Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need full anwsers!!! ch 4 graded hw Problem 4-14 (Algo) Compute and Use Activity Rates to Determine the Costs of Serving Customers [LO4-2, LO4-3, LO4-4]

need full anwsers!!!

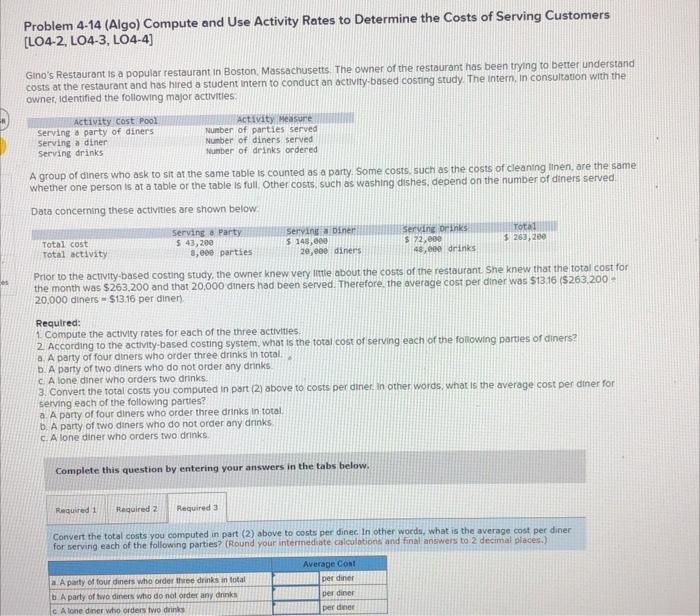

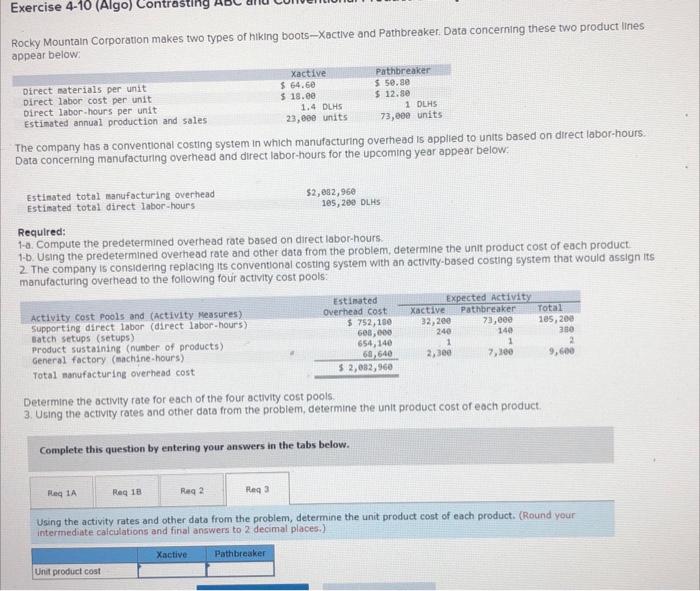

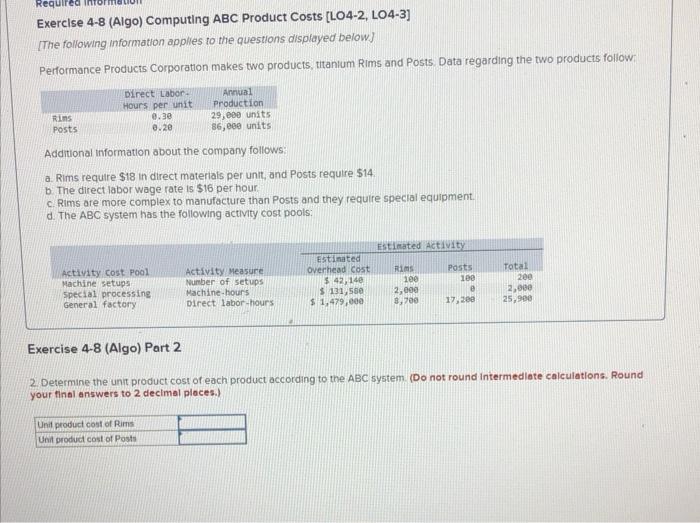

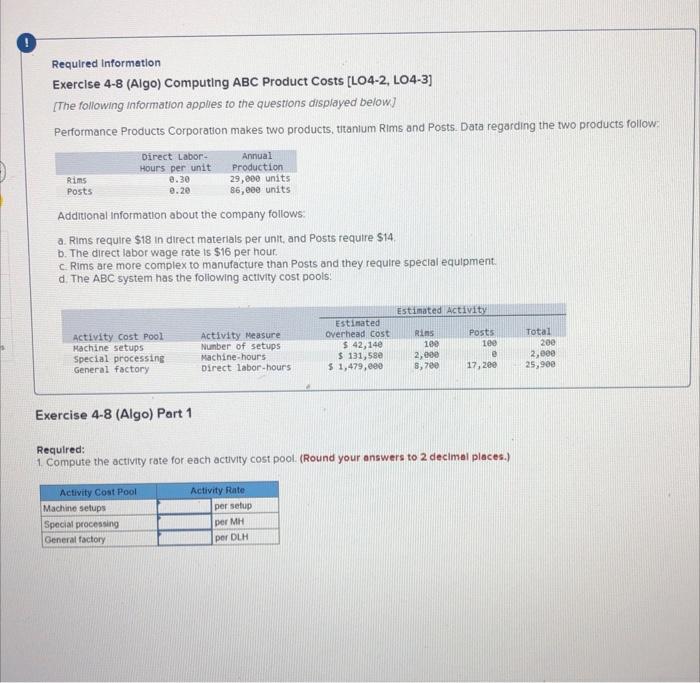

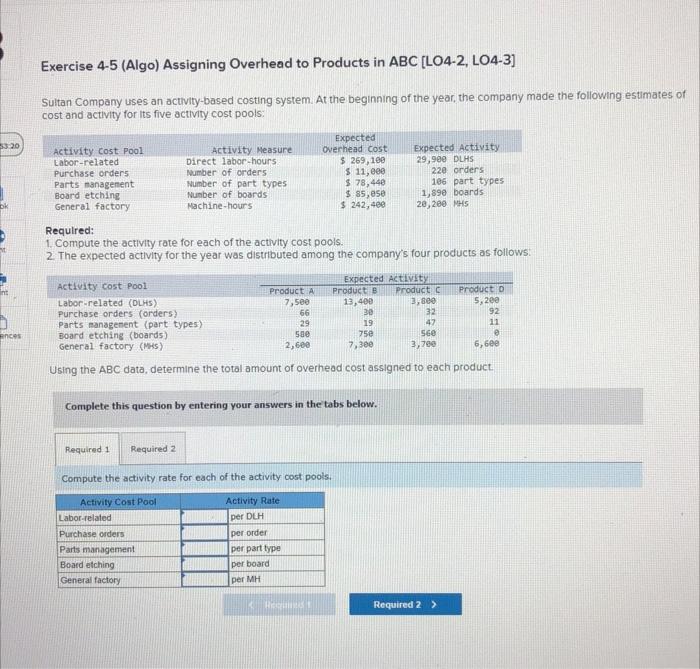

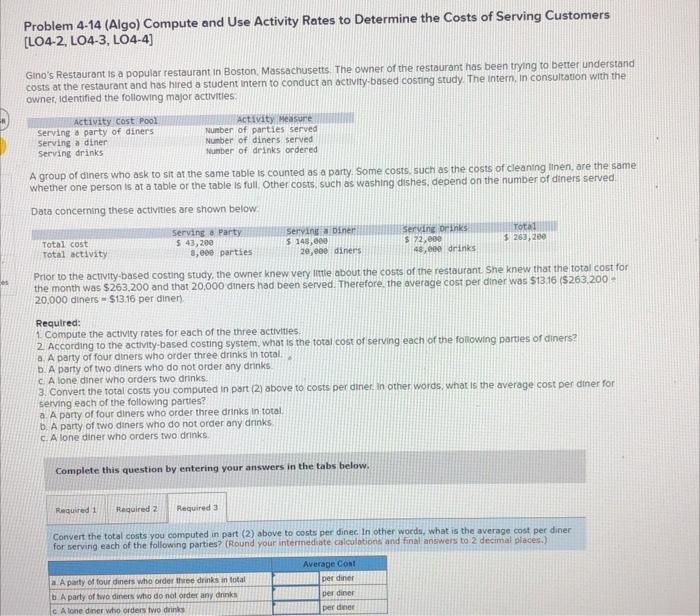

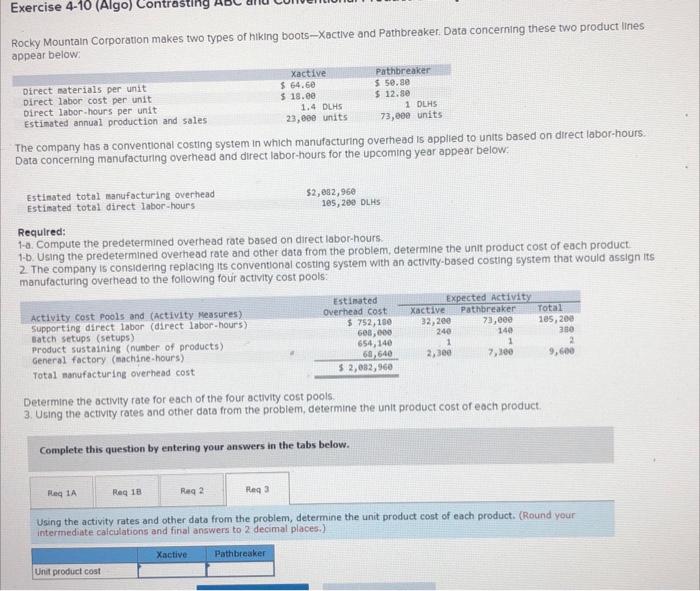

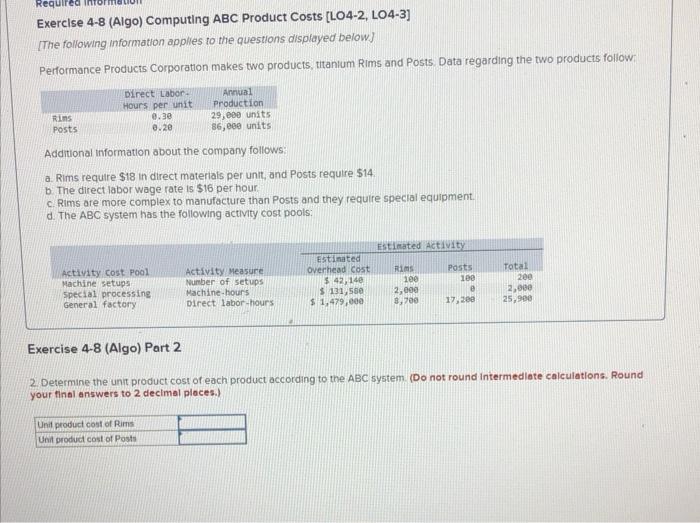

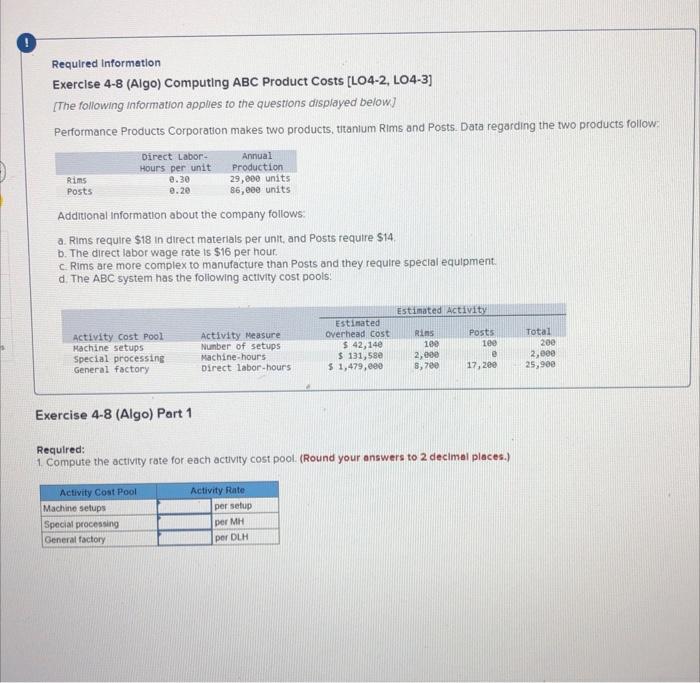

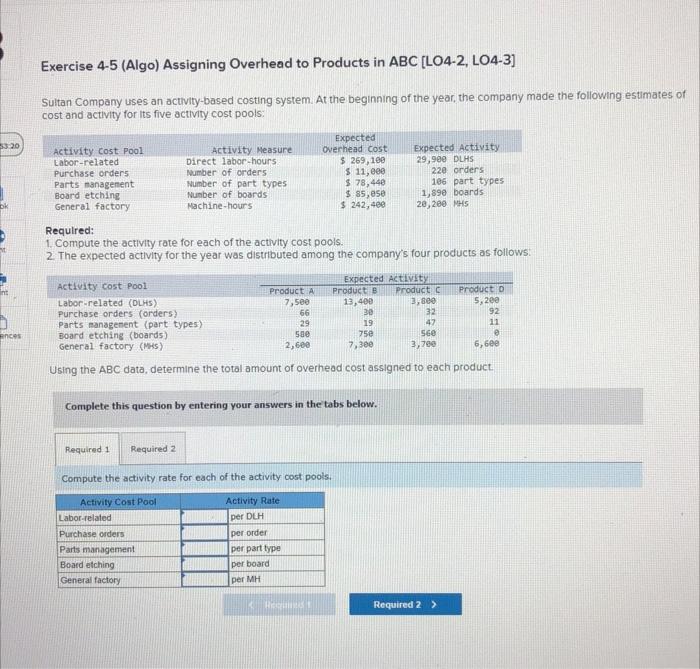

Problem 4-14 (Algo) Compute and Use Activity Rates to Determine the Costs of Serving Customers [LO4-2, LO4-3, LO4-4] Gino's Restaurant is a popular restaurant in Boston, Massachusetts. The owner of the restaurant has been trying to better understand costs at the restaurant and has hired a student intern to conduct an activity-based costing study. The intern, in consultation with the owner, identified the following major activities: Activity Cost Pool Serving a party of diners serving a diner Serving drinks Activity Measure Number of parties served Number of diners served Number of drinks ordered A group of diners who ask to sit at the same table is counted as a party. Some costs, such as the costs of cleaning linen, are the same whether one person is at a table or the table is full. Other costs, such as washing dishes, depend on the number of diners served Data concerning these activities are shown below. Total cost Total activity Serving & Party $ 43,200 8,000 parties Serving a Diner 5 148,000 20,000 diners Prior to the activity-based costing study, the owner knew very little about the costs of the restaurant. She knew that the total cost for the month was $263,200 and