Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help 21-24 21. Borrowing securities to sell them, hoping to repurchase them after their price falls, is referred to as: Margining Margarine Indentured transaction

need help 21-24

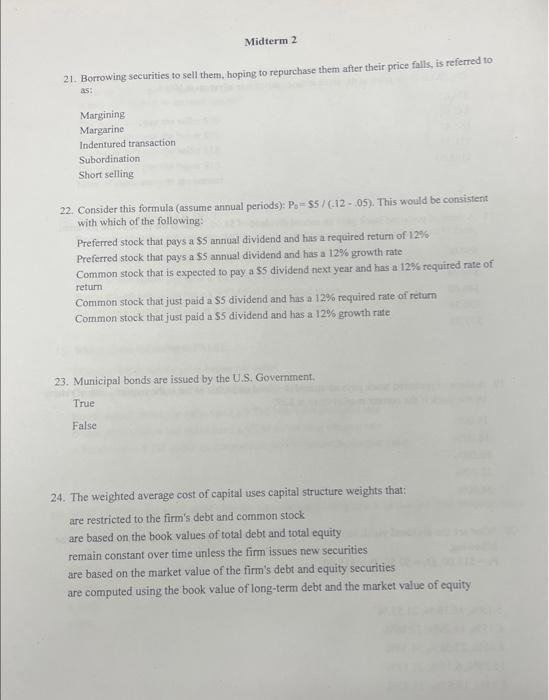

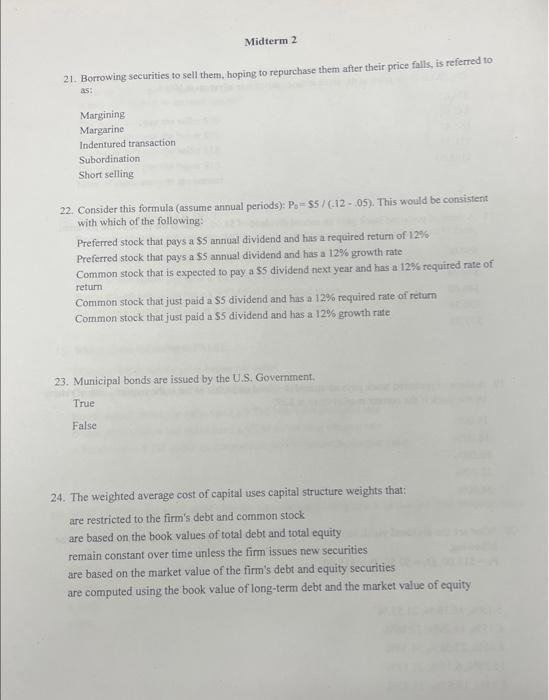

21. Borrowing securities to sell them, hoping to repurchase them after their price falls, is referred to as: Margining Margarine Indentured transaction Subordination Short selling 22. Consider this formula (assume annual periods): P0=$5/(12.05). This would be consistent: with which of the following: Preferred stock that pays a $5 annual dividend and his a required return of 12% Preferred stock that pays a $5 annual dividend and has a 12% growth rate Common stock that is expected to pay a 55 dividend next year and has a 12% required rate of return Common stock that just paid a $5 dividend and has a 12% required rate of return Common stock that just paid a $5 dividend and has a 12% growth rate 23. Municipal bonds are issued by the U.S. Government. True False 24. The weighted average cost of capital uses capital structure weights that: are restricted to the firm's debt and common stock are based on the book values of total debt and total equity remain constant over time unless the firm issues new securities are based on the market value of the firm's debt and equity securities are computed using the book value of long-term debt and the market value of equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started