Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need flow chart using the information provided the two photos (description). need asap pls Stage One - Flowchart (20 marks) Consider the described descriptions, complete

need flow chart using the information provided the two photos (description). need asap pls

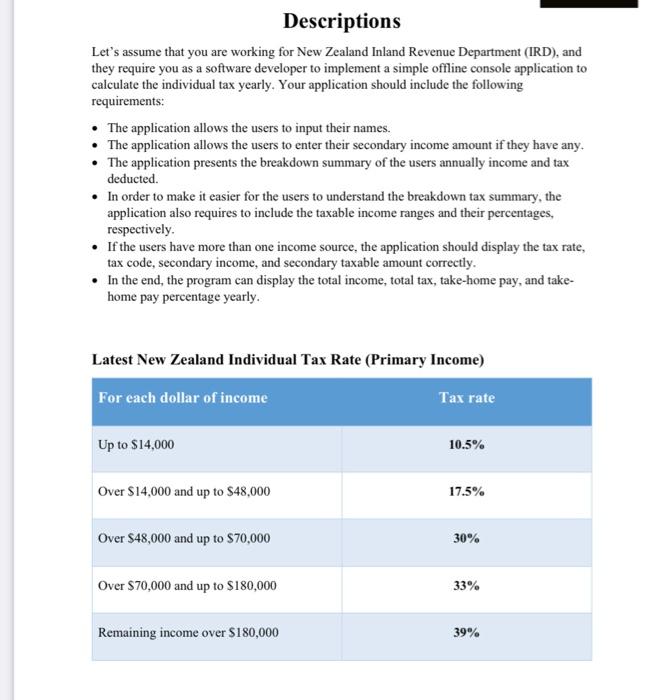

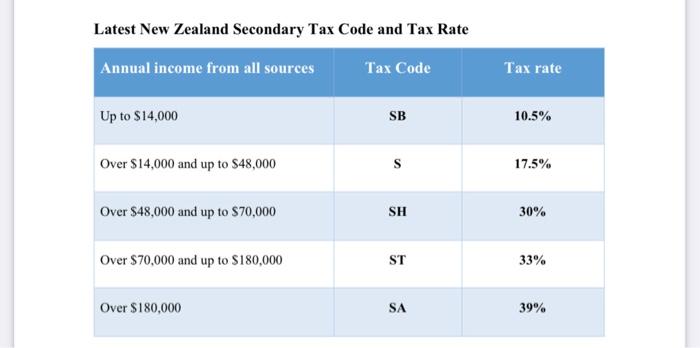

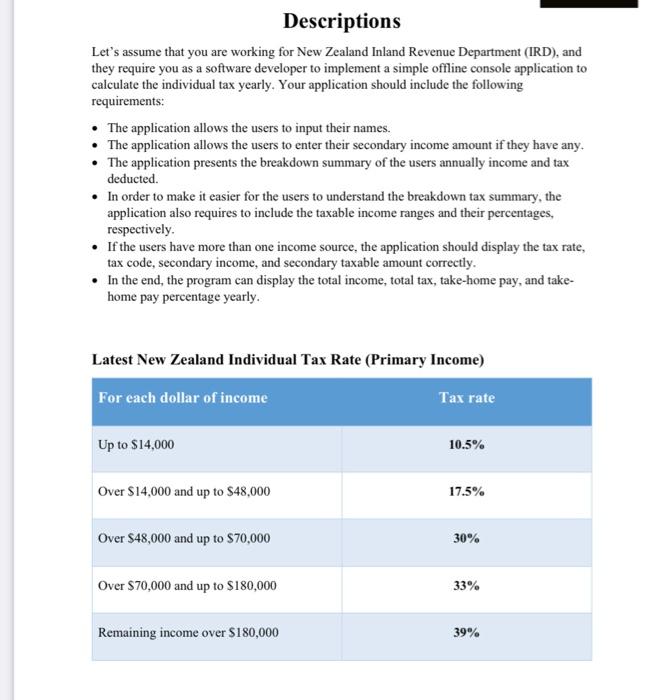

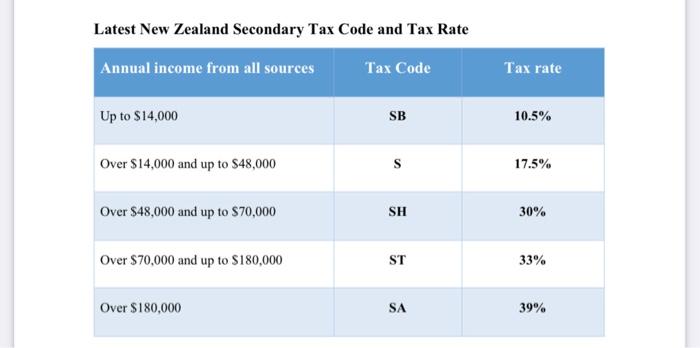

Stage One - Flowchart (20 marks) Consider the described descriptions, complete the following flowchart for the application design plan. Please make sure that your flowchart should be able to present the following components correctly: Flow arrows A step or instruction in the algorithm (process) A decision to be made in the algorithm Terminator (Start/End) Input and output START ! END Descriptions Let's assume that you are working for New Zealand Inland Revenue Department (IRD), and they require you as a software developer to implement a simple offline console application to calculate the individual tax yearly. Your application should include the following requirements: The application allows the users to input their names. The application allows the users to enter their secondary income amount if they have any The application presents the breakdown summary of the users annually income and tax deducted. In order to make it easier for the users to understand the breakdown tax summary, the application also requires to include the taxable income ranges and their percentages, respectively. If the users have more than one income source, the application should display the tax rate, tax code, secondary income, and secondary taxable amount correctly. In the end, the program can display the total income, total tax, take-home pay, and take- home pay percentage yearly. Latest New Zealand Individual Tax Rate (Primary Income) For each dollar of income Tax rate Up to $14,000 10.5% Over $14,000 and up to $48,000 17.5% Over $48,000 and up to $70,000 30% Over $70,000 and up to $180,000 33% Remaining income over $180,000 39% Latest New Zealand Secondary Tax Code and Tax Rate Annual income from all sources Tax Code Tax rate Up to $14,000 SB 10.5% Over $14,000 and up to $48,000 17.5% Over $48,000 and up to $70,000 SH 30% Over $70,000 and up to $180,000 ST 33% Over $180,000 SA 39%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started