Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help for #16 and may need information from #15 15. Scenario Analysis and Portfolio Risk. The common stock of Leaning Tower of Pita Inc.,

need help for #16 and may need information from #15

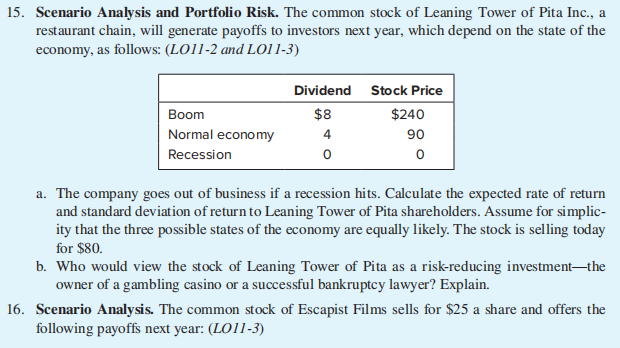

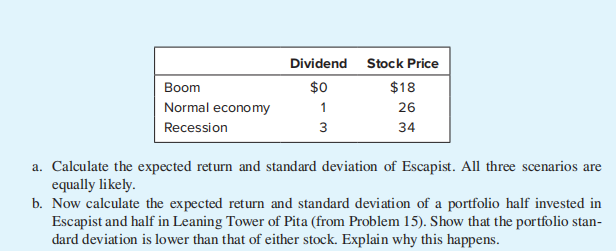

15. Scenario Analysis and Portfolio Risk. The common stock of Leaning Tower of Pita Inc., a restaurant chain, will generate payoffs to investors next year, which depend on the state of the economy, as follows: (L011-2 and LO11-3) Boom Normal economy Recession Dividend Stock Price $8 $240 4 90 0 0 a. The company goes out of business if a recession hits. Calculate the expected rate of return and standard deviation of return to Leaning Tower of Pita shareholders. Assume for simplic- ity that the three possible states of the economy are equally likely. The stock is selling today for $80. b. Who would view the stock of Leaning Tower of Pita as a risk-reducing investmentthe owner of a gambling casino or a successful bankruptcy lawyer? Explain. 16. Scenario Analysis. The common stock of Escapist Films sells for $25 a share and offers the following payoffs next year: (L011-3) Boom Normal economy Recession Dividend Stock Price $0 $18 1 26 3 34 a. Calculate the expected return and standard deviation of Escapist. All three scenarios are equally likely. b. Now calculate the expected return and standard deviation of a portfolio half invested in Escapist and half in Leaning Tower of Pita (from Problem 15). Show that the portfolio stan- dard deviation is lower than that of either stock. Explain why this happens. 15. Scenario Analysis and Portfolio Risk. The common stock of Leaning Tower of Pita Inc., a restaurant chain, will generate payoffs to investors next year, which depend on the state of the economy, as follows: (L011-2 and LO11-3) Boom Normal economy Recession Dividend Stock Price $8 $240 4 90 0 0 a. The company goes out of business if a recession hits. Calculate the expected rate of return and standard deviation of return to Leaning Tower of Pita shareholders. Assume for simplic- ity that the three possible states of the economy are equally likely. The stock is selling today for $80. b. Who would view the stock of Leaning Tower of Pita as a risk-reducing investmentthe owner of a gambling casino or a successful bankruptcy lawyer? Explain. 16. Scenario Analysis. The common stock of Escapist Films sells for $25 a share and offers the following payoffs next year: (L011-3) Boom Normal economy Recession Dividend Stock Price $0 $18 1 26 3 34 a. Calculate the expected return and standard deviation of Escapist. All three scenarios are equally likely. b. Now calculate the expected return and standard deviation of a portfolio half invested in Escapist and half in Leaning Tower of Pita (from Problem 15). Show that the portfolio stan- dard deviation is lower than that of either stock. Explain why this happensStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started