Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help filling out the table, I dont understand it and its due tonight. Please help! Thank you! Di Stefano Office Supply Company received a

Need help filling out the table, I dont understand it and its due tonight. Please help! Thank you!

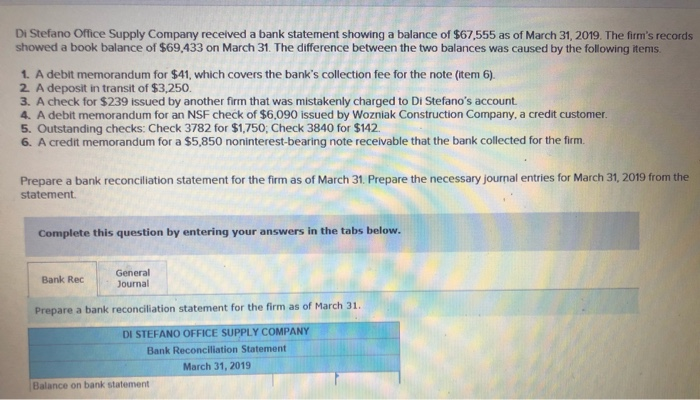

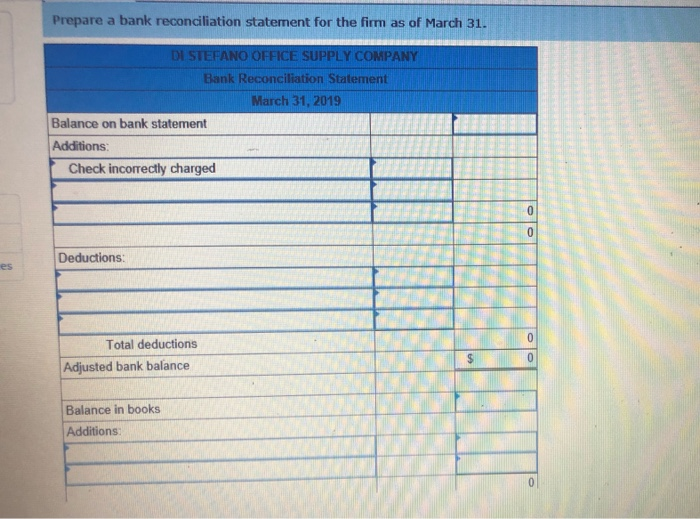

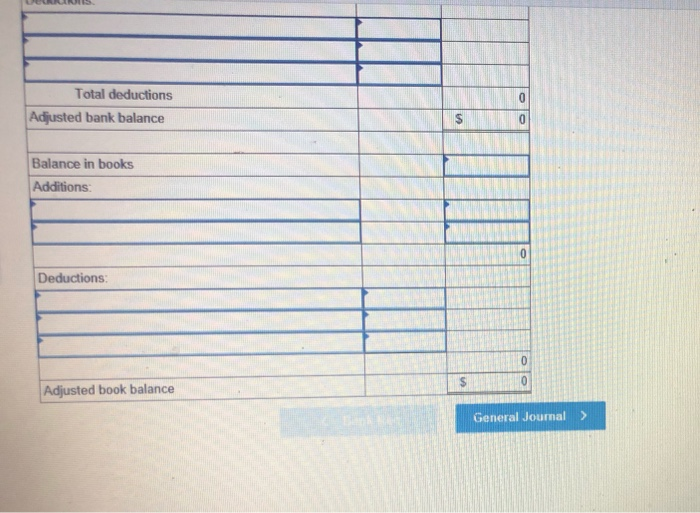

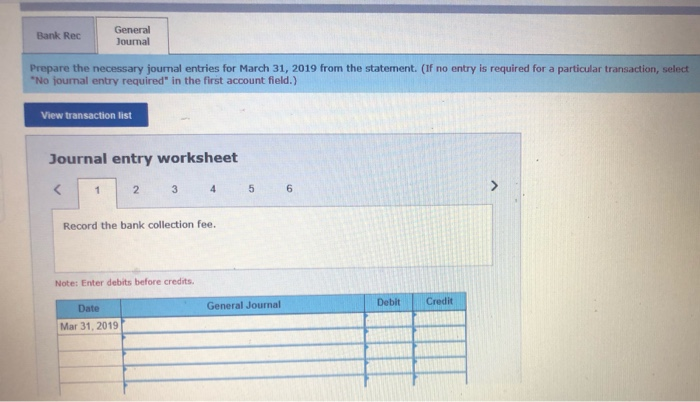

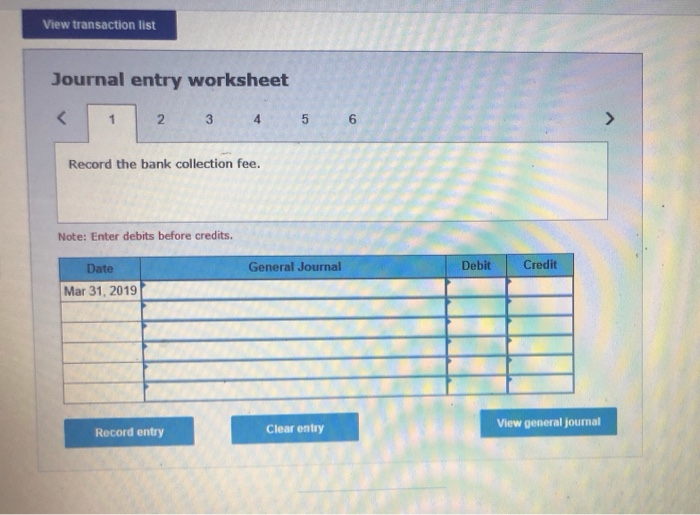

