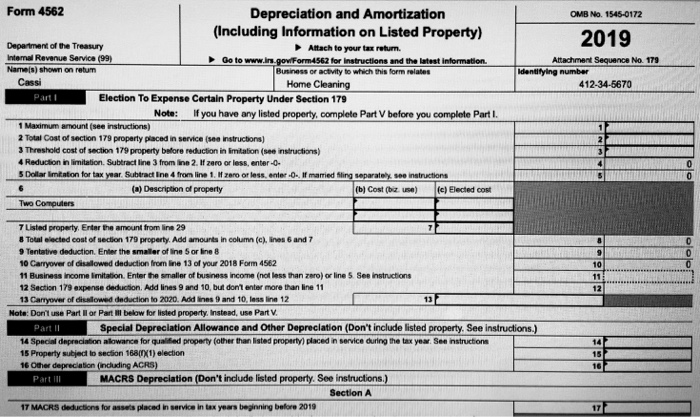

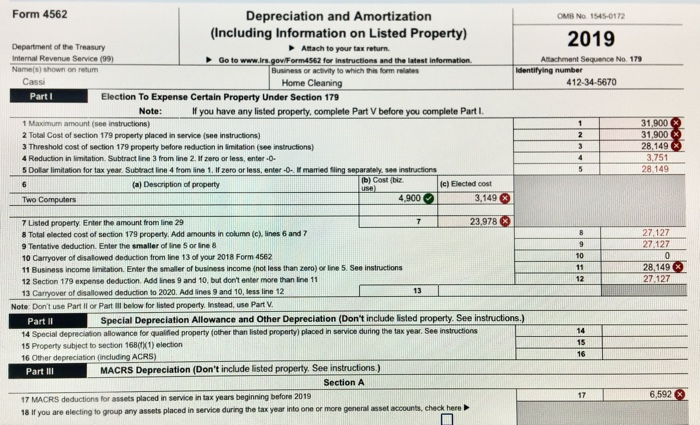

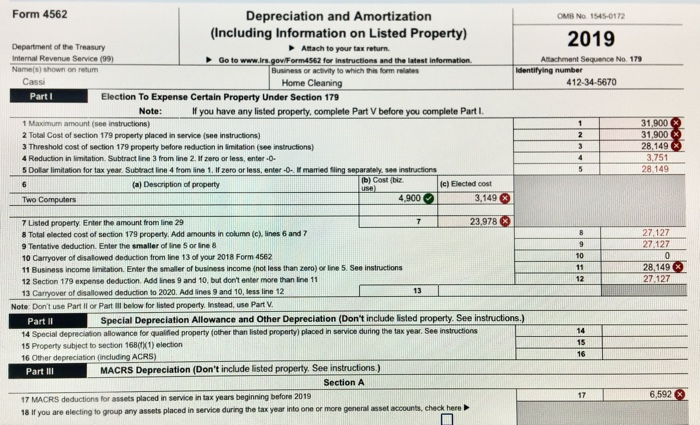

Need help 2019 Form 4562

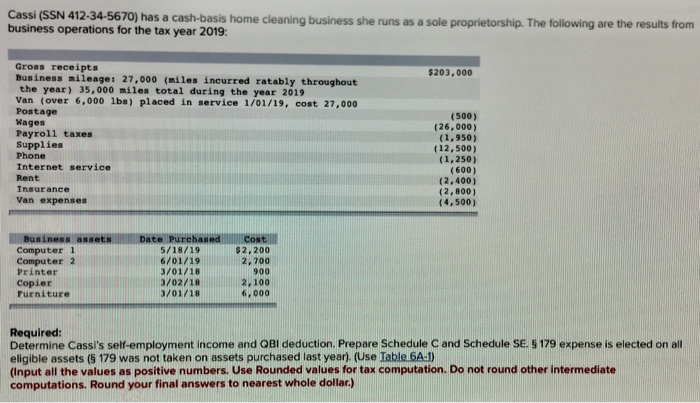

with lines 1, 2, 3, 6, 7, 11, and 17.

