Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help filling the sheets out and help figure out what formulas to use to fill out specific formula portions? 4,5 % PR 21-6A Contribution

need help filling the sheets out and help figure out what formulas to use to fill out specific formula portions?

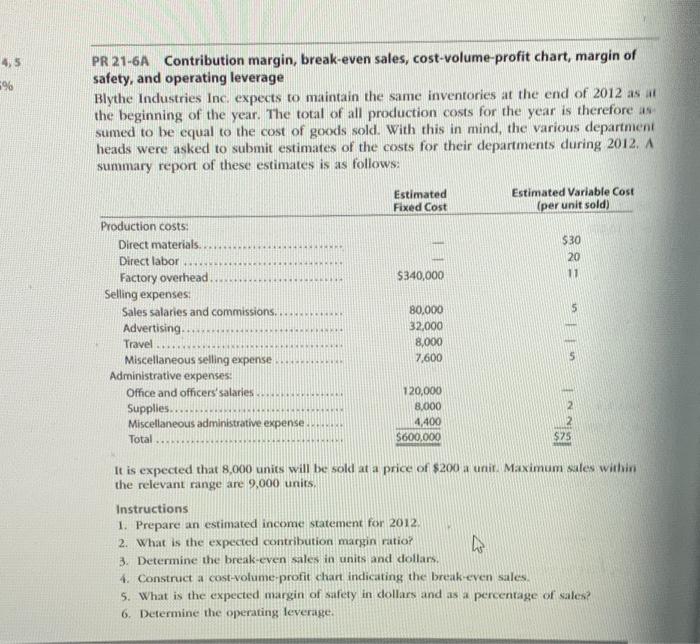

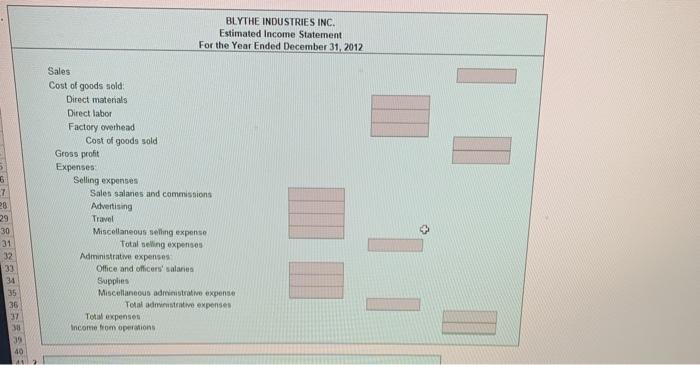

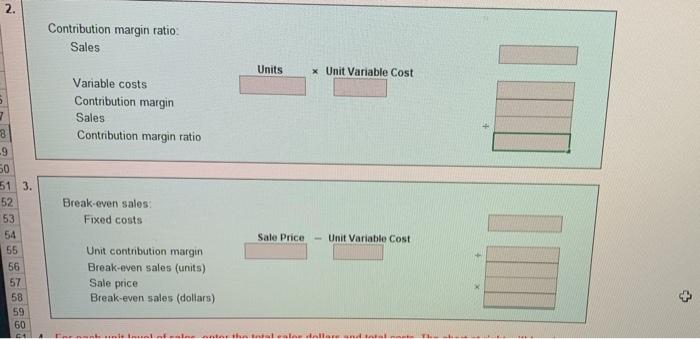

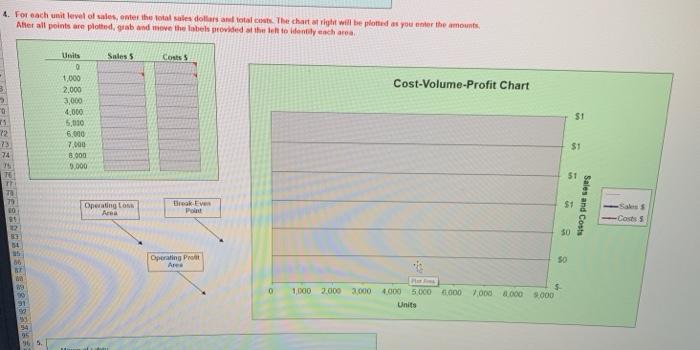

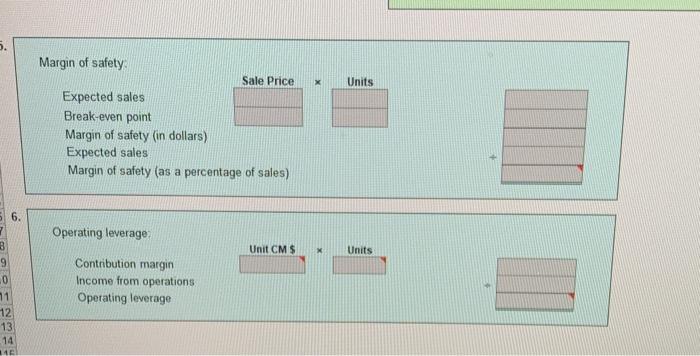

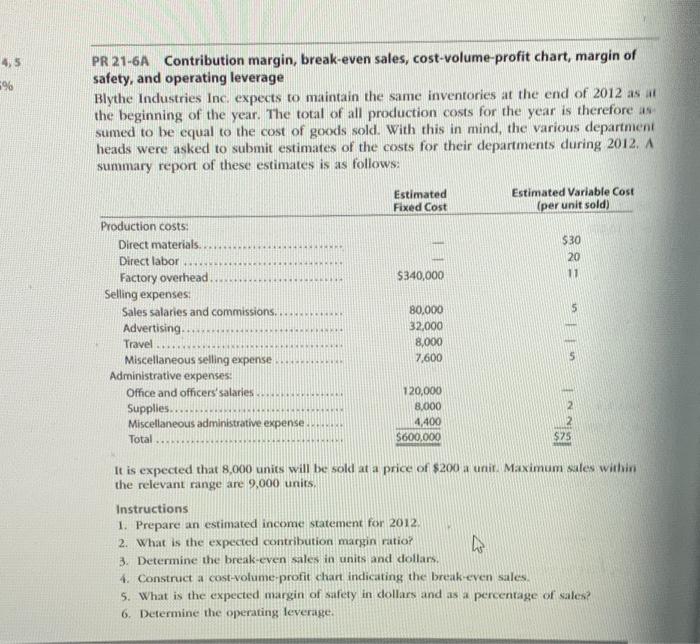

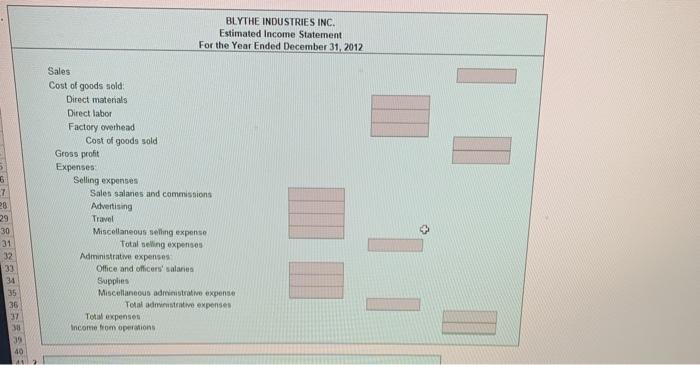

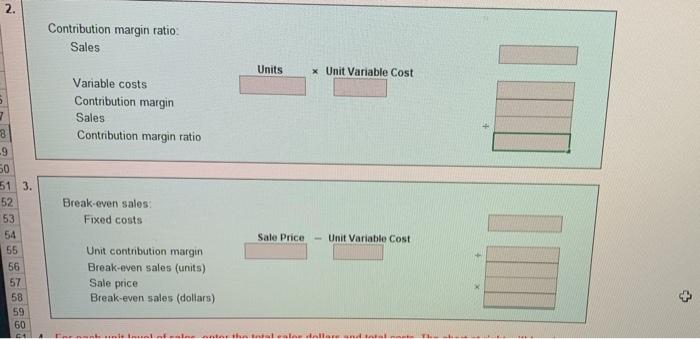

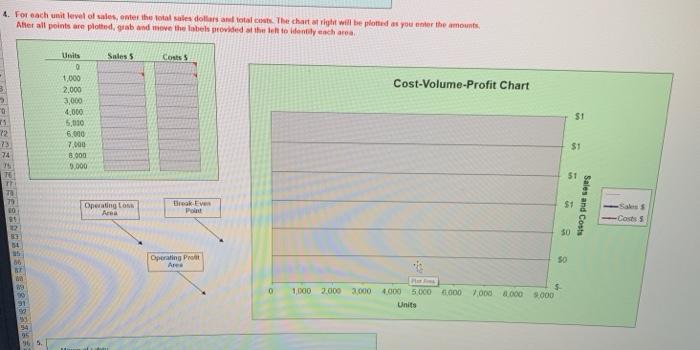

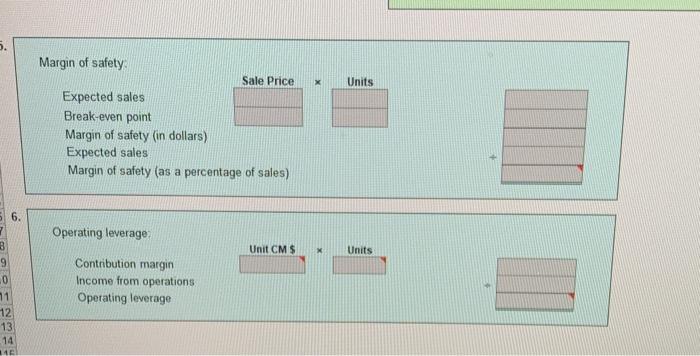

4,5 % PR 21-6A Contribution margin, break-even sales, cost-volume-profit chart, margin of safety, and operating leverage Blythe Industries Inc. expects to maintain the same inventories at the end of 2012 as a the beginning of the year. The total of all production costs for the year is therefore as sumed to be equal to the cost of goods sold. With this in mind, the various department heads were asked to submit estimates of the costs for their departments during 2012. A summary report of these estimates is as follows: Estimated Fixed Cost Estimated Variable Cost (per unit sold) 530 20 11 $340,000 Production costs: Direct materials. Direct labor Factory overhead. Selling expenses Sales salaries and commissions............... Advertising Travel.. Miscellaneous selling expense Administrative expenses Office and officers'salaries Supplies........ Miscellaneous administrative expense. Total 80,000 32,000 8,000 7,600 120,000 8,000 4,400 $600,000 WOX $75 It is expected that 8,000 units will be sold at a price of $200 a unit Maximum sales within the relevant range are 9,000 units. Instructions 1. Prepare an estimated income statement for 2012 2. What is the expected contribution margin ratio? De 3. Determine the break-even sales in units and dollars. 4. Construct a cost-volume-profit chan indicating the break-even sales, 5. What is the expected margin of safety in dollars and as a percentage of sales? 6. Determine the operating leverage. BLYTHE INDUSTRIES INC. Estimated Income Statement For the Year Ended December 31, 2012 5 7 28 229 30 31 32 33 34 Sales Cost of goods sold Direct matenals Direct labor Factory overhead Cost of goods sold Gross profit Expenses Selling expenses Sales salanes and commissions Advertising Travel Miscellaneous selling expense Total selling expenses Administrative expenses Office and officers' salanes Supplies Miscellaneous administrative expense Tots distrative expenses Tot expenses Income from operions 35 37 38 39 40 2. Contribution margin ratio Sales Units x Unit Variable Cost Variable costs Contribution margin Sales Contribution margin ratio LIT 7 8 -9 Break-even sales Fixed costs 50 51 3. 52 53 54 55 56 57 58 Sale Price Unit Variable Cost Unit contribution margin Break-even sales (units) Sale price Break-even sales (dollars) 59 60 C dalam 4. For each unit level of sales, enter the total sales dollars totals. The chartaight will be plotted as you enter the amounts After all points are plote, grab and move the labels provided at the Betto dently each area Sales Costs Cost-Volume-Profit Chart Units 0 1,000 2,000 3,000 4,000 5,010 6.000 7.000 8000 5.000 $1 72 73 74 $1 76 51 70 10 90 Operating to Break Ev Point $1 Sales and Costs -Costs 50 15 B6 Operating Prom Area SO 09 0 1,000 2.000 6.000 1.000.000.000 3.000 4000 5.000 Units 91 95 95, X Units Margin of safety Sale Price Expected sales Break-even point Margin of safety (in dollars) Expected sales Margin of safety (as a percentage of sales) 6. Operating leverage Unit CMS X Units 3 9 .0 71 12 13 14 10 Contribution margin Income from operations Operating leverage

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started