need help asap!

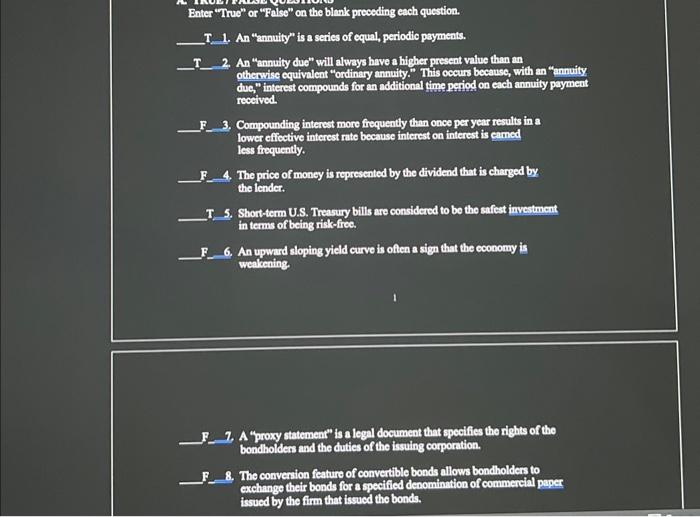

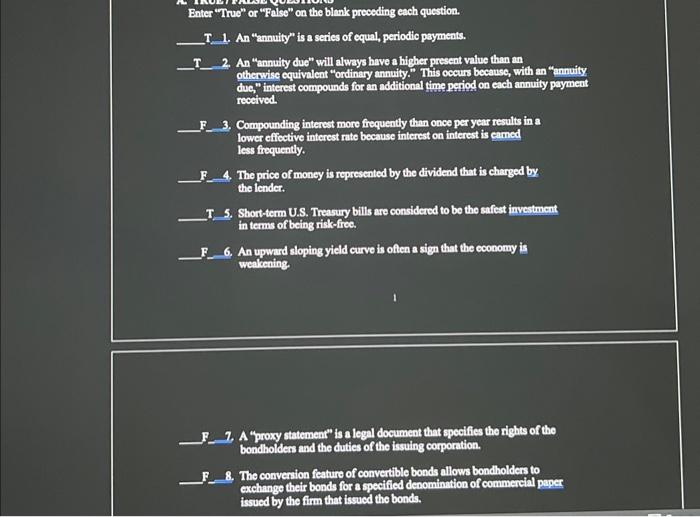

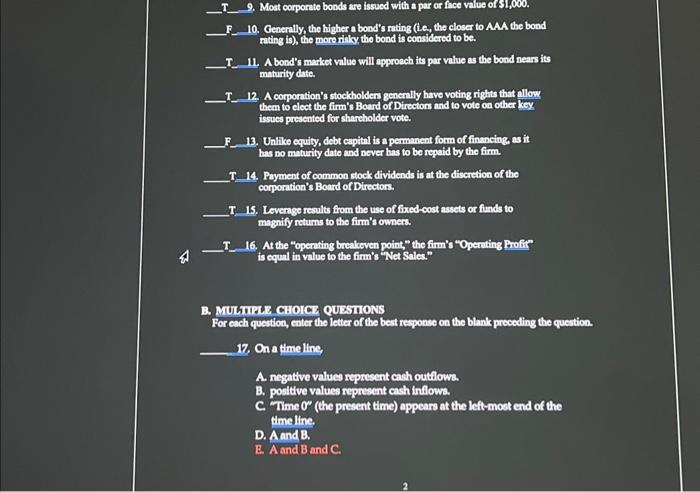

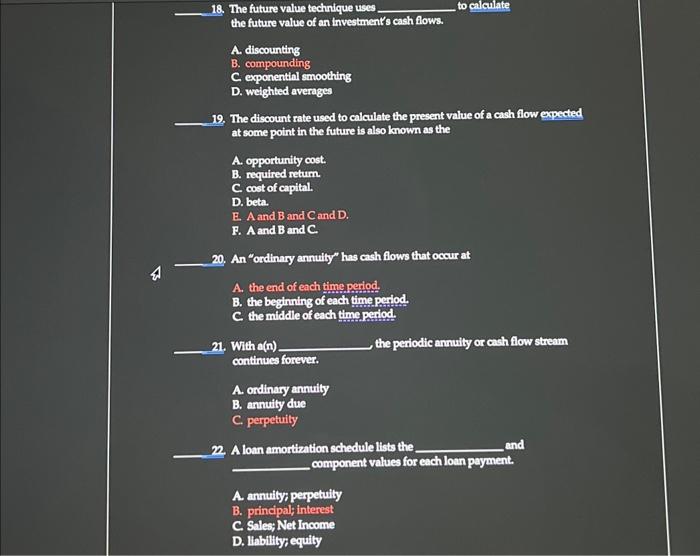

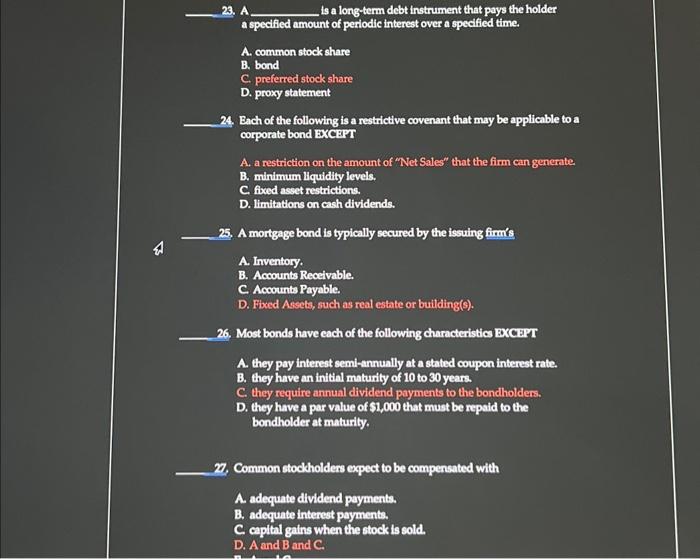

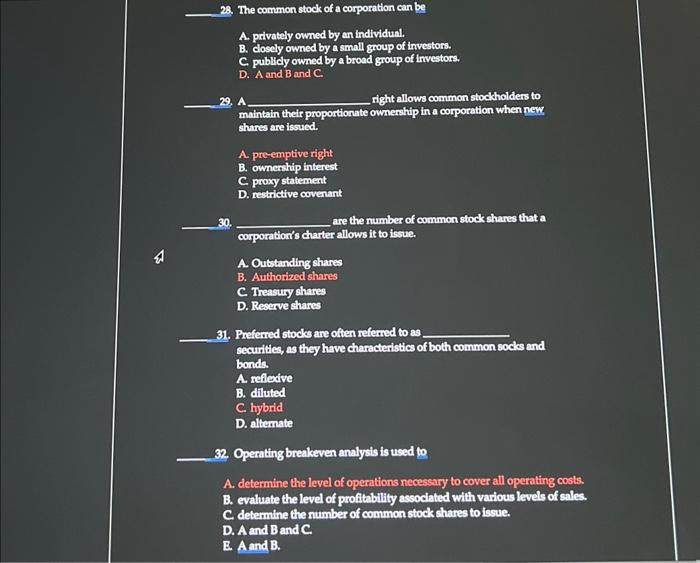

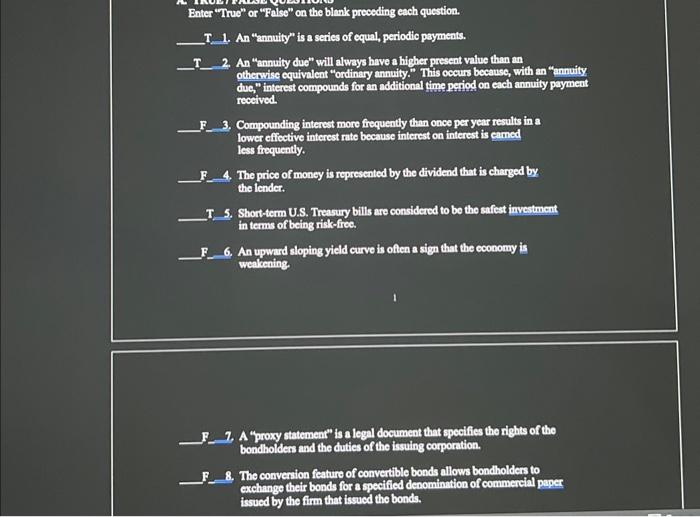

Enter "True" or "False" on the blank preceding each question. T.1. An "annuity" is a series of equal, periodio payments. T_2. An "annuity due" will always have a higher present value than an An "annuity due" will always have a higher present value than an duc," interest compounds for an additional time period on each annuity payment received F 3. Compounding interest more frequently than once per year results in a lower effective interest rate because interest on interest is eamed less frequently. F. 4. The price of money is represented by the dividend that is charged by the lender. T. 5. Short-term U.S. Treasury bills are considerod to be the snfest investment in terms of being risk-fice. F. 6. An upward sloping yield curve is often a sign that the coonomy is weakening. 1 F. 1. A "proxy statement" is a legal document that specifies the rights of the bondholders and the duties of the issulng corportion. 8. The conversion feature of convertible bonds allows bondholders to exchange their bonds for a specified denomination of commercial paper issued by the firm that issued tho bonds. 9. Most corpornte bonds are issued with a par of face value of S,000. 10. Genenally, the higher a bond's nating (i.e, the closer to AAA the bond reting is), the more ritly the bond is coasidered to be. T_11. A bood's market value will approach its par value as the bond nears its maturity dute. T_ 12. A corpontion's stockholden genenilly have voting rights that allows them to elect the firm's Bourd of Directons and to vote on other key issues presented for sharcholder vote. 