thank you

Line 6 was the only answer I got right

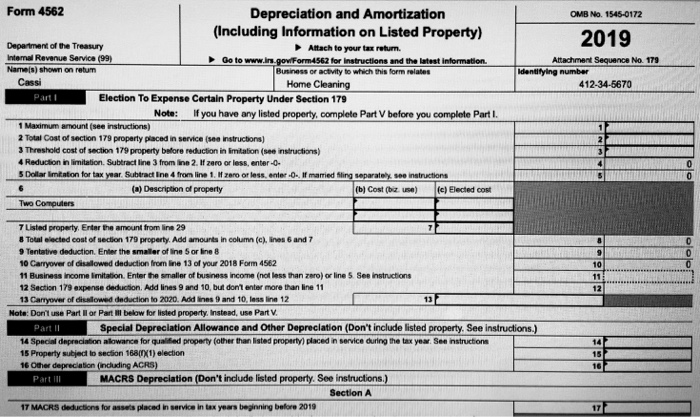

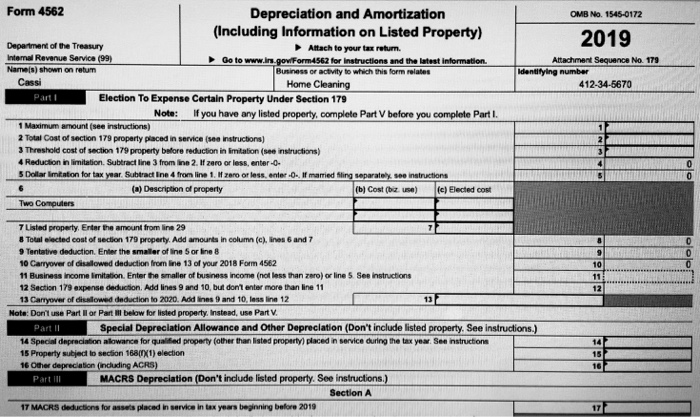

OMB No. 1545-0172 2019 Attachment Sequence No. 179 Identifying number 412-34-5670 Form 4562 Depreciation and Amortization (Including Information on Listed Property) Department of the Treasury Attach to your tax retum. Intamal Revenue Servica (99) Go to www.lrs.gov/ Form4562 for instructions and the latest information Name() shown on retum Business or activity to which this form relates Cassi Home Cleaning Parti Election To Expense Certain Property Under Section 179 Note: If you have any listed property, complete Part V before you complete Part I. 1 Maximum armount (see instructions) 2 Total Cost of section 179 property placed in service (see instructions) 3 Threshold cost of section 179 property before reduction in Imitation (see instructions) 4 Reduction in limitation. Subtract line 3 from line 2. If zero or less, enter- Dollar imitation for tax year. Subtractine 4 from line 1. zero or less, enter..If married fling separately see instructions () Description of property (b) Cost (biz use) (c) Elected cost Two Computers 7 Listed property. Enter the amount from line 29 8 Total elected cost of section 179 property. Add amounts in Column (c), Ines 6 and 7 9 Tentative deduction. Enter the smaller of line 5 or line 8 10 Carryover of disallowed deduction from line 13 of your 2018 Form 4562 11 Business Income limitation Enter the smaller of business income (not less than zaro) or line 5 See Instructions 12 Section 179 expense deduction. Add lines 9 and 10, but don't enter more than line 11 13 Carryover of disallowed deduction to 2020. Add lines 9 and 10, less line 12 Note: Don't use Part llor Part below for listed property. Instead, use Part V. Part II Special Depreciation Allowance and Other Depreciation (Don't include listed property. See instructions.) 14 Special depreciation allowance for qualified property (other than listed properly placed in service during the tax year See Instruction 15 Property subject to section 168(X1) election 16 Other depreciation (including ACRS) Partill M ACRS Depreciation (Don't include listed property. See instructions.) Section A 17 MACRS deductions for assets placed in service in tax years beginning before 2019 Cassi (SSN 412-34-5670) has a cash-basis home cleaning business she runs as a sole proprietorship. The following are the results from business operations for the tax year 2019: $203,000 Gross receipts Business mileage: 27,000 miles incurred ratably throughout the year) 35,000 miles total during the year 2019 Van (over 6,000 lbs) placed in service 1/01/19, cost 27,000 Postage Wages Payroll taxes Supplies Phone Internet service Rent Insurance Van expenses (500) (26,000) (1,950) (12,500) (1,250) (600) (2,400) (2,800) (4,500) Cost Business assets Computer 1 Computer 2 Printer Copier Furniture Date Purchased 5/18/19 6/01/19 3/01/18 3/02/18 3/01/18 $2,200 2,700 900 2,100 6,000 Required: Determine Cassi's self-employment income and OBI deduction. Prepare Schedule C and Schedule Se. S 179 expense is elected on all eligible assets (5 179 was not taken on assets purchased last year). (Use Table 6A-1) (Input all the values as positive numbers. Use Rounded values for tax computation. Do not round other intermediate computations. Round your final answers to nearest whole dollar) OM NO 1545-0172 2019 Attachment Sequence No 1713 Identifying number 412-34-5670 Form 4562 Depreciation and Amortization (Including Information on Listed Property) Department of the Treasury Anach to your tax return Wemal Revenue Service (99) Go to www.in.gov/form4562 for instructions and the latest Information Name shown on ruum Business or to which the form e s Cassi Home Cleaning Parti