need help

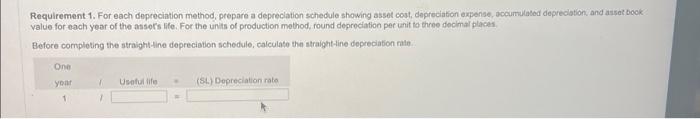

1. For each depreciation method, prepare a depreciation schedule showing asset cost, depreciation expense, accumulated depreciation, and asset book value for each year of the asset's life. For the units of production method, round depreciation per unit to three decimai places. 2. Grayzka Enterprises, Inc. prepares financial statements using the depreciation method that reports the highest income in the early years of asset use. For income tax purposes, the company uses the depreciation method that minimizes income taxes in the early years. Consider the first year Grayzka Enterprises, Inc.4 uses the equipment. Identify the depreciation methods that meet Grayzka Enterprises' objectives, assuming the income tax authorities permit the use of any mothod. Requirement.1. For each dopreciation method, prepare a depreclation schedule showing asset cost, depreciation expense, accumblated depreclation, and aisat book value for each year of the assors life. For the units of production mothod, found deprociation per unit ta three decimat places Before cornpleting the straight tine depreciotion schedule, calculate the straight-line depreciabion ntle 1. For each depreciation method, prepare a depreciation schedule showing asset cost, depreciation expense, accumulated depreciation, and asset book value for each year of the asset's life. For the units of production method, round depreciation per unit to three decimai places. 2. Grayzka Enterprises, Inc. prepares financial statements using the depreciation method that reports the highest income in the early years of asset use. For income tax purposes, the company uses the depreciation method that minimizes income taxes in the early years. Consider the first year Grayzka Enterprises, Inc.4 uses the equipment. Identify the depreciation methods that meet Grayzka Enterprises' objectives, assuming the income tax authorities permit the use of any mothod. Requirement.1. For each dopreciation method, prepare a depreclation schedule showing asset cost, depreciation expense, accumblated depreclation, and aisat book value for each year of the assors life. For the units of production mothod, found deprociation per unit ta three decimat places Before cornpleting the straight tine depreciotion schedule, calculate the straight-line depreciabion ntle