Answered step by step

Verified Expert Solution

Question

1 Approved Answer

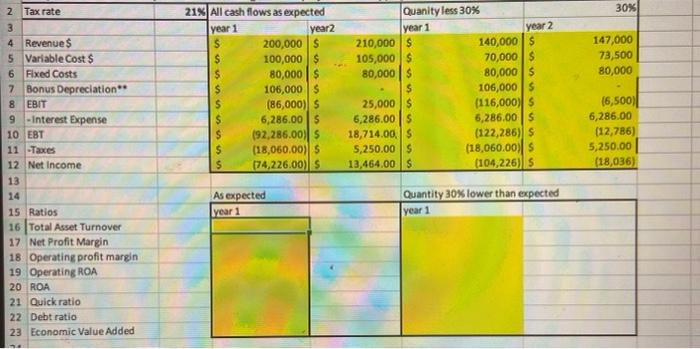

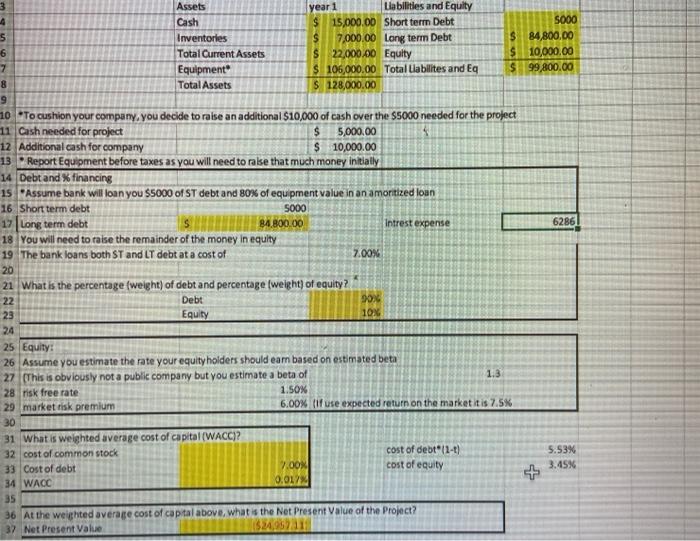

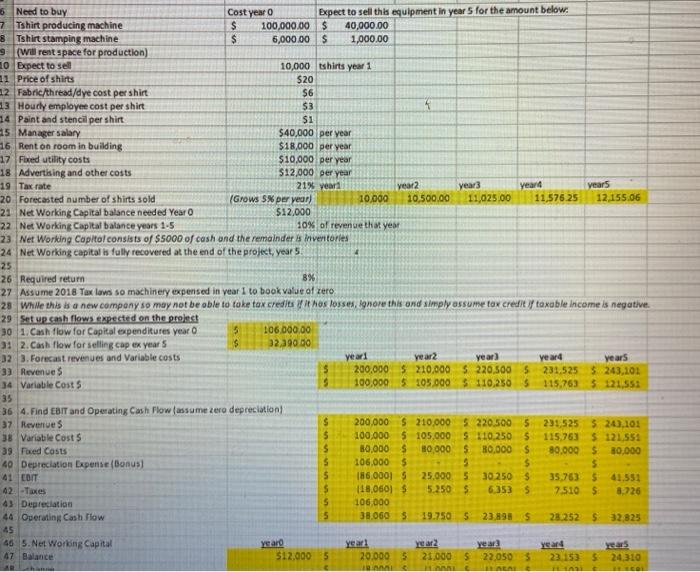

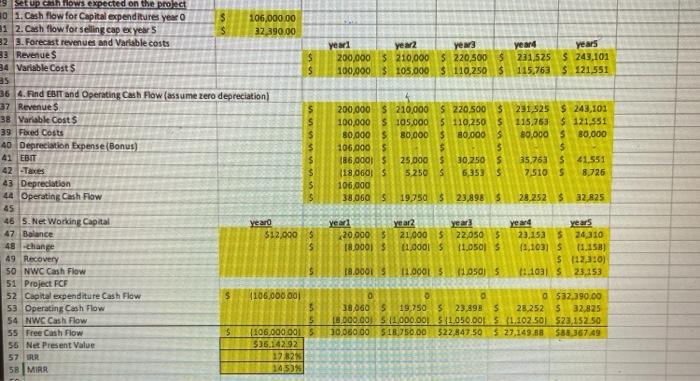

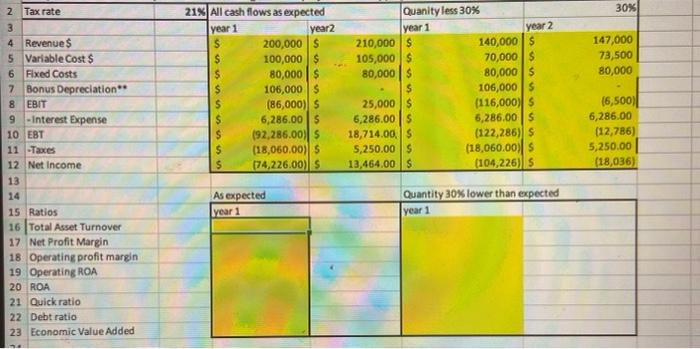

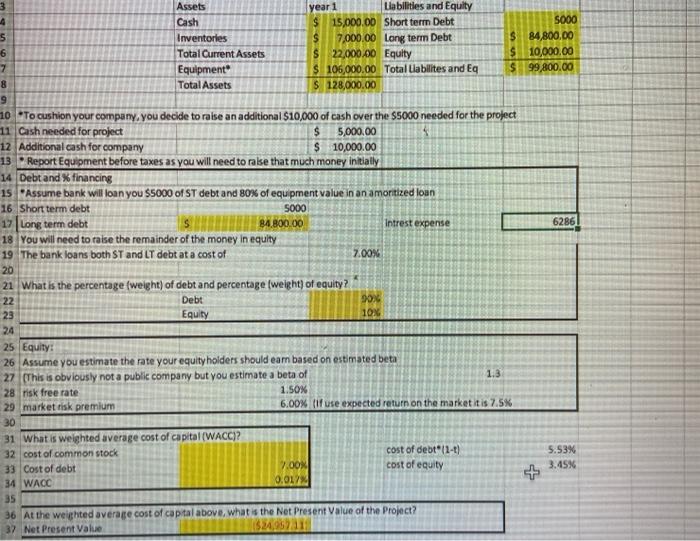