that 20.000 diners had been served. Therefore, the average cost per diner was $13.16 ($263,200 - 20.000 diners $13.16 per diner), Complete this question by entering your answers in the tabs below. Serving Drinks $ 72,000 48,000 drinks Required: 1 Compute the activity rates for each of the three activities. 2. According to the activity-based costing system, what is the total cost of serving each of the following parties of diners? a. A party of four diners who order three drinks in total. b. A party of two diners who do not order any drinks cA lone diner who orders two drinks. 3. Convert the total costs you computed in part (2) above to costs per diner, in other words, what is the average cost per diner for serving each of the following parties? a. A party of four diners who order three drinks in total. b. A party of two diners who do not order any drinks. c. A lone diner who orders two drinks. a. A party of four diners who order three drinks in total b. A party of two diners who do not order any drinks c A lone diner who orders two drinks Total $263,200 Required 1 Required 2 Required 3 Convert the total costs you computed in part (2) above to costs per dinec. In other words, what is the average cost per diner for serving each of the following parties? (Round your intermediate calculations and final answers to 2 decimal places.) Average Cost per diner per diner per diner Exercise 4-10 (Algo) Contrasting Rocky Mountain Corporation makes two types of hiking boots-Xactive and Pathbreaker. Data concerning these two product lines appear below: Direct materials per unit Direct labor cost per unit Direct labor-hours per unit Estimated annual production and sales. Estimated total manufacturing overhead Estimated total direct labor-hours Activity Cost Pools and (Activity Measures) Supporting direct labor (direct