Need help answering these questions

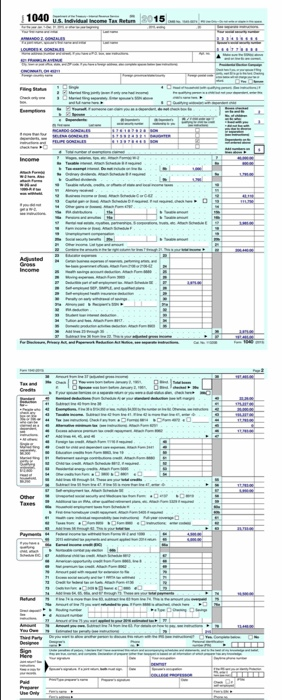

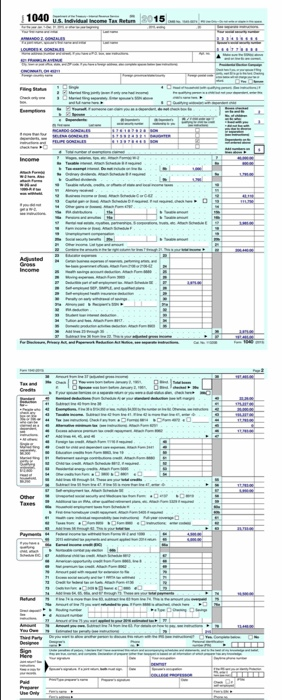

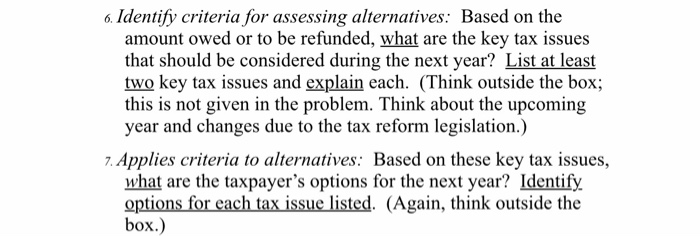

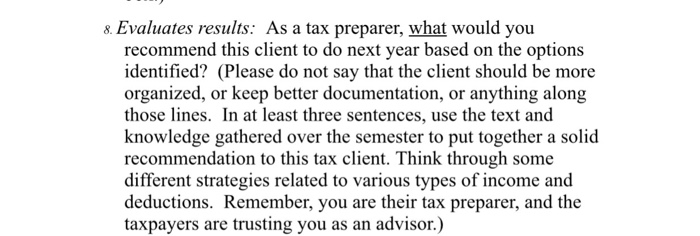

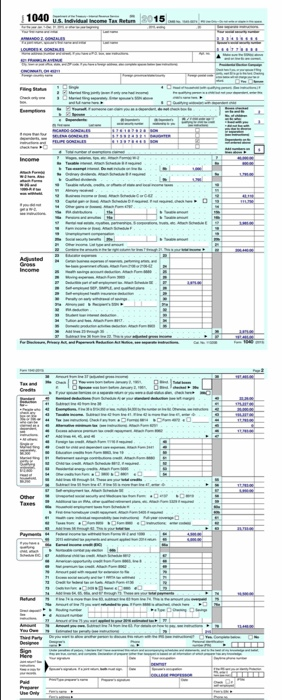

6. Identify criteria for assessing alternatives: Based on the amount owed or to be refunded, what are the key tax issues that should be considered during the next year? List at least two key tax issues and explain each. (Think outside the box this is not given in the problem. Think about the upcoming year and changes due to the tax reform legislation.) criteria to alternatives: Based on these key tax issues, what are the taxpayer's options for the next year? Identify options for each tax issue listed. (Again, think outside the box.) . Evaluates results: As a tax preparer, what would you recommend this client to do next year based on the options identified? (Please do not say that the client should be more organized, or keep better documentation, or anything along those lines. In at least three sentences, use the text and knowledge gathered over the semester to put together a solid recommendation to this tax client, Think through some different strategies related to various types of income and deductions. Remember, you are their tax preparer, and the taxpayers are trusting you as an advisor.) 6. Identify criteria for assessing alternatives: Based on the amount owed or to be refunded, what are the key tax issues that should be considered during the next year? List at least two key tax issues and explain each. (Think outside the box this is not given in the problem. Think about the upcoming year and changes due to the tax reform legislation.) criteria to alternatives: Based on these key tax issues, what are the taxpayer's options for the next year? Identify options for each tax issue listed. (Again, think outside the box.) . Evaluates results: As a tax preparer, what would you recommend this client to do next year based on the options identified? (Please do not say that the client should be more organized, or keep better documentation, or anything along those lines. In at least three sentences, use the text and knowledge gathered over the semester to put together a solid recommendation to this tax client, Think through some different strategies related to various types of income and deductions. Remember, you are their tax preparer, and the taxpayers are trusting you as an advisor.)