Need: Form 1120, 1125-A and M-3

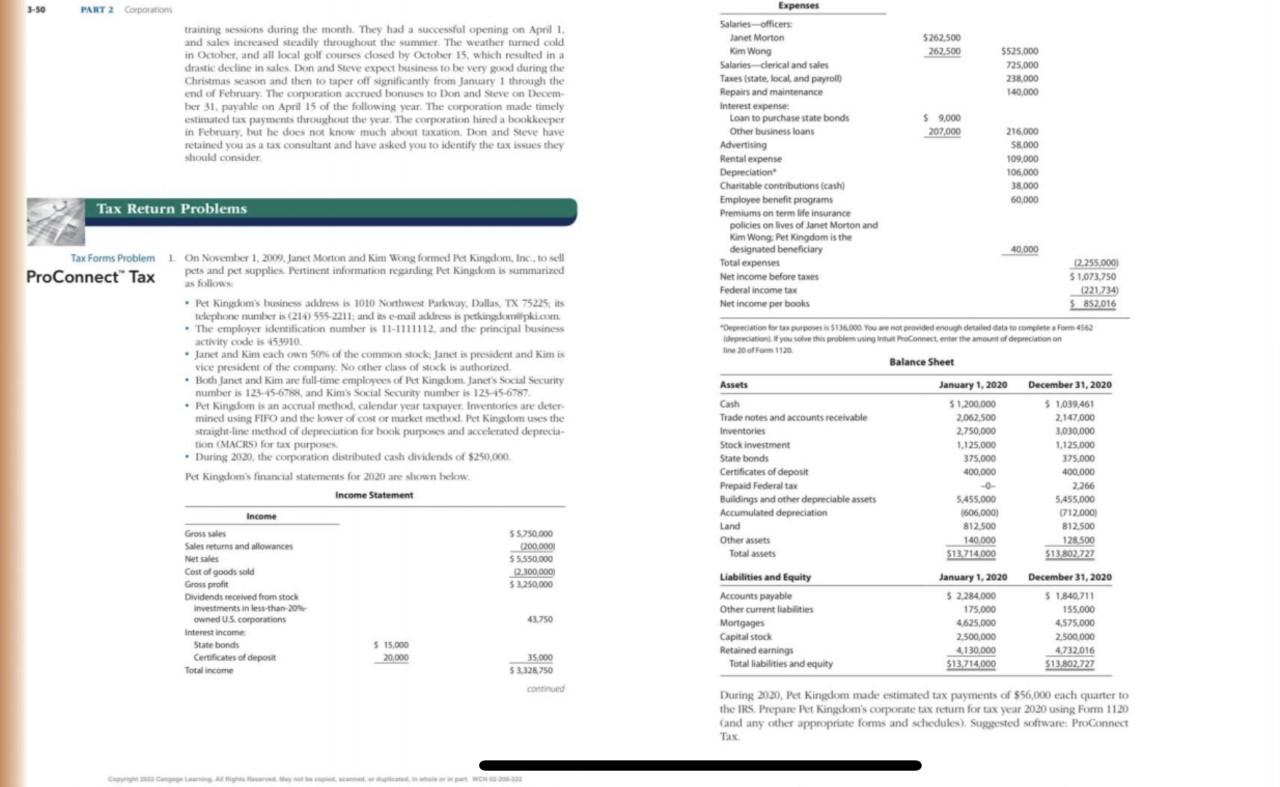

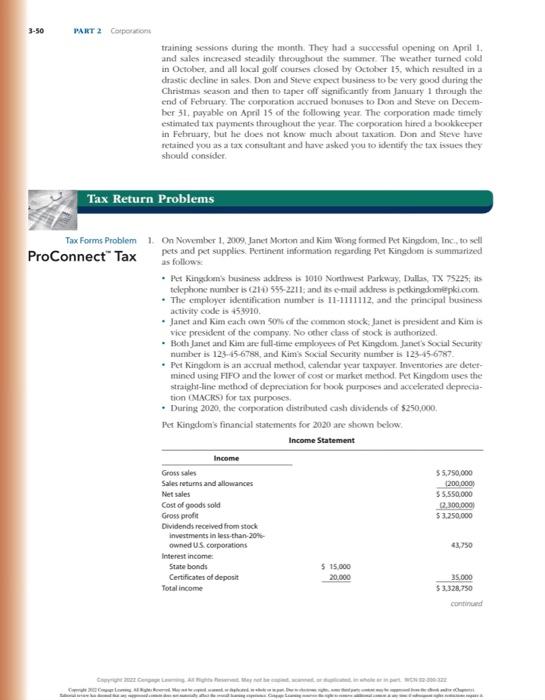

training sessions during the month. They had a suceessful opening on April 1. and sales increased steadaly throughout the sumener. The weather narned cold in Octoloet, and all loxal golf courses closed hy Octolet 14, which resulted in a drastie decline in sakes. Dron and Steve expect husinems to be very gorod during the end of Fehruary. The corporation acrried loonuses to Bon and Steve on Thecemtaer 31. payatsie on April 15 of the following year. The corporation made timely estimated tas payments theroughout the yeat. The cooporation hired a bookkecper should consider. training sessions during the isonth. They had a successful opening on Apni 1 . and ales inctesed steadily thecrgghout the sumener. The weather turned cold in October, and all local goll courses closed by October 15, which resulted in a drastic decline in sales. Don and Steve expect business to be very good during the Christmes season and then to taper off significantly from January 1 through the end of Fetraary. The coeporation accrucd bonuses to Lhon and Steve on Decemher 51, payable on April 15 of the following year. The comporation made timely estimated tax payments throughout the year. The coeporation hired a bookkeeper in Fehruary, but he dees not know much about taxition. Don and steve have retained you as a tax consultant and have asked you to identify the tax issties they should consider. Tax Return Problems Tax Forms Problem 1. On Nowenaber 1. 2009, Janet Morton and Kim Wong formed Pet Kingolom, Inc, to sell pets and pet supplies. Pertinent information regarding Pet Kingdoen is summarized as follows - Pet Kingsken's business adklereo bo 1010 Nonthwest Parkway, Dalles, TX 75225, its tecephone number is (214) 555-2211; and its email address is petkingdomepici.com. - The cmployer identification number is 11-1111112, and the principal business activity code is 453910 . - Janet and Kim each own 5005 of the comenon stock; lanet is president and Kim is vice president of the company. No other class of tock is authorized. - Both Janet and Kim are full-time employees of Pet Kengdoen Janet's Socul security number is 123.45-6788, and Kim's Social Security number is 123.45-6787. - Fet Kingdom is an accrual method, calendar year taxpayer. Invertories afe determined using FIFO and the lower of cost or market method. Pet Kingdom uses the strateht-line method of defrecuation for bock purposes and accelerated depreciation (MNCles) for tax prorposes. - During 2020, the coeporation divinituted cash dividends of $250,000, Pet Kingdom's financial statements for 2020 are stwown below. line ab efform 1122. During 2020, Pct Kingolom made estimated tax poymeriss of 556,000 each quarter to the IRs. Prepare Pet Kingdons's coeporate tax ncturn for Lax year 3030 using Form 1130 (and any other approptiate