Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help. Camille Sikorski was divorced in 2018. She currently provides a home for her 15 -year-old daughter Kaly. Kaly lived in Camille's home for

need help.

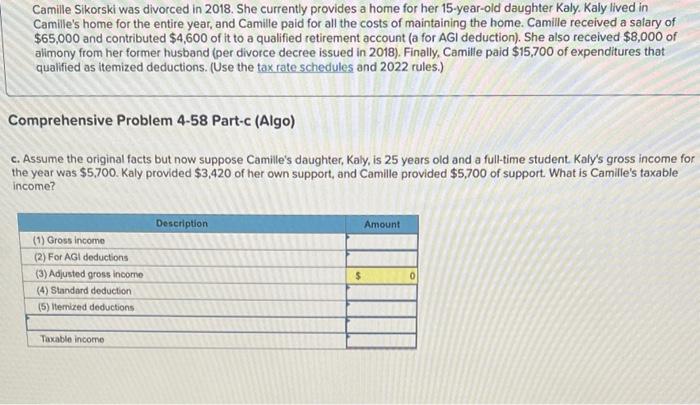

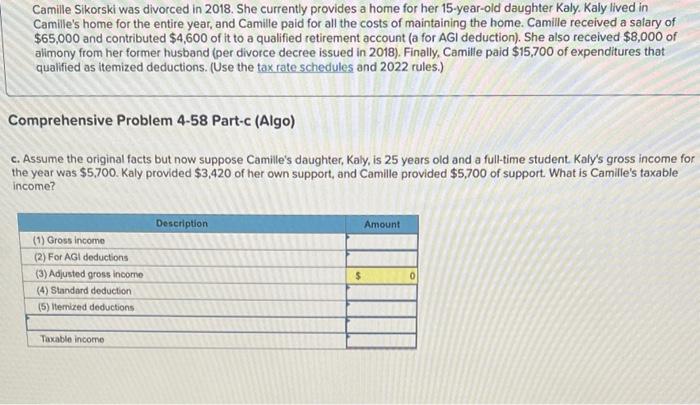

Camille Sikorski was divorced in 2018. She currently provides a home for her 15 -year-old daughter Kaly. Kaly lived in Camille's home for the entire year, and Camille paid for all the costs of maintaining the home. Camille received a salary of $65,000 and contributed $4,600 of it to a qualified retirement account (a for AGI deduction). She also received $8,000 of alimony from her former husband (per divorce decree issued in 2018). Finally, Camille paid $15,700 of expenditures that qualified as itemized deductions. (Use the tax rate schedules and 2022 rules.) Comprehensive Problem 4-58 Part-c (Algo) c. Assume the original facts but now suppose Camille's daughter, Kaly, is 25 years old and a fulltime student. Kaly's gross income for the year was $5,700. Kaly provided $3,420 of her own support, and Camille provided $5,700 of support. What is Camille's taxable income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started