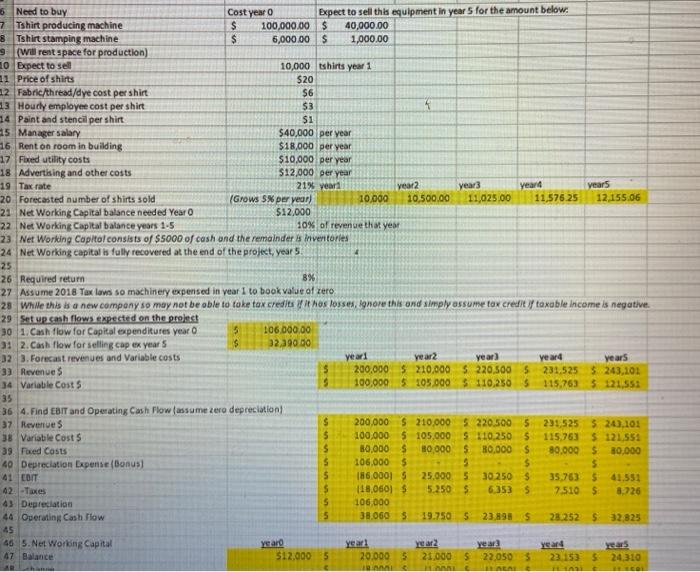

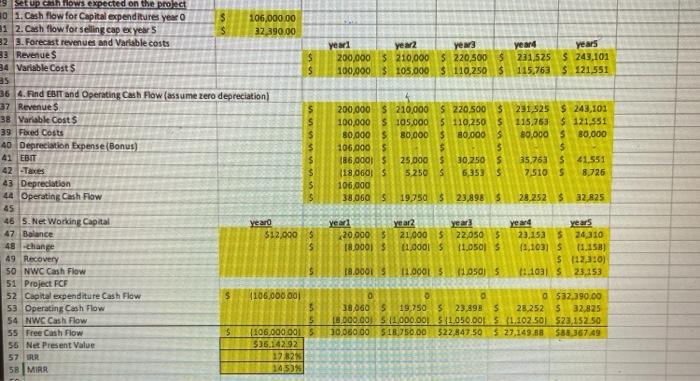

need help doing the yellow parts, if you could briefly show your work id appreciate it, thanks! other pics are for information related! 30% 147,000

need help doing the yellow parts, if you could briefly show your work id appreciate it, thanks! other pics are for information related!

