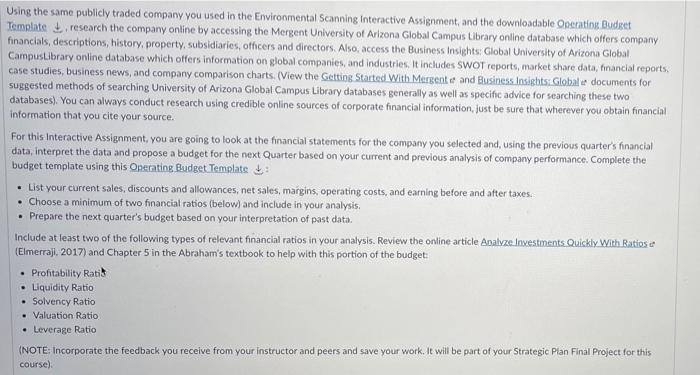

the compny that I chose was Coca-cola. i just need the chart filled out in the second picture and two ratios of your choice shown in picture 1.

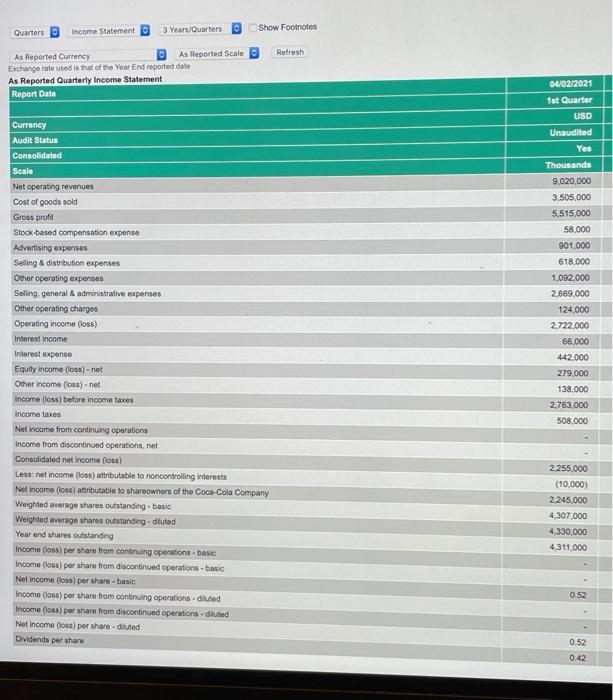

Using the same publicly traded company you used in the Environmental Scanning Interactive Assignment, and the downloadable Operating Budget Template research the company online by accessing the Mergent University of Arizona Global Campus Library online database which offers company financials, descriptions, history, property, subsidiaries, officers and directors. Also, access the Business Insights: Global University of Arizona Global CampusLibrary online database which offers information on global companies, and industries. It includes SWOT reports, market share data, financial reports, case studies, business news, and company comparison charts. (View the Getting Started With Mergente and Business Insights: Global documents for suggested methods of searching University of Arizona Global Campus Library databases generally as well as specific advice for searching these two databases). You can always conduct research using credible online sources of corporate financial information, Just be sure that wherever you obtain financial information that you cite your source. For this interactive Assignment, you are going to look at the financial statements for the company you selected and using the previous quarter's financial data, interpret the data and propose a budget for the next Quarter based on your current and previous analysis of company performance. Complete the budget template using this Operating Budget Template List your current sales, discounts and allowances, net sales, margins, operating costs, and earning before and after taxes. Choose a minimum of two financial ratios (below) and include in your analysis, Prepare the next quarter's budget based on your interpretation of past data. Include at least two of the following types of relevant financial ratios in your analysis. Review the online article Analyze.Investments Quickly With Ratios er (Elmerraji. 2017) and Chapter 5 in the Abraham's textbook to help with this portion of the budget: Prohtability Ratis Liquidity Ratio Solvency Ratio Valuation Ratio Leverage Ratio (NOTE: Incorporate the feedback you receive from your instructor and peers and save your work. It will be part of your Strategic Plan Final Project for this course) Coca-Cola: Operating Budget 21 Var +/- Var % [Prior Quarter Budget Projection Next Q Revenue Sales Revenue Interest Income Investment Income Other Income TOTAL INCOME [Prior Quarter] Budget Projection Next Q Var +/- Var % Costs and Expenses Advertising Health Insurance Installation/Repair of Equipment Inventory Purchases Salaries Supplies Insurance Rent/Lease Payments Other Expenses TOTAL EXPENSES NET PROFIT/LOSS Net Earnings Before Taxes (Gain or Loss Income Tax Expense Net Earnings After Taxes [Prior Q] Proi. Change Ratio Analysis (Choose a minimum of two Profitability Ratio Liquidity Ratio Solvency Ratio Valuation Ratio Leverage Ratio Quarters Income Statement 3 Years/Quarters Show Footnotes Refresh As Reported Currency As Reported Scale Exchange rate used is that of the Year End reported date As Reported Quarterly Income Statement Report Date 04/02/2025 1st Quarter USD Unaudited Yes Thousands 9,020,000 3.505,000 5,515,000 58,000 901,000 618,000 1.092,000 2,669,000 124.000 2,722,000 Currency Audit Status Consolidated Scale Net operating revenues Cost of goods sold Gross profit Stock-based compensation expense Advertising expenses Selling & distribution expenses Other operating expenses Selling general & administrative expenses Other operating charges Operating income (loss) Interest Income Interest expense Equity Income (ss).net Other income foss) .net Income (los) before income taxes Income taxes Net income from continuing operations Income from discontinued operations, net Consolidated net income (loss) Less: net income (loss) attributable to noncontrolling interests Not income (los) atributable to shareowners of the Coca-Cola Company Weighted average shares outstanding basic Weighted average shares outstanding-diluted Year and shares outstanding Income (los) per share from continuing operations - basic Income (oss) per share from discontinued operations - basic Net Income (los) per share-basic Income (los) per share from continuing operations. diluted Income (loss) per share from discontinued operations. duled Net Income (los) per share-diluted Dividends per share 86.000 