Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help ASAP Applying a perpetual inventory system, prepare the journal entries that summarize the transactions that created these balances, Include alf end of petiod

need help ASAP

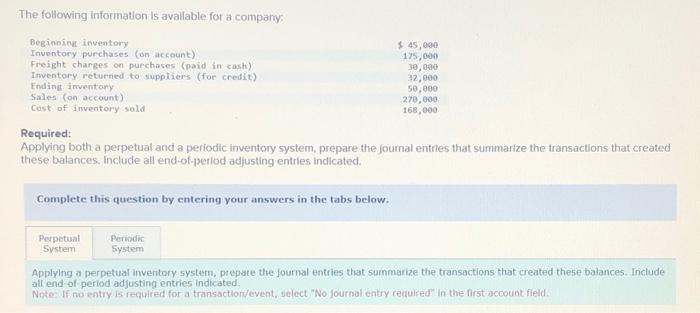

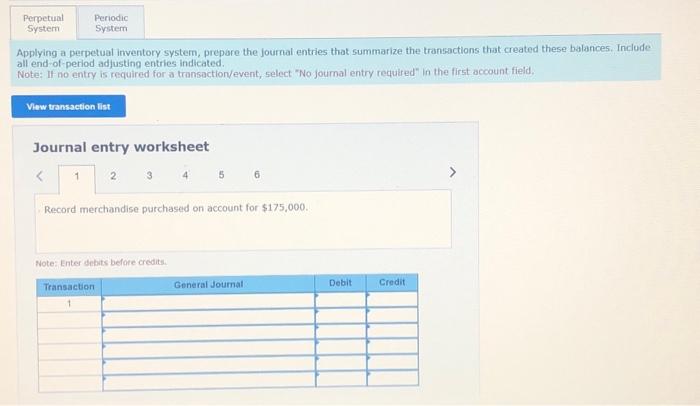

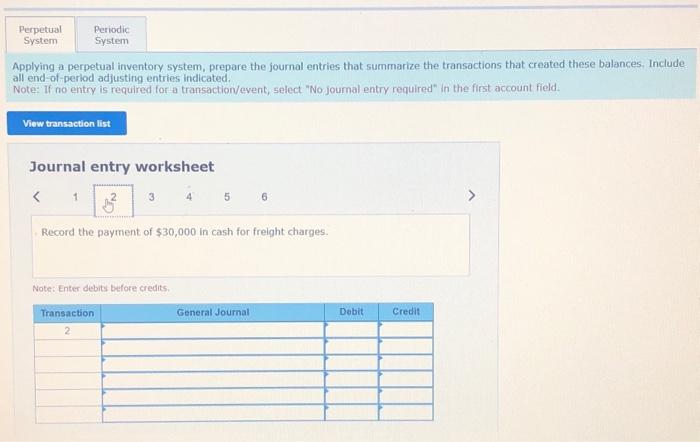

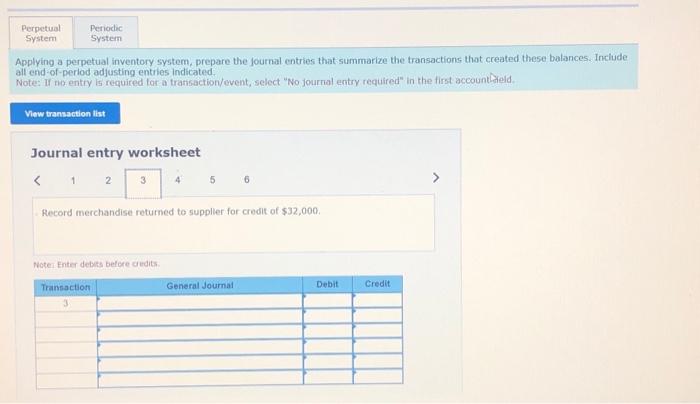

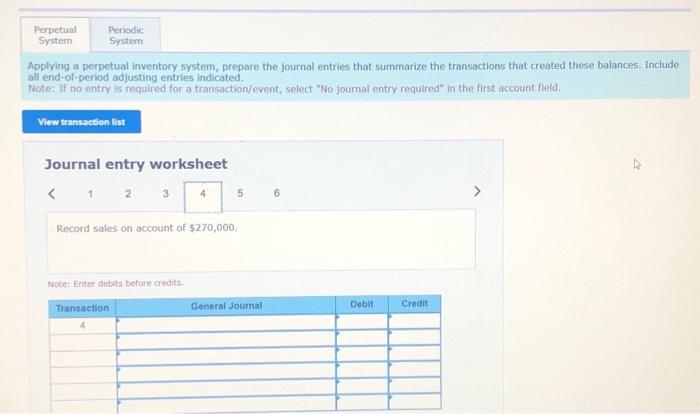

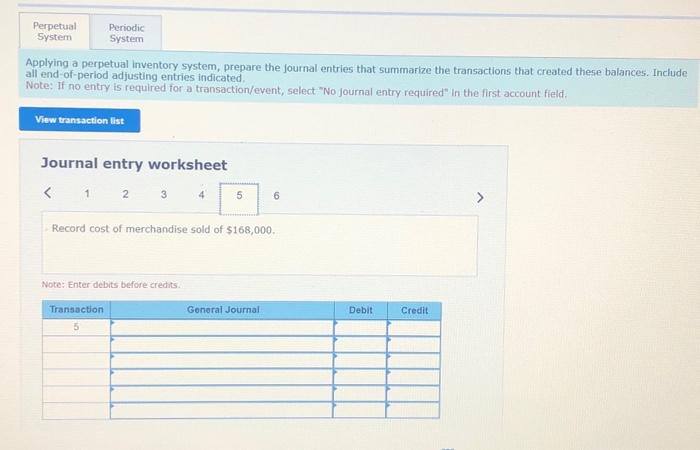

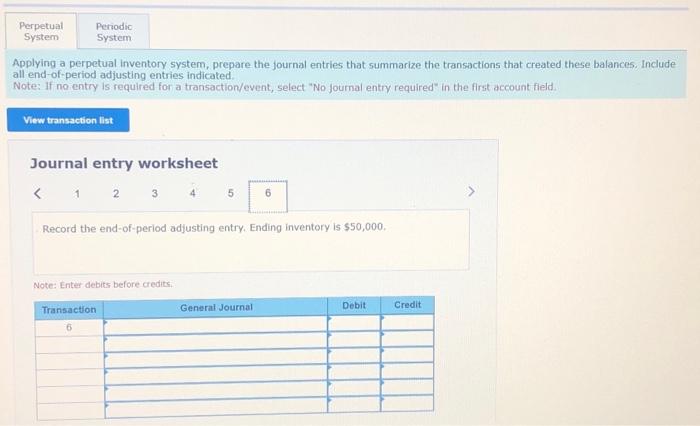

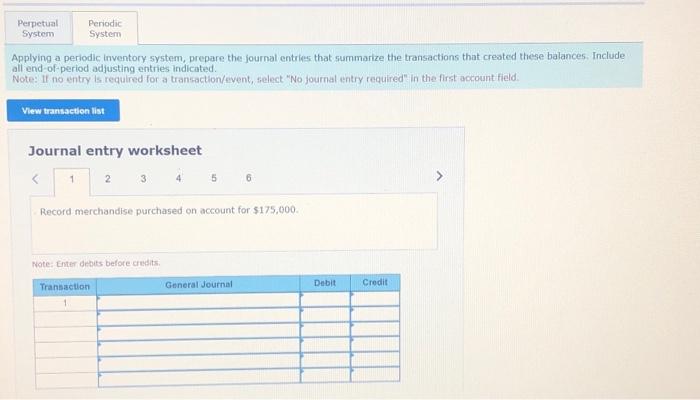

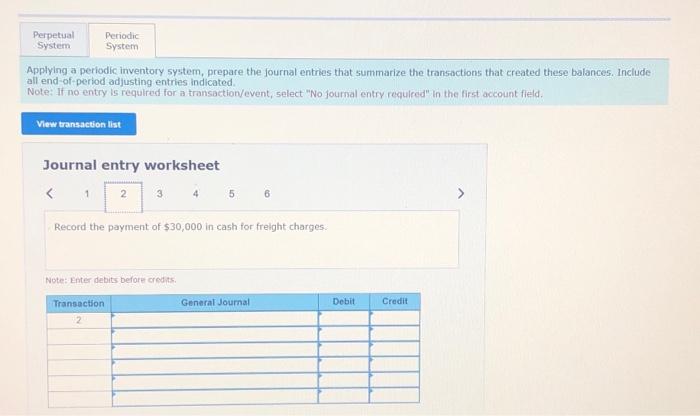

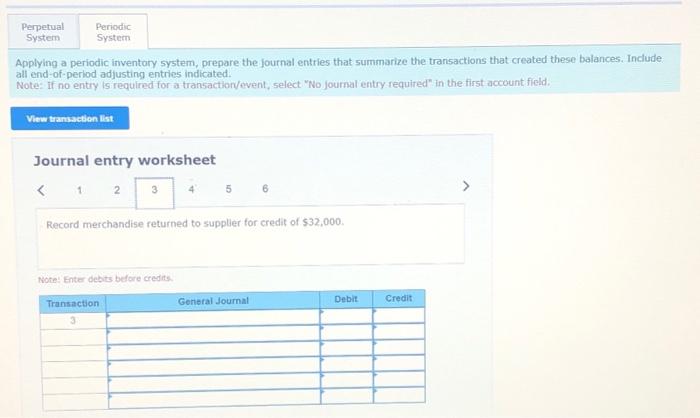

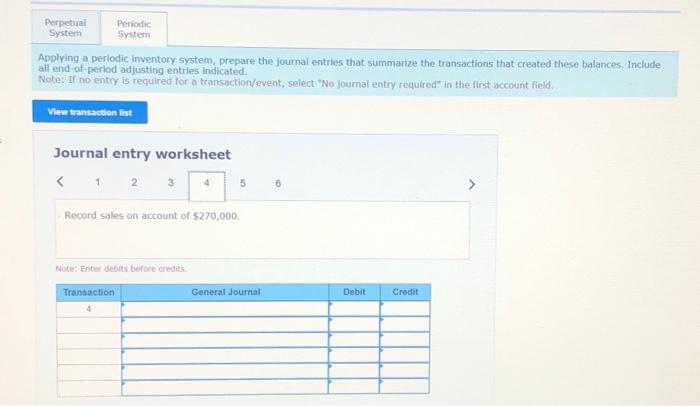

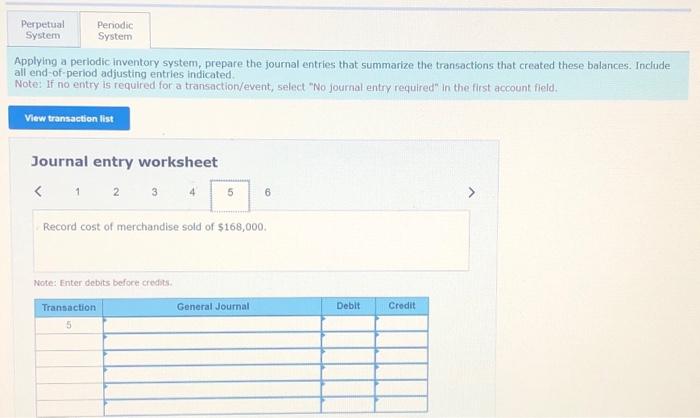

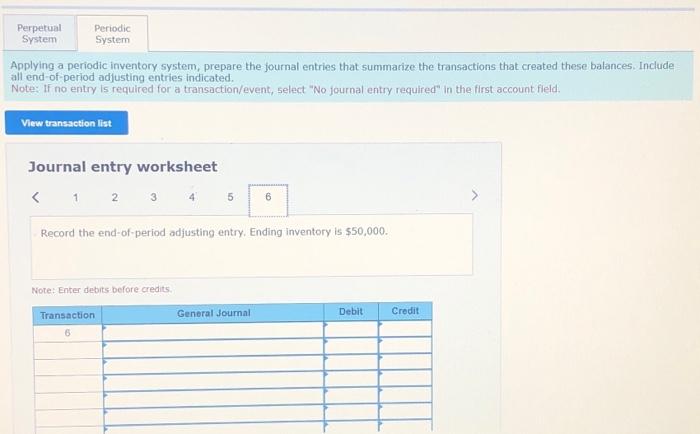

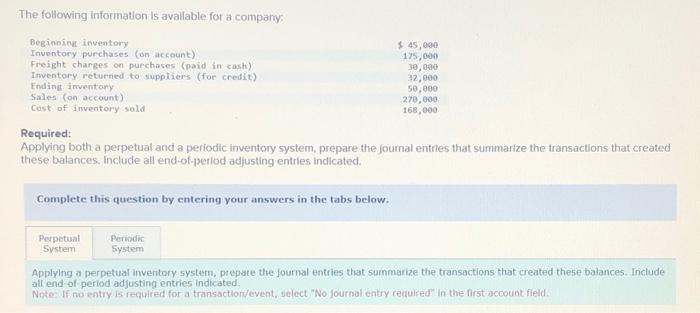

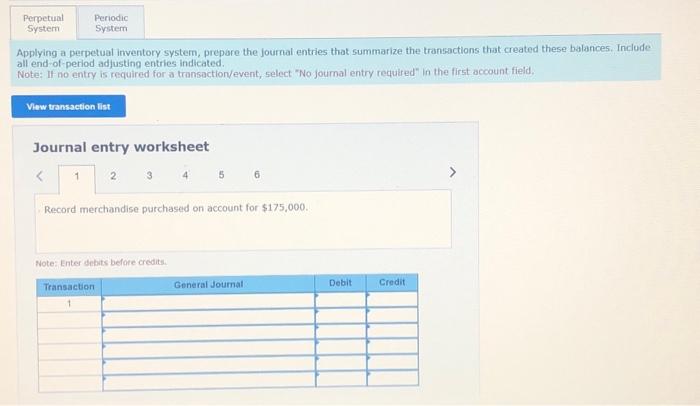

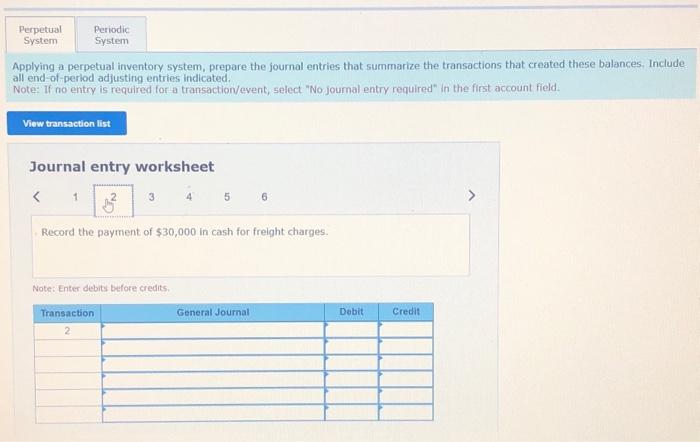

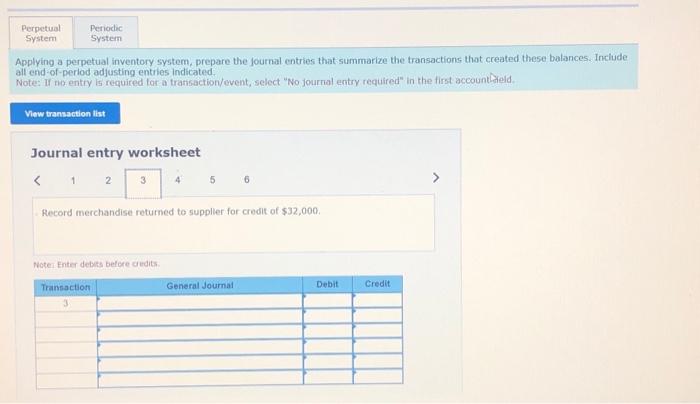

