Need help answering this question. Not for sure which one.

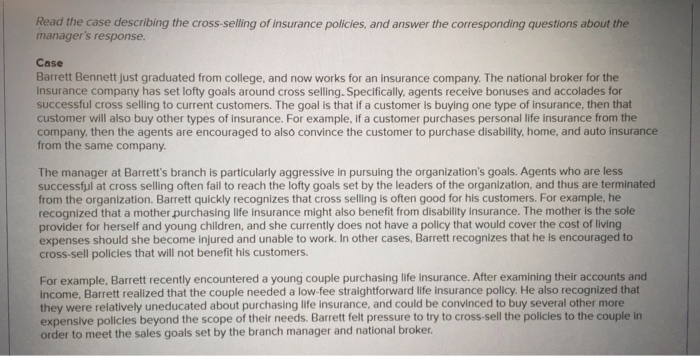

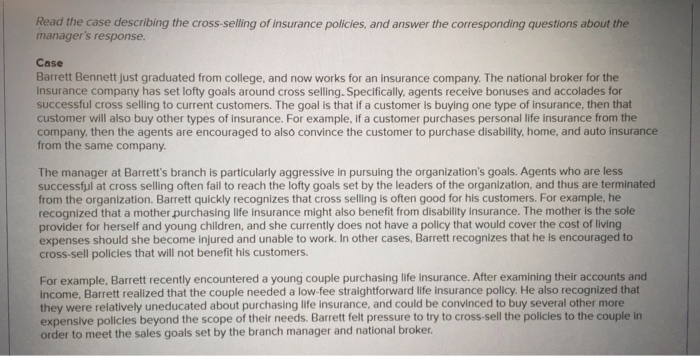

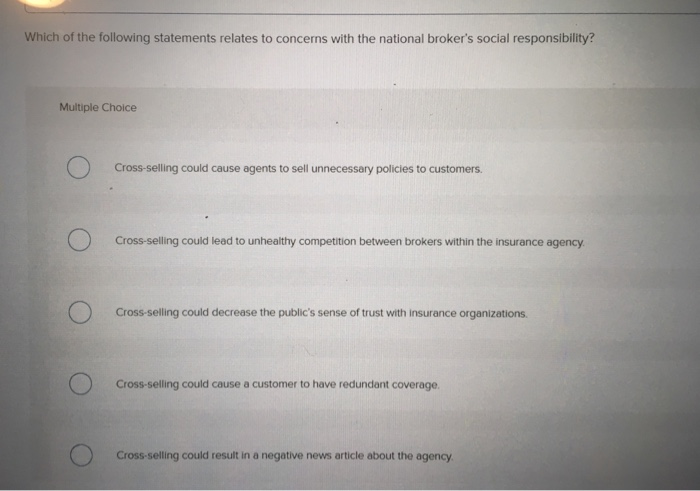

Read the case describing the cross-selling of insurance policies, and answer the corresponding questions about the managers response Case Barrett Bennett just graduated from college, and now works for an insurance company. The national broker for the insurance company has set lofty goals around cross selling. Specifically, agents receive bonuses and accolades for successful cross selling to current customers. The goal is that if a customer is buying one type of insurance, then that customer will also buy other types of insurance. For example, if a customer purchases personal life insurance from the company, then the agents are encouraged to also convince the customer to purchase disability. home, and auto insurance from the same company. The manager at Barrett's branch is particularly aggressive in pursuing the organization's goals. Agents who are less successful at cross selling often fail to reach the lofty goals set by the leaders of the organization, and thus are terminated from the organization. Barrett quickly recognizes that cross selling is often good for his customers. For example, he recognized that a mother purchasing life insurance might also benefit from disability insurance. The mother is the sole provider for herself and young children, and she currently does not have a policy that would cover the cost of living expenses should she become injured and unable to work. In other cases, Barrett recognizes that he is encouraged to cross-sell policies that will not benefit his customers. For example, Barrett recently encountered a young couple purchasing life insurance. After examining their accounts and income, Barrett realized that the couple needed a low-fee straightforward life insurance policy. He also recognized that they were relatively uneducated about purchasing life insurance, and could be convinced to buy several other more expensive policies beyond the scope of their needs. Barrett felt pressure to try to cross-sell the policles to the couple in order to meet the sales goals set by the branch manager and national broker Which of the following statements relates to concerns with the national broker's social responsibility? Multiple Choice Cross sling could cause egents to sell unecessary policies to customens Cross-selling could lead to unhealthy competition between brokers within the insurance agency Cross-selling could decrease the public's sense of trust with insurance organizations Cross-selling could cause a customer to have redundant coverage. Cross-selling could result in a negative news article about the agency