30% 147,000 73,500 80,000 $ 2 Tax rate 3 4 Revenue $ 5 Variable costs 6 Fixed Costs 7 Bonus Depreciation 8 EBIT 9 - Interest Expense 10 EBT 11 Taces 12 Net Income 13 14 15 Ratios 16 Total Asset Turnover 17 Net Profit Margin 18 Operating profit margin 19 Operating ROA 20 ROA 21 Quick ratio 22 Debt ratio 23 Economic Value Added 21All cash flows as expected year 1 year2 200,000 $ $ 100,000 $ 80,000 $ 106,000 $ (86,000) $ 6,286.00 $ $ (92,286.00) (18,060,00) 5 (74,226.005 Quanity less 30% year 1 year 2 210,000 $ 140,000S 105,000 $ 70,000 $ 80,000 $ 80,000 $ $ 106,000 $ 25,000 $ (116,000) 6,286.00 6,286.00 $ 18,714.00 S (122,286) 5,250.00 $ (18,060,00) 13,464.00 (104,226) (6,500) 6,286.00 (12,786) 5,250.00 (18,036) As expected Quantity 30% lower than expected year 1 year 1 3 4 Assets year 1 Liabilities and Equity Cash S 15,000.00 Short term Debt 5000 5 Inventories S 7,000.00 Long term Debt $ 84,800.00 6 Total Current Assets $ 22,000.00 Equity $ 10,000.00 7 Equipment $ 106,000.00 Total Labilites and Eq $ 99,800.00 8 Total Assets S. 128,000.00 9 10 To cushion your company, you decide to raise an additional $10,000 of cash over the $5000 needed for the project 11 Cash needed for project $ 5,000.00 12 Additional cash for company $ 10,000.00 13 Report Equipment before taxes as you will need to raise that much money initially 14 Debt and financing 15 Assume bank will loan you $5000 of ST debt and 80% of equipment value in an amortized loan 16 Short term debt 5000 17 Long term debt 84 800.00 Intrest expense 6286) 18 You will need to raise the remainder of the money in equity 19 The bank loans both ST and LT debt at a cost of 7.00% 20 21 What is the percentage (weight) of debt and percentage (weight) of equity ? 22 Debt 23 Equity 10% 24 25 Equity: 26 Assume you estimate the rate your equity holders should eam based on estimated beta 27 This is obviously not a public company but you estimate a beta of 1.3 28 risk free rate 1.50% 29 market risk premium 6.00% (if use expected return on the marketitis 7.5% 30 31 What is weighted average cost of capital (WACC)? 32 cost of common stock cost of debt1-1) 5.53% 33 Cost of debt 7.00 cost of equity 3.45% 34 WAOC 0.017 35 36 At the weighted average cost of capital above what is the Net Present Value of the Project? 37 Net Present Value 90X 6 Need to buy Cost year o Expect to sell this equipment in years for the amount below: 7 Tshirt producing machine $ 100,000.00 $ 40,000.00 8 Tshirt stamping machine $ 6,000.00 $ 1,000.00 9 (Willrent space for production) 10 Expect to sell 10,000 tshirts year 1 11 Price of shirts $20 12 Fabric/thread/dye cost per shirt $6 13 Houdly employee cost per shirt $3 14 Paint and stencil per shirt $1 15 Manager salary $40,000 per year 16 Rent on room in building $18,000 per year 17 Fixed utility costs $10,000 per year 18 Advertising and other costs $12,000 per year 19 Tax rate 21% year vet2 year3 yeard years 20 Forecasted number of shirts sold (Grows $ per year) 10,000 10,500.00 11,025.00 11.576.25 12.155.06 21 Net Working Capital balance needed Year O $12,000 22 Net Working Capital balance years 1.5 10% of revenge that year 23 Net Working Capitol consists of $5000 of cash and the remainder & Inventories 24 Net Working capital is fully recovered at the end of the projet, years. 