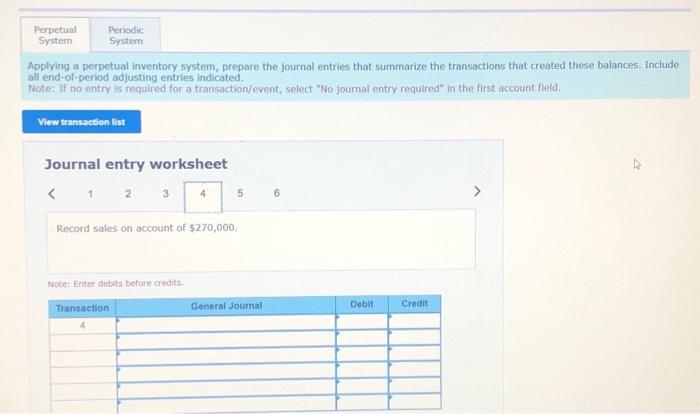

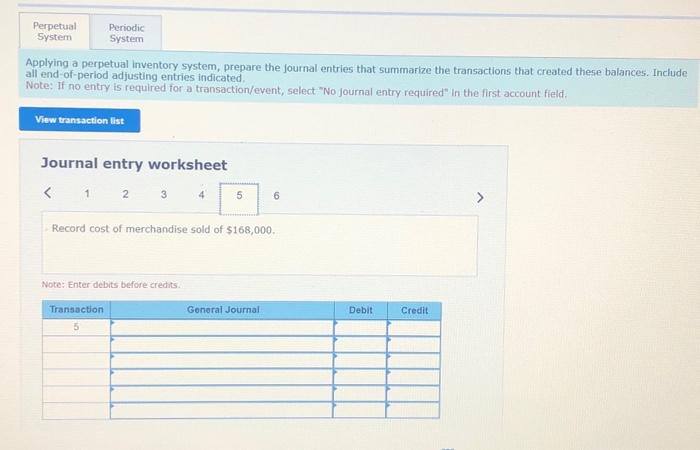

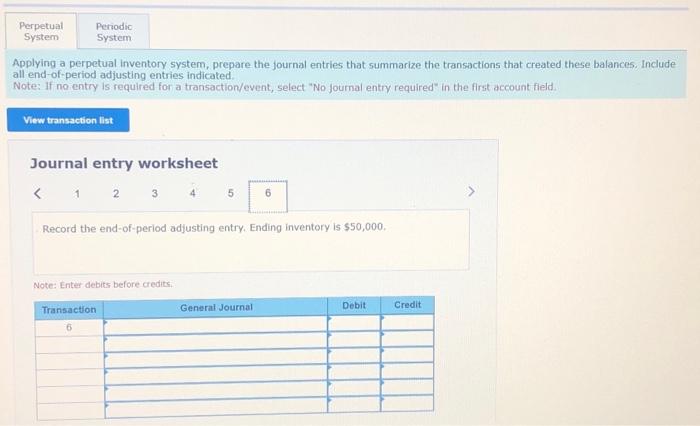

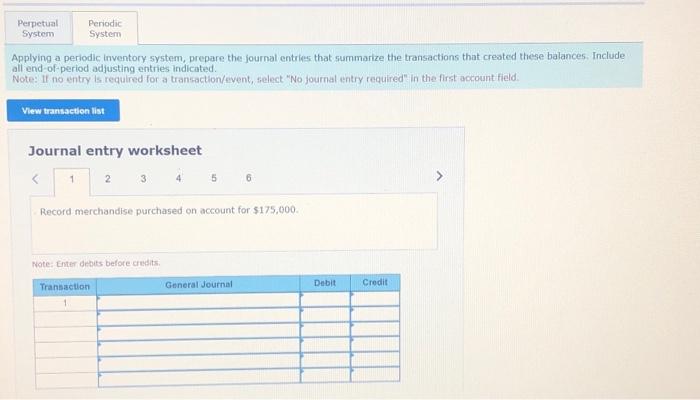

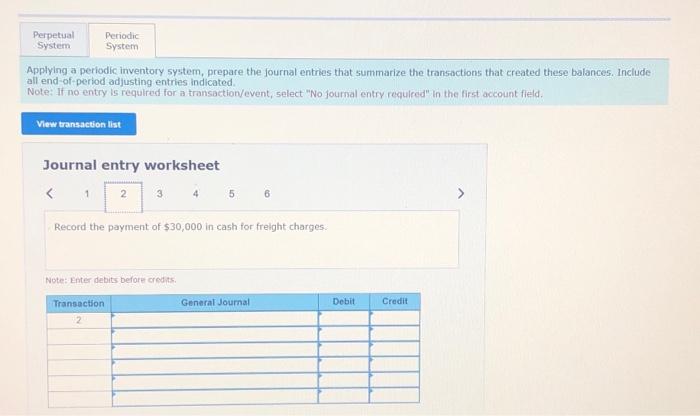

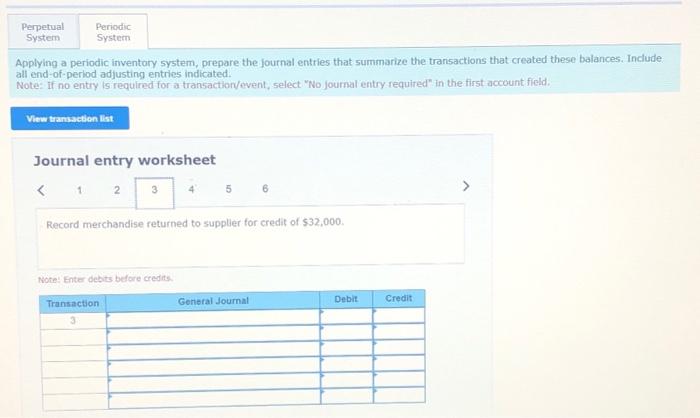

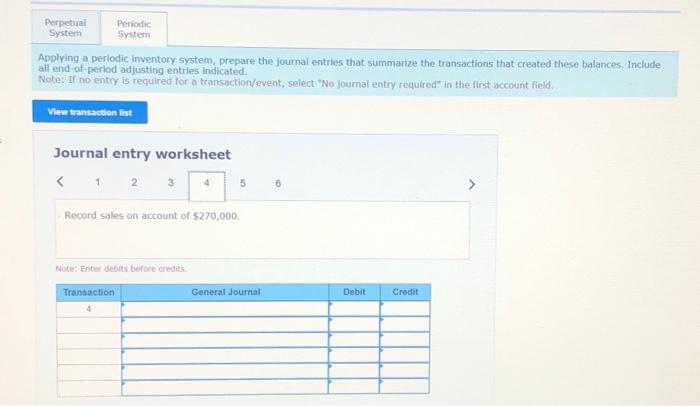

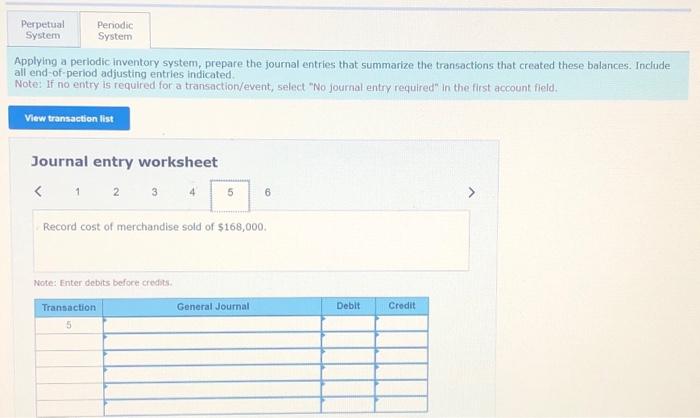

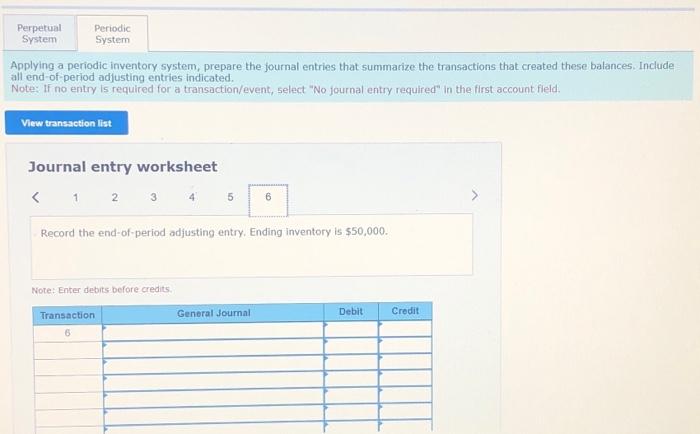

Applying a perpetual inventory system, prepare the journal entries that summarize the transactions that created these balances, Include alf end of petiod adfusting entries Indicated. Note: If no entry is required for a transaction/event, select "No journal entry requitred" in the first account field. Journal entry worksheet 23456 Record merchandise purchased on account for $175,000. Note: Enter debits befote credits. Applying a periodic inventory system, prepare the journal entries that summarize the transactions that created these balances. Include all end-of-period