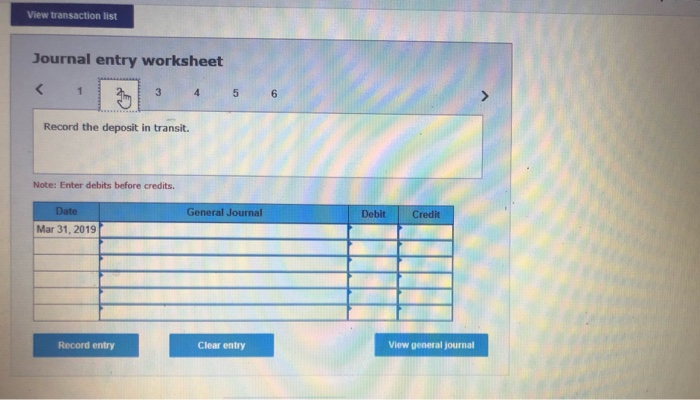

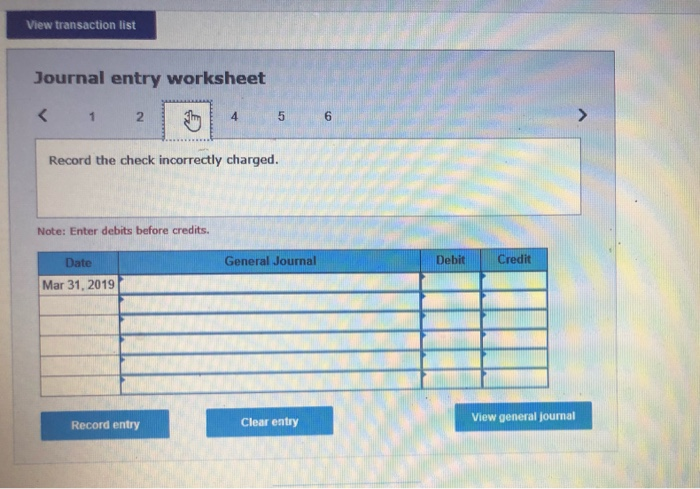

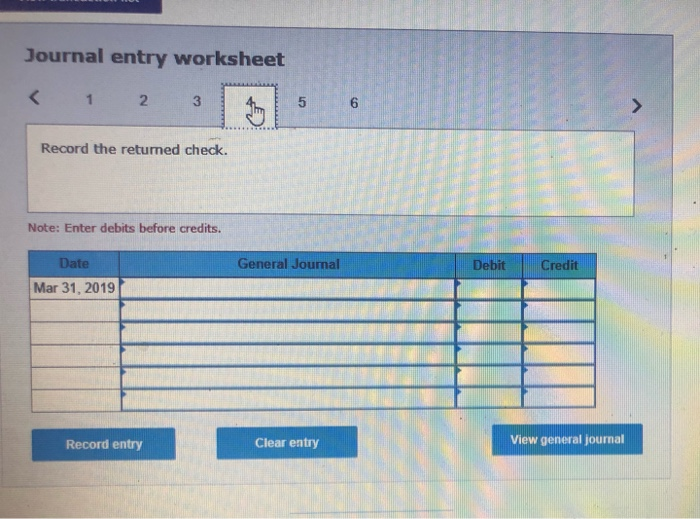

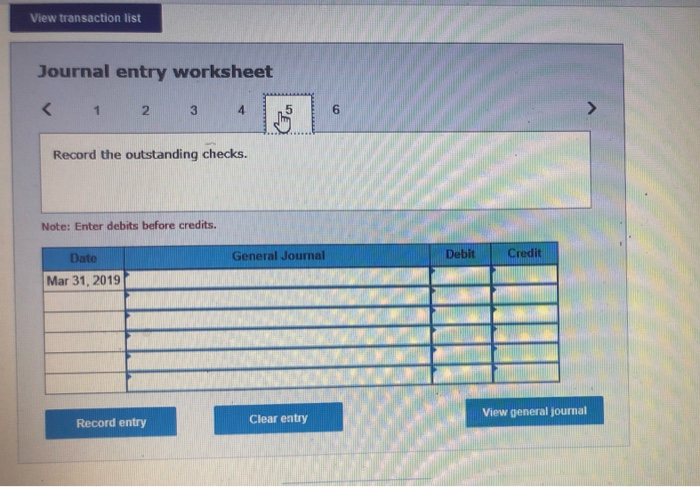

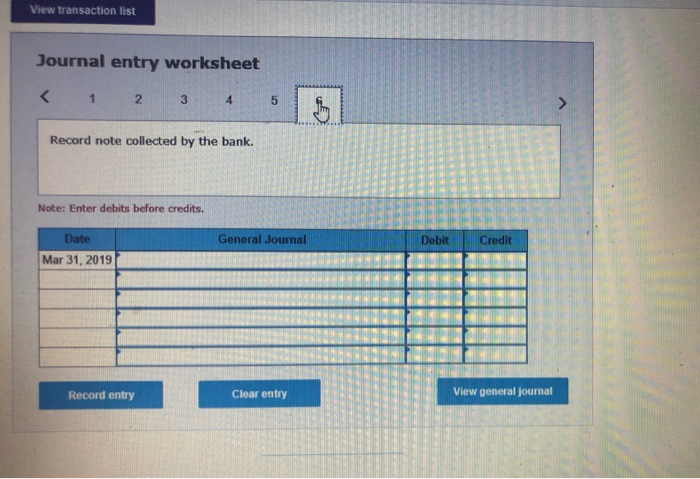

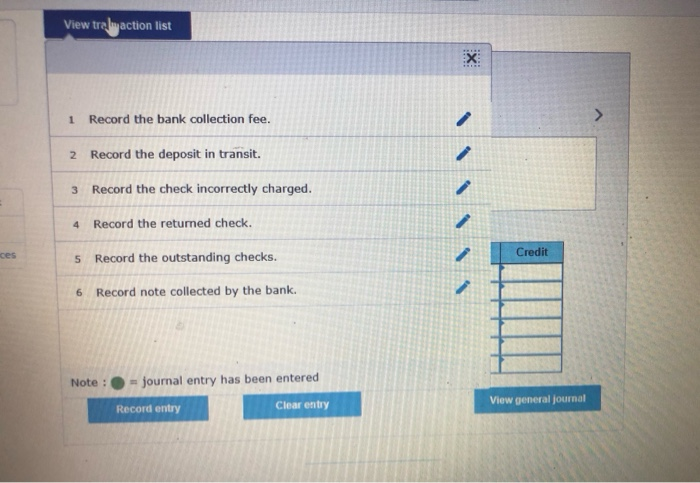

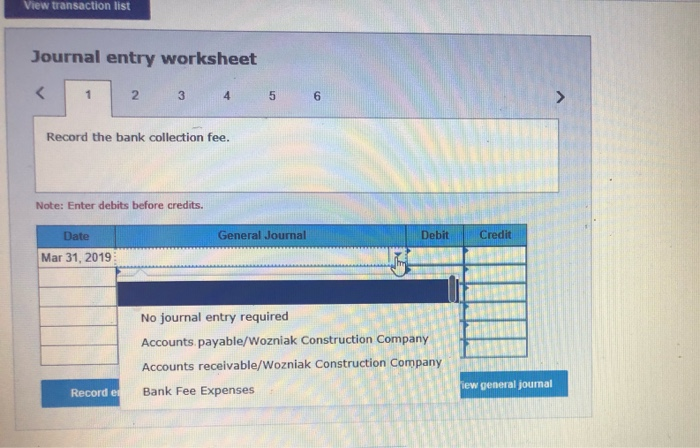

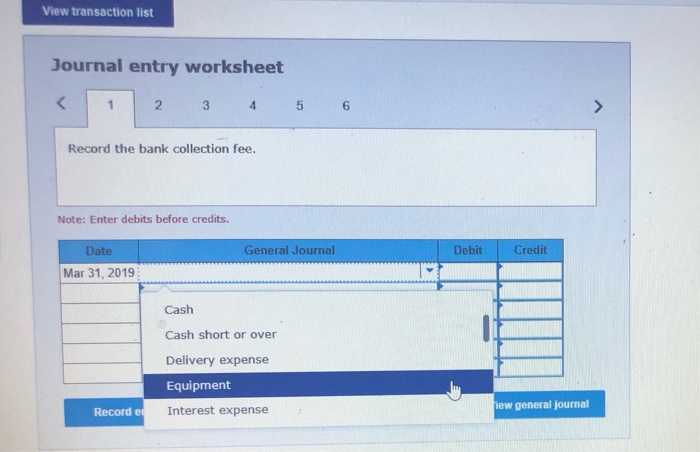

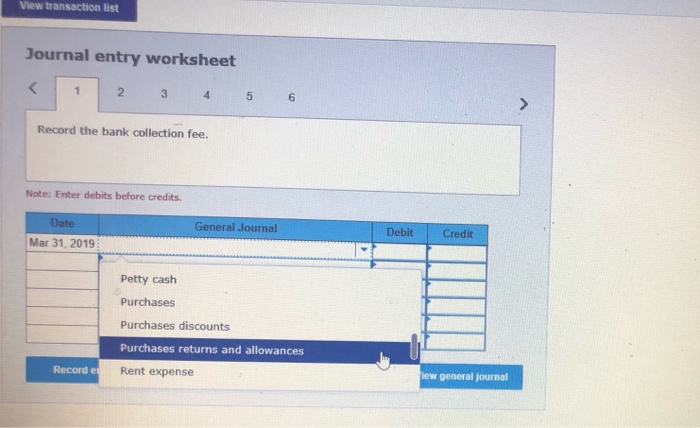

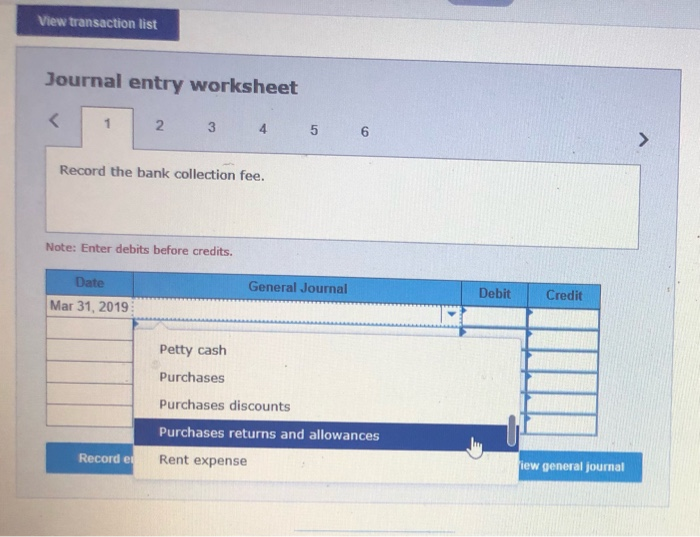

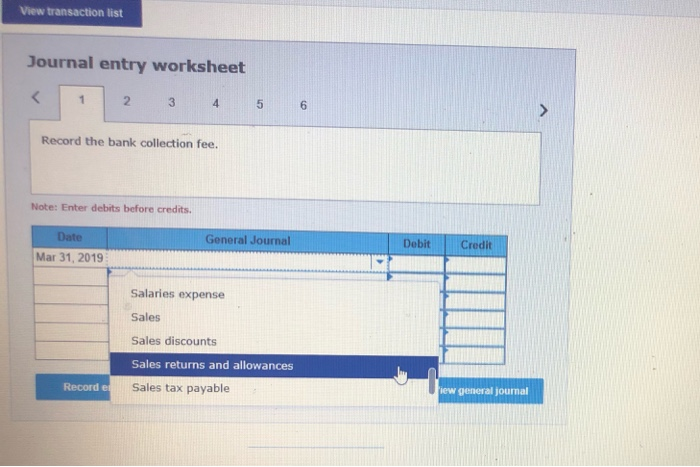