25 26 Required return 8% 27 Assume 2018 Tax laws so machinery expensed in year I to book value of zero 28 While this is a new company so may not be able to take tax credits y nos losses, ignore this and simply assume tax credit taxable income is negative. 29 Setup cash flows expected on the project 30 1.Cash flow for Capital expenditures year 5 106,000.00 3: 2. Cash flow for selling cap ex years 32.390.00 32 3. Forecast revenues and Variable costs year2 year) year4 years 3) Revenues 5 200,000 $ 210.000 S 220.500 5 231.525 5 243.101 34 Variable Costs 5 100,000 $105.000 5 110,250 $ 115.763 5121.551 35 36 4. Find EBIT and Operating Cash Flow assume zero depreciation 37. Revenues $ 200,000 $ 210.000 5220.500 5 231.525 5 243,101 38 Variable Costs $ 100,000 $ 105,000 S 110.250 5 115.763 $ 121.551 39. Foxed Costs $ 80,000 $ 80,000 5 B0.000 80.000 S 80,000 40 Depreciation Expense (Bonus 5 106,000 $ 9 $ $ 41 COIT 5 186.00015 25.000 5 30.250 $ 35.763 $ 41.551 42 -Taxes $ 118.0605 5.250 5 6.3535 7.510 S 8,726 4 Depreciation 5 106,000 44 Operating Cash Flow 5 38.0605 19.750 5 23.8985 28.252 $32.825 45 46 5. Net Working Capital Year years 47 Balance 512,000 5 20.000 5 21.000 22,050 $ 23.1535 24,310 IMAI years ARE years year2 Yes Yeard years 200,000 $ 210,000 S 220,500 $ 231,525 $ 243,101 100,000 $ 105,000 $ 110,250 $ 115,763 $ 121,551 9 Setup.ch now.expected on the project 20 1. Cash flow for Capital expenditures year S 106,000.00 31 2. Cash flow for selling cap ex years S 32 390.00 32 3. Forecast revenues and Variable costs 33 Revenues $ 34 Variable Cost $ $ BS 36 4. Find EBIT and Operating Cash Flow (assume zero depreciation) 37 Revenue $ $ 38 Variable costs $ 39 Faxed Costs $ 40 Depreciation Expense (Bonus) $ 41 EBIT $ 42 -Tres $ 43 Depreciation $ 44 Operating Cash Flow 5 45 46 5. Net Working Capital year 47 Balance $12.000 $ 48 change 5 49 Recovery 50 NWC Cash Flow 51 Project FCF 52 Capital expenditure Cash Flow 106,000.00 53 Operating Cash Flow 5 54 NWC Cash Flow 5 55 Free Cash Flow S 106,000.00 5 56 Net Present Value $35.14292 57 IR 17821 58 MIRR 1453% 231,525 $ 243,101 115.763 $ 121.551 80,000 S 80,000 5 35.763 $ 41.551 7.510 S 8.726 200.000 $ 210,000 $220.500 100,000 $105.000 5 110,250 $ 80,000 $ 80,000 $ 80.000 s 106.000 $ 5 $ 186.000 $ 25 000 $ 30,250 5 (180601 s 5250 5 6,353 $ 106.000 38,060 5 19,7505 23,8985 28,252 S 32 825 year year year 20.000 $ 21,000 5 22050 $ 1800013 1.000 $ 11,0505 Yeard years 23.153 5 24310 14,103) $ 11.158) $ 112,310) 13.1031 S 23,153 18.0001 11.0005 115j5 0 532 390.00 38060 519,750 5 23.8985 28.252 5 32,825 18.000,00) 51.000.00! 