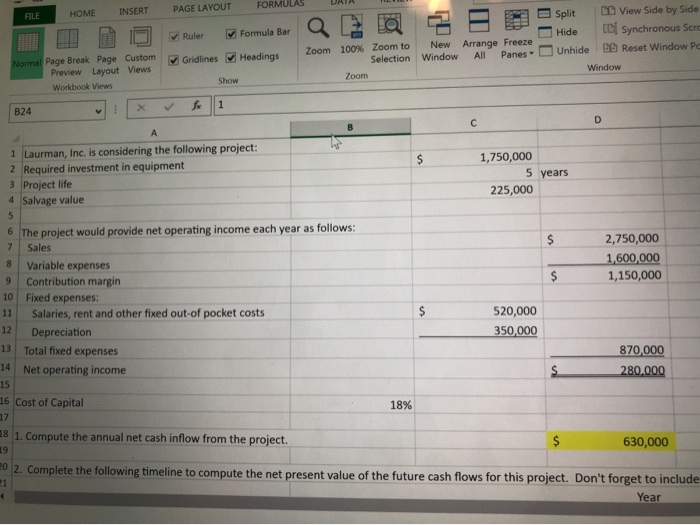

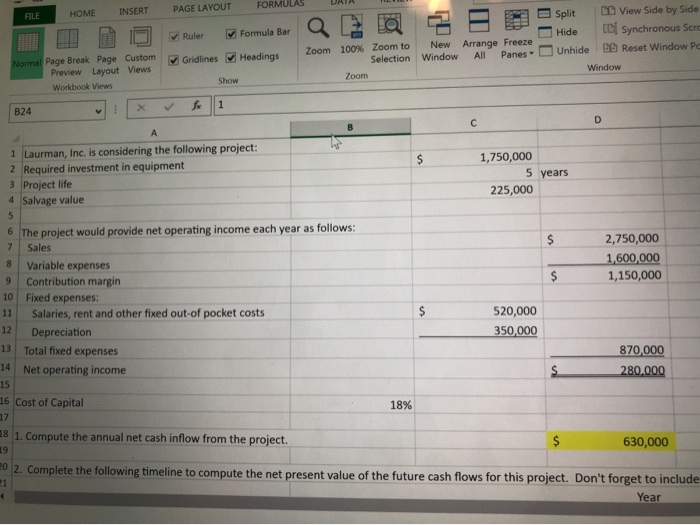

Need Excel formulas FORMULAS INSERT PAGE LAYOUT HOME FILE Split Hide Q Formula Bar CD View Side by Side DI Synchronous Sere O Reset Window

Need Excel formulas

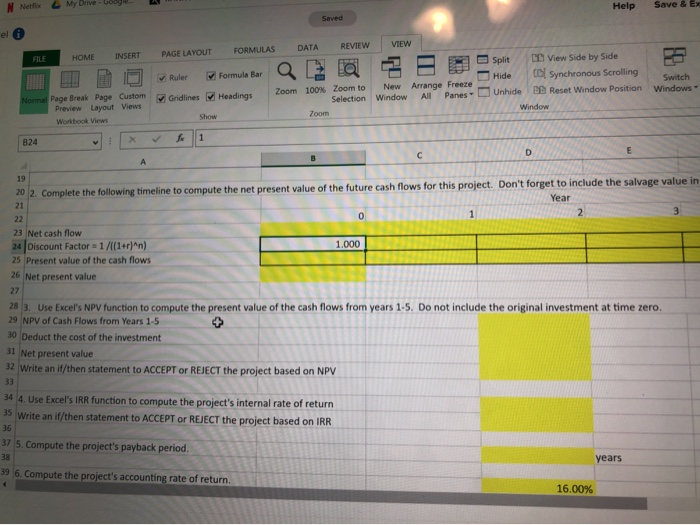

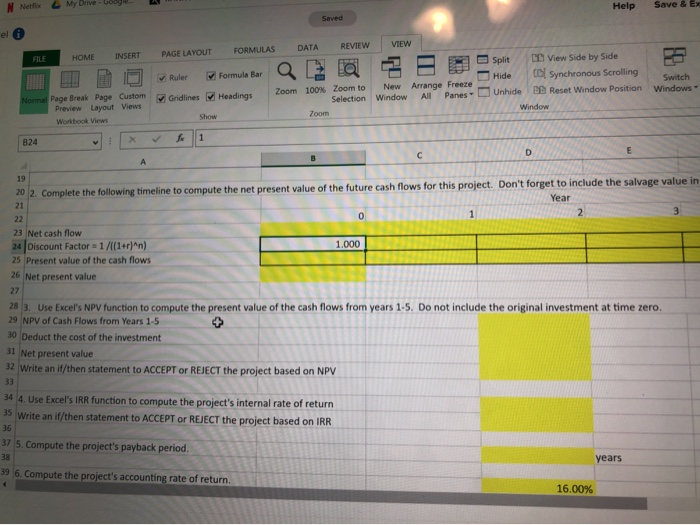

FORMULAS INSERT PAGE LAYOUT HOME FILE Split Hide Q Formula Bar CD View Side by Side DI Synchronous Sere O Reset Window Pe Ruler Unhide Gridlines Headings Zoom 100% Zoom to New Arrange Freeze Selection Window All Panes - Zoom Normal Page Break Page Custom Preview Layout Views Workbook Views Window Show V S 1 B24 D 1 Laurman, Inc. is considering the following project: 1,750,000 2 Required investment in equipment 5 years 3 Project life 225,000 4 Salvage value 5 6 The project would provide net operating income each year as follows: 7 $ Sales 2,750,000 8 Variable expenses 1,600,000 9 Contribution margin $ 1,150,000 10 Fixed expenses: 11 Salaries, rent and other fixed out of pocket costs 520,000 12 Depreciation 350,000 13 Total fixed expenses 870,000 14 Net operating income $ 280.000 15 16 Cost of Capital 18% 17 18 1. Compute the annu I net cash inflow from the project. 19 $ 630,000 20 2. Complete the following timeline to compute the net present value of the future cash flows for this project. Don't forget to include 21 Year $ 1 Netti My Drive Help Save & EX Shved el DATA FORMULAS REVIEW VIEW FILE PAGE LAYOUT HOME INSERT Split Hide Ruler Formula Bar O View Side by Side Synchronous Scrolling BD Reset Window Position Switch Windows Unhide Gridlines Headings Normal Page Break Page Custom Preview Layout Views Workbook Views Zoom 100% Zoom to New Arrange Freeze Selection Window All Panes Zoom Window Show 1 824 D E 21 1 19 20 2. Complete the following timeline to compute the net present value of the future cash flows for this project. Don't forget to include the salvage value in Year 0 2 22 23 Net cash flow 24 Discount Factor = 1/((1+r)^n) 1.000 25 Present value of the cash flows 26 Net present value 27 28 3. Use Excel's NPV function to compute the present value of the cash flows from years 1-5. Do not include the original investment at time zero. 29 NPV of Cash Flows from Years 1-5 30 Deduct the cost of the investment 31 Net present value 32 Write an it/then statement to ACCEPT or REJECT the project based on NPV 33 34 4. Use Excel's IRR function to compute the project's internal rate of return 35 Write an it/then statement to ACCEPT or REJECT the project based on IRR 36 37 5. Compute the project's payback period. 38 years 39 6. Compute the project's accounting rate of return. 16.00%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started