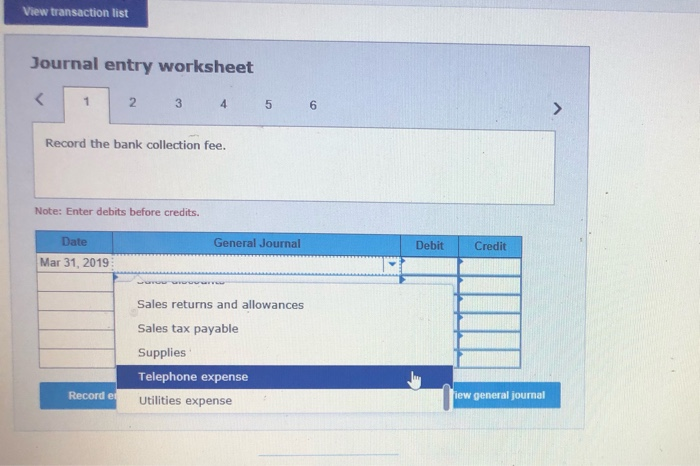

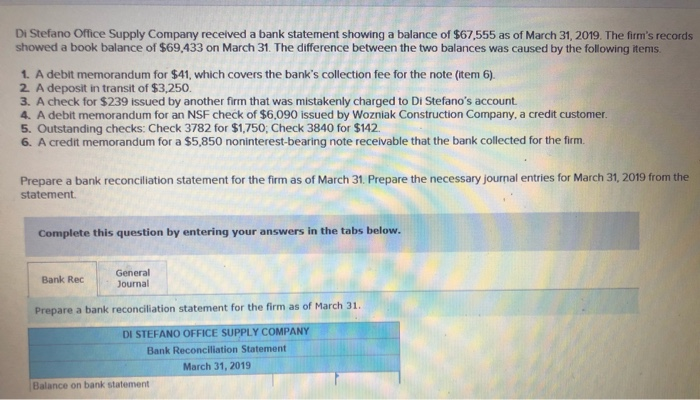

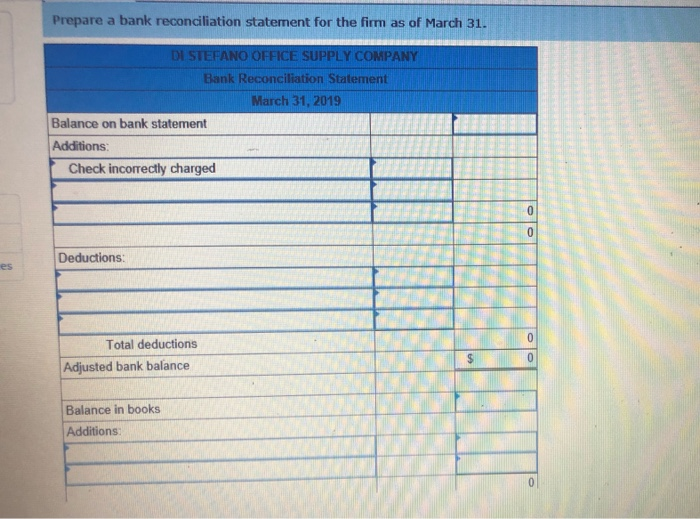

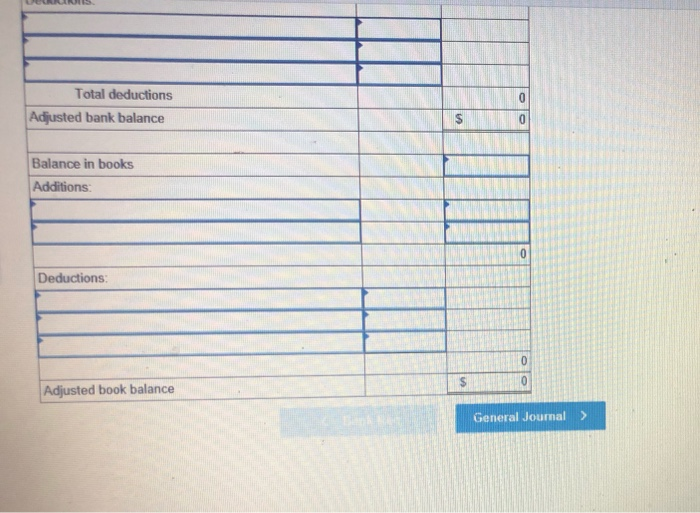

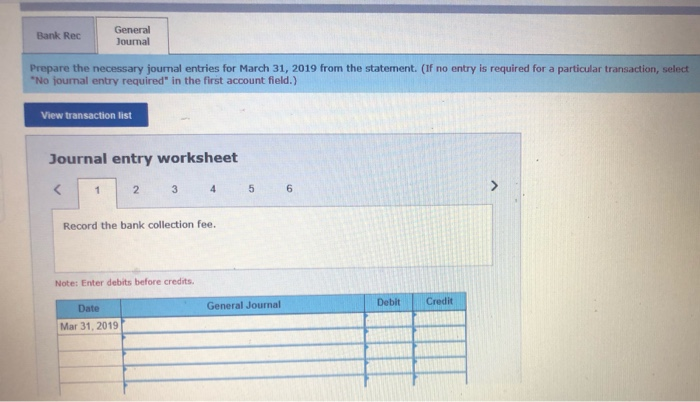

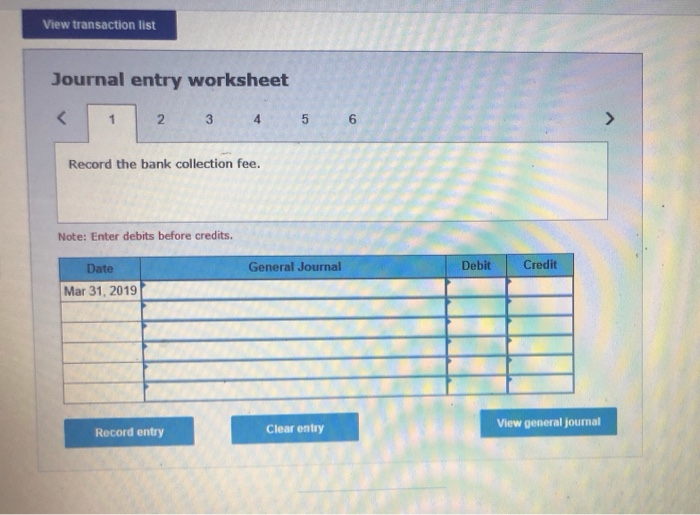

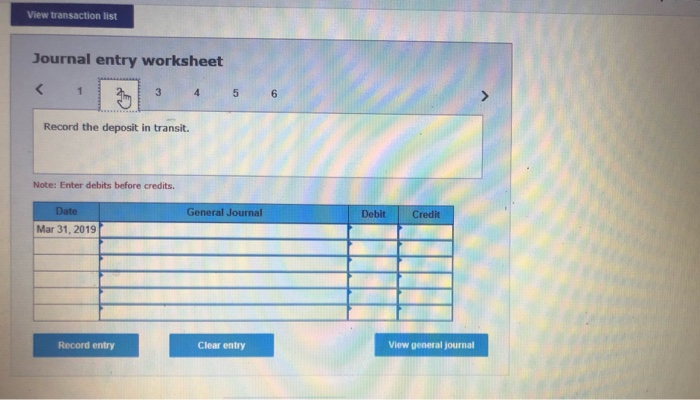

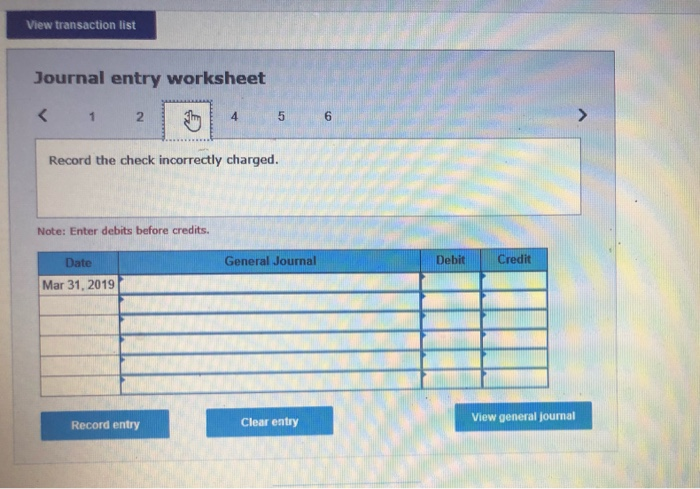

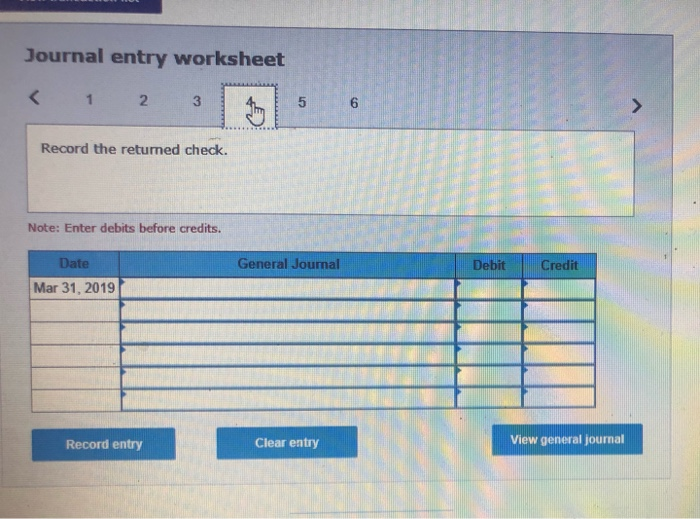

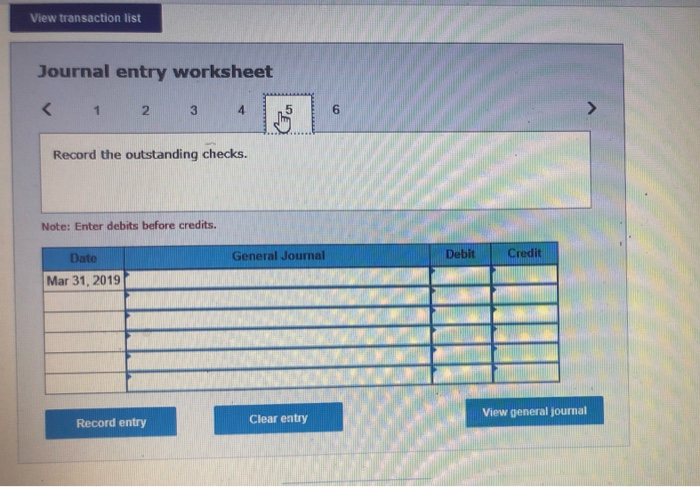

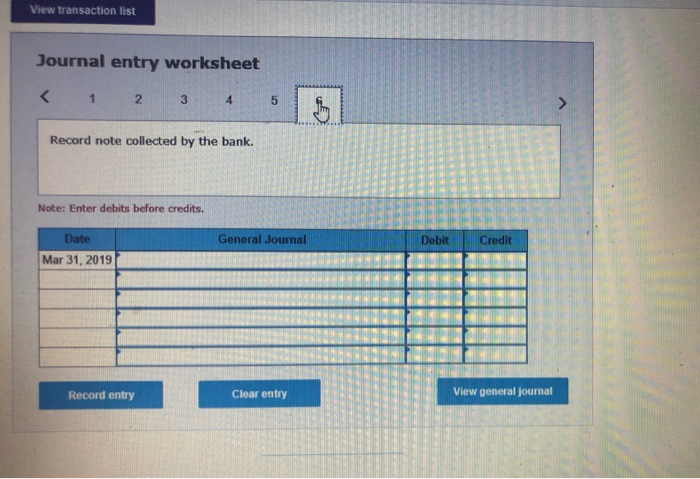

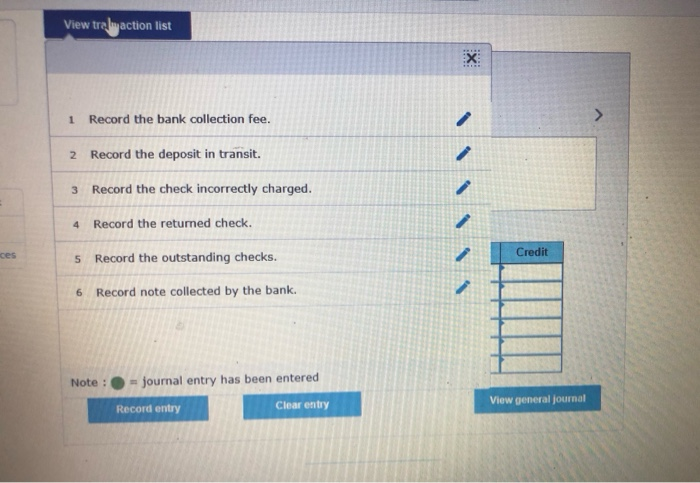

