Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help answering part A using the case study provided in picture. Case Study: K-Viro, Inc. You are Chief Financial Officer at K-Viro, Inc., the

need help answering part A using the case study provided in picture.

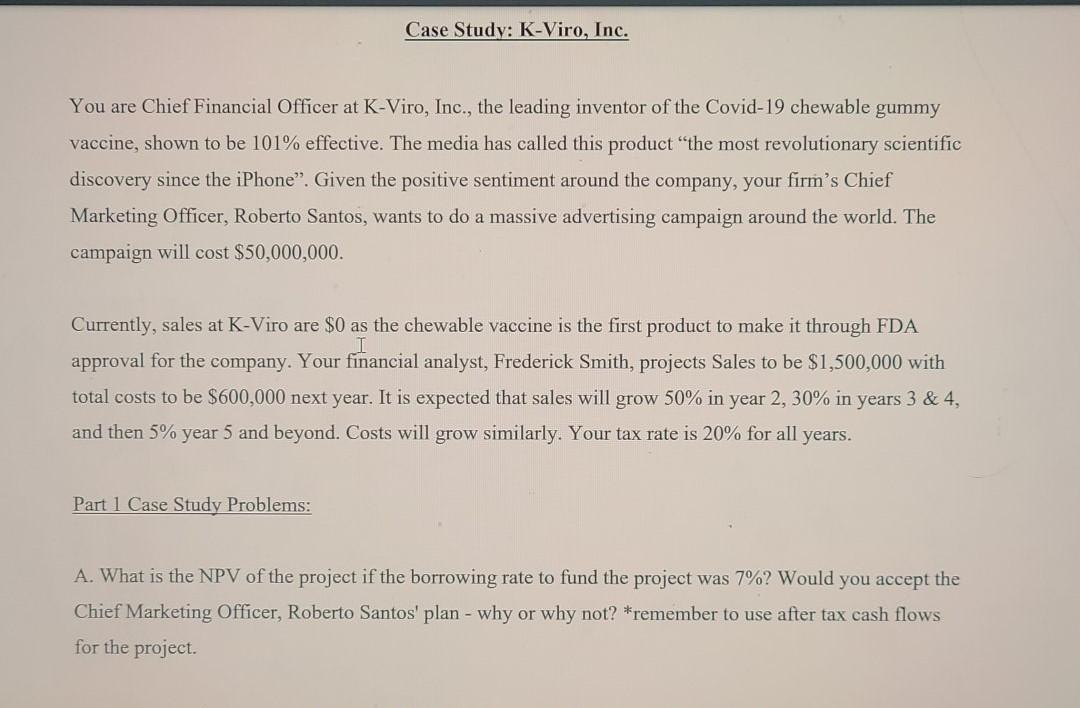

Case Study: K-Viro, Inc. You are Chief Financial Officer at K-Viro, Inc., the leading inventor of the Covid-19 chewable gummy vaccine, shown to be 101% effective. The media has called this product the most revolutionary scientific discovery since the iPhone. Given the positive sentiment around the company, your firm's Chief Marketing Officer, Roberto Santos, wants to do a massive advertising campaign around the world. The campaign will cost $50,000,000. Currently, sales at K-Viro are $0 as the chewable vaccine is the first product to make it through FDA T approval for the company. Your financial analyst, Frederick Smith, projects Sales to be $1,500,000 with total costs to be $600,000 next year. It is expected that sales will grow 50% in year 2, 30% in years 3 & 4, and then 5% year 5 and beyond. Costs will grow similarly. Your tax rate is 20% for all years. Part 1 Case Study Problems: A. What is the NPV of the project if the borrowing rate to fund the project was 7%? Would you accept the Chief Marketing Officer, Roberto Santos' plan - why or why not? *remember to use after tax cash flows for the projectStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started