Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help filling in the information in the excel spreadsheets, please show the formulas in excel, I attached to docs that contain notes in them

need help filling in the information in the excel spreadsheets, please show the formulas in excel, I attached to docs that contain notes in them about specific answers, additionally the question is in the word doc with data, leave a comment if you have any questions, thank you

what information do you need, everything is provided

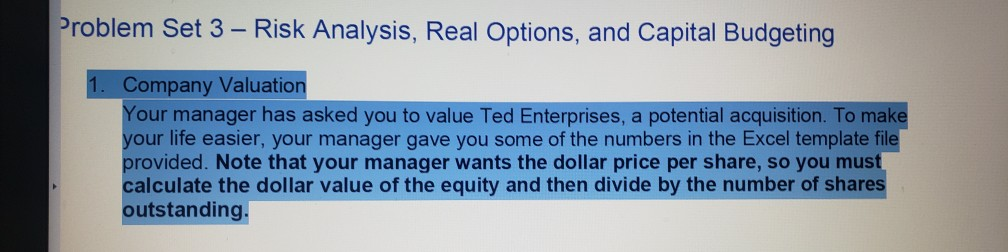

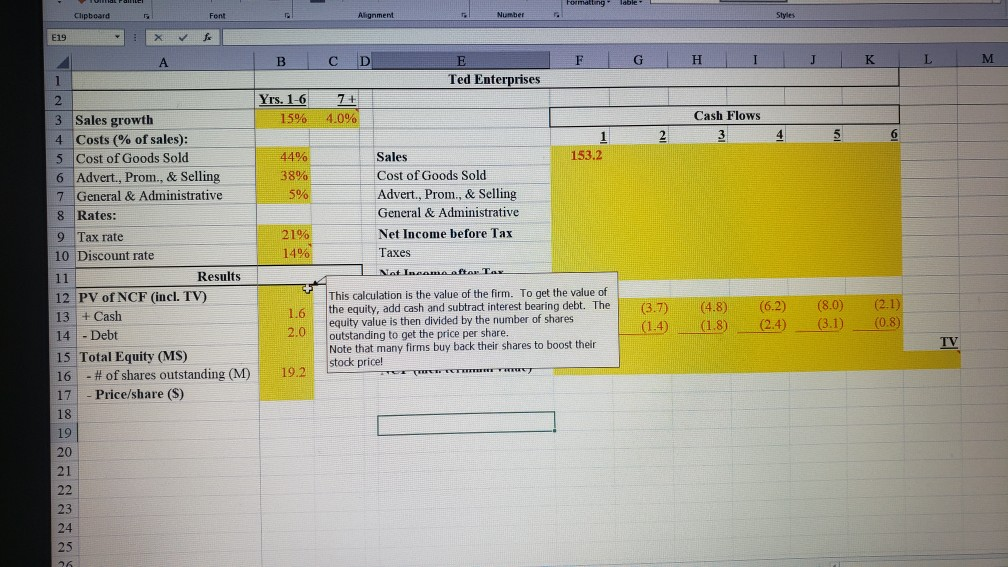

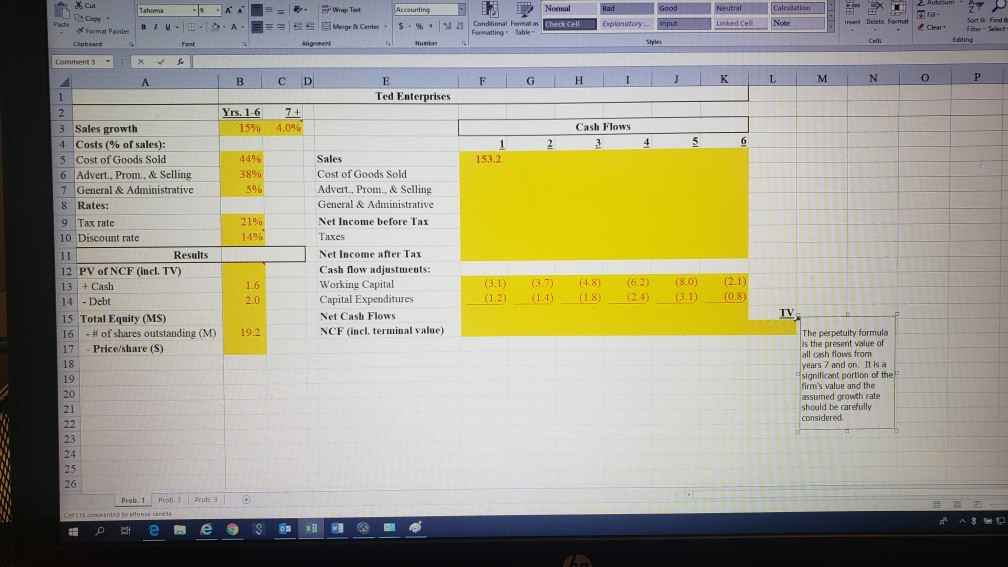

Problem Set 3 - Risk Analysis, Real Options, and Capital Budgeting 1. Company Valuation Your manager has asked you to value Ted Enterprises, a potential acquisition. To make your life easier, your manager gave you some of the numbers in the Excel template file provided. Note that your manager wants the dollar price per share, so you must calculate the dollar value of the equity and then divide by the number of shares outstanding. EI Formatting Table Clipboard 5 Font Alignment Number Styles E19 X for A B D F G H J K L M E Ted Enterprises 1 Yrs. 1-6 15% 4.0% Cash Flows 3 2 4 5 6 153.2 44% 38% % 5% Sales Cost of Goods Sold Advert., Prom., & Selling General & Administrative Net Income before Tax Taxes Nat Inuama afta Tar 2196 14% 1.6 2.0 (3.7) (1.4) (4.8) (1.8) (6.2) (2.4) 2 3 Sales growth 4 Costs (% of sales): 5 Cost of Goods Sold 6 Advert., Prom., & Selling 7 General & Administrative 8 Rates: 9 Tax rate 10 Discount rate 11 Results 12 PV of NCF (incl. TV) 13 + Cash 14 - Debt 15 Total Equity (MS) 16 - # of shares outstanding (M) 17 Price/share ($) 18 19 20 21 22 23 24 