Need help! 1.  2.

2.

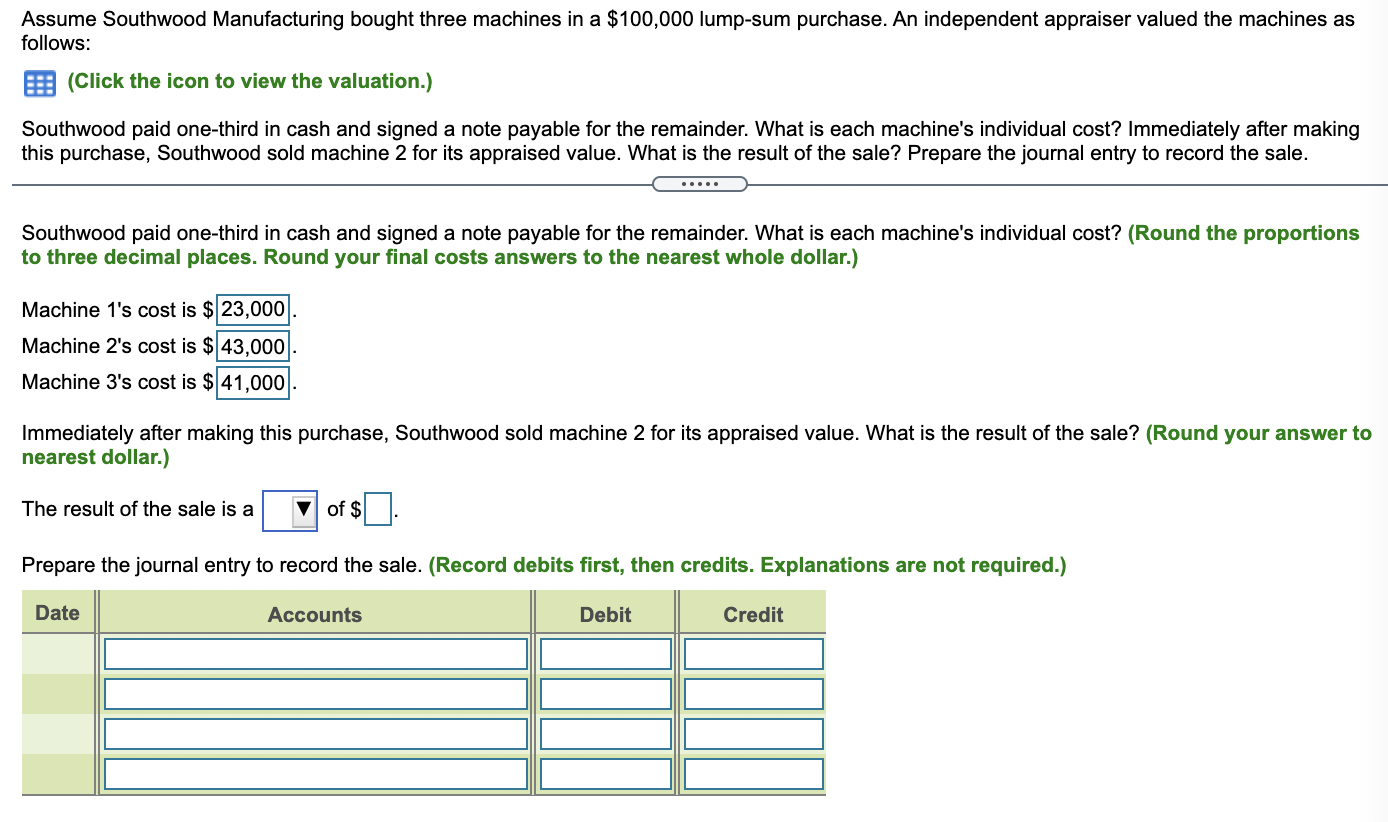

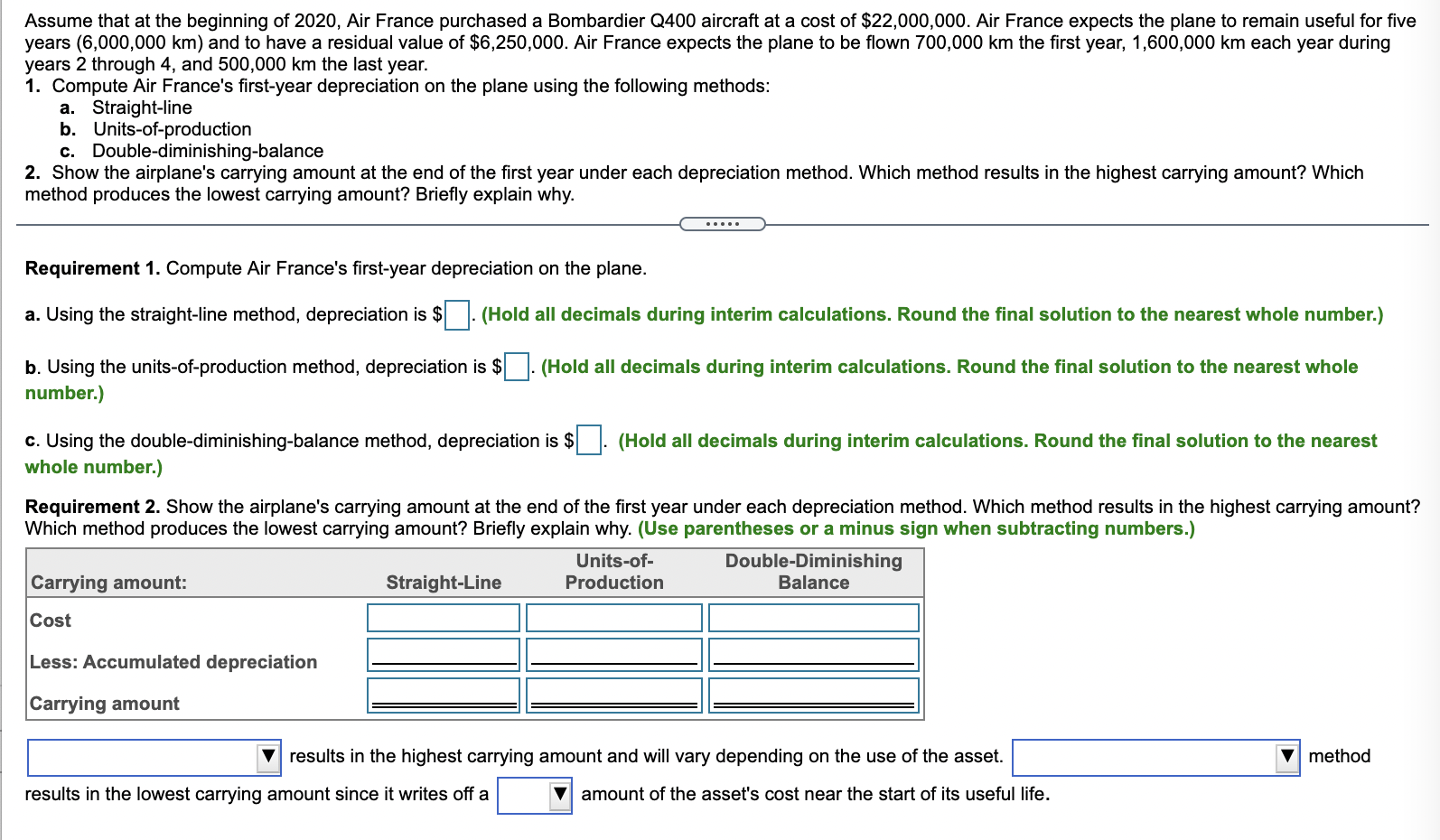

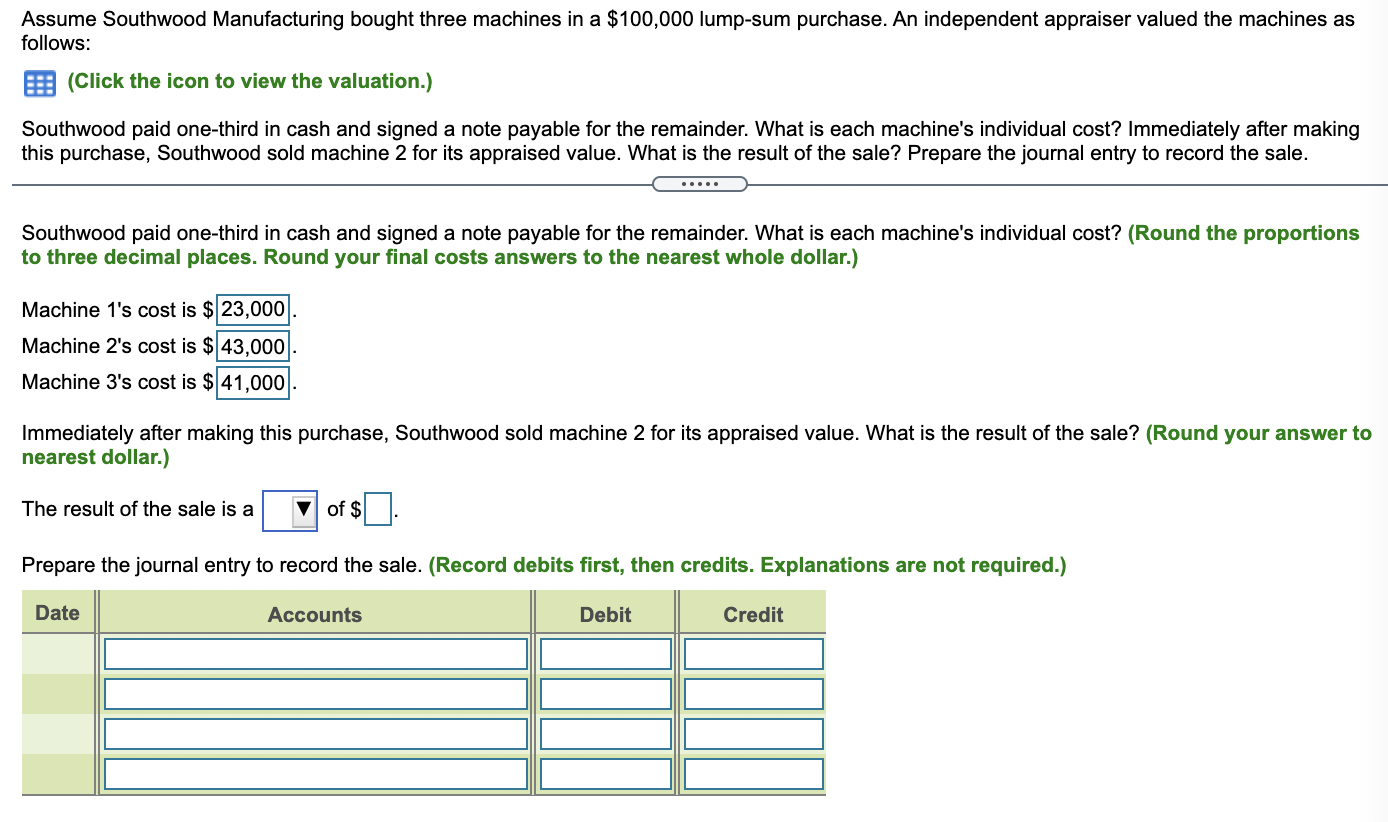

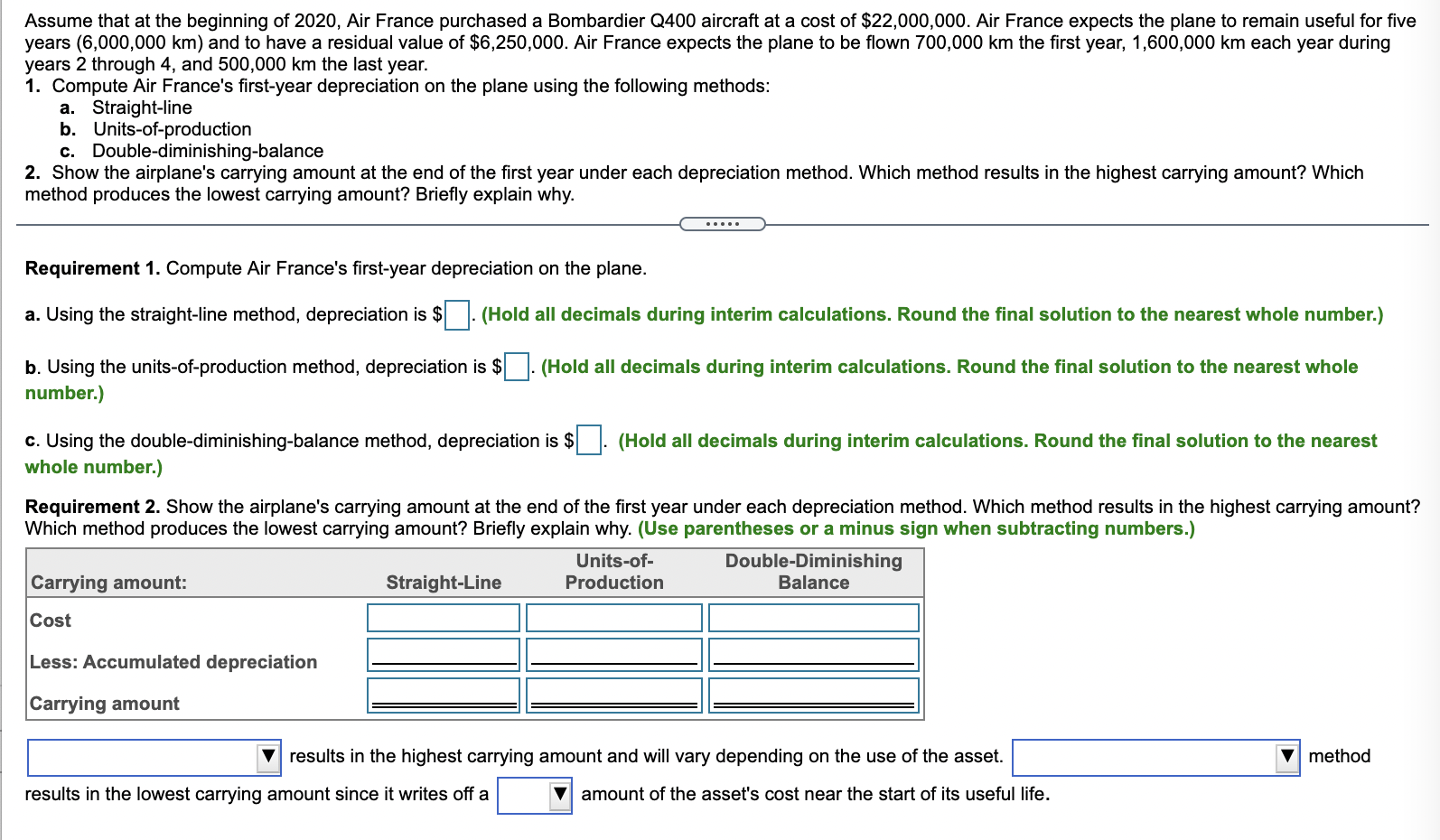

Assume that at the beginning of 2020, Air France purchased a Bombardier Q400 aircraft at a cost of $22,000,000. Air France expects the plane to remain useful for five years (6,000,000 km) and to have a residual value of $6,250,000. Air France expects the plane to be flown 700,000 km the first year, 1,600,000 km each year during years 2 through 4, and 500,000 km the last year. 1. Compute Air France's first-year depreciation on the plane using the following methods: a. Straight-line b. Units-of-production c. Double-diminishing-balance 2. Show the airplane's carrying amount at the end of the first year under each depreciation