labor-hours) Batch setups (setups) Product sustaining (number of products) General factory (machine-hours) Total manufacturing overhead cost The company has a conventional costing system in which manufacturing overhead is applied to units based on direct labor-hours. Data concerning manufacturing overhead and direct labor-hours for the upcoming year appear below: Required: 1-a. Compute the predetermined overhead rate based on direct labor-hours. 1-b. Using the predetermined overhead rate and other data from the problem, determine the unit product cost of each product. 2. The company is considering replacing its conventional costing system with an activity-based costing system that would assign its manufacturing overhead to the following four activity cost pools: Req 18 Unit product cost Xactive 64.60 $ $ 18.00 Req 2 1.4 DLHS 23,000 units Complete this question by entering your answers in the tabs below. Req 3 Xactive Pathbreaker $ 50.80 $ 12.80 1 DLHS 73,000 units Pathbreaker $2,082,960 105,200 DLHS Estimated Overhead Cost $ 752,100 600,000 654,140 68,640 $ 2,082,960 Determine the activity rate for each of the four activity cost pools. 3. Using the activity rates and other data from the problem, determine the unit product cost of each product. Xactive Expected Activity Pathbreaker 73,000 140 32,200 240 1 2,300 1 7,300 Req 1A Using the activity rates and other data from the problem, determine the unit product cost of each product. (Round your intermediate calculations and final answers to 2 decimal places.) Total 105, 200 380 2 9,600 Required Exercise 4-8 (Algo) Computing ABC Product Costs [LO4-2, LO4-3] [The following information applies to the questions displayed below] Performance Products Corporation makes two products, titanium Rims and Posts. Data regarding the two products follow: Direct Labor- Hours per unit 