Answered step by step

Verified Expert Solution

Question

1 Approved Answer

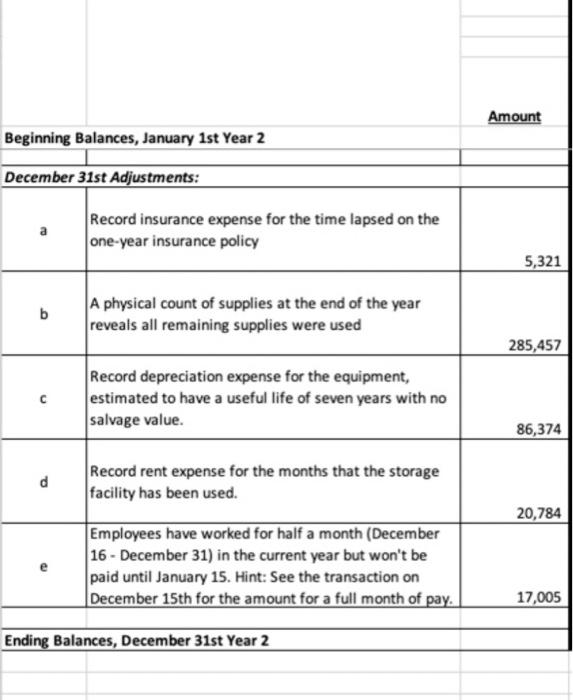

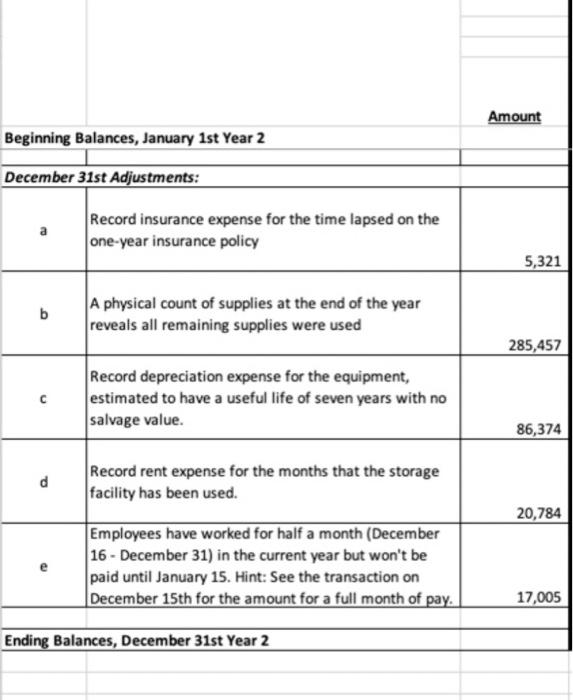

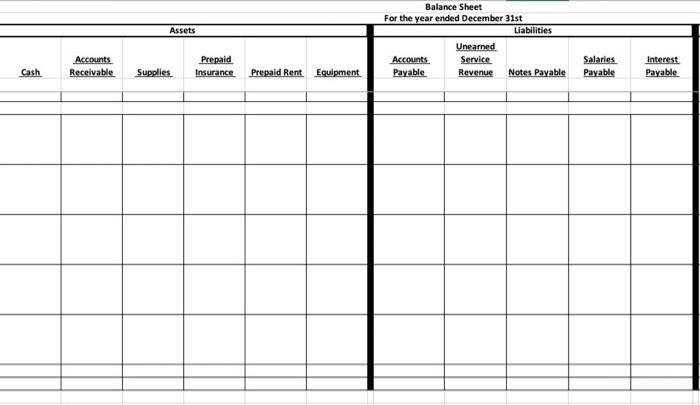

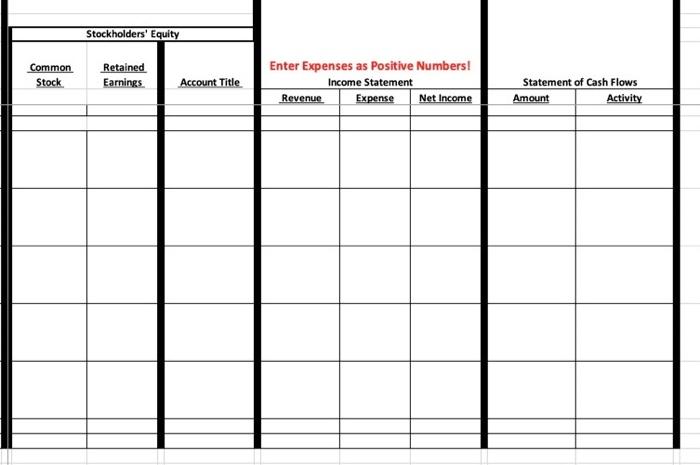

Need help filling the amounts into the columns Amount Beginning Balances, January 1st Year 2 December 31st Adjustments: Record insurance expense for the time lapsed

