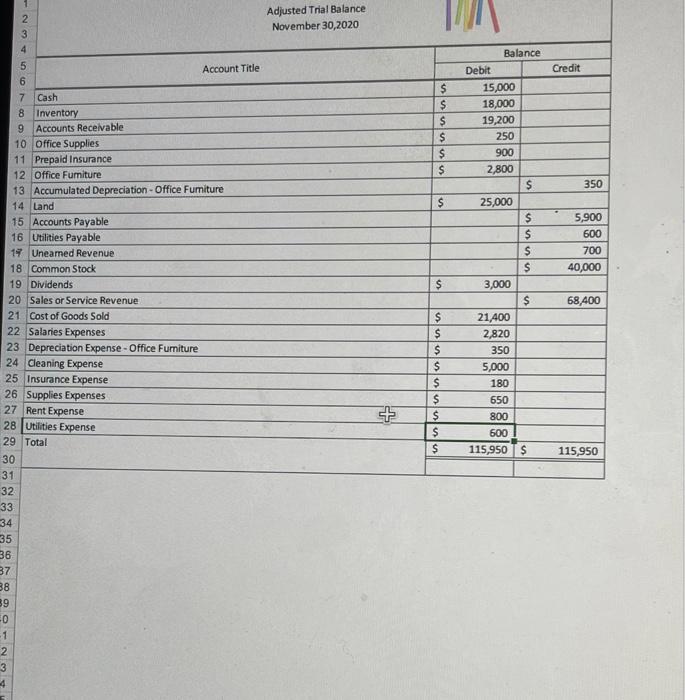

need help filling out balance sheet and owners equity

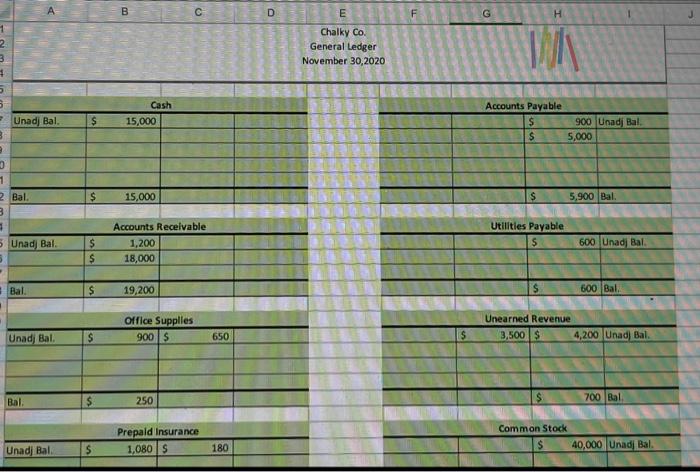

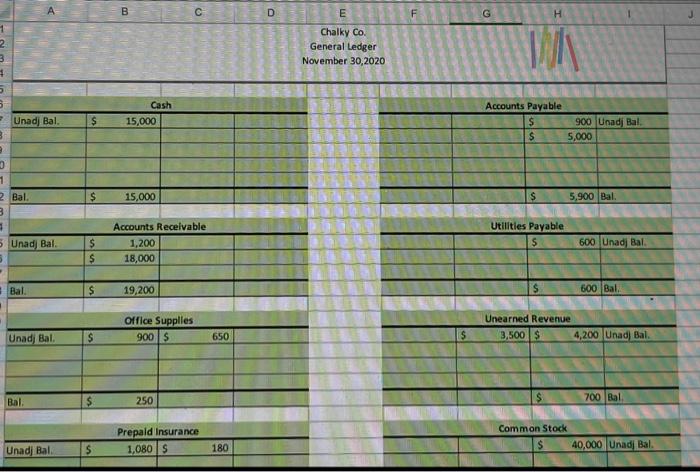

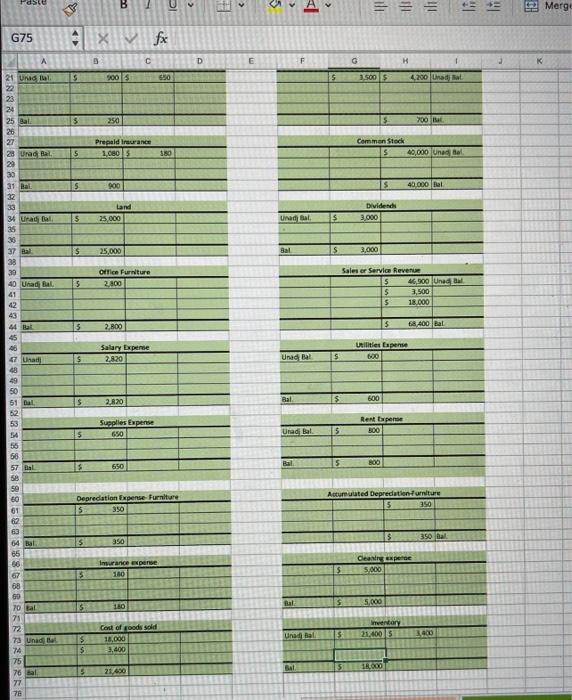

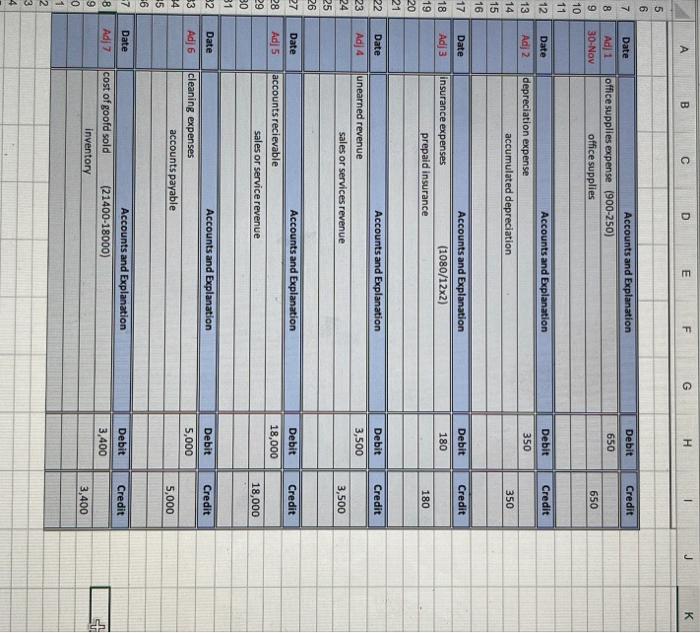

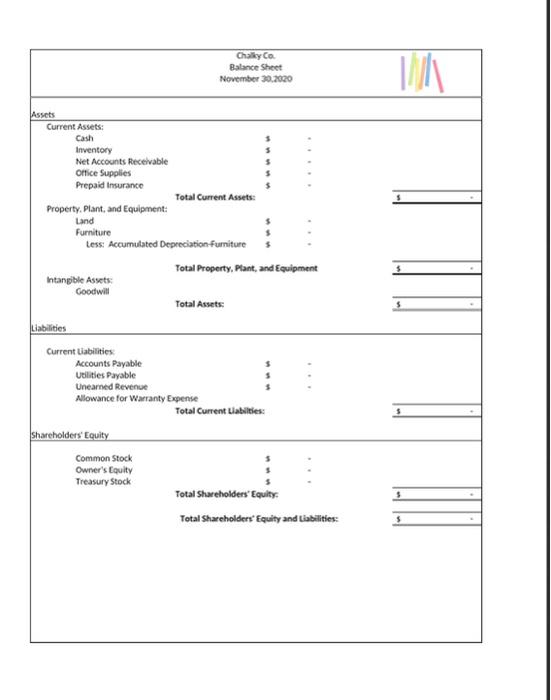

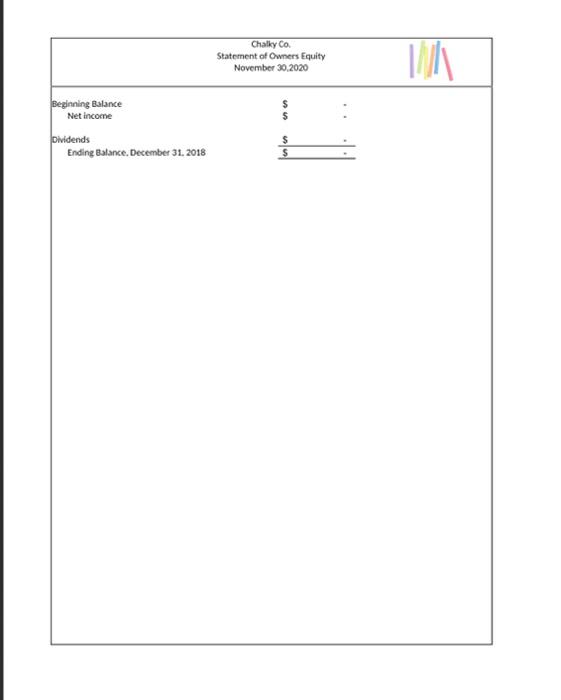

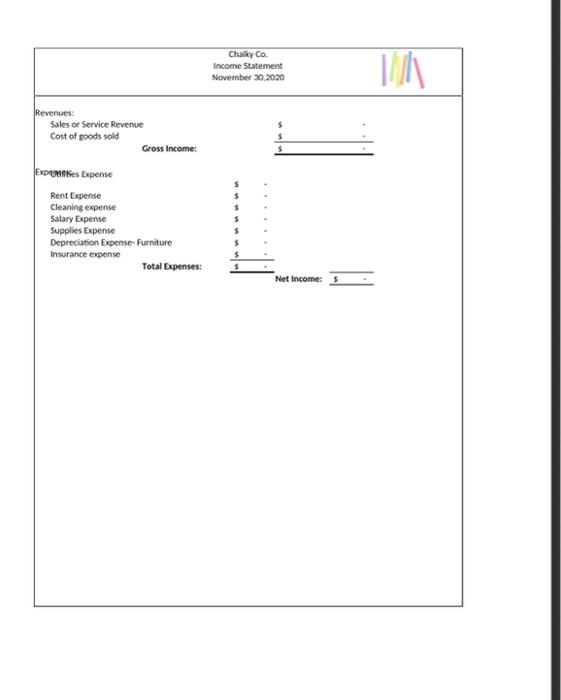

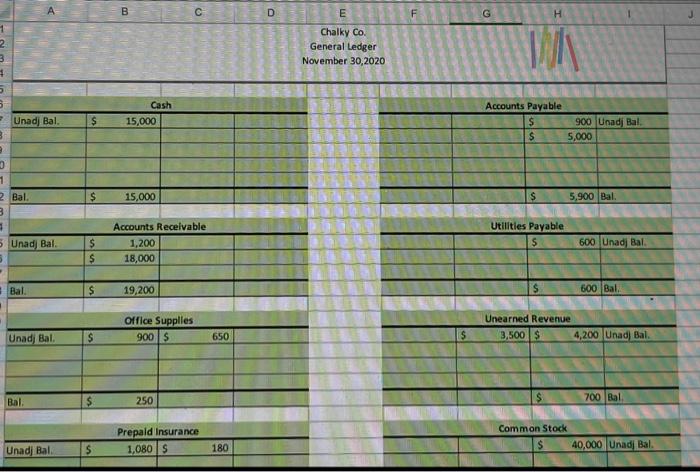

1 3 # 5 6 Unadj Bal. B 9 0 1 2 Bal. B 1 5 Unadj Bal. 7 Bal. Unadi Bal. Bal. Unadj Bal. $ $ $ $ $ $ $ B Cash 15,000 15,000 Accounts Receivable 1,200 18,000 19,200 Office Supplies 900 $ C 250 Prepaid Insurance 1,080 S 650 180 D E Chalky Co. General Ledger November 30,2020 F $ G H Accounts Payable $ $ $ Utilities Payable $ 5,000 900 Unadj Bal. Unearned Revenue 3,500 $ Common Stock $ 5,900 Bal. 600 Unadj Bal. 600 Bal. 4,200 Unad) Bal. 700 Bal. 40,000 Unadj Bal. G75 ERRRRRRRRRRRR XRRRRA75973986 21 Unad Bal 28 Unad Bal 32 31 Bal 34 Urad Bal 37 Bal 41 40 Unad Bal 42 43 Paste 45 44 Bal 46 Bal.$ 988288288 47 Unad 48 49 50 51 Dal 62 53 55 56 57 Bal 58 50 60 61 62 63 3388688RER RARRER 64 Bal 65 66 60 70 tal 71 72 73 Unad Bal 74 75 76 Bal P # X B 77 78 BM $ 5 S $ $ 5 5 $ $ $ $ 5 $ $ $ $ $ B $ 900 $ 250 Prepaid Insurance 1,080 $ 900 Land 25.000 25,000 Office Furniture 2,800 2,800 Salary Expense 2,820 2,820 C 650 Depreciation Expense- Furniture 350 Supplies Expense 650 350 180 fx Insurance