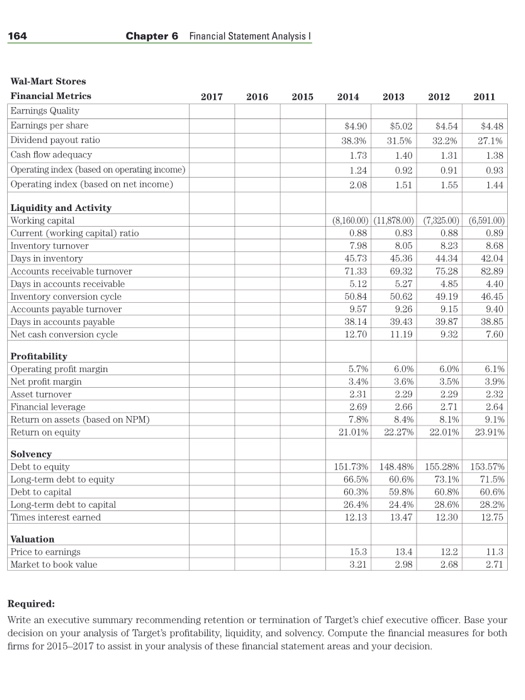

Need help filling out data for 2015 to 2017 on page 163-164.

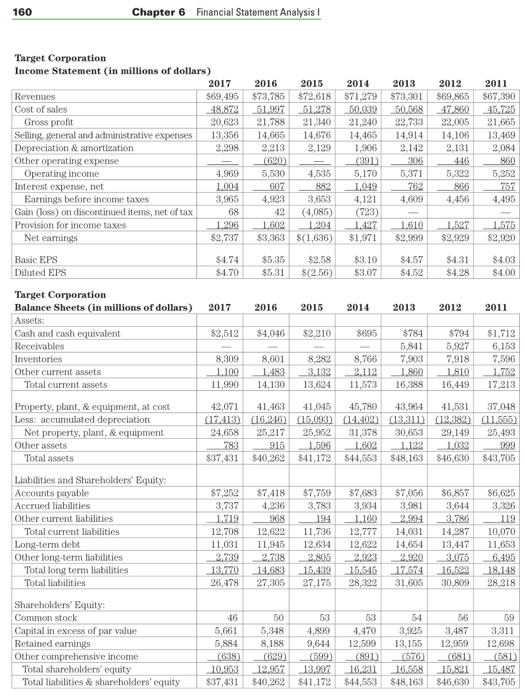

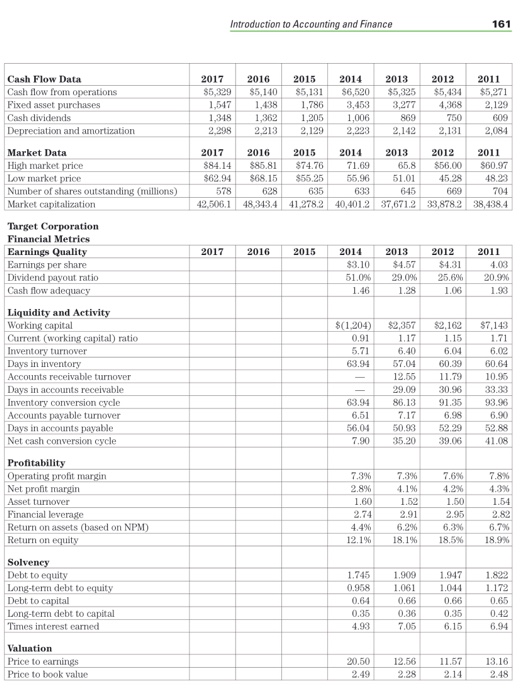

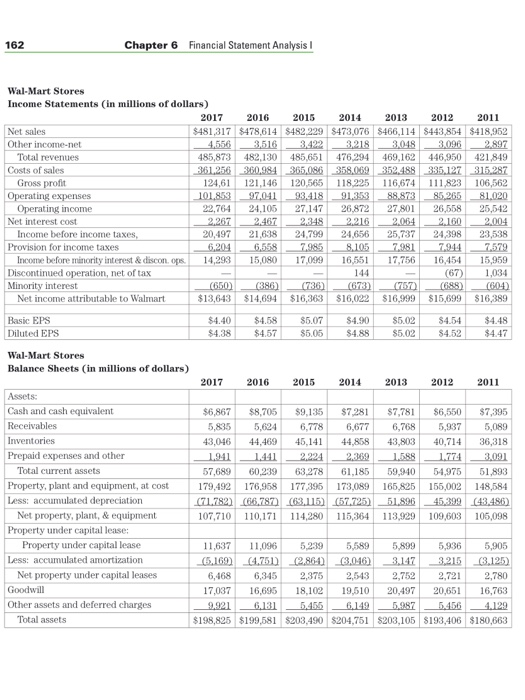

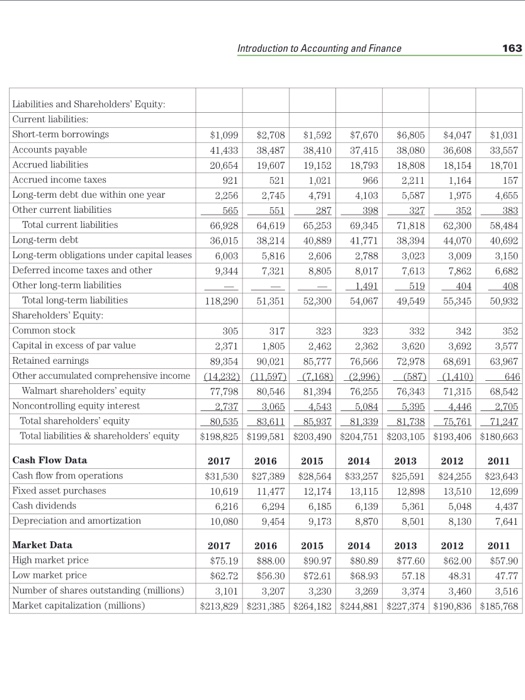

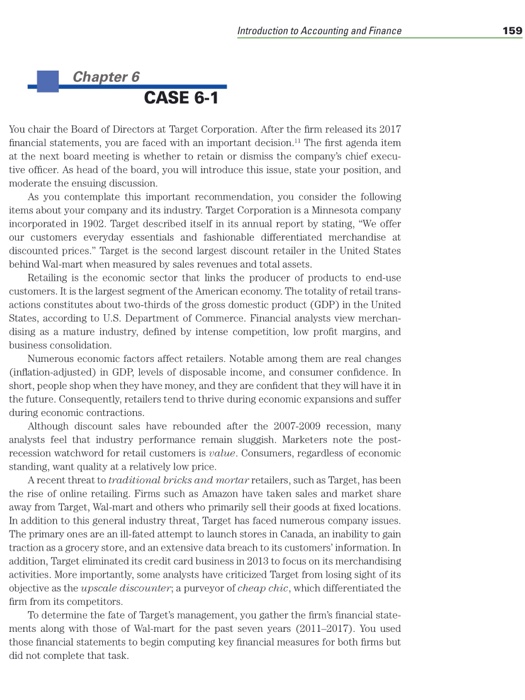

Introduction to Acco and Finance 159 Chapter 6 CASE 6-1 You chair the Board of Directors at Target Corporation. After the firm released its 2017 financial statements, you are faced with an important decision The first agenda item at the next board meeting is whether to retain or dismiss the company's chief execu- tive officer. As head of the board, you will introduce this issue, state your position, and moderate theensuing discussion. As you contemplate this important recommendation, you consider the following items about your company and its industry. Target Corporation is a Minnesota company incorporated in 1902. Target described itself in its annual report by stating, "We offer our customers everyday essentials and fashionable differentiated merchandise at discounted prices." Target is the second largest discount retailer in the United States behind Wal-mart when measured by sales revenues and total assets. Retailing is the economic sector that links the producer of products to end-use customers. It is the largest segment of the American economy. The totality of retail trans- actions constitutes about two-thirds of the gross domestic product (GDP) in the United States, according to U.S. Department of Commerce. Financial analysts view merchan- dising as a mature industry, defined by intense competition, low proft margins, and business consolidation. Numerous economic factors affect retailers. Notable among them are real changes (inflation-adjusted) in GDP, levels of disposable income, and consumer confidence. In short, people shop when they have money, and they are confident that they will have it in the future. Consequently, retailers tend to thrive during economic expansions and suffer during economic contractions. Although discount sales have rebounded after the 2007-2009 recession, many analysts feel that industry performance remain sluggish. Marketers note the post- recession watchword for retail customers is value. Consumers, regardless of economic standing, want quality at a relatively low price. A recent threat to traditional bricks and mortar retailers, such as Target, has been the rise of online retailing. Firms such as Amazon have taken sales and market share away from Target, Wal-mart and others who primarily sell their goods at fixed locations. In addition to this general industry threat, Target has faced numerous company issues. The primary ones are an ill-fated attempt to launch stores in Canada, an inability to gain traction as a grocery store, and an extensive data breach to its customers information. In addition, Target eliminated its credit card business in 2013 to focus on its merchandising activities. More importantly, some analysts have criticized Target from losing sight of its objective as the upscale discounter; a purveyor of cheap chic, which d firm from its competitors. To determine the fate of Target's management, you gather the firm's financial state- ments along with those of Wal-mart for the past seven years (2011-2017). You used those financial statements to begin computing key financial measures for both firms but did not complete that task