13. Unlike equity, debt capital is a permanent form of financing as it has no maturity date and never has to be repaid by the firm. T. 14. Puyment of common stock dividends is at the discretion of the corpontion's Barrd of Directors. T. 15. Levernge results from the use of fired-cost assets or finds to magnify returns to the firm's owners. T_ 16. At the "openting breakeven point" the firm's "Openting Profir is equal in value to the firm's "Net Sales" B. MULTI: CHOICr QU35TONS For each question, enter the letter of the best repponse on the blank preceding the quention. 17. On a timeline, A negattve values represent ach outflows. B. poittive values represent cash inflows. C. Time 0 (the present time) appears at the left-most end of the timeline, D. A and B. B. A and B and C 2 18. The future value technique uses to calchite the future value of an investments cash flows. A. discounting B. compounding C. exponential smoothing D. welghted averages 19. The discount rate used to calculate the present value of a cash flow expected at some point in the future is also known as the A. Opportunity cost. B. required retum. C. cost of capital. D. beta. E. A and B and C and D. F. A and B and C. 20. An "ordinary annulty" has cash flows that occur at A. the end of each time period. B. the begining of each time period. C the middle of each time period. 21. With a(n) the periodic annuity or ash flow stream continues forever. A. ondinary annuity B. annuity due C. perpetuity 2. A loan amortization schedule lists the and component values for each loan payment. A. annuityp perpetuily B. principal; interest C. Sales; Net Income D. lisbilitys equity 23. A Is a long-term debt instrument that pays the holder a spedfied amount of periodic interest over a specified time. A. common stock share B. bond C. preferred stock share D. proxy statement 24. Bach of the following is a restrictive covenant that may be applicable to a corporate bond EXCEPT A. a restriction on the amount of "Net Sales" that the firm can generate. B. minimum liquidity levels. C. fixed asset restrictions. D. limitations on cash dividends. 