Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help answering Construct and Interpret a Product Profitability Report, Allocating Selling and Administrative Expenses Naper Inc. manufactures power equipment. Naper has two primary products-generators

need help answering

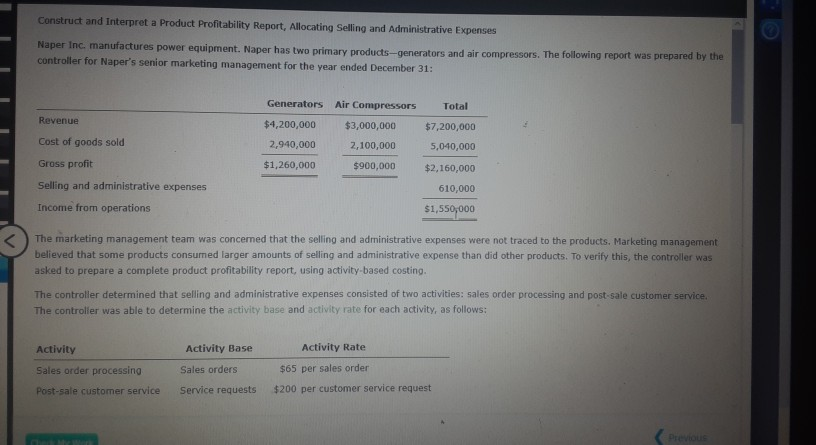

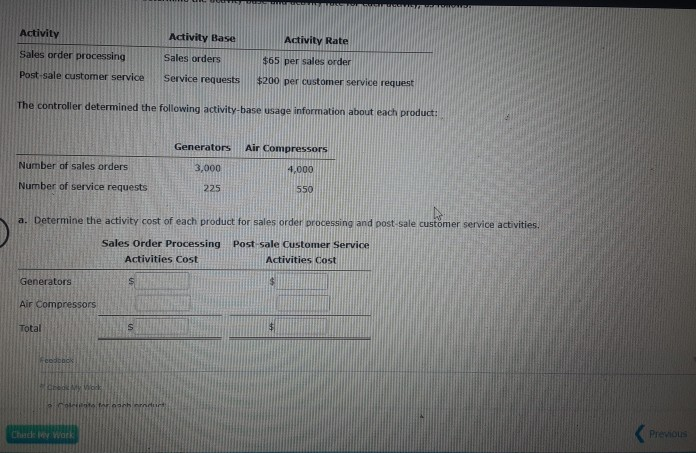

Construct and Interpret a Product Profitability Report, Allocating Selling and Administrative Expenses Naper Inc. manufactures power equipment. Naper has two primary products-generators and air compressors. The following report was prepared by the controller for Naper's senior marketing management for the year ended December 31: Generators Air Compressors Total Revenue $3,000,000 $7,200,000 $4,200,000 2,940,000 Cost of goods sold 2,100,000 5,040,000 $1,260,000 $900,000 $2,160,000 Gross profit Selling and administrative expenses Income from operations 610,000 $1,550,000 The marketing management team was concerned that the selling and administrative expenses were not traced to the products. Marketing management believed that some products consumed larger amounts of selling and administrative expense than did other products. To verify this, the controller was asked to prepare a complete product profitability report, using activity-based costing. The controller determined that selling and administrative expenses consisted of two activities: sales order processing and post-sale customer service. The controller was able to determine the activity base and activity rate for each activity, as follows: Activity Activity Base Activity Rate Sales orders $65 per sales order Sales order processing Post-sale customer service Service requests $200 per customer service request Previous Activity Activity Base Activity Rate Sales orders Sales order processing Post sale customer service $65 per sales order Service requests $200 per customer service request The controller determined the following activity-base usage information about each product: Generators Air Compressors Number of sales orders 3,000 4.000 Number of service requests 225 550 a. Determine the activity cost of each product for sales order processing and post-sale customer service activities. Sales Order Processing Activities Cost Post sale Customer Service Activities Cost Generators S Air Compressors Total S $ odbo Mak este for the Chack My Work PreviousStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started