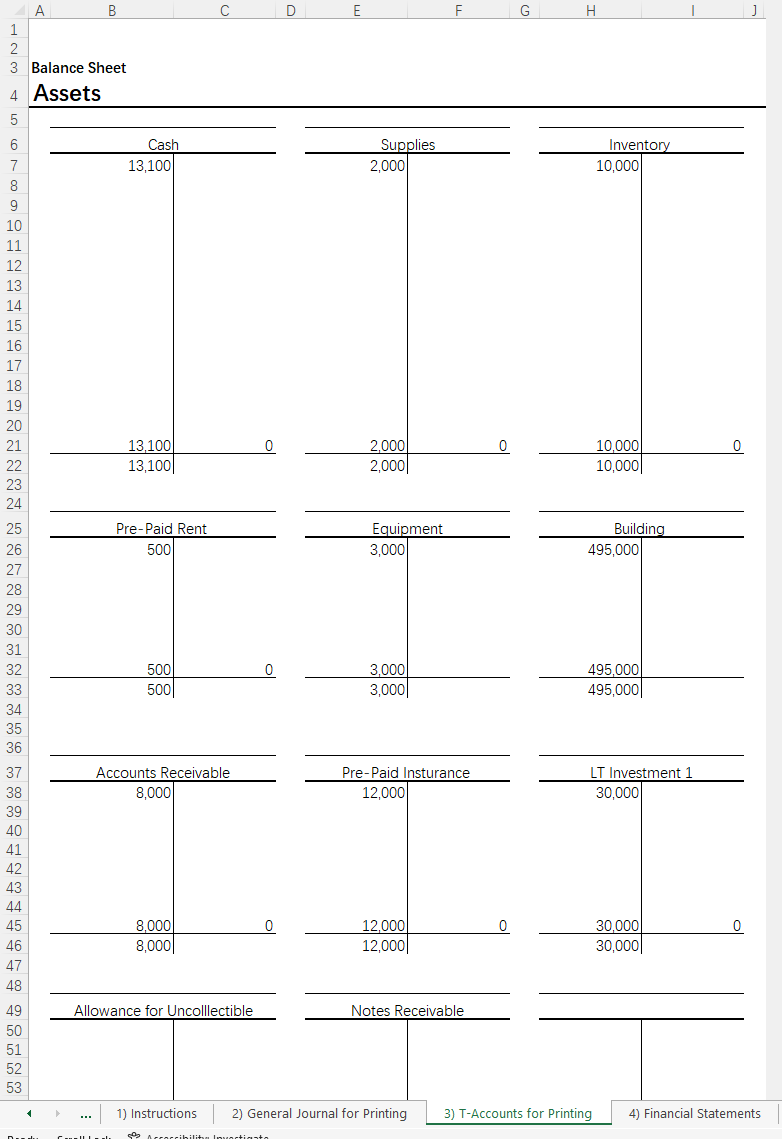

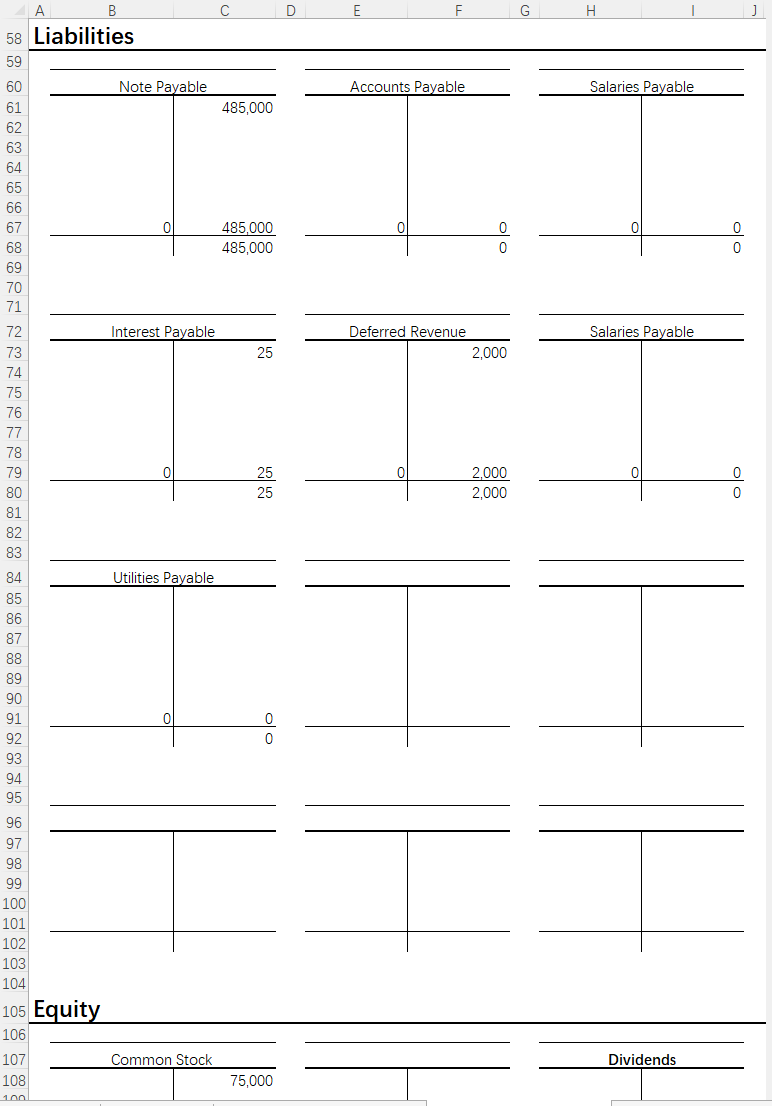

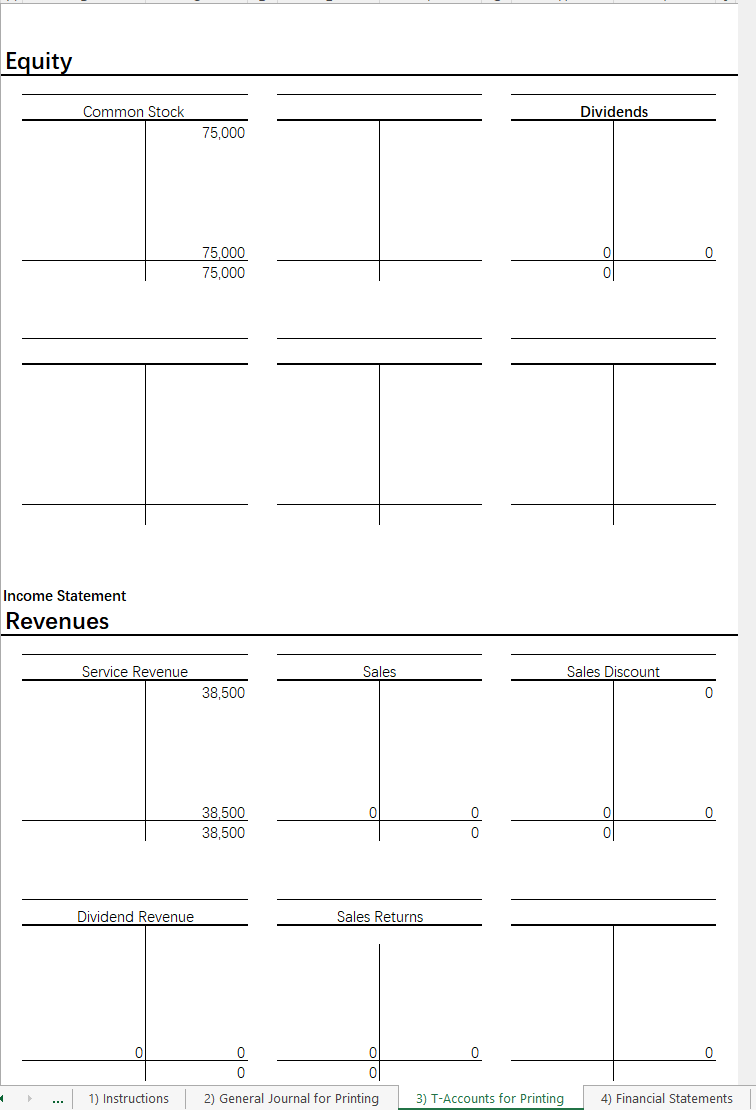

Question

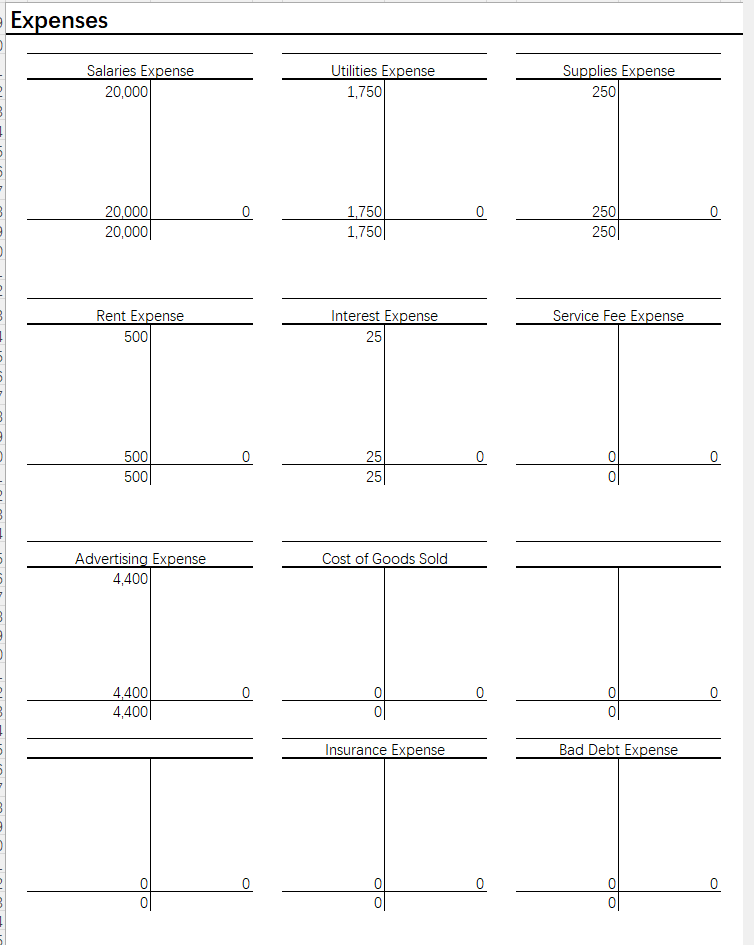

Need fill both balance sheet and income statement. February 23rd 2/23/2022 Orca Company record a $250 service fee charged by the bank and deducted from

