need help calculating equipment and marketable securities

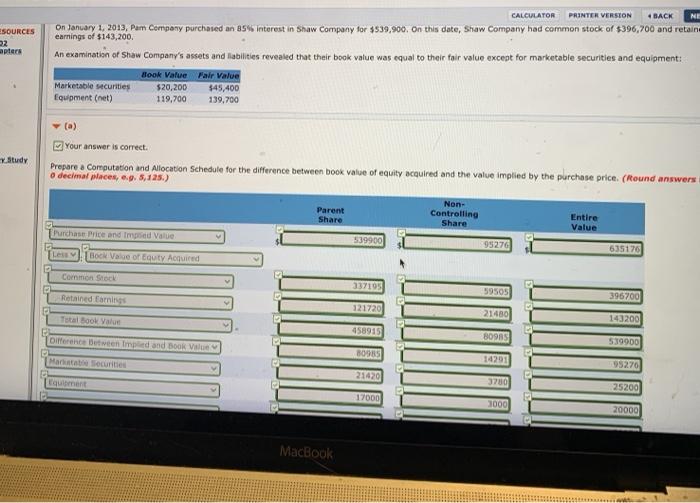

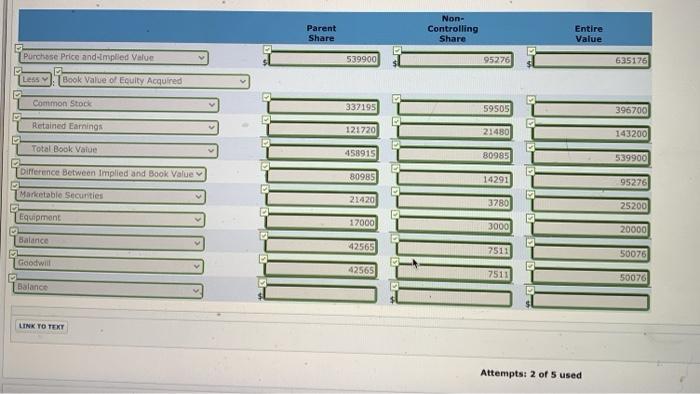

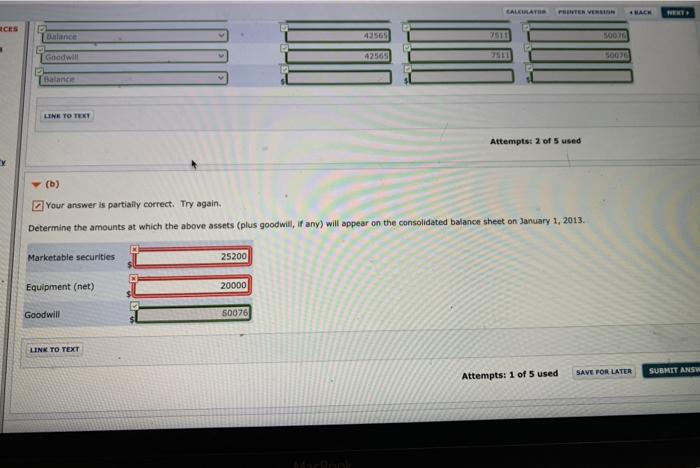

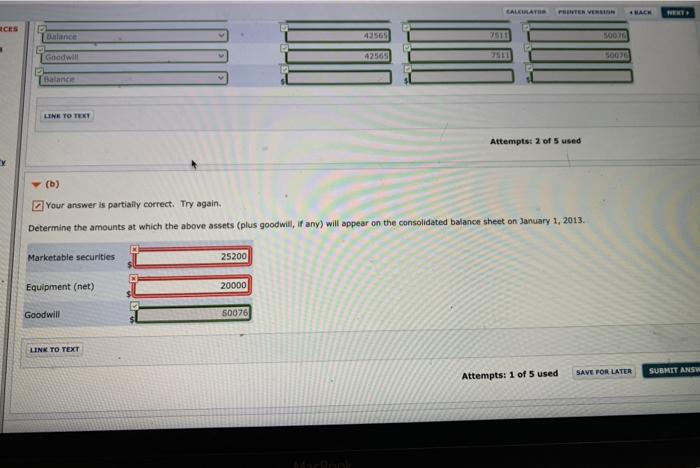

CALERAT PETER VERLIN HACH RERS Balance 43565 5000 Goodwill 42565 Balance LINK TO TEKY Attempts: 2 of 5 used (6) Your answer is partially correct. Try again. Determine the amounts at which the above assets (plus goodwill, if any) will appear on the consolidated balance sheet on January 1, 2013 Marketable securities 25200 Equipment (net) 20000 Goodwill 50076 LINK TO TEXT SAVE POR LATER SUBMIT ANSW Attempts: 1 of 5 used NE ESOURCES 32 apters CALCULATOR PRINTER VERSION BACK On January 1, 2013, Pam Company purchased an 85% Interest in Shaw Company for $539,900. On this date, Shaw Company had common stock of $396,700 and retain earnings of $143,200. An examination of Show company's assets and abilities revealed that their book value was equal to their fair value except for marketable securities and equipment: Book Value Fair Value Marketable securities $20,200 $45,400 Equipment (net) 119,700 139,700 (a) Study Your answer is correct. Prepare a computation and Allocation Schedule for the difference between book value of equity acquired and the value implied by the purchase price. (Round answers o decimal places, e.g. 5,125.) Parent Share Non- Controlling Share Entire Value Purchase Price and Ted Value v 539900 95276 635176 Les Boc Value of Equty Acquired Common Stock 337195 59505 Retired Earning 396700 121720 Total Book Value 21480 143200 458915 80985 Difference Between Imped and Book Value 519900 CO 3095 Mark Securities 14201 95270 21420 Equipment 3780 25200 17000 3000 20000 MacBook Parent Share Non- Controlling Share Entire Value Purchase Price and implied Value 539900 95276 635176 Les Book Value of Equity Acquired Common Stock 337195 59505 396700 Retained Earnings 121720 21480 143200 Total Book Value 458915 80985 539900 Difference Between Implied and Book Value 80985 14291 95276 Marketable Securities 21420 3780 25200 Equipment 17000 3000 20000 Balance 42565 7511 50076 Goodwill 42565 