Need help filling the amounts into the columns

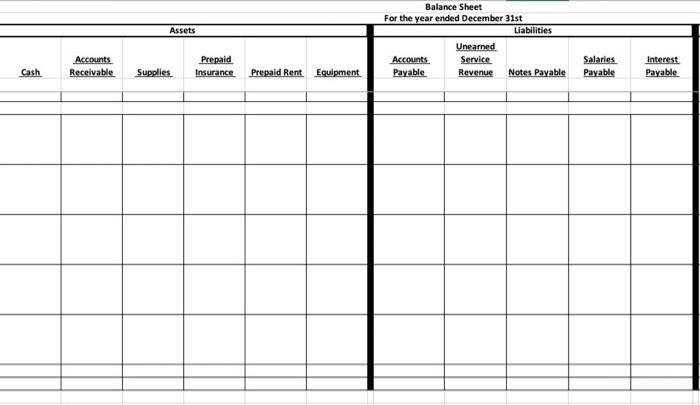

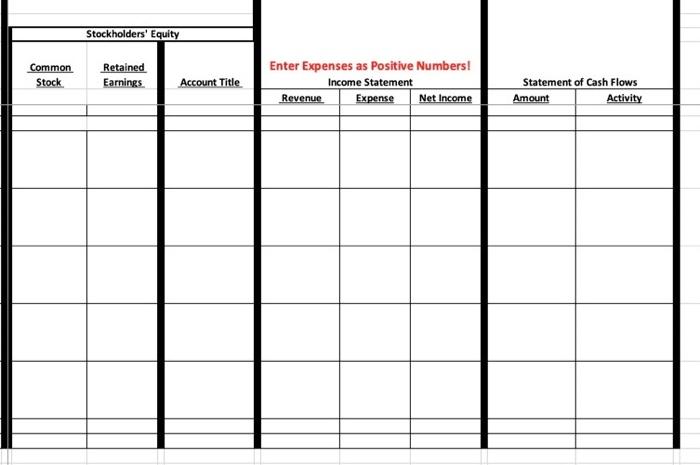

Amount Beginning Balances, January 1st Year 2 December 31st Adjustments: Record insurance expense for the time lapsed on the one-year insurance policy 5,321 b A physical count of supplies at the end of the year reveals all remaining supplies were used 285,457 Record depreciation expense for the equipment, estimated to have a useful life of seven years with no salvage value. 86,374 d Record rent expense for the months that the storage facility has been used. 20,784 Employees have worked for half a month (December 16 - December 31) in the current year but won't be paid until January 15. Hint: See the transaction on December 15th for the amount for a full month of pay. Ending Balances, December 31st Year 2 17,005 Assets Balance Sheet For the year ended December 31st Liabilities Unearned Accounts Service Payable Revenue Notes Payable Accounts Receivable Prepaid Insurance Salaries Payable Interest Payable Cash Supplies Prepaid Rent Equipment Stockholders' Equity Common Stock Retained Earnings Account Title Enter Expenses as Positive Numbers! Income Statement Revenue Expense Net Income Statement of Cash Flows Amount Activity Amount Beginning Balances, January 1st Year 2 December 31st Adjustments: Record insurance expense for the time lapsed on the one-year insurance policy 5,321 b A physical count of supplies at the end of the year reveals all remaining supplies were used 285,457 Record depreciation expense for the equipment, estimated to have a useful life of seven years with no salvage value. 86,374 d Record rent expense for the months that the storage facility has been used. 20,784 Employees have worked for half a month (December 16 - December 31) in the current year but won't be paid until January 15. Hint: See the transaction on December 15th for the amount for a full month of pay. Ending Balances, December 31st Year 2 17,005 Assets Balance Sheet For the year ended December 31st Liabilities Unearned Accounts Service Payable Revenue Notes Payable Accounts Receivable Prepaid Insurance Salaries Payable Interest Payable Cash Supplies Prepaid Rent Equipment Stockholders' Equity Common Stock Retained Earnings Account Title Enter Expenses as Positive Numbers! Income Statement Revenue Expense Net Income Statement of Cash Flows Amount Activity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started