25 26 (8.0) (3.1) (2.1) (0.8) This calculation is the value of the firm. To get the value of the equity, add cash and subtract interest bearing debt. The equity value is then divided by the number of shares outstanding to get the price per share Note that many firms buy back their shares to boost their stock price! ETTE ETTER TV 19.2 - IS nh, H. Bad Calculation Good FDX X Cut Copy - Format Ponte Paste Neutral Linked Cell -A==. Wrap Test A Merge Center - Alignment Accounting I Normal $ % & Conditional Format as Check Cell Formatting Table Number Input Explanatory I o Imert Delete Fumat Note 2 Autum 27 F Sort & Find Clear Far Set Eating Style Cell Cupboard Font Comment 3 - f A B D F G H H K L M N 0 P E Ted Enterprises 7 + Yrs. 1-6 1596 4.0% Cash Flows 4 5 6 1 153.2 44% 38% 5% 21% 14% 1 2 - 3 Sales growth 4 Costs (% of sales): 5 Cost of Goods Sold 6 Advert., Prom., & Selling 7 General & Administrative 8 Rates: 9 Tax rate 10 Discount rate 11 Results 12 PV of NCF (incl. TV) 13 + Cash 14 - Debt 15 Total Equity (MS) - # of shares outstanding (M) 17 Price/share (S) 18 19 20 21 22 23 Sales Cost of Goods Sold Advert.. Prom., & Selling General & Administrative Net Income before Tax Taxes Net Income after Tax HT Cash flow adjustments: Working Capital Capital Expenditures Net Cash Flows NCF (incl. terminal value) (6.2) 1.6 2.0 (3.1) (1.2) (3.7 (1.4) (4.8) (1.8 (8.0 ) (3.1 (2.1) (0.8) TV 19.2 The perpetuity formula is the present value of all cash flows from years 7 and on. It is a significant portion of the firm's value and the assumed growth rate should be carefully considered 24 25 26 Prob. 1 Prob. 2 Prob. 3 Ceil Cented by stonia tanti e e S 0 xil WE ComStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started