Answered step by step

Verified Expert Solution

Question

1 Approved Answer

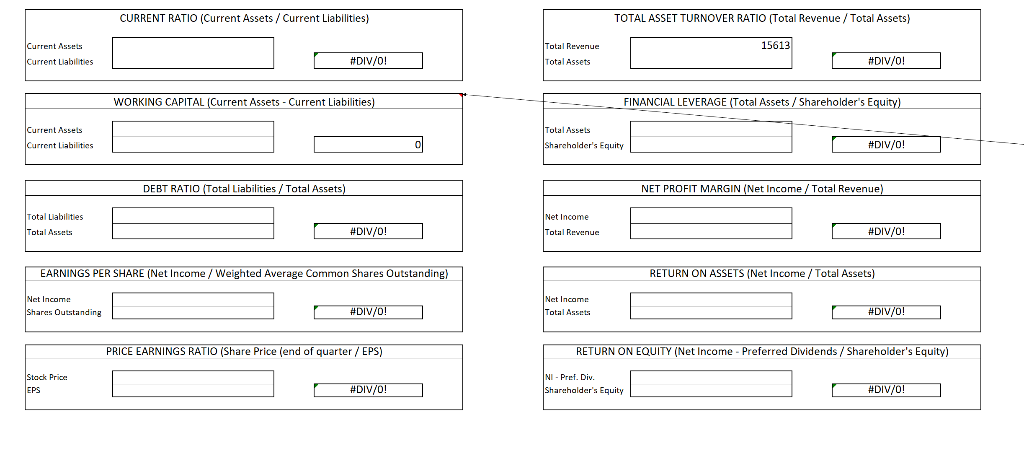

NEED help filling out the spreasheet for DISNEY The balance sheet, income statement, and cash flow statement from the most recent fiscal quarter (from Mergent

NEED help filling out the spreasheet for DISNEY

- The balance sheet, income statement, and cash flow statement from the most recent fiscal quarter (from Mergent Online)

- The Ratios Most Recent Fiscal Qtr worksheet in the Project Two Financial Formulas workbook.

- For example, if the most recent fiscal quarter available is the third quarter in 2022, youll compare those results to the same financial calculations from the third quarter in 2021.

Use the documents to calculate key financial ratios.

Then open the following documents:

- The balance sheet, income statement, and cash flow statement from the same fiscal quarter one year ago

- The Ratios Same Fiscal Qtr 1 Year Ago worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started