Election To Expense Certain Property Under Section 179 Note: you have any listed property, complete Part V before you complete Parti 1 Maximum amount instructions) 2 Total Cost of section 179 property placed in services instruction) 3 Threshold cost of section 179 property before reduction in Imitation instructions) 4 Reduction in limitation. Subtract line from line 2. If ore or less enter-O- 5 Doll limitation for tax year. Subtract line 4 from ine 1. If zero or less enter 0. marred Sling separately see instructions (a) Description of property Dj Coster c) Elected cost Two Computers 4,900 3.149 X 31.900 31.900 28.149 3.751 28 149 27.127 27.127 10 11 12 28 149 27 127 | 7 Usted property Enter the amount from line 29 7 23.978 X 8 Total elected cost of section 179 property. Add amounts in column (c), lines 6 and 7 9 Tentative deduction Enter the smaller of line 5 or line 8 10 Carryover of disalowed deduction from line 13 of your 2018 Form 4562 11 Business income limitation Enter the smaller of business income (not less than zero) or line 5. See instructions 12 Section 179 expense deduction. Addins 9 and 10, but don't enter more than line 11 13 Carryover of disallowed deduction to 2020. Add lines 9 and 10 less line 12 13 Note: Don't use Partilor Part below for listed property. Instead, use Part V. Part 1 Special Depreciation Allowance and Other Depreciation (Don't include listed property. See instructions.) 14 Special depreciation allowance for qualified property other than listed property placed in service during the tax year. See instructions 15 Property subject to section 168(X1) election 16 Other depreciation (including ACRS) Partill MACRS Depreciation (Don't include listed property. See instructions.) Section A 17 MACRS deductions for assets placed in service in tax years beginning before 2019 18 If you are electing to group any assets placed in service during the tax year into one or more general asset accounts, check here 6,592 OMB No. 1545-0172 2019 Attachment Sequence No. 179 Identifying number 412-34-5670 Form 4562 Depreciation and Amortization (Including Information on Listed Property) Department of the Treasury Attach to your tax retum. Intamal Revenue Servica (99) Go to www.lrs.gov/ Form4562 for instructions and the latest information Name() shown on retum Business or activity to which this form relates Cassi Home Cleaning Parti Election To Expense Certain Property Under Section 179 Note: If you have any listed property, complete Part V before you complete Part I. 1 Maximum armount (see instructions) 2 Total Cost of section 179 property placed in service (see instructions) 3 Threshold cost of section 179 property before reduction in Imitation (see instructions) 4 Reduction in limitation. Subtract line 3 from line 2. If zero or less, enter- Dollar imitation for tax year. Subtractine 4 from line 1. zero or less, enter..If married fling separately see instructions () Description of property (b) Cost (biz use) (c) Elected cost Two Computers 7 Listed property. Enter the amount from line 29 8 Total elected cost of section 179 property. Add amounts in Column (c), Ines 6 and 7 9 Tentative deduction. Enter the smaller of line 5 or line 8 10 Carryover of disallowed deduction from line 13 of your 2018 Form 4562 11 Business Income limitation Enter the smaller of business income (not less than zaro) or line 5 See Instructions 12 Section 179 expense deduction. Add lines 9 and 10, but don't enter more than line 11 13 Carryover of disallowed deduction to 2020. Add lines 9 and 10, less line 12 Note: Don't use Part llor Part below for listed property. Instead, use Part V. Part II Special Depreciation Allowance and Other Depreciation (Don't include listed property. See instructions.) 