need full calculation please

need full calculation please

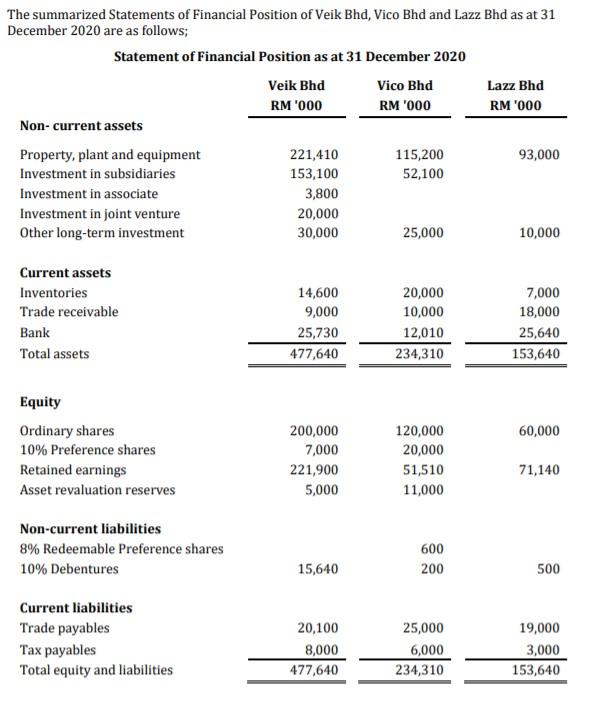

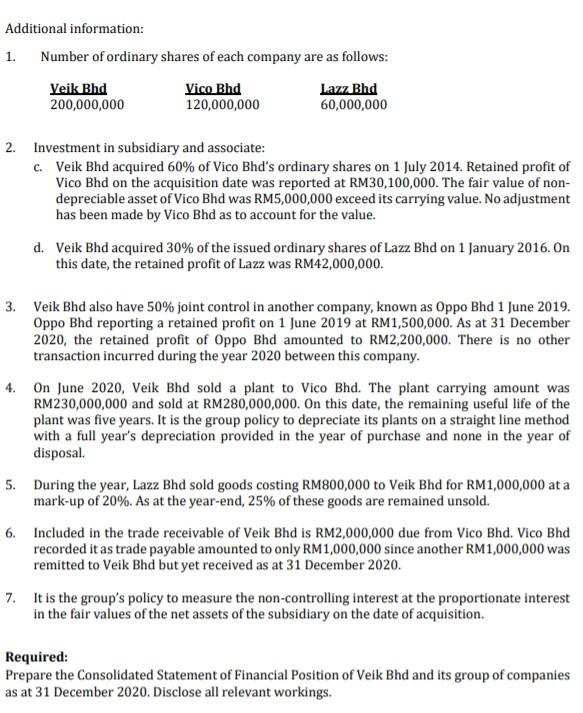

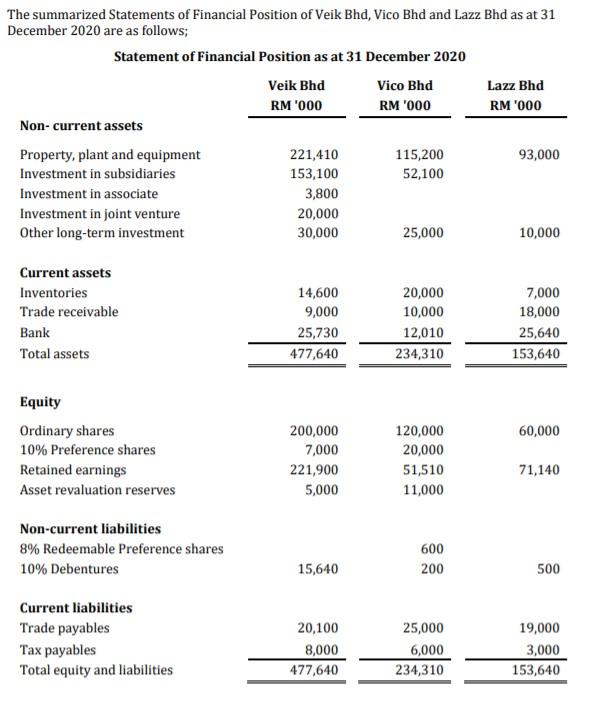

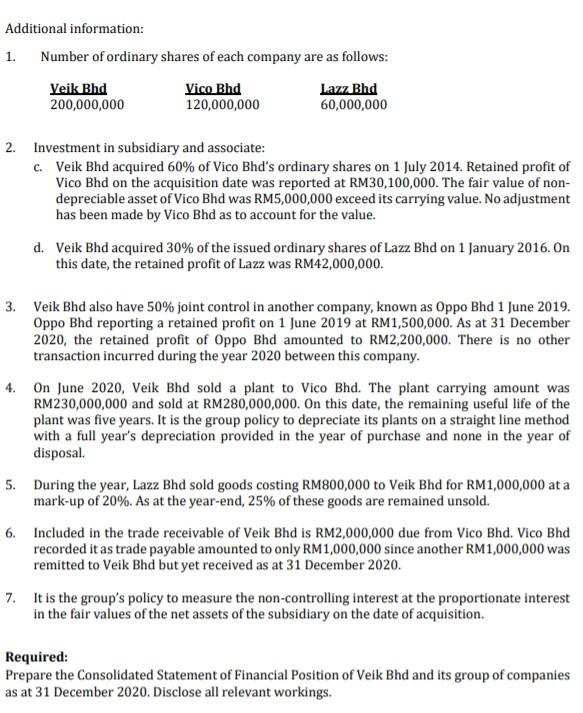

The summarized Statements of Financial Position of Veik Bhd, Vico Bhd and Lazz Bhd as at 31 December 2020 are as follows; Statement of Financial Position as at 31 December 2020 Veik Bhd Vico Bhd Lazz Bhd RM '000 RM '000 RM 1000 Non-current assets Property, plant and equipment 221,410 115,200 93,000 Investment in subsidiaries 153,100 52,100 Investment in associate 3,800 Investment in joint venture 20,000 Other long-term investment 30,000 25,000 10,000 Current assets Inventories Trade receivable Bank Total assets 14,600 9,000 25,730 477,640 20,000 10,000 12,010 234,310 7,000 18,000 25,640 153,640 60,000 Equity Ordinary shares 10% Preference shares Retained earnings Asset revaluation reserves 200,000 7,000 221,900 5,000 120,000 20,000 51,510 11,000 71,140 Non-current liabilities 8% Redeemable Preference shares 10% Debentures 15,640 600 200 500 Current liabilities Trade payables Tax payables Total equity and liabilities 20,100 8,000 477,640 25,000 6,000 234,310 19,000 3,000 153,640 Additional information: 1. Number of ordinary shares of each company are as follows: Veik Bhd Vico Bhd Lazz Bhd 200,000,000 120,000,000 60,000,000 2. Investment in subsidiary and associate: c. Veik Bhd acquired 60% of Vico Bhd's ordinary shares on 1 July 2014. Retained profit of Vico Bhd on the acquisition date was reported at RM30,100,000. The fair value of non- depreciable asset of Vico Bhd was RM5,000,000 exceed its carrying value. No adjustment has been made by Vico Bhd as to account for the value. d. Veik Bhd acquired 30% of the issued ordinary shares of Lazz Bhd on 1 January 2016. On this date, the retained profit of Lazz was RM42,000,000. 