11.050.00 51.202.50 523,152.50 10.060.00 518,750.00 522 847.50 $ 27,149.88 $88.36749 30% 147,000 73,500 80,000 $ 2 Tax rate 3 4 Revenue $ 5 Variable costs 6 Fixed Costs 7 Bonus Depreciation 8 EBIT 9 - Interest Expense 10 EBT 11 Taces 12 Net Income 13 14 15 Ratios 16 Total Asset Turnover 17 Net Profit Margin 18 Operating profit margin 19 Operating ROA 20 ROA 21 Quick ratio 22 Debt ratio 23 Economic Value Added 21All cash flows as expected year 1 year2 200,000 $ $ 100,000 $ 80,000 $ 106,000 $ (86,000) $ 6,286.00 $ $ (92,286.00) (18,060,00) 5 (74,226.005 Quanity less 30% year 1 year 2 210,000 $ 140,000S 105,000 $ 70,000 $ 80,000 $ 80,000 $ $ 106,000 $ 25,000 $ (116,000) 6,286.00 6,286.00 $ 18,714.00 S (122,286) 5,250.00 $ (18,060,00) 13,464.00 (104,226) (6,500) 6,286.00 (12,786) 5,250.00 (18,036) As expected Quantity 30% lower than expected year 1 year 1 3 4 Assets year 1 Liabilities and Equity Cash S 15,000.00 Short term Debt 5000 5 Inventories S 7,000.00 Long term Debt $ 84,800.00 6 Total Current Assets $ 22,000.00 Equity $ 10,000.00 7 Equipment $ 106,000.00 Total Labilites and Eq $ 99,800.00 8 Total Assets S. 128,000.00 9 10 To cushion your company, you decide to raise an additional $10,000 of cash over the $5000 needed for the project 11 Cash needed for project $ 5,000.00 12 Additional cash for company $ 10,000.00 13 Report Equipment before taxes as you will need to raise that much money initially 14 Debt and financing 15 Assume bank will loan you $5000 of ST debt and 80% of equipment value in an amortized loan 16 Short term debt 5000 17 Long term debt 84 800.00 Intrest expense 6286) 18 You will need to raise the remainder of the money in equity 19 The bank loans both ST and LT debt at a cost of 7.00% 20 21 What is the percentage (weight) of debt and percentage (weight) of equity ? 22 Debt 23 Equity 10% 24 25 Equity: 26 Assume you estimate the rate your equity holders should eam based on estimated beta 27 This is obviously not a public company but you estimate a beta of 1.3 28 risk free rate 1.50% 29 market risk premium 6.00% (if use expected return on the marketitis 7.5% 30 31 What is weighted average cost of capital (WACC)? 32 cost of common stock cost of debt1-1) 5.53% 33 Cost of debt 7.00 cost of equity 3.45% 34 WAOC 0.017 35 36 At the weighted average cost of capital above what is the Net Present Value of the Project? 37 Net Present Value 90X 6 Need to buy Cost year o Expect to sell this equipment in years for the amount below: 7 Tshirt producing machine $ 100,000.00 $ 40,000.00 8 Tshirt stamping machine $ 6,000.00 $ 1,000.00 9 (Willrent space for production) 10 Expect to sell 10,000 tshirts year 1 11 Price of shirts $20 12 Fabric/thread/dye cost per shirt $6 13 Houdly employee cost per shirt $3 14 Paint and stencil per shirt $1 15 Manager salary $40,000 per year 16 Rent on room in building $18,000 per year 17 Fixed utility costs $10,000 per year 18 Advertising and other costs $12,000 per year 19 Tax rate 21% year vet2 year3 yeard years 20 Forecasted number of shirts sold (Grows $ per year) 10,000 10,500.00 11,025.00 11.576.25 12.155.06 21 Net Working Capital balance needed Year O $12,000 22 Net Working Capital balance years 1.5 10% of revenge that year 23 Net Working Capitol consists of $5000 of cash and the remainder & Inventories 24 Net Working capital is fully recovered at the end of the projet, years. 