Answered step by step

Verified Expert Solution

Question

1 Approved Answer

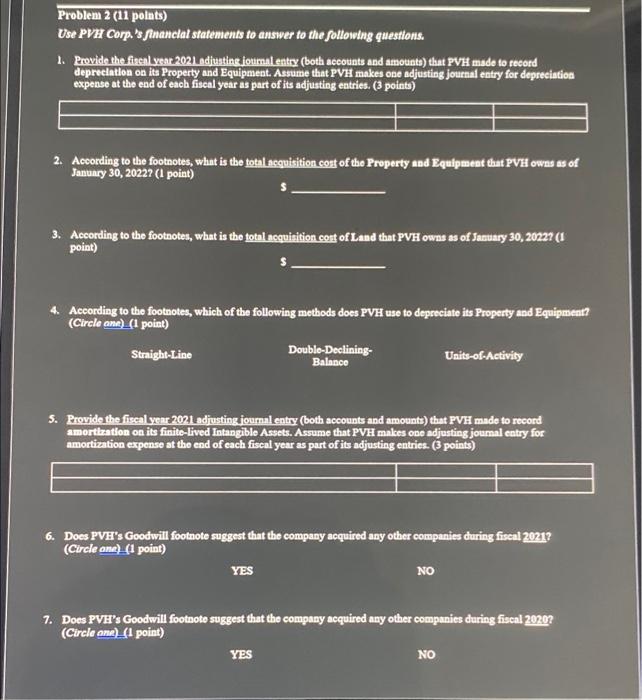

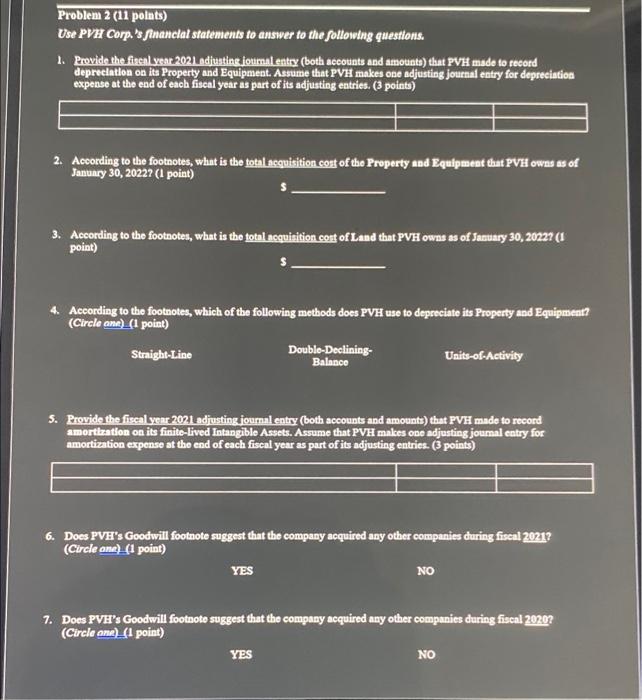

need help asap Problem 2 (11 points) Use PVH Corp.'s financial statements to answer to the following questions. 1. Provide the fiscal year 2021 adjusting