expense 180 21,400 DI > Cost of goods sold 18,000 3,400 650 180 D Unad Bal Bal Unad Bal Bal. Urad Bal Bal Bal Unadi Bal Bal > 5 $ $ $ $ 5 $ 13 G $ === 5 3,500 $ Common Stock Dividends 3,000 3,000 $ 600 Sales or Service Revenue 5 $ S 800 H S Rent Expense 800 5,000 Utilities Expense 600 $ 18,000 4,200 Unadj Bal Accumulated Depreciation furniture 5 350 40,000 Unad Bal Inventory 21,400 $ 700 Ba 40,000 Bal 46,900 Unad Bal 3,500 18,000 Cleaning experse 5,000 68,400 Bal 350 Bal 3,400 41 3 HE K Merge 5 6678 PERSON 2 ENKS 58885 16 9 10 11 12 Date 13 Adj 2 14 15 17 18 19 20 21 23 24 25 22 Date Adj 4 26 27 28 29 34 5 =6 -7 8 9 0 1 A 2 3 Date 4 Adj 1 30-Nov Date Adj 3 Date Adj 5 Date Adj 6 Date Adj 7 B C office supplies expense (900-250) office supplies depreciation expense insurance expenses accumulated depreciation unearned revenue prepaid insurance accounts recievable cleaning expenses Accounts and Explanation sales or services revenue cost of goofd sold Accounts and Explanation inventory sales or service revenue accounts payable E Accounts and Explanation (1080/12x2) F Accounts and Explanation Accounts and Explanation Accounts and Explanation (21400-18000) Accounts and Explanation G H Debit 650 Debit 350 Debit 180 Debit 3,500 Debit 18,000 Debit 5,000 Debit 3,400 Credit 650 Credit 350 Credit 180 Credit 3,500 Credit 18,000 Credit 5,000 Credit 3,400 J K n SUI You are hired as a new staff accountant for Chalky Co., a reputable chalkboard company, that specializes in selling and installing chalkboards. Your task is to prepare the financial statements for November 30, 2020. 