Question

Need help figuring out this problem! Please! Beta is 0.45 Finance 431 Stock Valuation Assignment # 2 In this problem, you are going to calculate

Need help figuring out this problem! Please! Beta is 0.45

Finance 431

Stock Valuation Assignment # 2

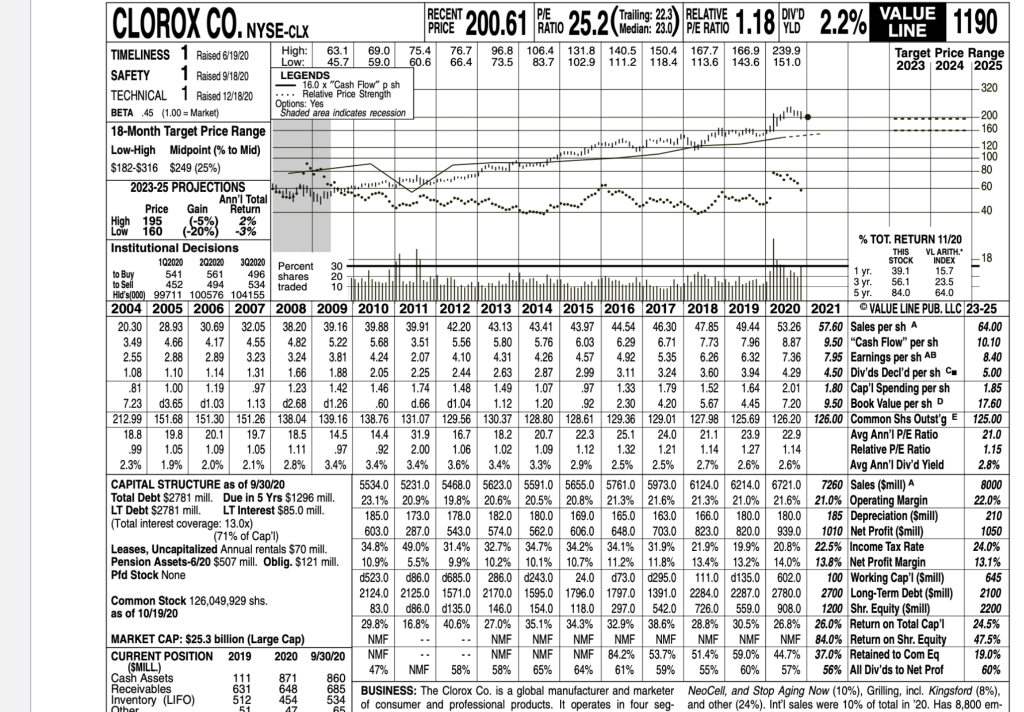

In this problem, you are going to calculate the present value of the stock of Clorox Company. As you did last week, assume the risk-free rate is 2% and the market risk premium is 6%. The current stock price for Clorox Company (CLX) is $180.07. In this problem, you are to determine if the stock at $180.07 is over or under-valued based on the intrinsic value you compute.

Using the examples covered in class, calculate the present value of the dividend and present value of the stock price for Clorox Company using the data provided on the Value Line sheet for Clorox