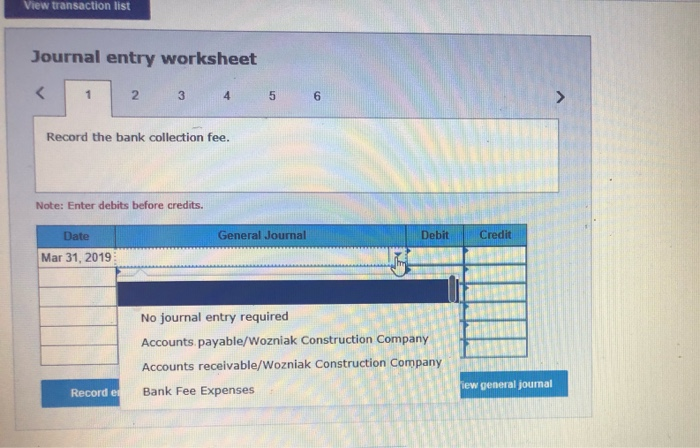

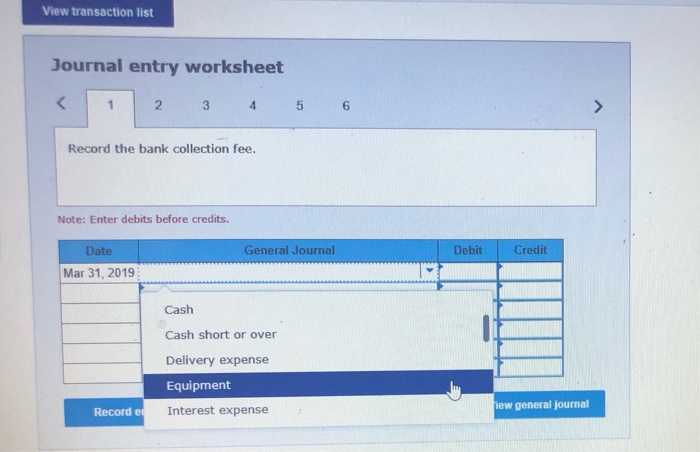

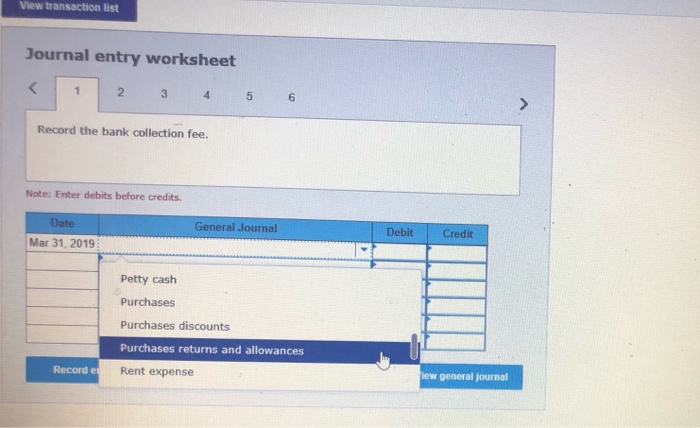

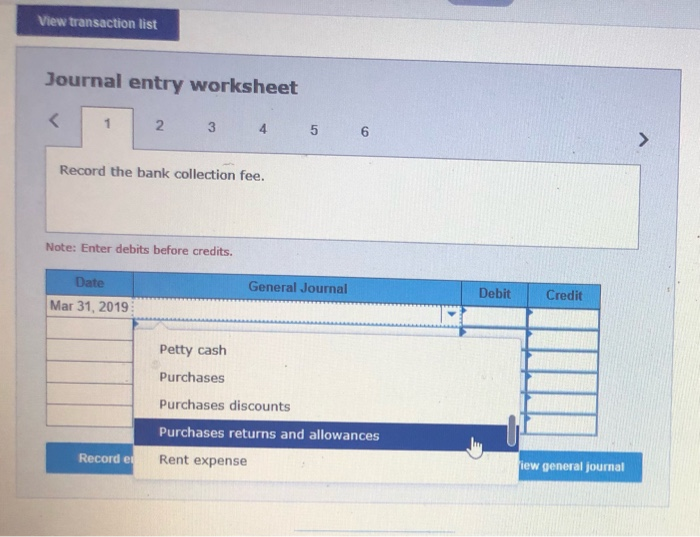

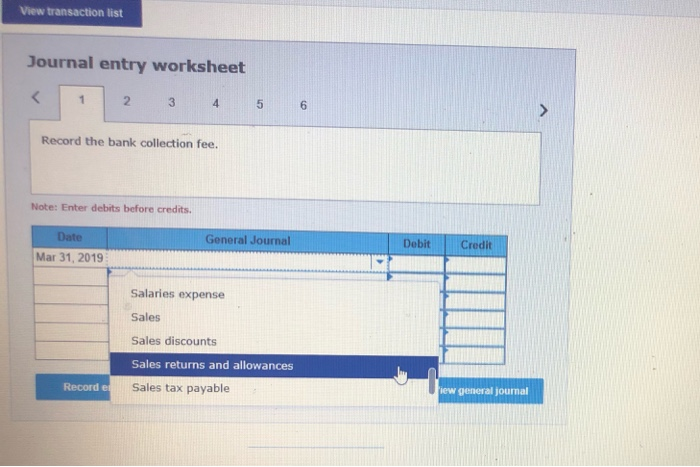

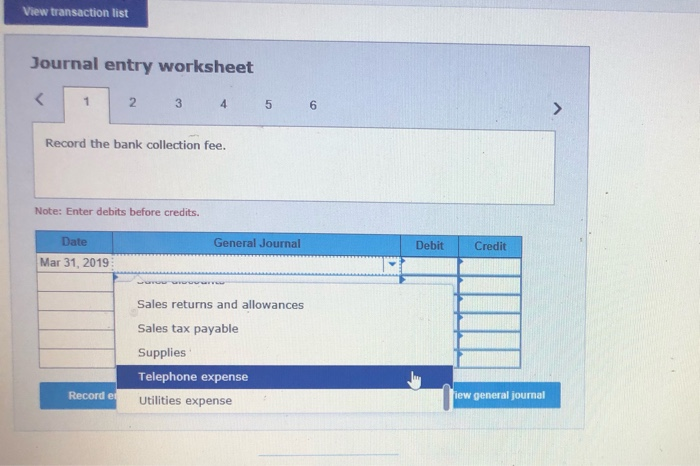

Di Stefano Office Supply Company received a bank statement showing a balance of $67,555 as of March 31, 2019. The firm's records showed a book balance of $69,433 on March 31. The difference between the two balances was caused by the following items! 