3. Veik Bhd also have 50% joint control in another company, known as Oppo Bhd 1 June 2019. Oppo Bhd reporting a retained profit on 1 June 2019 at RM1,500,000. As at 31 December 2020, the retained profit of Oppo Bhd amounted to RM2,200,000. There is no other transaction incurred during the year 2020 between this company. 4. On June 2020, Veik Bhd sold a plant to Vico Bhd. The plant carrying amount was RM230,000,000 and sold at RM280,000,000. On this date, the remaining useful life of the plant was five years. It is the group policy to depreciate its plants on a straight line method with a full year's depreciation provided in the year of purchase and none in the year of disposal. 5. During the year, Lazz Bhd sold goods costing RM800,000 to Veik Bhd for RM1,000,000 at a mark-up of 20%. As at the year-end, 25% of these goods are remained unsold. 6. Included in the trade receivable of Veik Bhd is RM2,000,000 due from Vico Bhd. Vico Bhd recorded it as trade payable amounted to only RM1,000,000 since another RM1,000,000 was remitted to Veik Bhd but yet received as at 31 December 2020. 7. It is the group's policy to measure the non-controlling interest at the proportionate interest in the fair values of the net assets of the subsidiary on the date of acquisition. Required: Prepare the Consolidated Statement of Financial Position of Veik Bhd and its group of companies as at 31 December 2020. Disclose all relevant workings

need full calculation please

need full calculation please