Answered step by step

Verified Expert Solution

Question

1 Approved Answer

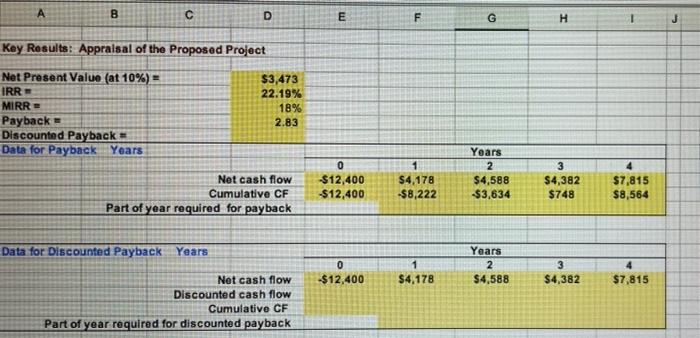

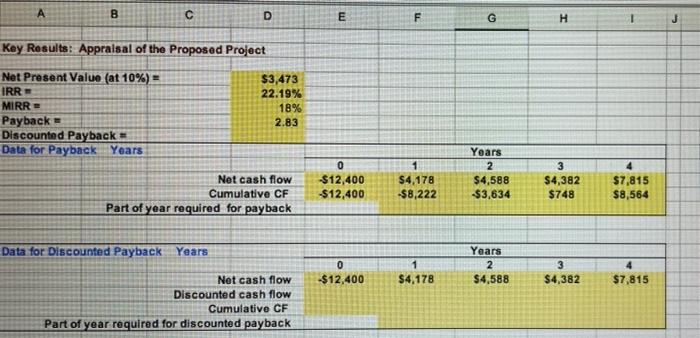

need help finding discounted payback for seconed picture! find NPV for this picture Webmasters.com has developed a powerful new server that would be used for

need help finding discounted payback for seconed picture!

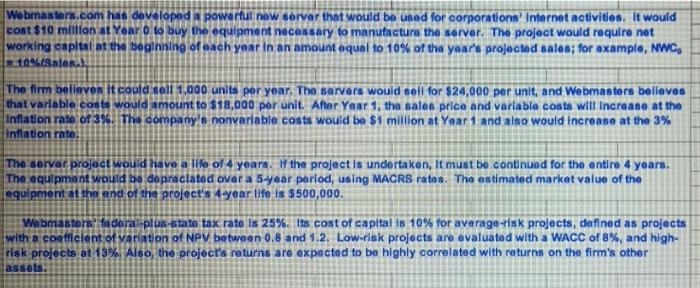

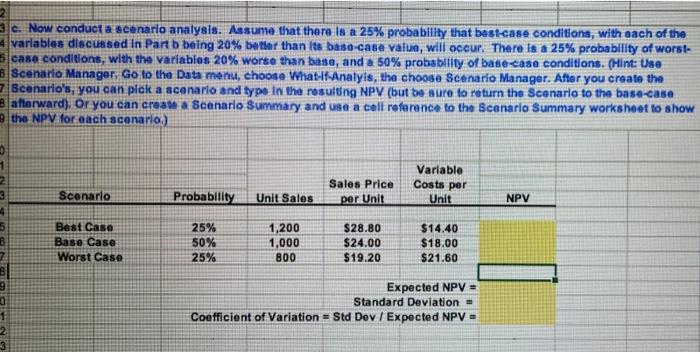

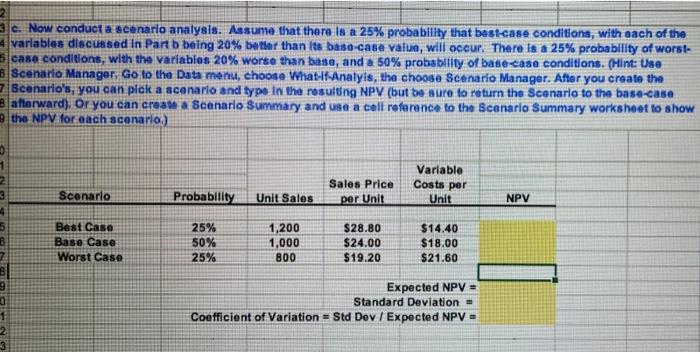

Webmasters.com has developed a powerful new server that would be used for corporations' Internet activities. It would cost $10 million at Year o to buy the equipment necessary to manufacture the server. The project would require net working capital at the beginning of each year in an amount equal to 10% of the year's projected sales; for example, NWC, 10% Salen), The firm believes it could sell 1,000 units per year. The servers would sell for $24,000 per unit, and Webmasters believes that varlable costs would amount to $18,000 per unit. After Year 1, the sales price and variable costs will increase at the Inflation rate of 3%. The company's nonvariable costs would be $1 million at Year 1 and also would increase at the 3% Inflation rate. The server project would have a life of 4 years. I the project is undertaken, It must be continued for the entire 4 years. The equipment would be dopraclated over a 5-year period, using MACRS rates. The estimated market value of the equipment at the end of the project's 4 year life is $500,000. Webmasters" faderal-plus-stato fax rate la 25%. Its cost of capital is 10% for average-risk projects, defined as projects with a coefficient of variation of NPV between 0.8 and 1 2. Low-risk projects are evaluated with a WACC of 8%, and high- risk projects at 13%. Also, the project's returns are expected to be highly correlated with returns on the firm's other assets B C D E F F H Key Results: Appraisal of the Proposed Project Net Present Value (at 10%) = IRR MIRR Payback Discounted Payback - Data for Payback Years $3,473 22.19% 18% 2.83 0 $12,400 -$12,400 Net cash flow Cumulative CF Part of year required for payback Years 2 $4,588 $3,634 1 $4,178 -$8,222 3 $4,382 $748 4 $7,815 $8,564 Data for Discounted Payback Years 0 $12,400 1 $4,178 Years 2 $4,588 3 $4,382 4 $7,815 Net cash flow Discounted cash flow Cumulative CF Part of year required for discounted payback 3c. Now conduct a scenario analysis. Assume that there is a 25% probability that best-case conditions, with each of the variables discussed in Part b being 20% bether than its base-case value, will occur. There is a 25% probability of worst- case conditions, with the variables 20% worse than base, and a 50% probability of base-case conditions. (Hint: Use BScenario Manager. Go to the Data menu, choose What If.Analyis, the choose Scenario Manager. After you create the 7 Scenario's, you can pick a scenario and type in the resulting NPV (but be sure to return the Scenario to the base-case 3 afterward). Or you can create a Scanario Summary and use a cell reference to the Scenario Summary worksheet to show the NPV for each scenario.) Variable Costs per Unit Scenario Probability Sales Price per Unit Unit Sales NPV 1 2 3 4 5 B 7 BU 9 0 1 2 3 Best Case Base Case Worst Case 25% 50% 25% 1,200 1,000 800 $28.80 $24.00 $19.20 $14.40 $18.00 $21.60 Expected NPV = Standard Deviation - Coefficient of Variation - Std Dev | Expected NPV =

find NPV for this picture

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started