adiusting entries indicated. Note: If no entry is required for a transaction/event, frelect "No journal entry required" in the first account field. Journal entry worksheet 2 4 5 6 Record merchandise purchased on account for $175,000. Note: Enter debits before credits. Applying a periodic inventary system, prepare the fournal entries that summarize the transactions that created these balances. Include all end of perlod adfusting entrites indicated: Note: If no entry is required for a transaction/event, select "No joumal entry required" in the first account fleld. Journal entry worksheet 456 Record merchandise returned to supplier for credit of $32,000. Note: Enter debits before credits. Applying a perpetual inventory system, prepare the journal entries that summarize the transactions that created these balances. Include all end-of-period adjusting entries indicated. Note: if no entry is required for a transaction/event, select "No joumal entry required" in the first account fleld. Journal entry worksheet 1 2 3 4 5 Record the end-of-period adjusting entry. Ending inventory is $50,000. Note: Enter debits before credits. Applying a periodic inventory system, prepare the journal entries that summarize the transactions that created these balances. Include all end-of-period adjusting entries indicated. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet 1 2 3 4 5 Record the end-of-period adjusting entry. Ending inventory is $50,000. Note: Enter debits before credits. Applying a perpetual inventory system, prepare the journal entries that summarize the transactions that created these balances. Include alf end of portod adfusting entries indicated: Note: If no entry is required for a transaction/event, select "No jourmal entry required" in the first accountheld. Journal entry worksheet 2 6 Record merchandise returned to supplier for credit of $32,000. Note Enter debits before