need help asap

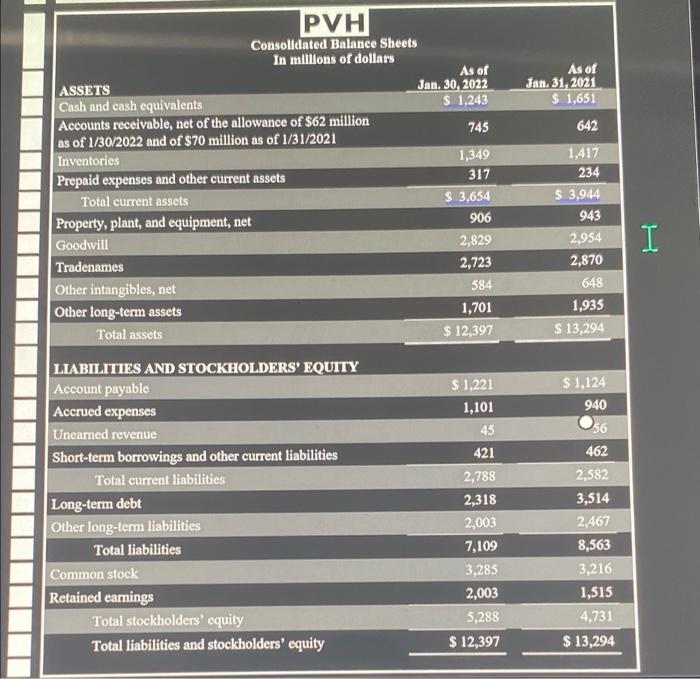

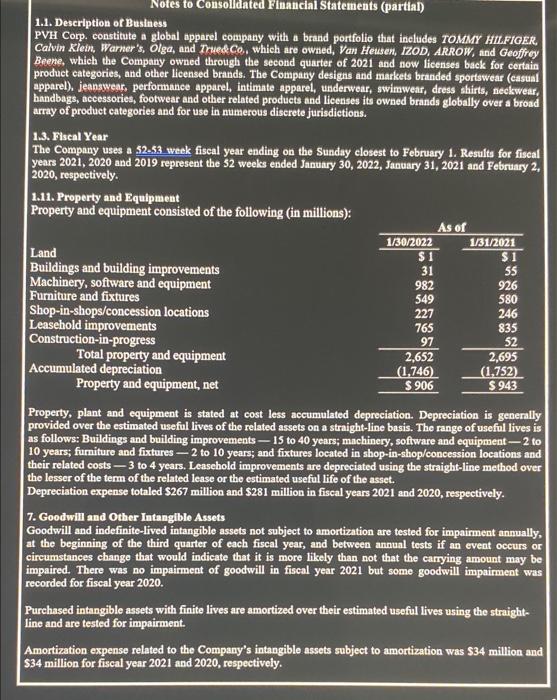

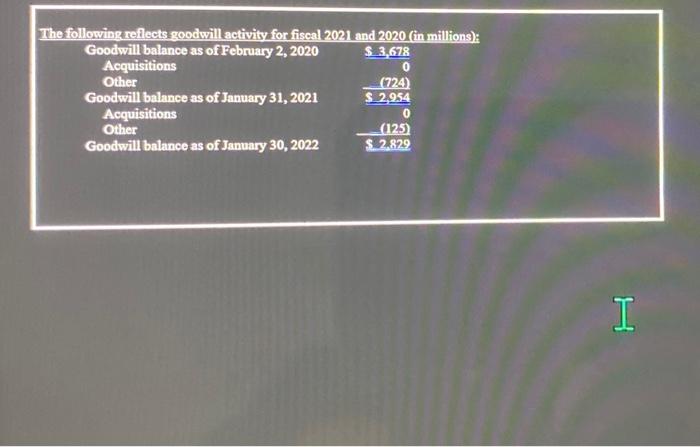

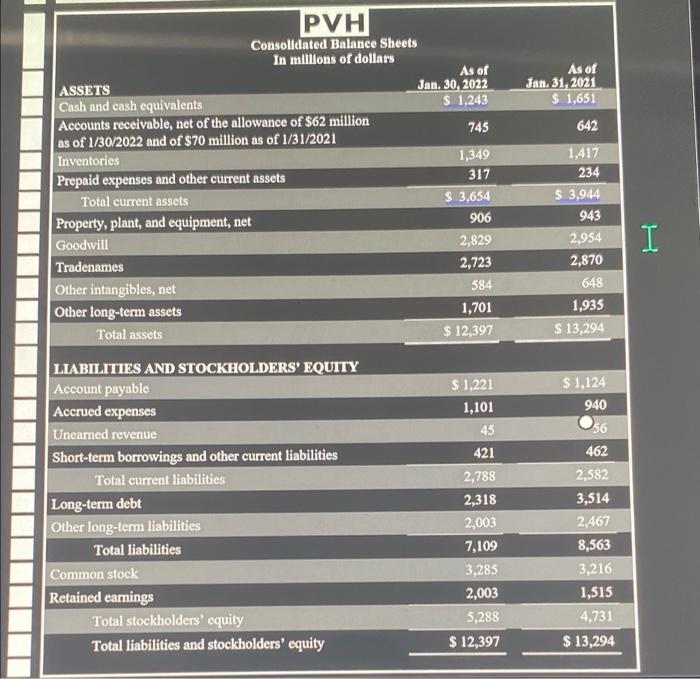

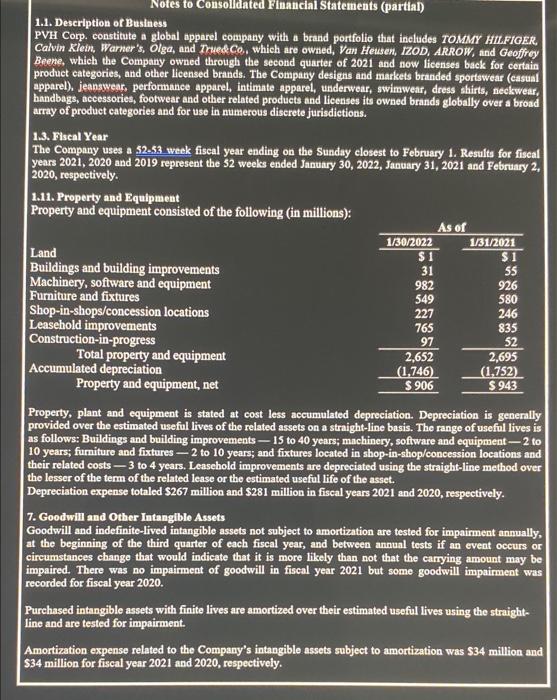

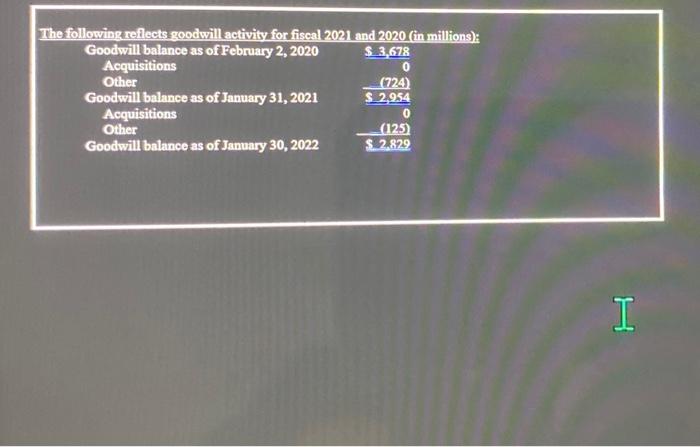

Problem 2 (11 points) Use PVH Corp.'s financial statements to answer to the following questions. 1. Provide the fiscal year 2021 adjusting journal entry (both accounts and amounts) that PVH made to record depreciation on its Property and Equipment. Assume that PVH makes one adjusting journal entry for depreciation expense at the end of each fiscal year as part of its adjusting entries. (3 points) 2. According to the footnotes, what is the total acquisition cost of the Property and Equipment that PVH owns as of January 30, 2022? (1 point) 3. According to the footnotes, what is the total acquisition cost of Land that PVH owns as of January 30, 20227 (1 point) 4. According to the footnotes, which of the following methods does PVH use to depreciate its Property and Equipment? (Circle ane) (1 point) Straight-Line Double-Declining- Balance Units-of-Activity 5. Provide the fiscal year 2021 adjusting journal entry (both accounts and amounts) that PVH made to record amortization on its finite-lived Intangible Assets. Assume that PVH makes one adjusting journal entry for amortization expense at the end of each fiscal year as part of its adjusting entries. (3 points) 6. Does PVH's Goodwill footnote suggest that the company acquired any other companies during fiscal 2021? (Circle one) (1 point) YES NO 7. Does PVH's Goodwill footnote suggest that the company acquired any other companies during fiscal 2020? (Circle one) (1 point) YES NO PVH Consolidated Balance Sheets In millions of dollars ASSETS Cash and cash equivalents Accounts receivable, net of the allowance of $62 million as of 1/30/2022 and of $70 million as of 1/31/2021 Inventories Prepaid expenses and other current assets Total current assets Property, plant, and equipment, net