0.30 0.20 29,000 units Rins Posts 86,000 units Additional Information about the company follows: a. Rims require $18 in direct materials per unit, and Posts require $14. b. The direct labor wage rate is $16 per hour. c. Rims are more complex to manufacture than Posts and they require special equipment. d. The ABC system has the following activity cost pools: Activity Cost Pool Machine setups special processing General factory Annual Production Unit product cost of Rims Unit product cost of Posts Activity Measure Number of setups Machine-hours Direct labor-hours Estimated Overhead Cost $ 42,140 $ 131,560 $ 1,479,000 Estimated Activity Rims 100 2,000 3,700 Posts 100 e 17,200 Total 200 2,000 25,900 Exercise 4-8 (Algo) Part 2 2. Determine the unit product cost of each product according to the ABC system. (Do not round Intermediate calculations. Round your final answers to 2 decimal places.) Required Information Exercise 4-8 (Algo) Computing ABC Product Costs [LO4-2, L04-3] [The following information applies to the questions displayed below] Performance Products Corporation makes two products, titanium Rims and Posts. Data regarding the two products follow: Rims Posts Direct Labor- Hours per unit 8.30 0.20 Additional Information about the company follows: a. Rims require $18 in direct materials per unit, and Posts require $14. b. The direct labor wage rate is $16 per hour. c. Rims are more complex to manufacture than Posts and they require special equipment. d. The ABC system has the following activity cost pools: Activity Cost Pool Hachine setups Special processing General factory Exercise 4-8 (Algo) Part 1 Activity Cost Pool Annual Production 29,000 units 86,000 units Machine setups Special processing General factory Activity Measure Number of setups Machine-hours Direct labor-hours Estimated Overhead Cost $ 42,140 $ 131,580 $ 1,479,000 Activity Rate per setup per MH per DLH Estimated Activity Rins Required: 1. Compute the activity rate for each activity cost pool. (Round your answers to 2 decimal places.) 