CLOROX CO. NYSE-CLX 20% VALUE 1190 TOTT Price 2% 302020 Percent 496 56.1 5 yr. DIV'D NYSE-CLX PRICE Median: 23.0RATIO LINE TIMELINESS 1 Raised 6/19/20 High: 63.1 69.0 75.4 76.7 96.8 106.4 131.8 140.5 150.4 167.7 166.9 239.9 Low: 45.7 59.0 Target Price Range 60.6 66.4 73.5 83.7 102.9 111.2 118.4 113.6 143.6 151.0 SAFETY 1 Raised 9/18/20 LEGENDS 2023 2024 2025 16.0 x "Cash Flow" p sh TECHNICAL 1 Raised 12/18/20 .... Relative Price Strength -320 Options: BETA .45 (1.00 = Market) Shaded area indicates recession 200 18-Month Target Price Range -160 Low-High Midpoint (% to Mid) 120 $182-$316 $249 (25%) -100 -80 2023-25 PROJECTIONS -60 Ann'l Total Gain Return 40 High 195 (-5%) Low 160 (-20%) -3% . Institutional Decisions % TOT. RETURN 11/20 102020 202020 THIS VL ARITH 30 STOCK INDEX 18 to Buy 541 561 shares 20 1 yr. 39.1 15.7 to Seli 452 494 534 traded 10 3 yr. 23.5 Hid's[000) 99711 100576 104155 84.0 64.0 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 VALUE LINE PUB. LLC 23-25 20.30 28.93 30.69 32.05 38.20 39.16 39.88 39.91 42.20 43.13 43.41 43.97 44.54 46.30 47.85 49.44 53.26 57.60 Sales per sh A 64.00 3.49 4.66 4.17 4.55 4.82 5.22 5.68 3.51 5.56 5.80 5.76 6.03 6.29 6.71 7.73 7.96 8.87 9.50 "Cash Flow" per sh 10.10 2.55 2.88 2.89 3.23 3.24 3.81 4.24 2.07 4.10 4.31 4.26 4.57 4.92 5.35 6.26 6.32 7.36 7.95 Earnings per sh AB 8.40 1.08 1.10 1.14 1.31 1.66 1.88 2.05 2.25 2.44 2.63 2.87 2.99 3.11 3.24 3.60 3.94 4.29 4.50 Div'ds Decl'd per sh C. 5.00 .81 1.00 1.19 97 1.23 1.42 1.46 1.74 1.48 1.49 1.07 .97 1.33 1.79 1.52 1.64 2.01 1.80 Cap'l Spending per sh 1.85 7.23 d3.65 d1.03 1.13 d2.68 d1.26 .60 d.66 d1.04 1.12 1.20 .92 2.30 4.20 5.67 4.45 7.20 9.50 Book Value per shD 17.60 212.99 151.68 151.30 151.26 138.04 139.16 138.76 131.07 129.56 130.37 128.80 128.61 129.36 129.01 127.98 125.69 126.20 126.00 Common Shs Outst'g E 125.00 18.8 19.8 20.1 19.7 18.5 14.5 14.4 31.9 16.7 18.2 20.7 22.3 25.1 24.0 21.1 23.9 22.9 Avg Ann'i P/E Ratio 21.0 .99 1.05 1.09 1.05 1.11 .97 .92 2.00 1.06 1.02 1.09 1.12 1.32 1.21 1.14 1.27 1.14 Relative P/E Ratio 1.15 2.3% 1.9% 2.0% 2.1% 2.8% 3.4% 3.4% 3.4% 3.6% 3.4% 3.3% 2.9% 2.5% 2.5% 2.7% 2.6% 2.6% Avg Ann'l Div'd Yield 2.8% CAPITAL STRUCTURE as of 9/30/20 5534.0 5231.0 5468.0 5623.0 5591.0 5655.0 5761.0 5973.0 6124.0 6214.0 6721.0 7260 Sales (Smill) A 8000 Total Debt $2781 mill. Due in 5 Yrs $1296 mill. 23.1% 20.9% 19.8% 20.6% 20.5% 20.8% 21.3% 21.6% LT Debt $2781 mill. LT Interest $85.0 mill. 21.3% 21.0% 21.6% 21.0% Operating Margin 22.0% 185.0 173.0 182.0 180.0 169.0 165.0 163.0 166.0 (Total interest coverage: 13.0x) 180.0 180.0 185 Depreciation (Smill) 210 (71% of Cap') 603.0 287.0 562.0 606.0 648.0 703.0 823.0 820.0 399.0 1010 Net Profit (Smill) 1050 Leases, Uncapitalized Annual rentals $70 mill. 34.8% 49.0% 31.4% 32.7% 34.7% 34.2% 34.1% 31.9% 21.9% 19.9% 20.8% 22.5% Income Tax Rate 24.0% Pension Assets-6/20 $507 mill. Oblig. $121 mill. 10.9% 18.5% 20.6% 5.5% 9.9% 10.2% 10.1% 10.7% 11.2% 11.2% 11.8% 13.4% 13.2% 14.0% 13.8% Net Profit Margin 13.1% Pfd Stock None d523.0 d86.0 0685.0 286.0 286.0 0243.0 24.0 d73.0 d295.0 20 111.0 d135.0 602.0 100 Working Cap' (Smill) 645 Common Stock 126,049,929 shs. 2124.0 2125.0 1571.0 2170.0 1595.0 1796.0 1797.0 1391.0 2284.0 2287.0 2780.0 2700 Long-Term Debt (Smill) 2100 as of 10/19/20 83.0 d86.0 0135.0 146.0 154.0 118.0 297,0 542.0 726.0 559.0 908.0 1200 Shr. Equity (Smill) 2200 29.8% % 16.8% 40.6% 27.0% 35.1% 34.3% 32.9% 38.6% 28.8% 30.5% 26.8% 26.0% Return on Total Cap'l 24.5% MARKET CAP: $25.3 billion (Large Cap) NMF NMF NMF NMF NMF NMF NMF NMF NMF 84.0% Return on Shr. Equity 47.5% CURRENT POSITION 2019 2020 9/30/20 NMF NMF NMF NMF 84.2% 53.7% 51.4% 59.0% 44.7% 37.0% Retained to Com Eq 19.0% (SMILL.) 47% 58% 58% NMF 65% 64% 61% 59% 55% Cash Assets 111 871 60% 57% 56% All Div'ds to Net Prof 60% 860 Receivables 631 648 685 BUSINESS: The Clorox Co. is a global manufacturer and marketer NeoCell, and Stop Aging Now (10%), Grilling, incl. Kingsford (8%), Inventory (LIFO) 512 454 534 47 of consumer and professional products. It operates in four seg- and other (24%). Int'l sales were 10% of total in '20. Has 8,800 em- 178.0 543.0 574.0 939.0 51 65

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started