NEED FULL CALCULATION PLEASE

NEED FULL CALCULATION PLEASE

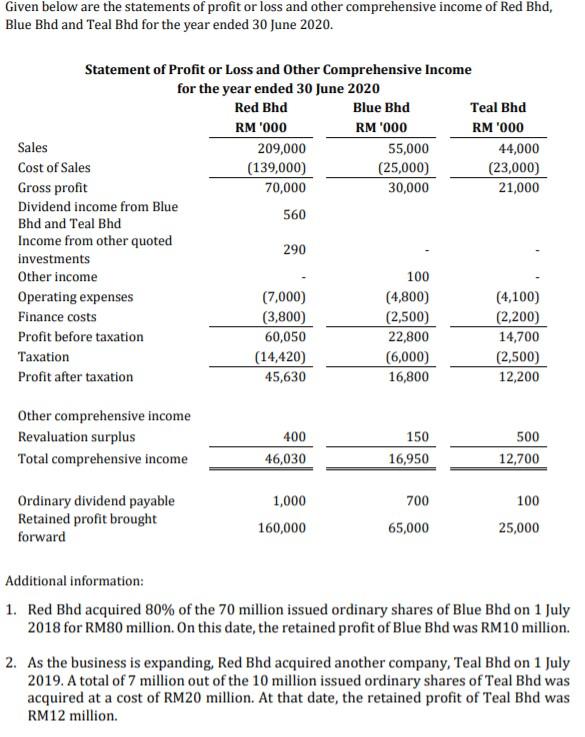

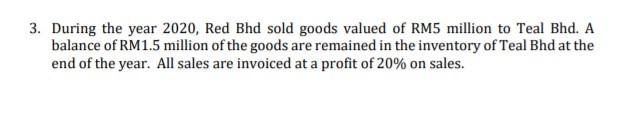

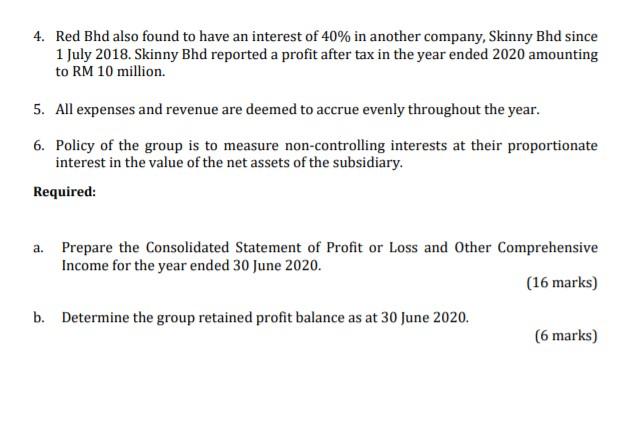

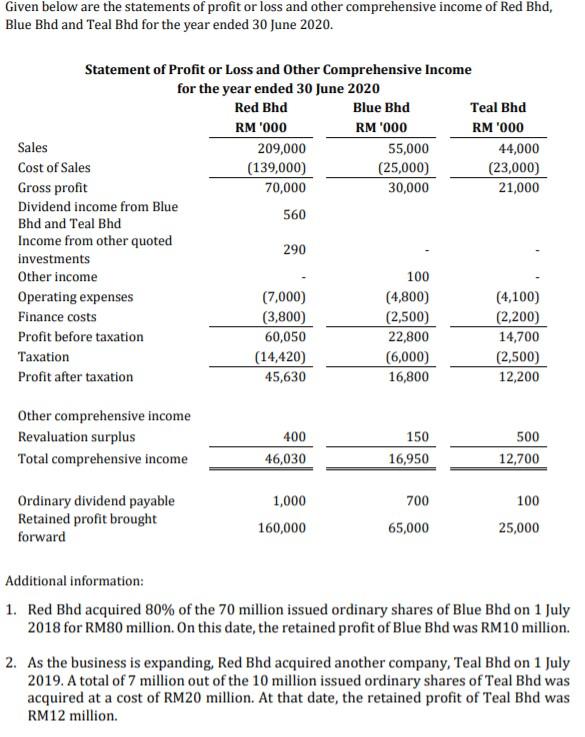

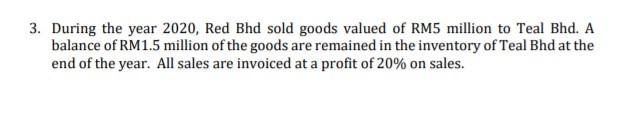

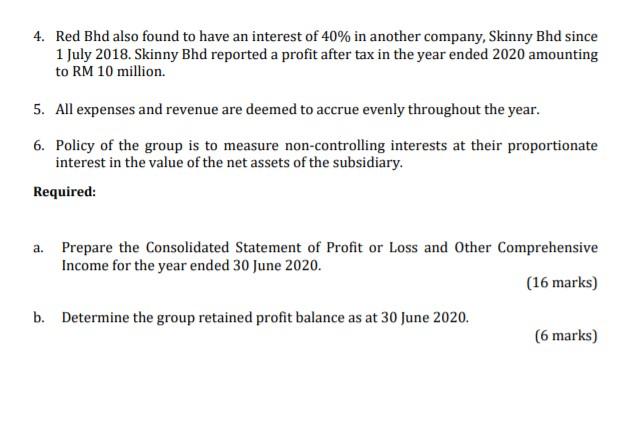

Given below are the statements of profit or loss and other comprehensive income of Red Bhd, Blue Bhd and Teal Bhd for the year ended 30 June 2020. Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 June 2020 Red Bhd Blue Bhd Teal Bhd RM '000 RM 1000 RM '000 Sales 209,000 55,000 44,000 Cost of Sales (139,000) (25,000) (23,000) Gross profit 70,000 30,000 21,000 Dividend income from Blue 560 Bhd and Teal Bhd Income from other quoted investments 290 Other income 100 Operating expenses (7,000) (4,800) (4,100) Finance costs (3,800) (2,500) (2,200) Profit before taxation 60,050 22,800 14,700 Taxation (14,420) (6,000) (2,500) Profit after taxation 45,630 16,800 12,200 Other comprehensive income Revaluation surplus Total comprehensive income 400 46,030 150 16,950 500 12,700 Ordinary dividend payable Retained profit brought forward 1,000 160,000 700 65,000 100 25,000 Additional information: 1. Red Bhd acquired 80% of the 70 million issued ordinary shares of Blue Bhd on 1 July 2018 for RM80 million. On this date, the retained profit of Blue Bhd was RM10 million. 2. As the business is expanding, Red Bhd acquired another company, Teal Bhd on 1 July 2019. A total of 7 million out of the 10 million issued ordinary shares of Teal Bhd was acquired at a cost of RM20 million. At that date, the retained profit of Teal Bhd was RM12 million. 3. During the year 2020, Red Bhd sold goods valued of RM5 million to Teal Bhd. A balance of RM1.5 million of the goods are remained in the inventory of Teal Bhd at the end of the year. All sales are invoiced at a profit of 20% on sales. 4. Red Bhd also found to have an interest of 40% in another company, Skinny Bhd since 1 July 2018. Skinny Bhd reported a profit after tax in the year ended 2020 amounting to RM 10 million. 5. All expenses and revenue are deemed to accrue evenly throughout the year. 6. Policy of the group is to measure non-controlling interests at their proportionate interest in the value of the net assets of the subsidiary. Required: a. Prepare the Consolidated Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 June 2020. (16 marks) b. Determine the group retained profit balance as at 30 June 2020. (6 marks)

NEED FULL CALCULATION PLEASE

NEED FULL CALCULATION PLEASE