442,000 279.000 138,000 2.763,000 508,000 2.255.000 (10,000) 2.245,000 4,307.000 4.330.000 4,311,000 0.52 0.52 0.42 Using the same publicly traded company you used in the Environmental Scanning Interactive Assignment, and the downloadable Operating Budget Template research the company online by accessing the Mergent University of Arizona Global Campus Library online database which offers company financials, descriptions, history, property, subsidiaries, officers and directors. Also, access the Business Insights: Global University of Arizona Global CampusLibrary online database which offers information on global companies, and industries. It includes SWOT reports, market share data, financial reports, case studies, business news, and company comparison charts. (View the Getting Started With Mergente and Business Insights: Global documents for suggested methods of searching University of Arizona Global Campus Library databases generally as well as specific advice for searching these two databases). You can always conduct research using credible online sources of corporate financial information, Just be sure that wherever you obtain financial information that you cite your source. For this interactive Assignment, you are going to look at the financial statements for the company you selected and using the previous quarter's financial data, interpret the data and propose a budget for the next Quarter based on your current and previous analysis of company performance. Complete the budget template using this Operating Budget Template List your current sales, discounts and allowances, net sales, margins, operating costs, and earning before and after taxes. Choose a minimum of two financial ratios (below) and include in your analysis, Prepare the next quarter's budget based on your interpretation of past data. Include at least two of the following types of relevant financial ratios in your analysis. Review the online article Analyze.Investments Quickly With Ratios er (Elmerraji. 2017) and Chapter 5 in the Abraham's textbook to help with this portion of the budget: Prohtability Ratis Liquidity Ratio Solvency Ratio Valuation Ratio Leverage Ratio (NOTE: Incorporate the feedback you receive from your instructor and peers and save your work. It will be part of your Strategic Plan Final Project for this course) Coca-Cola: Operating Budget 21 Var +/- Var % [Prior Quarter Budget Projection Next Q Revenue Sales Revenue Interest Income Investment Income Other Income TOTAL INCOME [Prior Quarter] Budget Projection Next Q Var +/- Var % Costs and Expenses Advertising Health Insurance Installation/Repair of Equipment Inventory Purchases Salaries Supplies Insurance Rent/Lease Payments Other Expenses TOTAL EXPENSES NET PROFIT/LOSS Net Earnings Before Taxes (Gain or Loss Income Tax Expense Net Earnings After Taxes [Prior Q] Proi. Change Ratio Analysis (Choose a minimum of two Profitability Ratio Liquidity Ratio Solvency Ratio Valuation Ratio Leverage Ratio Quarters Income Statement 3 Years/Quarters Show Footnotes Refresh As Reported Currency As Reported Scale Exchange rate used is that of the Year End reported date As Reported Quarterly Income Statement Report Date 04/02/2025 1st Quarter USD Unaudited Yes Thousands 9,020,000 3.505,000 5,515,000 58,000 901,000 618,000 1.092,000 2,669,000 124.000 2,722,000 Currency Audit Status Consolidated Scale Net operating revenues Cost of goods sold Gross profit Stock-based compensation expense Advertising expenses Selling & distribution expenses Other operating expenses Selling general & administrative expenses Other operating charges Operating income (loss) Interest Income Interest expense Equity Income (ss).net Other income foss) .net Income (los) before income taxes Income taxes Net income from continuing operations Income from discontinued operations, net Consolidated net income (loss) Less: net income (loss) attributable to noncontrolling interests Not income (los) atributable to shareowners of the Coca-Cola Company Weighted average shares outstanding basic Weighted average shares outstanding-diluted Year and shares outstanding Income (los) per share from continuing operations - basic Income (oss) per share from discontinued operations - basic Net Income (los) per share-basic Income (los) per share from continuing operations. diluted Income (loss) per share from discontinued operations. duled Net Income (los) per share-diluted Dividends per share 86.000 442,000 279.000 138,000 2.763,000 508,000 2.255.000 (10,000) 2.245,000 4,307.000 4.330.000 4,311,000 0.52 0.52 0.42