1. When auditing supply inventory, you realized that it only had $250 of office supplies on hand. 2. Depreciation expense is $350 each month. It has not been recorded for November. 3. An insurance policy was purchased for $1,080. The policy term was for October-September 2021. Adjust the insurance accordingly. 4. Star Company paid $3.500 for chalkboard installation at their offices last month. Chalky Co. performed the installation service this month. 5. Chalky Co. provided installation service to Red Barn Inc for $18,000. Chalky Co. issued an Invoice to Red Barn Inc who will pay next month. 6. Pretty Office Cleaning, a cleaning service provided services to Chalky Co. during November. An invoice was received for the amount of $5,000 and will be paid next month. 7. Chalky Co. conducted a physical count of their inventory. The value of current inventory was $18,000 Assets Current Assets: Cash Inventory Net Accounts Receivable Office Supplies Prepaid Insurance Property. Plant, and Equipment: Land Liabilities Intangible Assets: Goodwill Furniture Less: Accumulated Depreciation Furniture Current Liabilities Accounts Payable Utilities Payable Unearned Revenue Shareholders' Equity Chalky Co. Balance Sheet November 30,2020 Total Current Assets: Common Stock Owner's Equity Treasury Stock Allowance for Warranty Expense Total Property, Plant, and Equipment Total Assets: Total Current Liabilities: Total Shareholders' Equity Total Shareholders' Equity and Liabilities: MA 3 S Beginning Balance Net income Dividends Ending Balance, December 31, 2018 Chalky Co. Statement of Owners Equity November 30,2020 $ THA Revenues: Sales or Service Revenue Cost of goods sold Expies Expense Rent Expense Cleaning expense Salary Expense Supplies Expense Gross Income: Depreciation Expense- Furniture Insurance expense Total Expenses: Chalky Co. Income Statement November 30,2020 Net Income: TAN 12 3 5 6 7 Cash 8 Inventory 9 Accounts Receivable 10 Office Supplies 11 Prepaid Insurance 12 Office Furniture. 13 Accumulated Depreciation - Office Furniture 14 Land 15 Accounts Payable 16 Utilities Payable 17 Uneamed Revenue 18 Common Stock 30 31 4 19 Dividends 20 Sales or Service Revenue 21 Cost of Goods Sold 22 Salaries Expenses 23 Depreciation Expense-Office Furniture 24 Cleaning Expense 32 33 34 35 36 37 38 39 0 1 2 3 4 25 Insurance Expense 26 Supplies Expenses 27 Rent Expense 28 Utilities Expense 29 Total Account Title Adjusted Trial Balance November 30,2020 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ Debit Balance 15,000 18,000 19,200 250 900 2,800 25,000 3,000 21,400 2,820 350 $ $ SSS $ 5,000 180 650 800 600 115,950 $ Credit 350 5,900 600 700 40,000 68,400 115,950