14 Special depreciation allowance for qualified property (other than listed properly placed in service during the tax year See Instruction 15 Property subject to section 168(X1) election 16 Other depreciation (including ACRS) Partill M ACRS Depreciation (Don't include listed property. See instructions.) Section A 17 MACRS deductions for assets placed in service in tax years beginning before 2019 Cassi (SSN 412-34-5670) has a cash-basis home cleaning business she runs as a sole proprietorship. The following are the results from business operations for the tax year 2019: $203,000 Gross receipts Business mileage: 27,000 miles incurred ratably throughout the year) 35,000 miles total during the year 2019 Van (over 6,000 lbs) placed in service 1/01/19, cost 27,000 Postage Wages Payroll taxes Supplies Phone Internet service Rent Insurance Van expenses (500) (26,000) (1,950) (12,500) (1,250) (600) (2,400) (2,800) (4,500) Cost Business assets Computer 1 Computer 2 Printer Copier Furniture Date Purchased 5/18/19 6/01/19 3/01/18 3/02/18 3/01/18 $2,200 2,700 900 2,100 6,000 Required: Determine Cassi's self-employment income and OBI deduction. Prepare Schedule C and Schedule Se. S 179 expense is elected on all eligible assets (5 179 was not taken on assets purchased last year). (Use Table 6A-1) (Input all the values as positive numbers. Use Rounded values for tax computation. Do not round other intermediate computations. Round your final answers to nearest whole dollar) OM NO 1545-0172 2019 Attachment Sequence No 1713 Identifying number 412-34-5670 Form 4562 Depreciation and Amortization (Including Information on Listed Property) Department of the Treasury Anach to your tax return Wemal Revenue Service (99) Go to www.in.gov/form4562 for instructions and the latest Information Name shown on ruum Business or to which the form e s Cassi Home Cleaning Parti Election To Expense Certain Property Under Section 179 Note: you have any listed property, complete Part V before you complete Parti 1 Maximum amount instructions) 2 Total Cost of section 179 property placed in services instruction) 3 Threshold cost of section 179 property before reduction in Imitation instructions) 4 Reduction in limitation. Subtract line from line 2. If ore or less enter-O- 5 Doll limitation for tax year. Subtract line 4 from ine 1. If zero or less enter 0. marred Sling separately see instructions (a) Description of property Dj Coster c) Elected cost Two Computers 4,900 3.149 X 31.900 31.900 28.149 3.751 28 149 27.127 27.127 10 11 12 28 149 27 127 | 7 Usted property Enter the amount from line 29 7 23.978 X 8 Total elected cost of section 179 property. Add amounts in column (c), lines 6 and 7 9 Tentative deduction Enter the smaller of line 5 or line 8 10 Carryover of disalowed deduction from line 13 of your 2018 Form 4562 11 Business income limitation Enter the smaller of business income (not less than zero) or line 5. See instructions 12 Section 179 expense deduction. Addins 9 and 10, but don't enter more than line 11 13 Carryover of disallowed deduction to 2020. Add lines 9 and 10 less line 12 13 Note: Don't use Partilor Part below for listed property. Instead, use Part V. Part 1 Special Depreciation Allowance and Other Depreciation (Don't include listed property. See instructions.) 14 Special depreciation allowance for qualified property other than listed property placed in service during the tax year. See instructions 15 Property subject to section 168(X1) election 16 Other depreciation (including ACRS) Partill MACRS Depreciation (Don't include listed property. See instructions.) Section A 17 MACRS deductions for assets placed in service in tax years beginning before 2019 18 If you are electing to group any assets placed in service during the tax year into one or more general asset accounts, check here 6,592