7511 50076 Balance LINK TO TEXT Attempts: 2 of 5 used CALERAT PETER VERLIN HACH RERS Balance 43565 5000 Goodwill 42565 Balance LINK TO TEKY Attempts: 2 of 5 used (6) Your answer is partially correct. Try again. Determine the amounts at which the above assets (plus goodwill, if any) will appear on the consolidated balance sheet on January 1, 2013 Marketable securities 25200 Equipment (net) 20000 Goodwill 50076 LINK TO TEXT SAVE POR LATER SUBMIT ANSW Attempts: 1 of 5 used NE ESOURCES 32 apters CALCULATOR PRINTER VERSION BACK On January 1, 2013, Pam Company purchased an 85% Interest in Shaw Company for $539,900. On this date, Shaw Company had common stock of $396,700 and retain earnings of $143,200. An examination of Show company's assets and abilities revealed that their book value was equal to their fair value except for marketable securities and equipment: Book Value Fair Value Marketable securities $20,200 $45,400 Equipment (net) 119,700 139,700 (a) Study Your answer is correct. Prepare a computation and Allocation Schedule for the difference between book value of equity acquired and the value implied by the purchase price. (Round answers o decimal places, e.g. 5,125.) Parent Share Non- Controlling Share Entire Value Purchase Price and Ted Value v 539900 95276 635176 Les Boc Value of Equty Acquired Common Stock 337195 59505 Retired Earning 396700 121720 Total Book Value 21480 143200 458915 80985 Difference Between Imped and Book Value 519900 CO 3095 Mark Securities 14201 95270 21420 Equipment 3780 25200 17000 3000 20000 MacBook Parent Share Non- Controlling Share Entire Value Purchase Price and implied Value 539900 95276 635176 Les Book Value of Equity Acquired Common Stock 337195 59505 396700 Retained Earnings 121720 21480 143200 Total Book Value 458915 80985 539900 Difference Between Implied and Book Value 80985 14291 95276 Marketable Securities 21420 3780 25200 Equipment 17000 3000 20000 Balance 42565 7511 50076 Goodwill 42565 7511 50076 Balance LINK TO TEXT Attempts: 2 of 5 used

need help calculating equipment and marketable securities

need help calculating equipment and marketable securities