25 26 Required return 8% 27 Assume 2018 Tax laws so machinery expensed in year I to book value of zero 28 While this is a new company so may not be able to take tax credits y nos losses, ignore this and simply assume tax credit taxable income is negative. 29 Setup cash flows expected on the project 30 1.Cash flow for Capital expenditures year 5 106,000.00 3: 2. Cash flow for selling cap ex years 32.390.00 32 3. Forecast revenues and Variable costs year2 year) year4 years 3) Revenues 5 200,000 $ 210.000 S 220.500 5 231.525 5 243.101 34 Variable Costs 5 100,000 $105.000 5 110,250 $ 115.763 5121.551 35 36 4. Find EBIT and Operating Cash Flow assume zero depreciation 37. Revenues $ 200,000 $ 210.000 5220.500 5 231.525 5 243,101 38 Variable Costs $ 100,000 $ 105,000 S 110.250 5 115.763 $ 121.551 39. Foxed Costs $ 80,000 $ 80,000 5 B0.000 80.000 S 80,000 40 Depreciation Expense (Bonus 5 106,000 $ 9 $ $ 41 COIT 5 186.00015 25.000 5 30.250 $ 35.763 $ 41.551 42 -Taxes $ 118.0605 5.250 5 6.3535 7.510 S 8,726 4 Depreciation 5 106,000 44 Operating Cash Flow 5 38.0605 19.750 5 23.8985 28.252 $32.825 45 46 5. Net Working Capital Year years 47 Balance 512,000 5 20.000 5 21.000 22,050 $ 23.1535 24,310 IMAI years ARE years year2 Yes Yeard years 200,000 $ 210,000 S 220,500 $ 231,525 $ 243,101 100,000 $ 105,000 $ 110,250 $ 115,763 $ 121,551 9 Setup.ch now.expected on the project 20 1. Cash flow for Capital expenditures year S 106,000.00 31 2. Cash flow for selling cap ex years S 32 390.00 32 3. Forecast revenues and Variable costs 33 Revenues $ 34 Variable Cost $ $ BS 36 4. Find EBIT and Operating Cash Flow (assume zero depreciation) 37 Revenue $ $ 38 Variable costs $ 39 Faxed Costs $ 40 Depreciation Expense (Bonus) $ 41 EBIT $ 42 -Tres $ 43 Depreciation $ 44 Operating Cash Flow 5 45 46 5. Net Working Capital year 47 Balance $12.000 $ 48 change 5 49 Recovery 50 NWC Cash Flow 51 Project FCF 52 Capital expenditure Cash Flow 106,000.00 53 Operating Cash Flow 5 54 NWC Cash Flow 5 55 Free Cash Flow S 106,000.00 5 56 Net Present Value $35.14292 57 IR 17821 58 MIRR 1453% 231,525 $ 243,101 115.763 $ 121.551 80,000 S 80,000 5 35.763 $ 41.551 7.510 S 8.726 200.000 $ 210,000 $220.500 100,000 $105.000 5 110,250 $ 80,000 $ 80,000 $ 80.000 s 106.000 $ 5 $ 186.000 $ 25 000 $ 30,250 5 (180601 s 5250 5 6,353 $ 106.000 38,060 5 19,7505 23,8985 28,252 S 32 825 year year year 20.000 $ 21,000 5 22050 $ 1800013 1.000 $ 11,0505 Yeard years 23.153 5 24310 14,103) $ 11.158) $ 112,310) 13.1031 S 23,153 18.0001 11.0005 115j5 0 532 390.00 38060 519,750 5 23.8985 28.252 5 32,825 18.000,00) 51.000.00! 11.050.00 51.202.50 523,152.50 10.060.00 518,750.00 522 847.50 $ 27,149.88 $88.36749

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started