Answered step by step

Verified Expert Solution

Question

1 Approved Answer

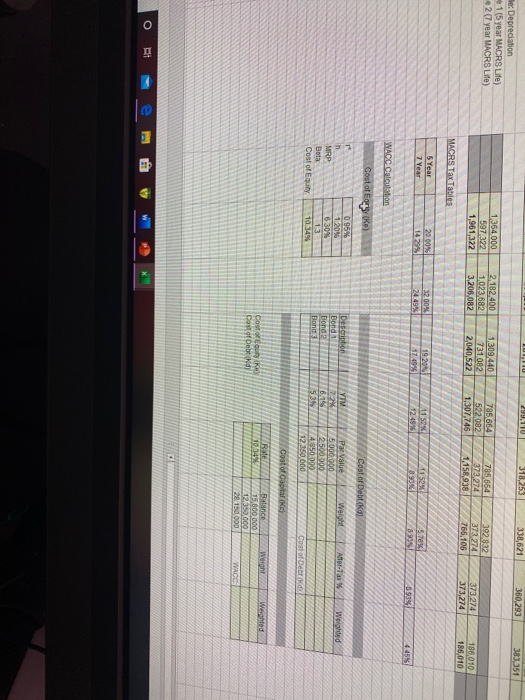

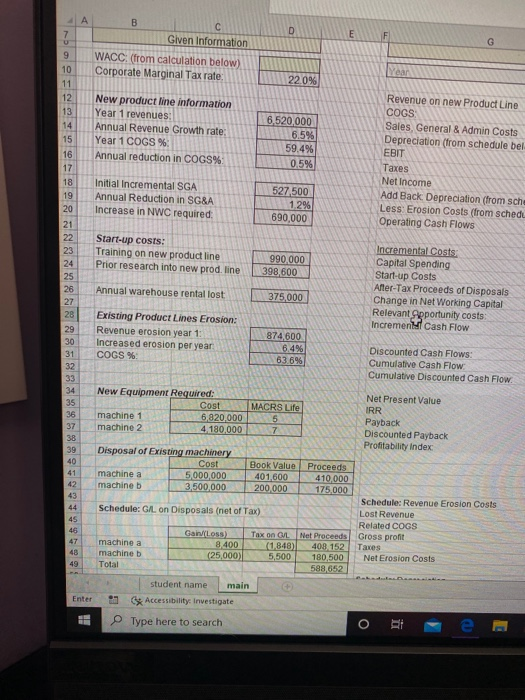

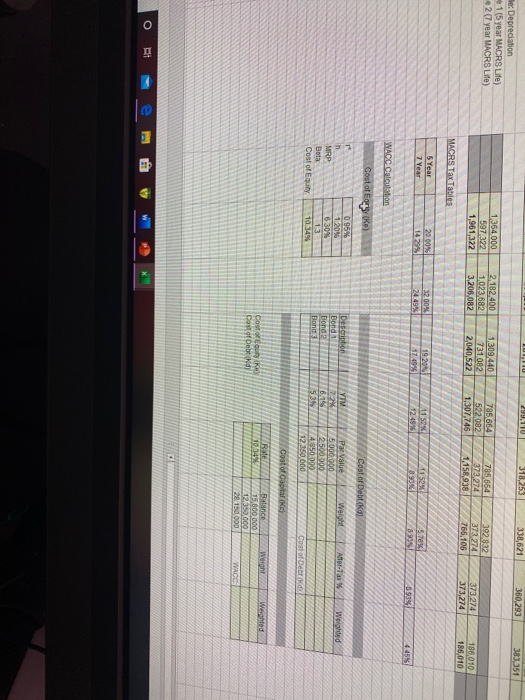

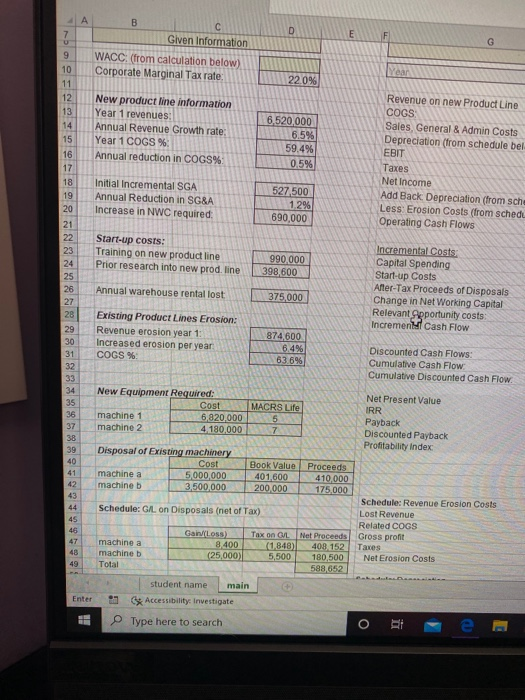

need formulas for wacc calculation 101,110 299,110 | 318,253 338,621 360,293 383 351 He: Depreciation 15 year MACRS Life) 27 year MACRS Life) 1,364.000 597322

need formulas for wacc calculation

101,110 299,110 | 318,253 338,621 360,293 383 351 He: Depreciation 15 year MACRS Life) 27 year MACRS Life) 1,364.000 597322 1,961,3223 2.182.400 1023.882 .206,082 1309,440 731082 2,040,522 7 85664 522082 1,307,746 7 85654 373 274 ,156,938 3 92832 373 274 7 66,106 1 373 274 3 73.274 186 010 185,010 MACRS Tax Tables 11.52% 11 52% 5.TEX WACC Calculation Costot Egye) Cost of Debt 0.95% 120% 6 30% W eight L ars Descripbon Bond 1 Bond2 Wooded LITYTM II 12 16.19 3 5 Par Value .000.000 2.500.000 4850.000 12.250.000 Cost of Equity 10.34% Cost of Deck Costo Capital ) Wegated Costa Cost of Debt kes RedBalance 19.94% 15,800 000 12.350.000 20150000 Oew Given Information WACC: (from calculation below) Corporate Marginal Tax rate: 111220% New product line information Year 1 revenues: Annual Revenue Growth rate: Year 1 COGS % Annual reduction in COGS%: 6.520,000 6.5% 59.4% 0.5% Revenue on new Product Line COGS Sales General & Admin Costs