Need help filling out this closing disclosure!

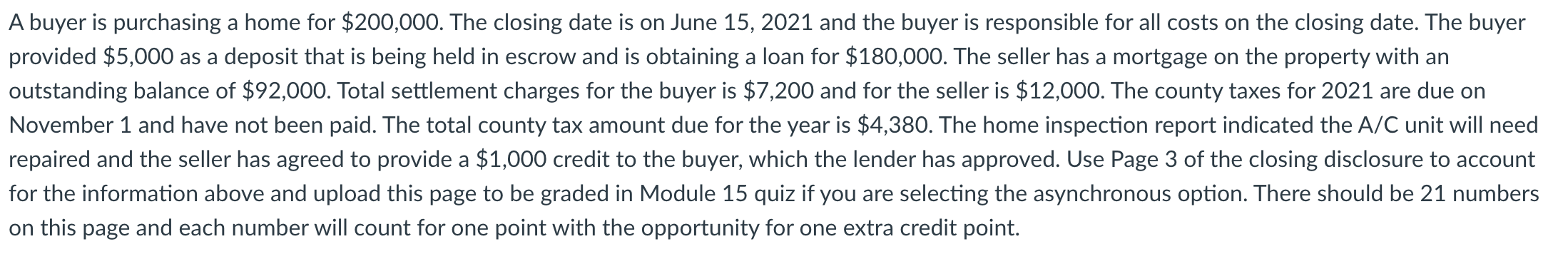

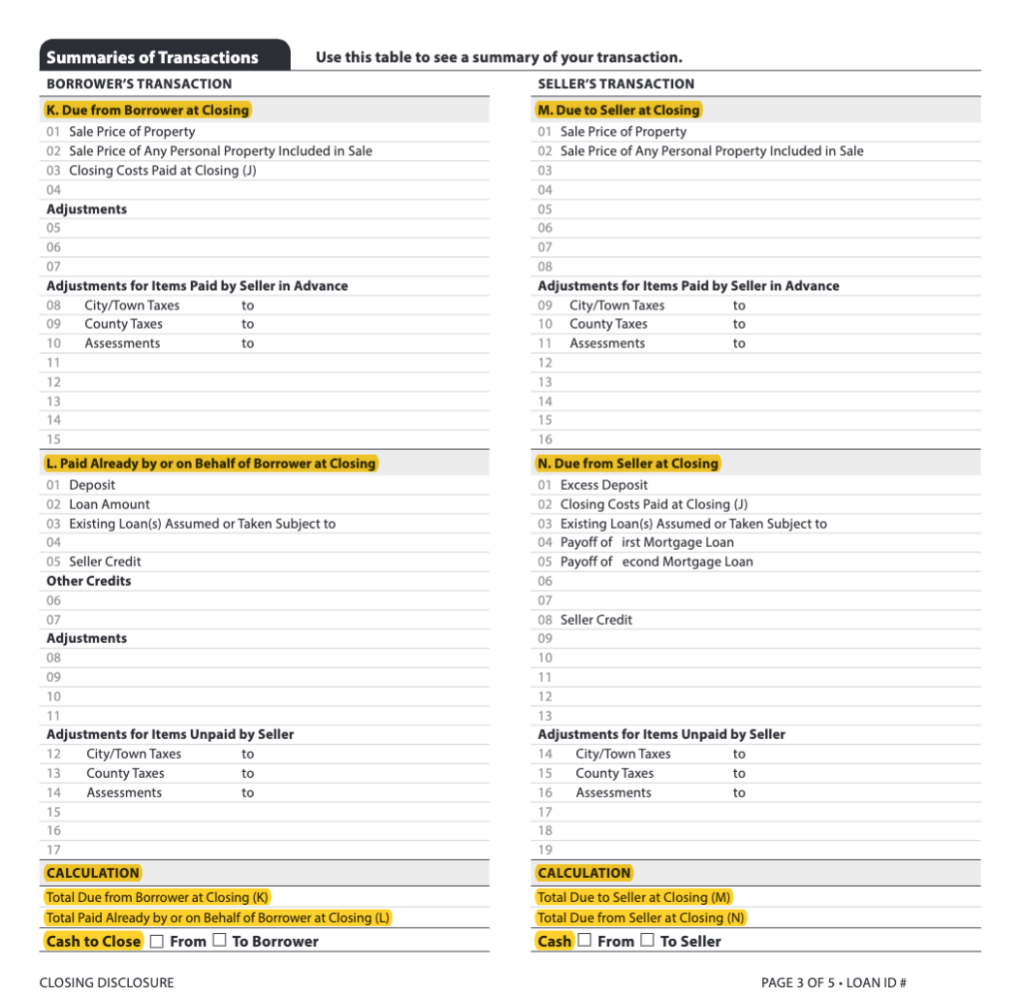

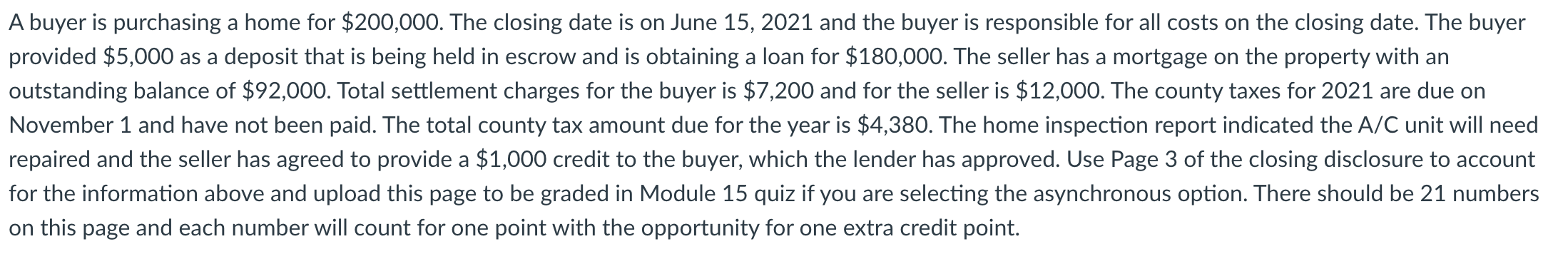

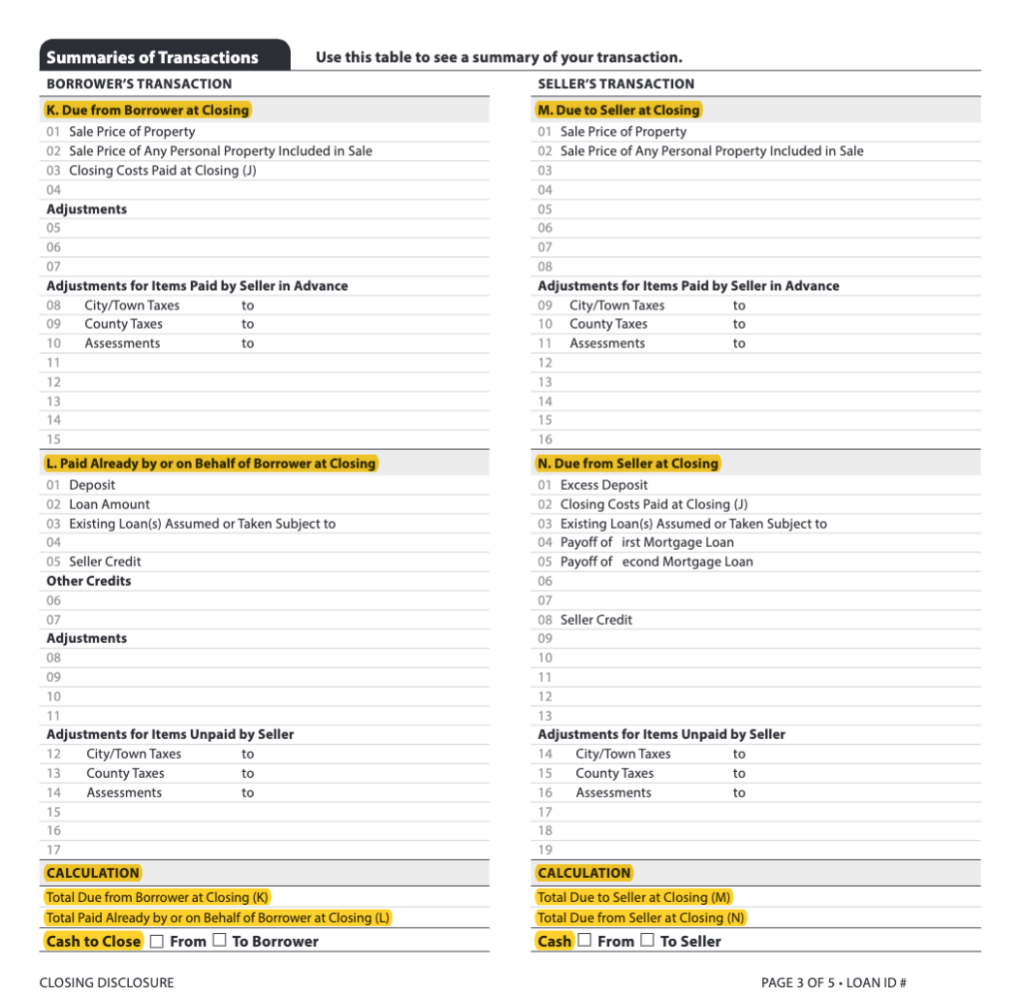

A buyer is purchasing a home for $200,000. The closing date is on June 15, 2021 and the buyer is responsible for all costs on the closing date. The buyer provided $5,000 as a deposit that is being held in escrow and is obtaining a loan for $180,000. The seller has a mortgage on the property with an outstanding balance of $92,000. Total settlement charges for the buyer is $7,200 and for the seller is $12,000. The county taxes for 2021 are due on November 1 and have not been paid. The total county tax amount due for the year is $4,380. The home inspection report indicated the A/C unit will need repaired and the seller has agreed to provide a $1,000 credit to the buyer, which the lender has approved. Use Page 3 of the closing disclosure to account for the information above and upload this page to be graded in Module 15 quiz if you are selecting the asynchronous option. There should be 21 numbers on this page and each number will count for one point with the opportunity for one extra credit point. Summaries of Transactions Use this table to see a summary of your transaction. BORROWER'S TRANSACTION SELLER'S TRANSACTION K. Due from Borrower at Closing M. Due to Seller at Closing 01 Sale Price of Property 01 Sale Price of Property 02 Sale Price of Any Personal Property Included in Sale 02 Sale Price of Any Personal Property Included in Sale 03 Closing Costs Paid at Closing (J) 03 04 04 Adjustments 05 05 06 06 07 07 08 Adjustments for Items Paid by Seller in Advance Adjustments for Items Paid by Seller in Advance 08 City/Town Taxes to 09 City/Town Taxes to 09 County Taxes to 10 