Goodwill Tradenames Other intangibles, net Other long-term assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Account payable Accrued expenses Unearned revenue Short-term borrowings and other current liabilities Total current liabilities Long-term debt Other long-term liabilities Total liabilities Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity As of Jan. 30, 2022 $ 1,243 745 1,349 317 $ 3,654 906 2,829 2,723 584 1,701 $ 12,397 $ 1,221 1,101 45 421 2,788 2,318 2,003 7,109 3,285 2,003 5,288 $ 12,397 As of Jan. 31, 2021 $ 1,651 642 1,417 234 $ 3,944 943 2,954 2,870 648 1,935 $ 13,294 $ 1,124 940 56 462 2,582 3,514 2,467 8,563 3,216 1,515 4,731 $ 13,294 I Notes to Consolidated Financial Statements (partial) 1.1. Description of Business PVH Corp. constitute a global apparel company with a brand portfolio that includes TOMMY HILFIGER, Calvin Klein, Warner's, Olga, and Trued Co., which are owned, Van Heusen, IZOD, ARROW, and Geoffrey Beene, which the Company owned through the second quarter of 2021 and now licenses back for certain product categories, and other licensed brands. The Company designs and markets branded sportswear (casual apparel), jeanswear, performance apparel, intimate apparel, underwear, swimwear, dress shirts, neckwear, handbags, accessories, footwear and other related products and licenses its owned brands globally over a broad array of product categories and for use in numerous discrete jurisdictions. 1.3. Fiscal Year The Company uses a 52-53 week fiscal year ending on the Sunday closest to February 1. Results for fiscal years 2021, 2020 and 2019 represent the 52 weeks ended January 30, 2022, January 31, 2021 and February 2, 2020, respectively. 1.11. Property and Equipment Property and equipment consisted of the following (in millions): As of 1/30/2022 1/31/2021 Land $1 $1 31 55 Buildings and building improvements Machinery, software and equipment Furniture and fixtures 982 926 549 580 227 246 Shop-in-shops/concession locations Leasehold improvements Construction-in-progress 