Answered step by step

Verified Expert Solution

Question

1 Approved Answer

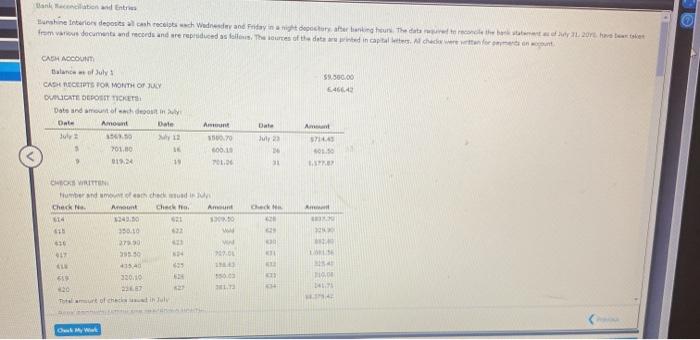

need help finding my mistakes Lanka Entre Barshine Interior deposits a cash recitch Wednesday and Friday night doctorate Banking hours. The data candles. 207.be from

need help finding my mistakes

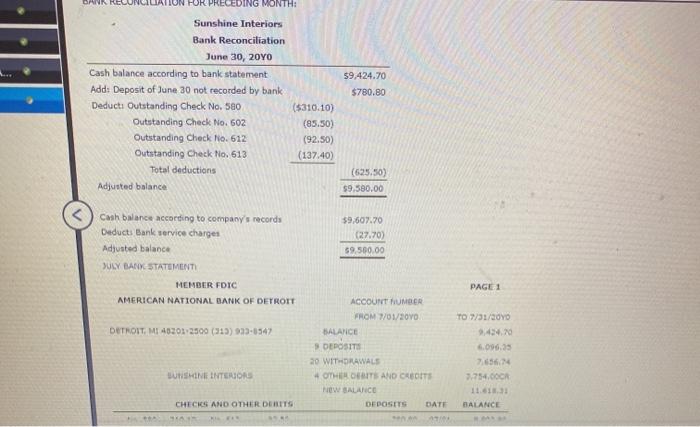

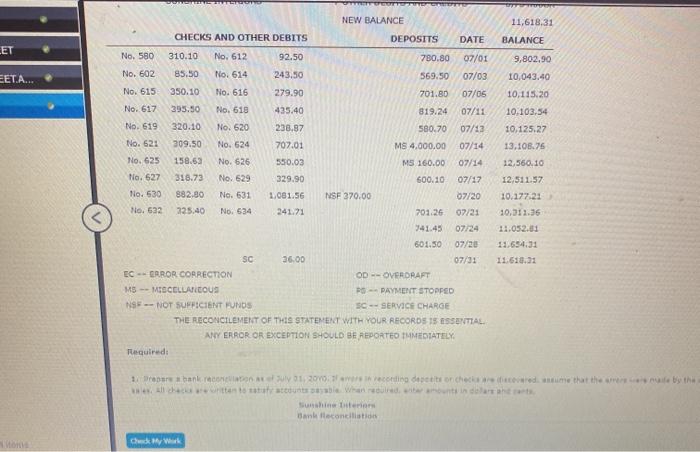

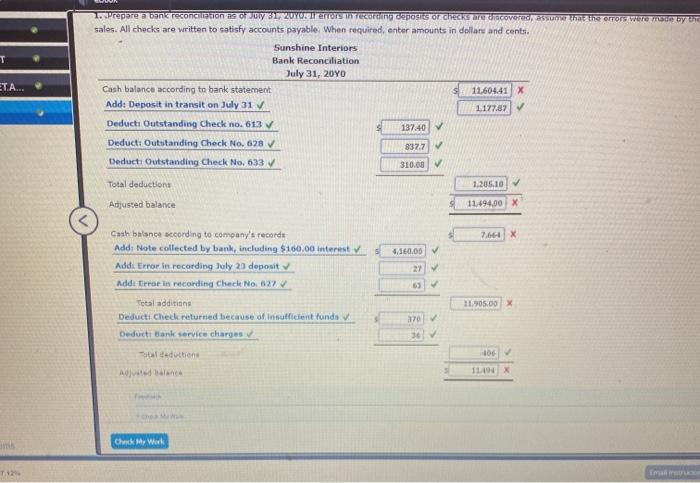

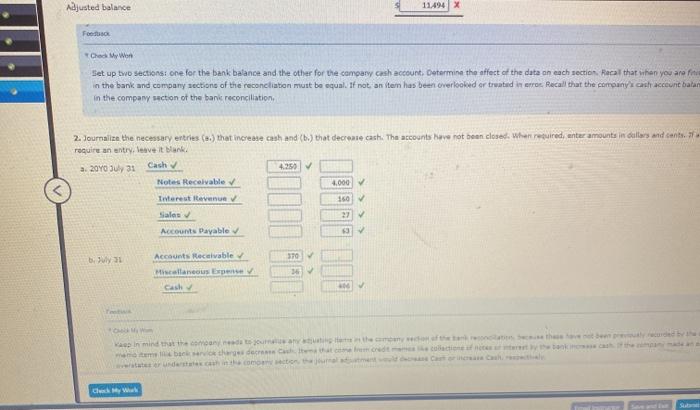

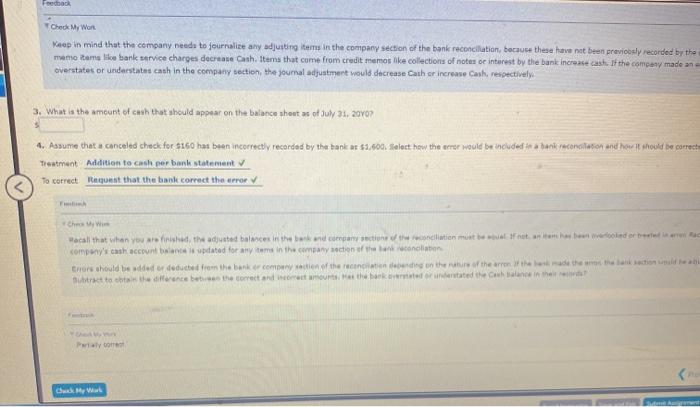

Lanka Entre Barshine Interior deposits a cash recitch Wednesday and Friday night doctorate Banking hours. The data candles. 207.be from various document and records and serduced as follows. The sources of the dead in capital Alche non $8.300.00 646643 CASH ACOUNT Balance of July CAST RECEIPTS FOR MONTH OR BUY DUCATE DEPOSIT TICKETS Date and molecti Date Amo Date 132.5 5 701.00 > 22 19 Date July 22 Ant 0.70 600. TOLD Amount SA 0.50 . 26 CHE WRITTEN bermath chai Check Check 14 12 Check 20 11 299 10 20 3550 15:40 519 330.10 20 27 Total art of chill 11 14.7 4 Ow My Wat CEDING MONTH: 59,424.70 $780.80 Sunshine Interiors Bank Reconciliation June 30, 20YO Cash balance according to bank statement Add: Deposit of June 30 not recorded by bank Deduct Outstanding Check No. 580 Outstanding Check No. 602 Outstanding Check No. 612 Outstanding Check No. 613 Total deductions Adjusted balance (5310.10) (85.30) (92.50) (137.40) (625.50) $9.580.00 $9,607.70 (27.70) $9,500.00 Cash balance according to company's records Deduct: Bank service charger Adjusted balance JULY BANK STATEMENT MEMBER FDIC AMERICAN NATIONAL BANK OF DETROIT PAGE 1 TO 7/31/2010 DETROIT, MI 482012500 (315) 933-8542 ACCOUNT NUMBER FROM 7/01/2010 BALANCE DEPOSIT 20 WITHDRAWALS 4 OTHER DEBITS AND CREDITS NEW BALANCE DEPOSITS DATE 6.096,35 DUNSHINE INTERIOR 3.754.00C CHECKS AND OTHER DEBITS BALANCE 11,618.31 BALANCE LET 9,802,90 10,043,40 EETA... 10,115.20 10.103.54 NEW BALANCE CHECKS AND OTHER DEBITS DEPOSITS