Depreciation (from schedule bel EBIT Taxes Net Income Add Back Depreciation (from sche Less: Erosion Costs (from schedu Operating Cash Flows Initial Incremental SGA Annual Reduction in SG&A Increase in NWC required 527500 1.2% 690,000 Start-up costs: Training on new product line Prior research into new prod. line 990.000 398 600 Annual warehouse rental lost Incremental Costs Capital Spending Start-up Costs After-Tax Proceeds of Disposals Change in Net Working Capital Relevant apportunity costs: Incrementu Cash Flow 375.000 Existing Product Lines Erosion: Revenue erosion year 1: Increased erosion per year COGS % 874,600 6.4% LA 63.6% Discounted Cash Flows: Cumulative Cash Flow Cumulative Discounted Cash Flow. New Equipment Required: Cost MACRS Life machine 1 6.820.0005 machine 2 4.180,000 37 Net Present Value IRR Payback Discounted Payback Profitability Index Disposal of Existing machinery Cost machine a 5.000.000 machineb 3,500,000 B ook Value 401.600 200.000 Proceeds 410,000 175.000 Schedule: G/L on Disposals (net of Tax) Gain/(Loss) 8.400 (25,000) machine a machine b Total Schedule: Revenue Erosion Costs Lost Revenue Related COGS Gross profit Taxes Net Erosion Costs Tax on CL Net Proceeds (1.848) 408 152 5,500 180,500 588,652 49 Enter student name main Accessibility: Investigate Type here to search i e a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started