Need help answersing these four questions.

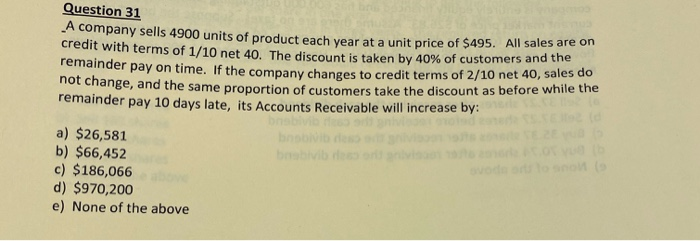

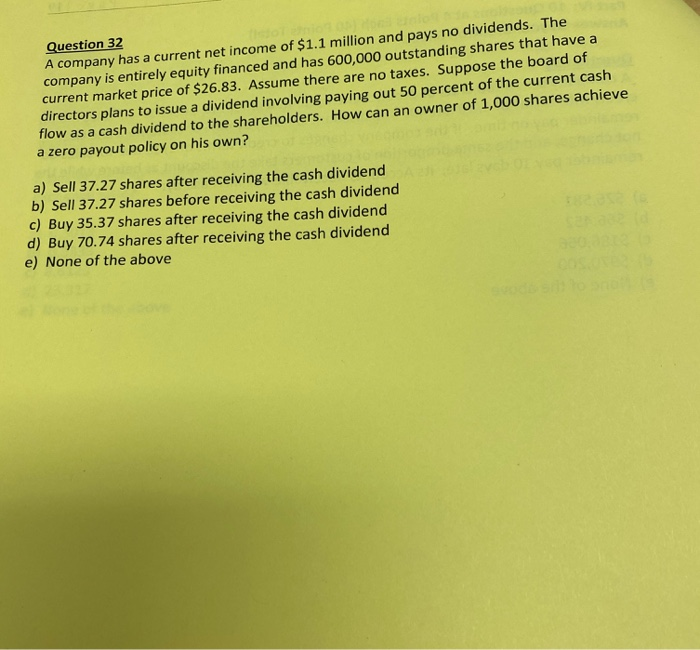

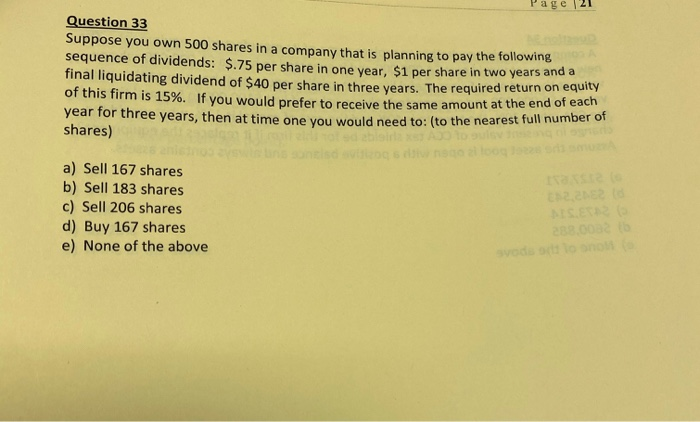

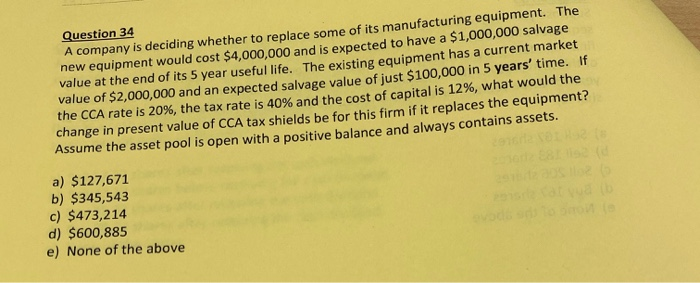

Question 31 - A company sells 4900 units of product each year at a unit price of $495. All sales are credit with terms of 1/10 net 40. The discount is taken by 40% of customers and remainder pay on time. If the company changes to credit terms of 2/10 net 40, Sales not change, and the same proportion of customers take the discount as before we remainder pay 10 days late, its Accounts Receivable will increase by: a) $26,581 b) $66,452 c) $186,066 d) $970,200 e) None of the above Question 32 A company has a current net income of $1.1 million and pays no dividends. The company is entirely equity financed and has 600,000 outstanding shares that have a current market price of $26.83. Assume there are no taxes. Suppose the board of directors plans to issue a dividend involving paying out 50 percent of the current cash flow as a cash dividend to the shareholders. How can an owner of 1,000 shares achieve a zero payout policy on his own? a) Sell 37.27 shares after receiving the cash dividend b) Sell 37.27 shares before receiving the cash dividend c) Buy 35.37 shares after receiving the cash dividend d) Buy 70.74 shares after receiving the cash dividend e) None of the above Page 21 Question 33 Suppose you own 500 shares in a company that is planning to pay the following sequence of dividends: $.75 per share in one vear. $1 per share in two years and a final liquidating dividend of $40 per share in three years. The required return on equ of this firm is 15%. If you would prefer to receive the same amount at the end o year for three years, then at time one you would need to: (to the nearest funn shares) would need to: (to the nearest full number of a) Sell 167 shares b) Sell 183 shares c) Sell 206 shares d) Buy 167 shares e) None of the above Question 34 A company is deciding whether to replace some of its manufacturing equipment. The new equipment would cost $4,000,000 and is expected to have a $1,000,000 salvage value at the end of its 5 year useful life. The existing equipment has a current market value of $2,000,000 and an expected salvage value of just $100,000 in 5 years' time. If the CCA rate is 20%, the tax rate is 40% and the cost of capital is 12%, what would the change in present value of CCA tax shields be for this firm if it replaces the equipment? Assume the asset pool is open with a positive balance and always contains assets. a) $127,671 b) $345,543 c) $473,214 d) $600,885 e) None of the above