Answered step by step

Verified Expert Solution

Question

1 Approved Answer

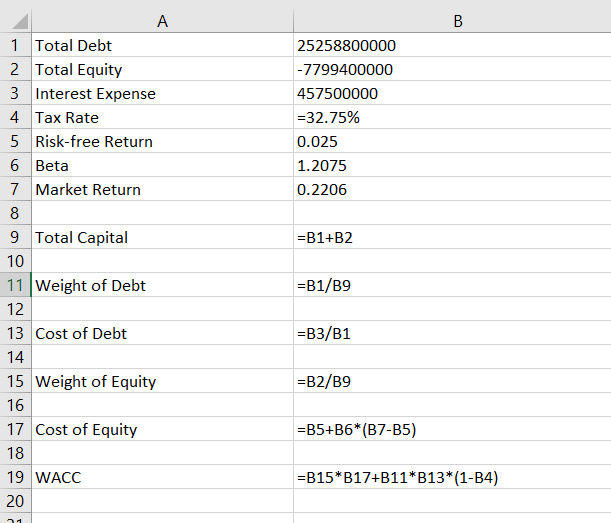

Need help calculating WACC for Starbucks 2020. Starbucks' equity was negative in 2020, so I keep getting a negative WACC. Calculate the weighted average cost

Need help calculating WACC for Starbucks 2020. Starbucks' equity was negative in 2020, so I keep getting a negative WACC. Calculate the weighted average cost of capital (WACC) using both the Security Market Line Approach and the Dividend Growth Model Approach. Compare the WACC for each approach, discussing the advantages and disadvantages of each approach.

SEE MY CALCULATION BELOW.

PLEASE UPLOAD EXCEL CALC IF POSSIBLE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started