need help doing balance sheet

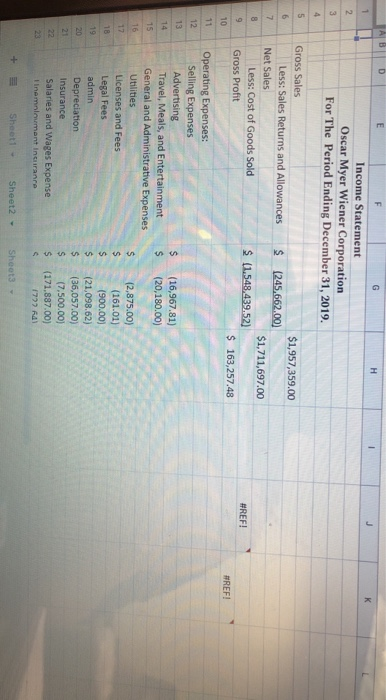

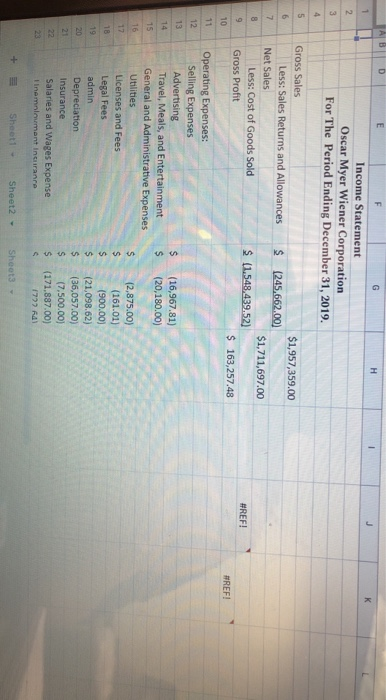

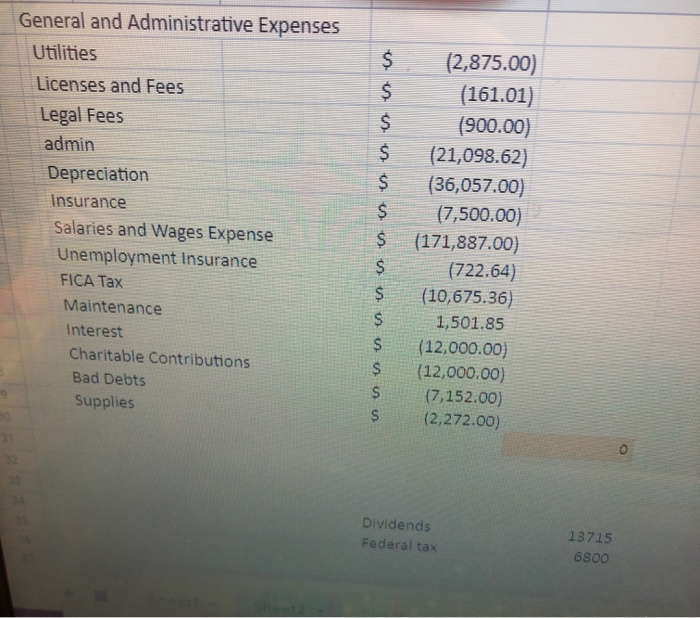

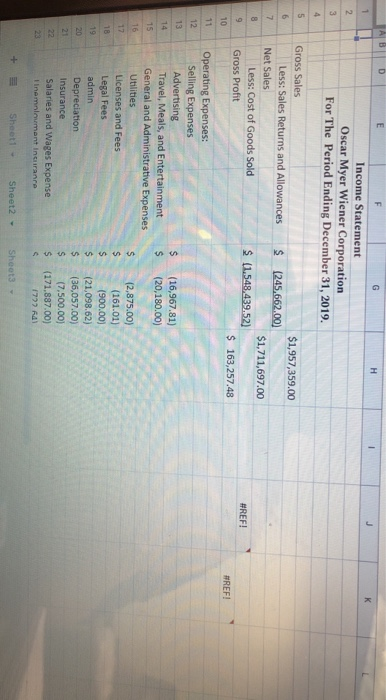

ALB D G H 1 K 2 Income Statement Oscar Myer Wiener Corporation For The Period Ending December 31, 2019. 3 4 5 Gross Sales $1,957,359.00 6 Less: Sales Returns and Allowances $ (245.662,00) 7 $1,711,697.00 8 Net Sales Less: Cost of Goods Sold Gross Profit $ (1.548,439,52) 9 #REF! $ 163,257.48 10 #REF! 11 12 13 14 $ $ (16,967.81) (20,180.00) 15 16 17 Operating Expenses: Selling Expenses Advertising Travel, Meals, and Entertainment General and Administrative Expenses Utilities Licenses and Fees Legal Fees admin Depreciation Insurance Salaries and Wages Expense I nemlument Insurance 18 19 sin is en is in 20 $ $ $ (2,875.00) (161.01) (900.00) (21,098.62) (36,057.00) 17.500.00) (171.887.00) 1727 21 Sheet1 Sheet2 - Shoot $ General and Administrative Expenses Utilities Licenses and Fees Legal Fees admin Depreciation Insurance Salaries and Wages Expense Unemployment Insurance FICA Tax Maintenance Interest Charitable Contributions Bad Debts Supplies $ (2,875.00) $ (161.01) (900.00) $ (21,098.62) $ (36,057.00) $ (7,500.00) $ (171,887.00) $ (722.64) $ (10,675.36) $ 1,501.85 $ (12,000.00) $ (12,000.00) S (7,152.00) (2,272.00) S Dividends Federal tax 13715 6800 ALB D G H 1 K 2 Income Statement Oscar Myer Wiener Corporation For The Period Ending December 31, 2019. 3 4 5 Gross Sales $1,957,359.00 6 Less: Sales Returns and Allowances $ (245.662,00) 7 $1,711,697.00 8 Net Sales Less: Cost of Goods Sold Gross Profit $ (1.548,439,52) 9 #REF! $ 163,257.48 10 #REF! 11 12 13 14 $ $ (16,967.81) (20,180.00) 15 16 17 Operating Expenses: Selling Expenses Advertising Travel, Meals, and Entertainment General and Administrative Expenses Utilities Licenses and Fees Legal Fees admin Depreciation Insurance Salaries and Wages Expense I nemlument Insurance 18 19 sin is en is in 20 $ $ $ (2,875.00) (161.01) (900.00) (21,098.62) (36,057.00) 17.500.00) (171.887.00) 1727 21 Sheet1 Sheet2 - Shoot $ General and Administrative Expenses Utilities Licenses and Fees Legal Fees admin Depreciation Insurance Salaries and Wages Expense Unemployment Insurance FICA Tax Maintenance Interest Charitable Contributions Bad Debts Supplies $ (2,875.00) $ (161.01) (900.00) $ (21,098.62) $ (36,057.00) $ (7,500.00) $ (171,887.00) $ (722.64) $ (10,675.36) $ 1,501.85 $ (12,000.00) $ (12,000.00) S (7,152.00) (2,272.00) S Dividends Federal tax 13715 6800