Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help finding the answers in blue, please provide formulas used to find the solutions. show work in order of the picture. The chapter demonstrated

need help finding the answers in blue, please provide formulas used to find the solutions. show work in order of the picture.

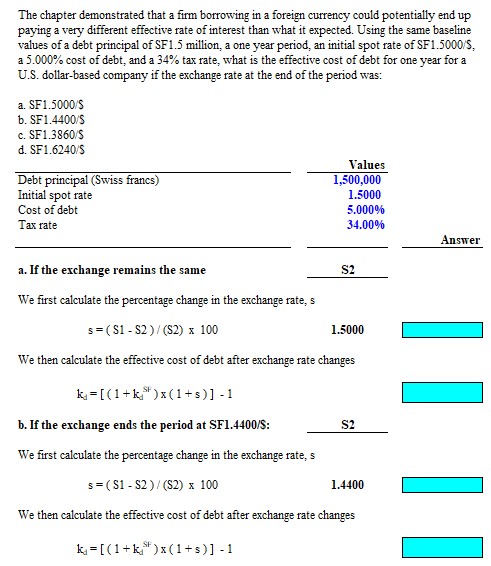

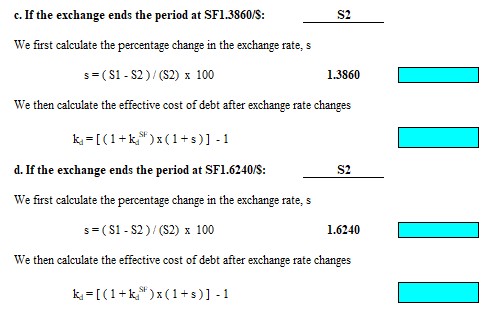

The chapter demonstrated that a firm borrowing in a foreign currency could potentially end up paying a very different effective rate of interest than what it expected. Using the same baseline values of a debt principal of SF1.5 million, a one year period, an initial spot rate of SF1.5000/S, a 5.000% cost of debt, and a 34% tax rate, what is the effective cost of debt for one year for a c. If the exchange ends the period at SF1.3860/$ : S2 We first calculate the percentage change in the exchange rate, s s=(S1S2)/(S2)100 1.3860 We then calculate the effective cost of debt after exchange rate changes kd=[(1+kdSF)(1+s)]1 d. If the exchange ends the period at SFl.6240/\$: S2 We first calculate the percentage change in the exchange rate, s s=(S1S2)/(S2)100 We then calculate the effective cost of debt after exchange rate changes kd=[(1+kdSF)x(1+s)]1

The chapter demonstrated that a firm borrowing in a foreign currency could potentially end up paying a very different effective rate of interest than what it expected. Using the same baseline values of a debt principal of SF1.5 million, a one year period, an initial spot rate of SF1.5000/S, a 5.000% cost of debt, and a 34% tax rate, what is the effective cost of debt for one year for a c. If the exchange ends the period at SF1.3860/$ : S2 We first calculate the percentage change in the exchange rate, s s=(S1S2)/(S2)100 1.3860 We then calculate the effective cost of debt after exchange rate changes kd=[(1+kdSF)(1+s)]1 d. If the exchange ends the period at SFl.6240/\$: S2 We first calculate the percentage change in the exchange rate, s s=(S1S2)/(S2)100 We then calculate the effective cost of debt after exchange rate changes kd=[(1+kdSF)x(1+s)]1 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started