Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help answering the following accounting questions!! thank you Questions 1 & 2 refer to the following information: X Company's 2019 budgeted overhead cost function

Need help answering the following accounting questions!! thank you

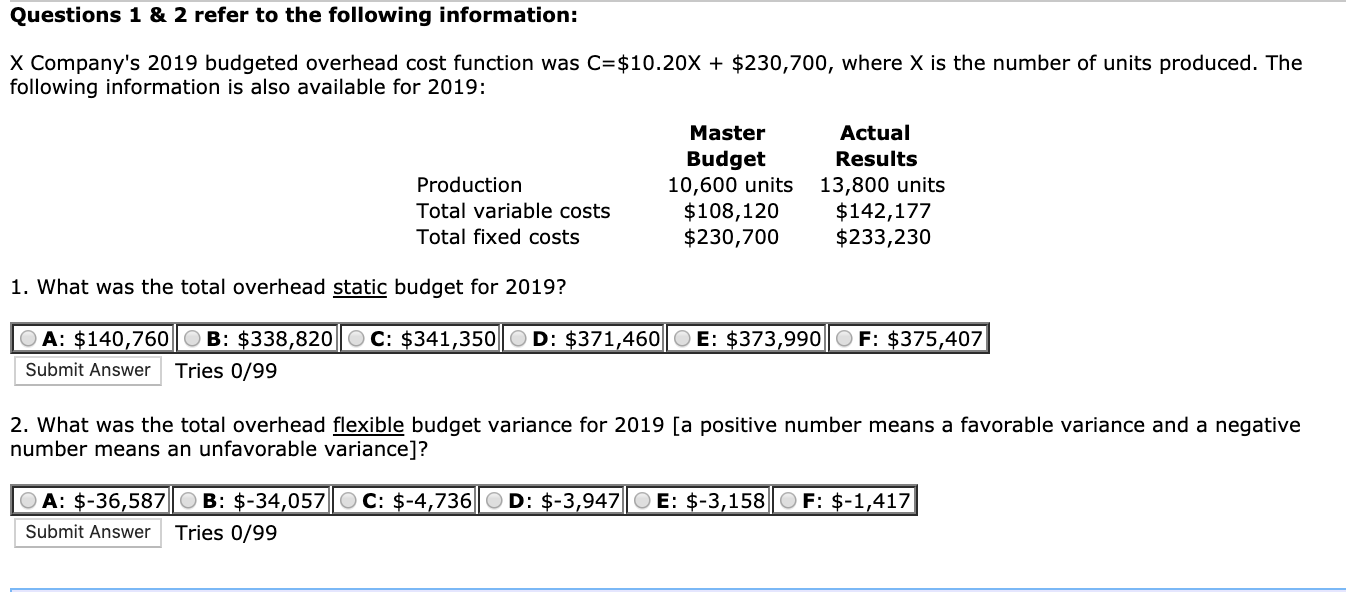

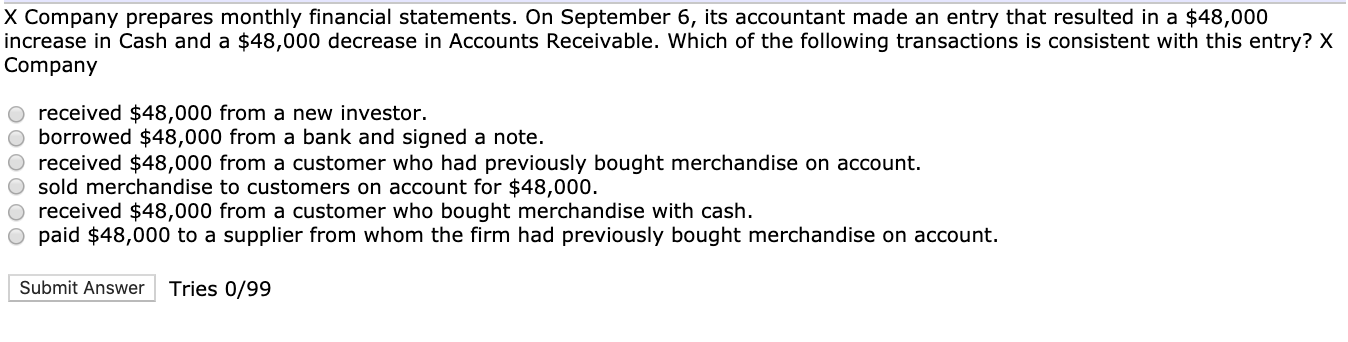

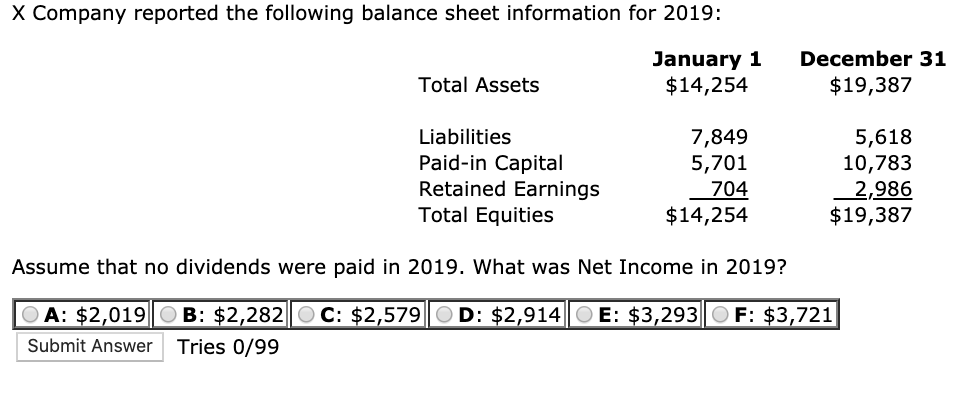

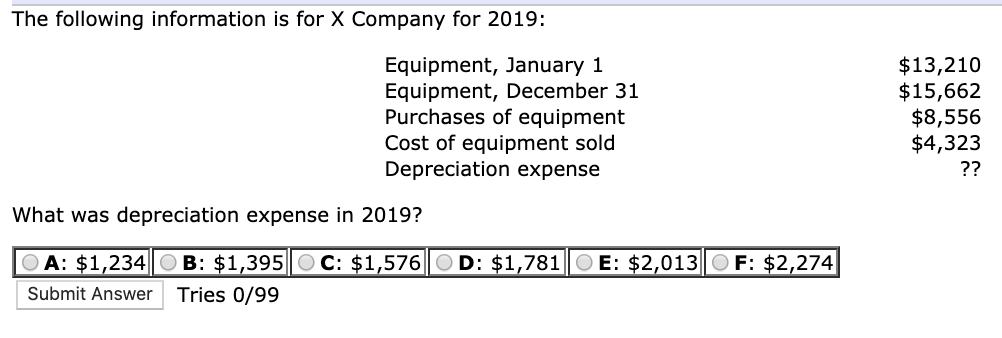

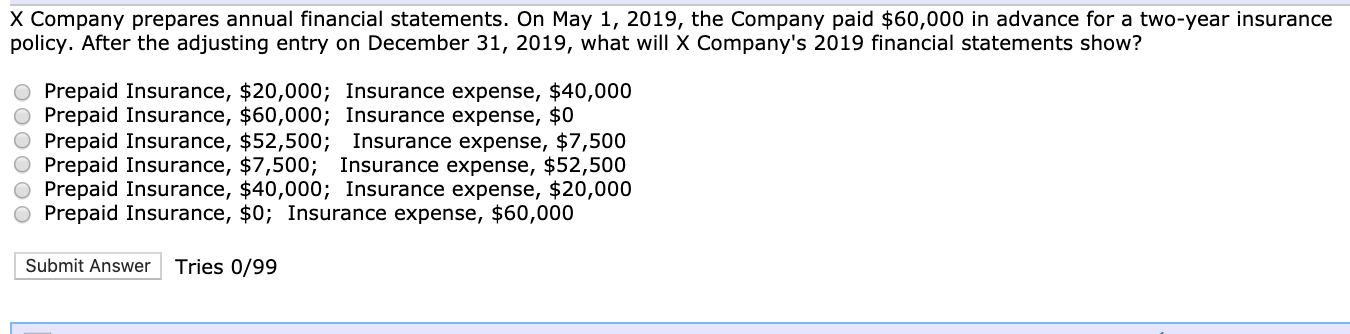

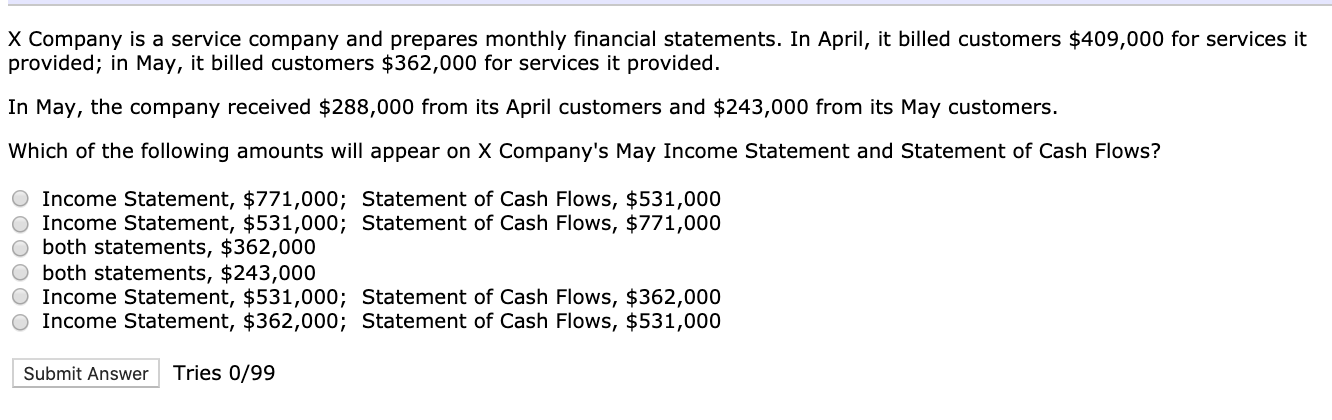

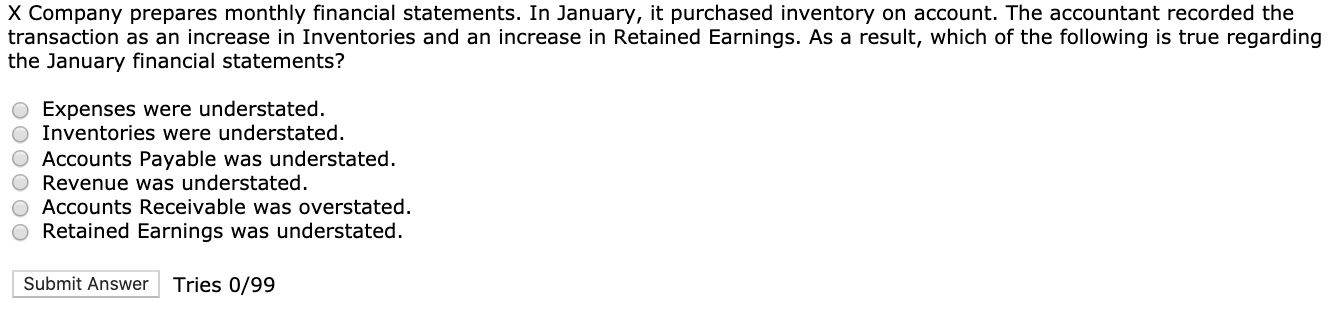

Questions 1 & 2 refer to the following information: X Company's 2019 budgeted overhead cost function was C=$10.20% + $230,700, where X is the number of units produced. The following information is also available for 2019: Production Total variable costs Total fixed costs Master Budget 10,600 units $108,120 $230,700 Actual Results 13,800 units $142,177 $233,230 1. What was the total overhead static budget for 2019? OA: $140,760|OB: $338,820|C: $341,350 OD: $371,460|OE: $373,990 | OF: $375,407 Submit Answer Tries 0/99 2. What was the total overhead flexible budget variance for 2019 [a positive number means a favorable variance and a negative number means an unfavorable variance)? OA: $-36,587|OB: $-34,057|OC: $-4,736 OD: $-3,947|OE: $-3,158 |OF: $-1,417 Submit Answer Tries 0/99 X Company reported the following balance sheet information for 2019: January 1 $14,254 December 31 $19,387 Total Assets 7,849 5,701 Liabilities Paid-in Capital Retained Earnings Total Equities os 704 5,618 10,783 2,986 $19,387 720 $14,254 Assume that no dividends were paid in 2019. What was Net Income in 2019? DA: $2,019 OB: $2,282 OC: $2,579 OD: $2,914 O E: $3,293 OF: $3,721 Submit Answer Tries 0/99 The following information is for X Company for 2019: Equipment, January 1 Equipment, December 31 Purchases of equipment Cost of equipment sold Depreciation expense $13,210 $15,662 $8,556 $4,323 ?? What was depreciation expense in 2019? OA: $1,234|OB: $1,395|OC: $1,576 OD: $1,781 OE: $2,013|OF: $2,274 Submit Answer Tries 0/99 X Company prepares annual financial statements. On May 1, 2019, the Company paid $60,000 in advance for a two-year insurance policy. After the adjusting entry on December 31, 2019, what will X Company's 2019 financial statements show? O Prepaid Insurance, $20,000; Insurance expense, $40,000 O Prepaid Insurance, $60,000; Insurance expense, $0 O Prepaid Insurance, $52,500; Insurance expense, $7,500 O Prepaid Insurance, $7,500; Insurance expense, $52,500 O Prepaid Insurance, $40,000; Insurance expense, $20,000 O Prepaid Insurance, $0; Insurance expense, $60,000 Submit Answer Tries 0/99 X Company is a service company and prepares monthly financial statements. In April, it billed customers $409,000 for services it provided; in May, it billed customers $362,000 for services it provided. In May, the company received $288,000 from its April customers and $243,000 from its May customers. Which of the following amounts will appear on X Company's May Income Statement and Statement of Cash Flows? O Income Statement, $771,000; Statement of Cash Flows, $531,000 O Income Statement, $531,000; Statement of Cash Flows, $771,000 o both statements, $362,000 O both statements, $243,000 O Income Statement, $531,000; Statement of Cash Flows, $362,000 O Income Statement, $362,000; Statement of Cash Flows, $531,000 Submit Answer Tries 0/99 X Company prepares monthly financial statements. In January, it purchased inventory on account. The accountant recorded the transaction as an increase in Inventories and an increase in Retained Earnings. As a result, which of the following is true regarding the January financial statements? O Expenses were understated. O Inventories were understated. O Accounts Payable was understated. O Revenue was understated. O Accounts Receivable was overstated. O Retained Earnings was understated. Submit Answer Tries 0/99

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started