DATE No. 580 310.10 No. 612 92.50 780.80 07/01 No. 602 85.50 No. 614 243.50 569.50 07/03 No. 615 350.10 No. 616 279.90 701.80 07/05 No. 617 395.50 No. 618 435.40 819.24 07/11 No. 619 320.10 No. 620 238.87 580.70 07/13 No. 62: 309.50 No. 624 707.01 MS 4.000.00 07/14 No. 625 158.63 No. 626 550.03 MS 160.00 07/14 No. 527 318.73 No. 629 329.90 600.10 07/17 No. 530 882,80 No. 631 1.081.56 NSE 370.00 07/20 No. 532 225.40 No. 534 241.21 201.26 07/21 141.45 07/24 601.50 07/20 SC 36:00 07/3: EC -- ERROR CORRECTION OD-OVERDRAFT MS -- MISCELLANEOUS PS - PAYMENT STOPPED NS -- NOT SUFFICIENT FUNDS SC - SERVICE CHARGE THE RECONCILEMENT OF THIS STATEMENT WITH YOUR RECORDS 15 ESSENTIAL ANY ERROR OR EXCEPTION SHOULD BE REPORTED TMMEDIATELY, Required: 10,125,27 13,106.75 12,560,10 12,511.57 10.177.21 10,311.35 11.052.81 11.654.31 11.610.1 para banker 1 recording desconhecer me that thereby the lotta totta contable Wanrecedunt in blatant Sunshine Bank Reconciliation Cucky T ETA... 1. Prepare a bank reconciliation as of July 317 2UY0. li errors in recent deposits or checks are discovered, nem terror Wome by the sales. All checks are written to satisfy accounts payable. When required, enter amounts in dollars and cents. Sunshine Interiors Bank Reconciliation July 31, 2010 Cash balance according to bank statement 11,60441 X Add: Deposit in transit on July 31 1177.87 Deducti Outstanding Check no. 613 137.40 Deducti Outstanding Check No. 628 837.7 Deducti Outstanding Check No. 633 310.00 Total deductions 1.205.10 Adjusted balance 11494,00 X 7.66 x 4.360.00 63 Cash balance according to company's records Add: Note collected by bank, including $160.00 interest Add: Error in recording July 23 deposit Add Treat in recording Cheche No. 627 Total additions Deducti. Check returned because of insufficient funds Deducti Bank service charges sedottin 11.905.00 x 270 106 1149 Chuck Werk TH Adjusted balance 11.494 X Food Chad My Won Set up two sections: one for the bank balance and the other for the