County Taxes to 10 Assessments to 11 Assessments to 11 12 12 13 13 14 14 15 15 16 L. Paid Already by or on Behalf of Borrower at Closing N. Due from Seller at Closing 01 Deposit 01 Excess Deposit 02 Loan Amount 02 Closing Costs Paid at Closing (J) 03 Existing Loan(s) Assumed or Taken Subject to 03 Existing Loan(s) Assumed or Taken Subject to 04 04 Payoff of irst Mortgage Loan 05 Seller Credit 05 Payoff of econd Mortgage Loan Other Credits 06 07 07 08 Seller Credit Adjustments 09 08 10 09 11 10 12 11 13 Adjustments for Items Unpaid by Seller Adjustments for Items Unpaid by Seller 12 City/Town Taxes 14 City/Town Taxes to 13 County Taxes to 15 County Taxes 14 Assessments to 16 Assessments 15 17 16 18 17 19 CALCULATION CALCULATION Total Due from Borrower at Closing (K) Total Due to Seller at Closing (M) Total Paid Already by or on Behalf of Borrower at Closing (L) Total Due from Seller at Closing (N) Cash to Close From To Borrower Cash From To Seller 06 to to to CLOSING DISCLOSURE PAGE 3 OF 5. LOAN ID # A buyer is purchasing a home for $200,000. The closing date is on June 15, 2021 and the buyer is responsible for all costs on the closing date. The buyer provided $5,000 as a deposit that is being held in escrow and is obtaining a loan for $180,000. The seller has a mortgage on the property with an outstanding balance of $92,000. Total settlement charges for the buyer is $7,200 and for the seller is $12,000. The county taxes for 2021 are due on November 1 and have not been paid. The total county tax amount due for the year is $4,380. The home inspection report indicated the A/C unit will need repaired and the seller has agreed to provide a $1,000 credit to the buyer, which the lender has approved. Use Page 3 of the closing disclosure to account for the information above and upload this