curdits. Applying a perpetual inventory system, prepare the journal entries that summarize the transactions that created these balances. Include all end-of-period adjusting entries indicated. Note: if no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet 12 6 Record cost of merchandise sold of $168,000. Note: Enter debits before credits. Applying a periodic inventory system, prepare the journal entries that summarize the transactions that created these balances. Include all end-of-period adjusting entries indicated. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet 12 6 Record cost of merchandise sold of $168,000. Note: Enter debits befoce crediss. Applying a periodic inventory system, prepare the journal entries that summarize the transactions that created these balances. Include all end-of-perlod adjusting entries indicated. Note: If no entry is required for a transaction/event, seiect "No journalentry required" in the first account field. Journal entry worksheet 1 2 5 6 Applying a perpetual inventory system, prepare the fournal entries that summarize the transactions that created these balances. Include all end-of-period adjusting entries indicated. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account. fleld. Journal entry worksheet 12 6 Record sales on account of $270,000. Note: Enter debuts before credits. Applying a periodic inventory system, prepare the journal entries that summarize the transactions that created these balances. Include all end-of-period adfusting entries indicated. Note: if no entry is required for is transactionvevent, select "No journal entry required" in the first account fleld. Journal entry worksheet 456 Record the payment of $30,000 in cash for freight charges. Note: Enter debits before credits. The following information is avallable for a company: Required: Applying both a perpetual and a periodic inventory system, prepare the joumal entries that summarize the transactions that created these balances. Include all end-of-period adjusting entries indicated. Complete this question by entering your answers in the tabs below. Applying a perpetual inventory system, prepare the fournal entries that summarize the transactions that created these balances. Include all end-of period adjusting entries indicated. Note: if no entry is required for a transactionvevent, select "No journal entry required" in the first account field. Applying a perpetual inventory system, prepare the joumal entries that summarize the transactions that created these balances, Include alf end of perlod adfusting entries Indicated. Note: if no entry is required for a transaction/event, select "No joumal entry required" in the first account field. Journal entry worksheet 56 Record the payment of $30,000 in cash for freight charges. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started