Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help asap (quantitative methods) 2. FCF has noted that there are definite differences among their customers. Their loan application process is quick and simple,

need help asap (quantitative methods)

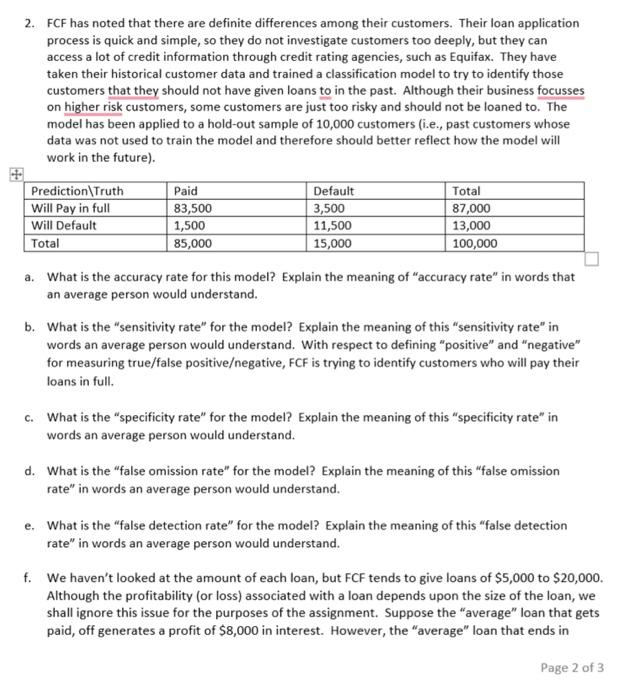

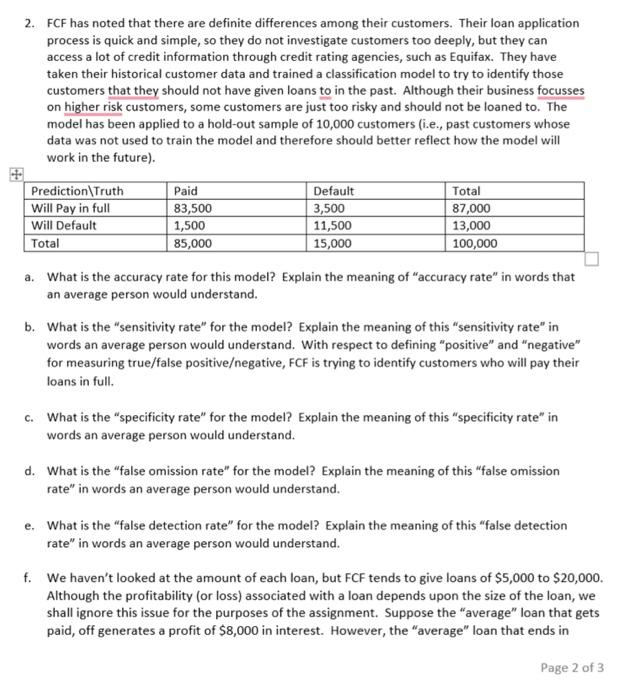

2. FCF has noted that there are definite differences among their customers. Their loan application process is quick and simple, so they do not investigate customers too deeply, but they can access a lot of credit information through credit rating agencies, such as Equifax. They have taken their historical customer data and trained a classification model to try to identify those customers that they should not have given loans to in the past. Although their business focusses on higher risk customers, some customers are just too risky and should not be loaned to. The model has been applied to a hold-out sample of 10,000 customers (i.e., past customers whose data was not used to train the model and therefore should better reflect how the model will work in the future). a. What is the accuracy rate for this model? Explain the meaning of "accuracy rate" in words that an average person would understand. b. What is the "sensitivity rate" for the model? Explain the meaning of this "sensitivity rate" in words an average person would understand. With respect to defining "positive" and "negative" for measuring true/false positiveegative, FCF is trying to identify customers who will pay their loans in full. c. What is the "specificity rate" for the model? Explain the meaning of this "specificity rate" in words an average person would understand. d. What is the "false omission rate" for the model? Explain the meaning of this "false omission rate" in words an average person would understand. e. What is the "false detection rate" for the model? Explain the meaning of this "false detection rate" in words an average person would understand. f. We haven't looked at the amount of each loan, but FCF tends to give loans of $5,000 to $20,000. Although the profitability (or loss) associated with a loan depends upon the size of the loan, we shall ignore this issue for the purposes of the assignment. Suppose the "average" loan that gets paid, off generates a profit of $8,000 in interest. However, the "average" loan that ends in Page 2 of 3 1206 Introduction to Data Analytics for Business Winter 202 default leads to a loss of $5,000. If FCF did not use the model and continued its current practices of giving loans, what would be their expected profit per loan? Note that we do not want the total profit for 100,000 loans in the confusion matrix, but the "expected" profit or average profit for a single loan. Suppose FCF changed its lending practices such that it only made loans to customers who it predicted would pay in full. Evaluating this strategy is problematic because they would not be making as many loans. Their expected profit per loan may be higher, but with fewer loans made, their expected profit per loan applicant may be lower. Let us look at the case of their current customer base and ask what is the expected profit if the reject 13% of loan applicants because they are predicted to default and thus make $0 profit anc $0 loss on each of these applicants. What is the expected profit per loan applicant if FCF uses the model? 2. FCF has noted that there are definite differences among their customers. Their loan application process is quick and simple, so they do not investigate customers too deeply, but they can access a lot of credit information through credit rating agencies, such as Equifax. They have taken their historical customer data and trained a classification model to try to identify those customers that they should not have given loans to in the past. Although their business focusses on higher risk customers, some customers are just too risky and should not be loaned to. The model has been applied to a hold-out sample of 10,000 customers (i.e., past customers whose data was not used to train the model and therefore should better reflect how the model will work in the future). a. What is the accuracy rate for this model? Explain the meaning of "accuracy rate" in words that an average person would understand. b. What is the "sensitivity rate" for the model? Explain the meaning of this "sensitivity rate" in words an average person would understand. With respect to defining "positive" and "negative" for measuring true/false positiveegative, FCF is trying to identify customers who will pay their loans in full. c. What is the "specificity rate" for the model? Explain the meaning of this "specificity rate" in words an average person would understand. d. What is the "false omission rate" for the model? Explain the meaning of this "false omission rate" in words an average person would understand. e. What is the "false detection rate" for the model? Explain the meaning of this "false detection rate" in words an average person would understand. f. We haven't looked at the amount of each loan, but FCF tends to give loans of $5,000 to $20,000. Although the profitability (or loss) associated with a loan depends upon the size of the loan, we shall ignore this issue for the purposes of the assignment. Suppose the "average" loan that gets paid, off generates a profit of $8,000 in interest. However, the "average" loan that ends in Page 2 of 3 1206 Introduction to Data Analytics for Business Winter 202 default leads to a loss of $5,000. If FCF did not use the model and continued its current practices of giving loans, what would be their expected profit per loan? Note that we do not want the total profit for 100,000 loans in the confusion matrix, but the "expected" profit or average profit for a single loan. Suppose FCF changed its lending practices such that it only made loans to customers who it predicted would pay in full. Evaluating this strategy is problematic because they would not be making as many loans. Their expected profit per loan may be higher, but with fewer loans made, their expected profit per loan applicant may be lower. Let us look at the case of their current customer base and ask what is the expected profit if the reject 13% of loan applicants because they are predicted to default and thus make $0 profit anc $0 loss on each of these applicants. What is the expected profit per loan applicant if FCF uses the model

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started