forms and sehedules), Suggested scifwane: ProConnect Tax. training sessions during the month. They had a suceessful opening on April 1. and sales increased steadaly throughout the sumener. The weather narned cold in Octoloet, and all loxal golf courses closed hy Octolet 14, which resulted in a drastie decline in sakes. Dron and Steve expect husinems to be very gorod during the end of Fehruary. The corporation acrried loonuses to Bon and Steve on Thecemtaer 31. payatsie on April 15 of the following year. The corporation made timely estimated tas payments theroughout the yeat. The cooporation hired a bookkecper should consider. training sessions during the isonth. They had a successful opening on Apni 1 . and ales inctesed steadily thecrgghout the sumener. The weather turned cold in October, and all local goll courses closed by October 15, which resulted in a drastic decline in sales. Don and Steve expect business to be very good during the Christmes season and then to taper off significantly from January 1 through the end of Fetraary. The coeporation accrucd bonuses to Lhon and Steve on Decemher 51, payable on April 15 of the following year. The comporation made timely estimated tax payments throughout the year. The coeporation hired a bookkeeper in Fehruary, but he dees not know much about taxition. Don and steve have retained you as a tax consultant and have asked you to identify the tax issties they should consider. Tax Return Problems Tax Forms Problem 1. On Nowenaber 1. 2009, Janet Morton and Kim Wong formed Pet Kingolom, Inc, to sell pets and pet supplies. Pertinent information regarding Pet Kingdoen is summarized as follows - Pet Kingsken's business adklereo bo 1010 Nonthwest Parkway, Dalles, TX 75225, its tecephone number is (214) 555-2211; and its email address is petkingdomepici.com. - The cmployer identification number is 11-1111112, and the principal business activity code is 453910 . - Janet and Kim each own 5005 of the comenon stock; lanet is president and Kim is vice president of the company. No other class of tock is authorized. - Both Janet and Kim are full-time employees of Pet Kengdoen Janet's Socul security number is 123.45-6788, and Kim's Social Security number is 123.45-6787. - Fet Kingdom is an accrual method, calendar year taxpayer. Invertories afe determined using FIFO and the lower of cost or market method. Pet Kingdom uses the strateht-line method of defrecuation for bock purposes and accelerated depreciation (MNCles) for tax prorposes. - During 2020, the coeporation divinituted cash dividends of $250,000, Pet Kingdom's financial statements for 2020 are stwown below. line ab efform 1122. During 2020, Pct Kingolom made estimated tax poymeriss of 556,000 each quarter to the IRs. Prepare Pet Kingdons's coeporate tax ncturn for Lax year 3030 using Form 1130 (and any other approptiate forms and sehedules), Suggested scifwane: ProConnect Tax