1. A debit memorandum for $41, which covers the bank's collection fee for the note (item 6). 2 A deposit in transit of $3,250. 3. A check for $239 issued by another firm that was mistakenly charged to Di Stefano's account. 4. A debit memorandum for an NSF check of $6,090 issued by Wozniak Construction Company, a credit customer. 5. Outstanding checks: Check 3782 for $1,750; Check 3840 for $142. 6. A credit memorandum for a $5,850 noninterest-bearing note receivable that the bank collected for the firm. Prepare a bank reconciliation statement for the firm as of March 31. Prepare the necessary journal entries for March 31, 2019 from the statement Complete this question by entering your answers in the tabs below. Bank Rec General Journal Prepare a bank reconciliation statement for the firm as of March 31. DI STEFANO OFFICE SUPPLY COMPANY Bank Reconciliation Statement March 31, 2019 Balance on bank statement Prepare a bank reconciliation statement for the firm as of March 31. DI STEFANO OFFICE SUPPLY COMPANY Bank Reconciliation Statement March 31, 2019 Balance on bank statement Additions: Check incorrectly charged Deductions: Total deductions Adjusted bank balance Balance in books Additions Total deductions Adjusted bank balance Balance in books Additions Deductions: Adjusted book balance General Journal > Bank Rec General Journal Prepare the necessary journal entries for March 31, 2019 from the statement. (If no entry is required for a particular transaction, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 2 3 5 6 Record the bank collection fee. Note: Enter debits before credits. General Journal Debit Credit Date Mar 31, 2019 View transaction list Journal entry worksheet 2 3 4 5 6 Record the bank collection fee. Note: Enter debits before credits. General Journal Debit Credit Date Mar 31, 2019 View general journal Record entry Clear entry View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started