Answered step by step

Verified Expert Solution

Question

1 Approved Answer

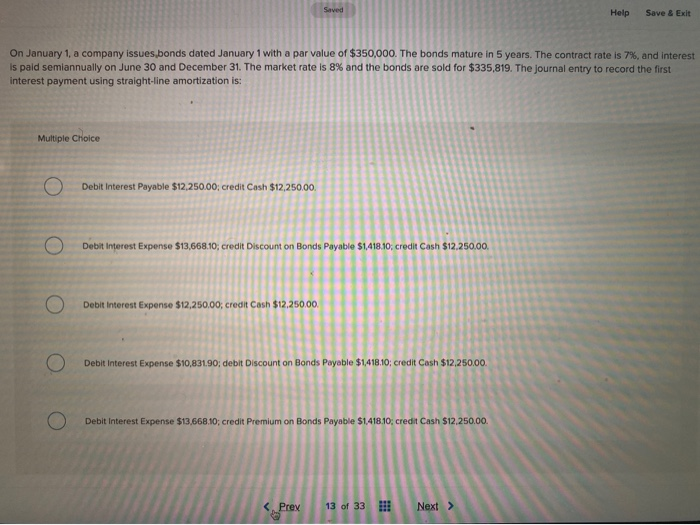

Need help figuring out these following questions. Saved Help Save & Exit On January 1, a company issues bonds dated January 1 with a par

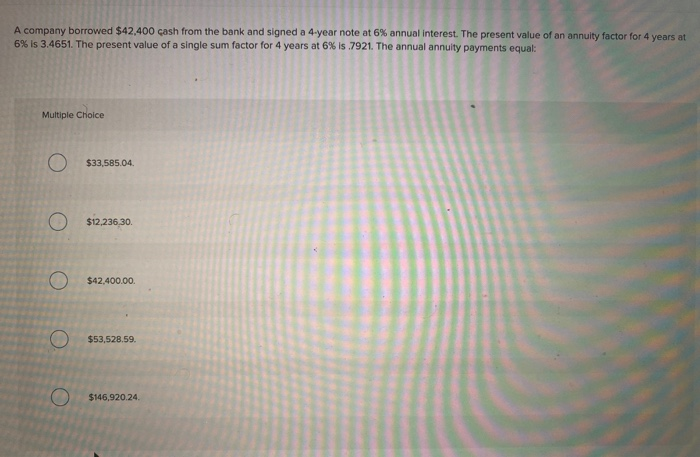

Need help figuring out these following questions.

Saved Help Save & Exit On January 1, a company issues bonds dated January 1 with a par value of $350,000. The bonds mature in 5 years. The contract rate is 7%, and interest is paid semiannually on June 30 and December 31. The market rate is 8% and the bonds are sold for $335,819. The journal entry to record the first interest payment using straight-line amortization is: Multiple Choice Debit Interest Payable $12,250.00; Credit Cash $12,250.00 Debit Interest Expense $13,668.10, credit Discount on Bonds Payable $1.418.10, credit Cash $12,250,00 O Debit interest Expense $12,250.00, credit Cash $12,250.00. Debit Interest Expense $10,831.90; debit Discount on Bonds Payable $1,418,10; credit Cash $12,250.00 Debit Interest Expense $13,668.10, credit Premium on Bonds Payable $1.418.10; credit Cash $12,250.00 A company borrowed $42.400 cash from the bank and signed a 4-year note at 6% annual interest. The present value of an annuity factor for 4 years at 6% is 3.4651. The present value of a single sum factor for 4 years at 6% is 7921. The annual annuity payments equal Multiple Choice $33,585.04. O $12,236,30 $42.400.00 $53,528.59 $146.920.24 O

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started