Need fill both balance sheet and income statement.

February 23rd

| 2/23/2022 | Orca Company record a $250 service fee charged by the bank and deducted from company's bank account |

| 2/23/2022 | Orca Company provides services to a customer for $16,000, to be paid on account |

| 2/23/2022 | Orca Company pays a $10,000 dividend to its shareholders |

| 2/23/2022 | Orca Company collects the $8,000) accounts receivable from the customer serviced on 2/4 (note, this adjusts an entry from submission #1) |

February 25th

| 2/25/2022 | Orca Company provides the $6,000 of scheduled services to the customer from 2/7 and collects the remainder of the cash owed ($4,000). |

| 2/25/2022 | Orca Company provides services to a customer worth $12,000, to be paid on account |

| 2/25/2022 | On 2/25 Orca Company purchases 200 units of additional inventory from its supplier at $50 per unit ($10,000 total), paying using a check (cash equivalent) |

February 28th

| 2/28/2022 | Orca Company sells 200 units of inventory for $80 per unit and is paid in cash. Recall that the cost of Inventory is $50 per unit. |

| 2/28/2022 | Orca Company receives a $500 dividend (revenue) for the investment it made on February 4th. |

| 2/28/2022 | Orca Company records salaries earned in February to be paid to employees in March of $25,000 |

| 2/28/2022 | Orca Company records a February utilities bill for $2,000 for utilities consumed in February to be paid next month |

| 2/28/2022 | Orca Company performs its adjusting entries for February Here are the entries you need to record: -Accrue Interest for BOTH note payables (1/1 $5,000 note and 1/31 $480,000 notes) for the month of February -Record using up one month of 2/4 Prepaid Insurance ($12,000/12 months =$1,000 monthly insurance used up) -Record using up 2/4 Prepaid Rent for February ($500) - It has used up $1,250 of supplies of the $2,000 it had purchased on 2/4 |

March 2nd

| 3/2/2022 | Orca Company sells 50 units of inventory for $80 per unit on account. The sale has terms of 2/10, n/30. Recall inventory was purchased for $50 per unit. |

| 3/2/2022 | It pays off the Utilities payable accrued on 2/28 |

| 3/2/2022 | It pays off the salaries payable accrued on 2/28 |

| 3/2/2022 | Orca Company per-pays its rent for March AND April. $500 each |

| 3/2/2022 | Orca Company records an allowance of 5% of current A/R including the transactions on March 2nd. (A/R current balance = $32,000) |

March 4th

| 3/4/2022 | Orca Company collects the receivable of $16,000 from services provided on February 23rd. No update is made to the allowance. |

| 3/4/2022 | Orca Company receives payment for the inventory sold on 3/2 ($4,000). Note this payment comes within 10 days of purchase with terms 2/10 net 30 |

| 3/4/2022 | Orca Company purchases 100 units of inventory at $50 per unit using cash |

| 3/4/2022 | A customer returns 20 units of inventory purchased on 2/28. The inventory is not defective, so Orca Company adds it back to its inventory supply Sales $80 Cash CGS $50 per unit |

| 3/4/2022 | Orca Company sells 100 units of inventory at $80 per unit. The customer is able to pay for half now and Orca Company records the remainder due on account with terms 1/10, n/30. |

| 3/4/2022 | Orca Company is told its customer serviced on 2/25 has gone insolvent. This requires Orca Company to record a write-off for the accounts receivable from the customer ($12,000). |

| 3/4/2022 | Orca Company is paid $11,000 of the Accounts Receivable for the insolvent customer from 2/25. Orca Company must record a recovery related to this $11,000 |

March 21st, 23rd

| 3/21/2022 | Orca Company purchased 500 units of inventory from its supplier, on account. The supplier offered Orca Company a price of $65 per unit. Orca Company adopted the FIFO Method of inventory. |

| 3/21/2022 | Orca Company negotiated a Promissory Note with the customer for the accounts receivable for purchased inventory on 3/4 ($4,000 balance). The note has terms of 6% interest owed in 6 months |

| 3/23/2022 | Orca Company sold 100 units of inventory on account. Due to recent demand, Orca Company raised its price to $100 per unit for the inventory. TO cost according to the FIFO method 170 units remaining in inventory priced at $50 before 500 unit of inventory purchased. So price the inventory sold $50 per unit cost x 100 units sold = $5,000 |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started