765 835 97 52 Total property and equipment Accumulated depreciation 2,652 2,695 (1,746) (1,752) Property and equipment, net $ 906 $943 Property, plant and equipment is stated at cost less accumulated depreciation. Depreciation is generally provided over the estimated useful lives of the related assets on a straight-line basis. The range of useful lives is as follows: Buildings and building improvements-15 to 40 years; machinery, software and equipment-2 to 10 years; furniture and fixtures-2 to 10 years; and fixtures located in shop-in-shop/concession locations and their related costs-3 to 4 years. Leasehold improvements are depreciated using the straight-line method over the lesser of the term of the related lease or the estimated useful life of the asset. Depreciation expense totaled $267 million and $281 million in fiscal years 2021 and 2020, respectively. 7. Goodwill and Other Intangible Assets Goodwill and indefinite-lived intangible assets not subject to amortization are tested for impairment annually, at the beginning of the third quarter of each fiscal year, and between annual tests if an event occurs or circumstances change that would indicate that it is more likely than not that the carrying amount may be impaired. There was no impairment of goodwill in fiscal year 2021 but some goodwill impairment was recorded for fiscal year 2020. Purchased intangible assets with finite lives are amortized over their estimated useful lives using the straight- line and are tested for impairment. Amortization expense related to the Company's intangible assets subject to amortization was $34 million and $34 million for fiscal year 2021 and 2020, respectively. The following reflects goodwill activity for fiscal 2021 and 2020 (in millions): $ 3,678 Goodwill balance as of February 2, 2020 Acquisitions 0 Other (724) $ 2,954 Goodwill balance as of January 31, 2021 Acquisitions 0 Other (125) $2.829 Goodwill balance as of January 30, 2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started