page to be graded in Module 15 quiz if you are selecting the asynchronous option. There should be 21 numbers on this page and each number will count for one point with the opportunity for one extra credit point. Summaries of Transactions Use this table to see a summary of your transaction. BORROWER'S TRANSACTION SELLER'S TRANSACTION K. Due from Borrower at Closing M. Due to Seller at Closing 01 Sale Price of Property 01 Sale Price of Property 02 Sale Price of Any Personal Property Included in Sale 02 Sale Price of Any Personal Property Included in Sale 03 Closing Costs Paid at Closing (J) 03 04 04 Adjustments 05 05 06 06 07 07 08 Adjustments for Items Paid by Seller in Advance Adjustments for Items Paid by Seller in Advance 08 City/Town Taxes to 09 City/Town Taxes to 09 County Taxes to 10 County Taxes to 10 Assessments to 11 Assessments to 11 12 12 13 13 14 14 15 15 16 L. Paid Already by or on Behalf of Borrower at Closing N. Due from Seller at Closing 01 Deposit 01 Excess Deposit 02 Loan Amount 02 Closing Costs Paid at Closing (J) 03 Existing Loan(s) Assumed or Taken Subject to 03 Existing Loan(s) Assumed or Taken Subject to 04 04 Payoff of irst Mortgage Loan 05 Seller Credit 05 Payoff of econd Mortgage Loan Other Credits 06 07 07 08 Seller Credit Adjustments 09 08 10 09 11 10 12 11 13 Adjustments for Items Unpaid by Seller Adjustments for Items Unpaid by Seller 12 City/Town Taxes 14 City/Town Taxes to 13 County Taxes to 15 County Taxes 14 Assessments to 16 Assessments 15 17 16 18 17 19 CALCULATION CALCULATION Total Due from Borrower at Closing (K) Total Due to Seller at Closing (M) Total Paid Already by or on Behalf of Borrower at Closing (L) Total Due from Seller at Closing (N) Cash to Close From To Borrower Cash From To Seller 06 to to to CLOSING DISCLOSURE PAGE 3 OF 5. LOAN ID #