comparw cash account. Determine the effect of the data on each section Recal that when you are fr in the bank and company sections of the reconciliation must be equal. If not an item has been overlooked or treated in error Recall that the company's cash account batan in the company action of the bank reconciliation 2. Journalize the necessary entries (e) that increase cash and (b) that decrease cash. The accounts have not been closed. When required, enter amounts in illors and cants. require an entry leave it Bank a. 2010 July 31 Cash 4.250 Notes Receivable 4.000 Interest in V 160 Sales 27 Accounts Payable 370 buy Accounts Receivable Miscellaneous pe Cash 36 brother Charmed Foedback Check My Won Meep in mind that the company needs to journalise any adjusting items in the company section of the bank reconciliation, because these have not been previously recorded by the memo items like banke service charges decrease Cash Items that come from credit memos like collections of notes or interest by the bank increase cashIf the company made an overstates or understates cash in the company section, the journal adjustment would decrease Cathor increase Cash, respectively 3. What is the amount of cash that should appear on the balance sheet as of July 31, 2007 1. Assume that a canceled check for $160 has been incorrectly recorded by the bank at $3,000 Select how the error would be included in a bank reconciliation and how it should be correct Treatment Addition to cash per bank statement To correct Request that the bank correct the error Che W Macall that when you are finished the activated balance in the band carry the content that older company's cash account bance wpdated for any me in the company section of the conciation Errors should be added ordeducted from the bank er action of the recent on the rule of the arron the then the second Det to the difference the correct and the bank vedrudented Chin the Pily wak My Wal Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started