25. A mortgage bond is typically secured by the issuing firm's A. Inventory. B. Acoounts Receivable. C. Acoounts Payable. D. Fixed Assets, such as real estate or building(s). 26. Most bonds have each of the following characteristios BXCEPT A. they pay interest semi-annualily at a stated coupon interest rate. B. they have an initial maturity of 10 to 30 years. C. thisy require annual dividend payments to the bondholders. D. they have a par value of $1,000 that must be repald to the bondholder at maturity. 77. Common stoctholders expect to be compensated with A adequate dividend payments. B. adequate interest payments. C. expital gains when the stock is sold. D. A and B and C. A. privately owned by an individunl. B. closely owned by a small group of investors. C publidy owned by a broad group of investors. D. A and B and C. 29. A right allows common stockholders to maintain their proportionate ownership in a corporation when new shares are issucd. A. pre-mptive right B. ownership interest C. proxy statement D. restrictive covenant 30. are the number of common stock shares that a corporation's charter allows it to issue. A. Outstanding shares B. Authorized shares C. Treasury shares D. Reserve shares 31. Preferred stod's ane often referned to as securities, as they have characteristics of both common socks and bonds. A. refledve B. diluted C. hybrid D. altemate 32. Operating breakeven analysis is used to A. determine the level of opentions necessary to cover all operating costs. B. evaluate the level of profitability associated with various levels of sales. C. determine the number of common stock shares to issue. D. A and B and C B. A and B