Need help detemining each individuals Federal Income Tax Deduction

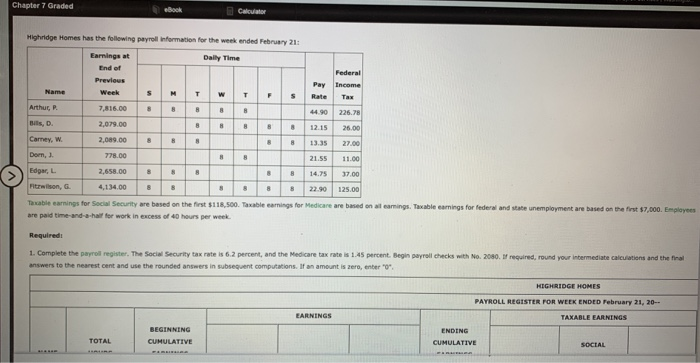

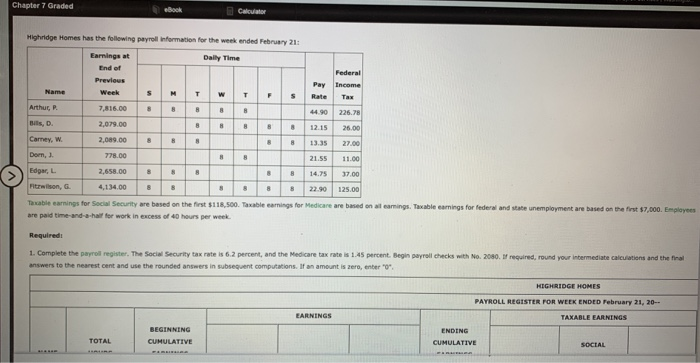

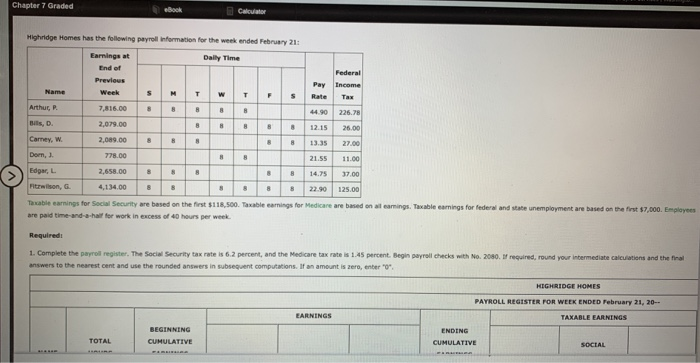

Chapter 7 Graded eBook Calouator Highridge Homes has the following payroll information for the week ended February 21: Earnings at Daily Time End of Federal Previous Pay Income Name Week M W T T s Rate Tax Arthur, P 7,816.00 226.78 44.90 Bills, D. 2,079.00 12.15 26.00 Carney, W 2,089.00 13.35 27.00 Dom, J. 778.00 21.55 11.00 Edgar, L 2,658.00 14.75 37.00 Fitzwilson, G. 4,134.00 125.00 22.90 Taxable earnings for Social Security are based on the first $118,500. Taxable earnings for Medicare are based on all eamings. Taxable earnings for federal and state unemployment are based on the first $7,000. Emplayees are paid time-and-a-half for work in excess of 40 hours per week Required: 1. Complete the payroll register, The Social Security tax rate is 6.2 percent, and the Medicare tax rate is 1.45 percent. Begin payrell checks with No. 2080, If required, round your intermediate calculations and the final answers to the nearest cent and use the rounded answers in subsequent computations. If an amount zero, enter "0 HIGHRIDGE ES PAYROLL REGISTER FOR WEEK ENDED February 21, 20 EARNINGS TAXABLE EARNINGS BEGINNING ENDING TTAL CUMULATIVE CUMULATIVE SOCIAL Chapter 7 Graded eBook Calouator Highridge Homes has the following payroll information for the week ended February 21: Earnings at Daily Time End of Federal Previous Pay Income Name Week M W T T s Rate Tax Arthur, P 7,816.00 226.78 44.90 Bills, D. 2,079.00 12.15 26.00 Carney, W 2,089.00 13.35 27.00 Dom, J. 778.00 21.55 11.00 Edgar, L 2,658.00 14.75 37.00 Fitzwilson, G. 4,134.00 125.00 22.90 Taxable earnings for Social Security are based on the first $118,500. Taxable earnings for Medicare are based on all eamings. Taxable earnings for federal and state unemployment are based on the first $7,000. Emplayees are paid time-and-a-half for work in excess of 40 hours per week Required: 1. Complete the payroll register, The Social Security tax rate is 6.2 percent, and the Medicare tax rate is 1.45 percent. Begin payrell checks with No. 2080, If required, round your intermediate calculations and the final answers to the nearest cent and use the rounded answers in subsequent computations. If an amount zero, enter "0 HIGHRIDGE ES PAYROLL REGISTER FOR WEEK ENDED February 21, 20 EARNINGS TAXABLE EARNINGS BEGINNING ENDING TTAL CUMULATIVE CUMULATIVE SOCIAL