Answered step by step

Verified Expert Solution

Question

1 Approved Answer

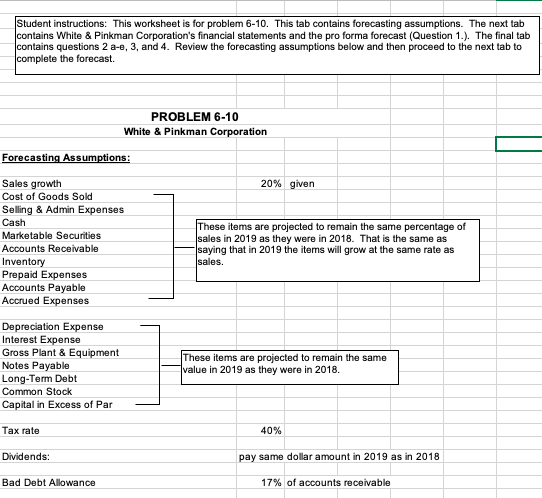

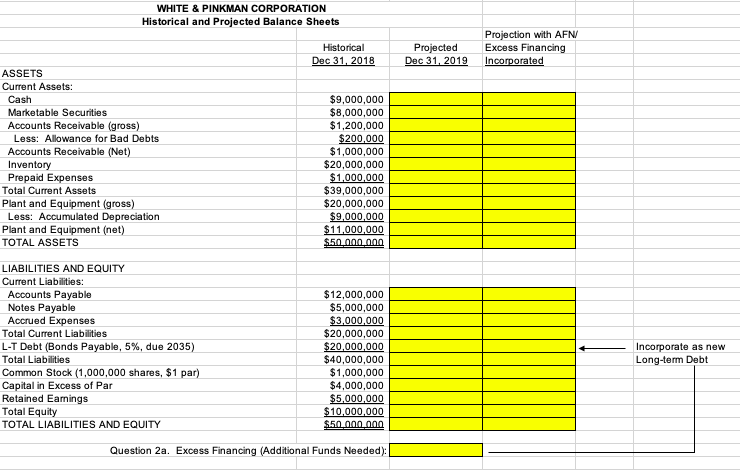

Need formulas for everything in yellow please! Student instructions: This worksheet is for problem 6-10. This tab contains forecasting assumptions. The next tab contains White

Need formulas for everything in yellow please!

Student instructions: This worksheet is for problem 6-10. This tab contains forecasting assumptions. The next tab contains White & Pinkman Corporation's financial statements and the pro forma forecast (Question 1.). The final tab contains questions 2 a-e, 3, and 4. Review the forecasting assumptions below and then proceed to the next tab to complete the forecast. PROBLEM 6-10 White & Pinkman Corporation Forecasting Assumptions: 20% given Sales growth Cost of Goods Sold Selling & Admin Expenses Cash Marketable Securities Accounts Receivable Inventory Prepaid Expenses Accounts Payable Accrued Expenses These items are projected to remain the same percentage of sales in 2019 as they were in 2018. That is the same as saying that in 2019 the items will grow at the same rate as sales. Depreciation Expense Interest Expense Gross Plant & Equipment Notes Payable Long-Term Debt Common Stock Capital in Excess of Par These items are projected to remain the same value in 2019 as they were in 2018. Tax rate 40% Dividends: pay same dollar amount in 2019 as in 2018 Bad Debt Allowance 17% of accounts receivable WHITE & PINKMAN CORPORATION Historical and Projected Balance Sheets Historical Dec 31, 2018 Projected Dec 31, 2019 Projection with AFN/ Excess Financing Incorporated ASSETS Current Assets: Cash Marketable Securities Accounts Receivable (gross) Less: Allowance for Bad Debts Accounts Receivable (Net) Inventory Prepaid Expenses Total Current Assets Plant and Equipment (gross) Less: Accumulated Depreciation Plant and Equipment (net) TOTAL ASSETS $9,000,000 $8,000,000 $1,200,000 $200,000 $1,000,000 $20,000,000 $1.000.000 $39,000,000 $20,000,000 $9,000,000 $11,000,000 $50.000.000 LIABILITIES AND EQUITY Current Liabilities: Accounts Payable Notes Payable Accrued Expenses Total Current Liabilities L-T Debt (Bonds Payable, 5%, due 2035) Total Liabilities Common Stock (1,000,000 shares, $1 par) Capital in Excess of Par Retained Eamnings Total Equity TOTAL LIABILITIES AND EQUITY $12,000,000 $5,000,000 $3,000,000 $20,000,000 $20,000,000 $40,000,000 $1,000,000 $4,000,000 $5,000,000 $10,000,000 $50.000.000 Incorporate as new Long-term Debt Question 2a. Excess Financing (Additional Funds Needed)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started