method. Which method results in the highest carrying amount? Which method produces the lowest carrying amount? Briefly explain why. Requirement 1. Compute Air France's first-year depreciation on the plane. a. Using the straight-line method, depreciation is $. (Hold all decimals during interim calculations. Round the final solution to the nearest whole number.) b. Using the units-of-production method, depreciation is $ . (Hold all decimals during interim calculations. Round the final solution to the nearest whole number.) c. Using the double-diminishing-balance method, depreciation is $. (Hold all decimals during interim calculations. Round the final solution to the nearest whole number.) Requirement 2. Show the airplane's carrying amount at the end of the first year under each depreciation method. Which method results in the highest carrying amount? Which method produces the lowest carrying amount? Briefly explain why. (Use parentheses or a minus sign when subtracting numbers.) Units-of- Double-Diminishing Carrying amount: Straight-Line Production Balance Cost Less: Accumulated depreciation Carrying amount method results in the highest carrying amount and will vary depending on the use of the asset. results in the lowest carrying amount since it writes off a amount of the asset's cost near the start of its useful life. Assume Southwood Manufacturing bought three machines in a $100,000 lump-sum purchase. An independent appraiser valued the machines as follows: B (Click the icon to view the valuation.) Southwood paid one-third in cash and signed a note payable for the remainder. What is each machine's individual cost? Immediately after making this purchase, Southwood sold machine 2 for its appraised value. What is the result of the sale? Prepare the journal entry to record the sale. Southwood paid one-third in cash and signed a note payable for the remainder. What is each machine's individual cost? (Round the proportions to three decimal places. Round your final costs answers to the nearest whole dollar.) Machine 1's cost is $23,000 Machine 2's cost is $ 43,000 Machine 3's cost is $ 41,000 Immediately after making this purchase, Southwood sold machine 2 for its appraised value. What is the result of the sale? (Round your answer to nearest dollar.) The result of the sale is a of $ Prepare the journal entry to record the sale. (Record debits first, then credits. Explanations are not required.) Date Accounts Debit Credit

2.

2.