100 2,000 8,700 Posts 100 e 17,200 Total 200 2,000 25,900 33:20 bk ances Exercise 4-5 (Algo) Assigning Overhead to Products in ABC [LO4-2, LO4-3] Sultan Company uses an activity-based costing system. At the beginning of the year, the company made the following estimates of cost and activity for its five activity cost pools: Activity Cost Pool Labor-related Purchase orders Parts management Board etching General factory Activity Measure Direct labor-hours: Number of orders Number of part types Number of boards Machine-hours Product A 7,500 66 29 Labor-related Purchase orders Parts management Board etching General factory Expected Overhead Cost $ 269,100 Required: 1. Compute the activity rate for each of the activity cost pools. 2. The expected activity for the year was distributed among the company's four products as follows: Required 1 Required 2 Compute the activity rate for each of the activity cost pools. Activity Cost Pool Activity Rate per DLH per order per per board per MH $ 11,000 $ 78,440 $ 85,050 $ 242,400 Activity Cost Pool Labor-related (DLHS) 3,800 Purchase orders (orders). 32 Parts management (part types) 47 580 560 Board etching (boards). General factory (MHS) 2,600 3,700 Using the ABC data, determine the total amount of overhead cost assigned to each product. part type Complete this question by entering your answers in the tabs below. Requined Expected Activity 29,900 DLHS 220 orders 106 part types 1,890 boards 20,200 MHS Expected Activity Product B 13,400 30 19 758 7,300 Product C Required 2 > Product D 5,200 92 11 e 6,600 ch 4 graded hw

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started