Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help ASAP Net present value method - annuity for a service company Stay-in-Style (SIS) Hotels Inc. is considering the construction of a new hotel

need help ASAP

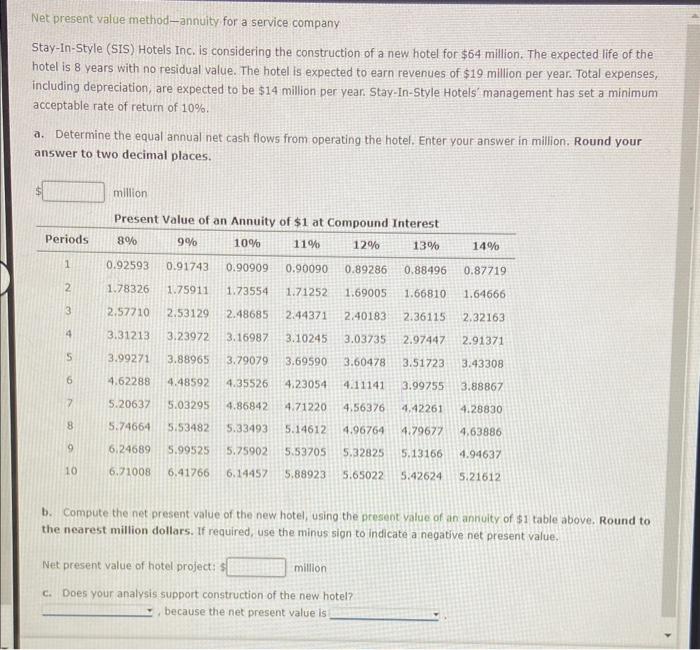

Net present value method - annuity for a service company Stay-in-Style (SIS) Hotels Inc. is considering the construction of a new hotel for $64 million. The expected life of the hotel is 8 years with no residual value. The hotel is expected to earn revenues of $19 million per year. Total expenses, including depreciation; are expected to be $14 million per year. Stay-In-Style Hotels management has set a minimum acceptable rate of return of 10% a. Determine the equal annual net cash flows from operating the hotel. Enter your answer in million. Round your answer to two decimal places. million Present Value of an Annuitu of \&t at ramnn.... V vi..wa.. b. Compute the net present value of the new hotel, using the present yalue of an annuity of $1 table above. Round to the nearest million dollars. If required, use the minus sign to indicate a negative net present value, Net present value of hotel project: 5 million c. Does your analysis support construction of the new hotel? because the net present value is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started