Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need Help For a, b, c,d, e Case Study 1 Persatuan Koperasi Perak (PKP) is evaluating two potential investments that cost RM20 million for Project

Need Help For a, b, c,d, e

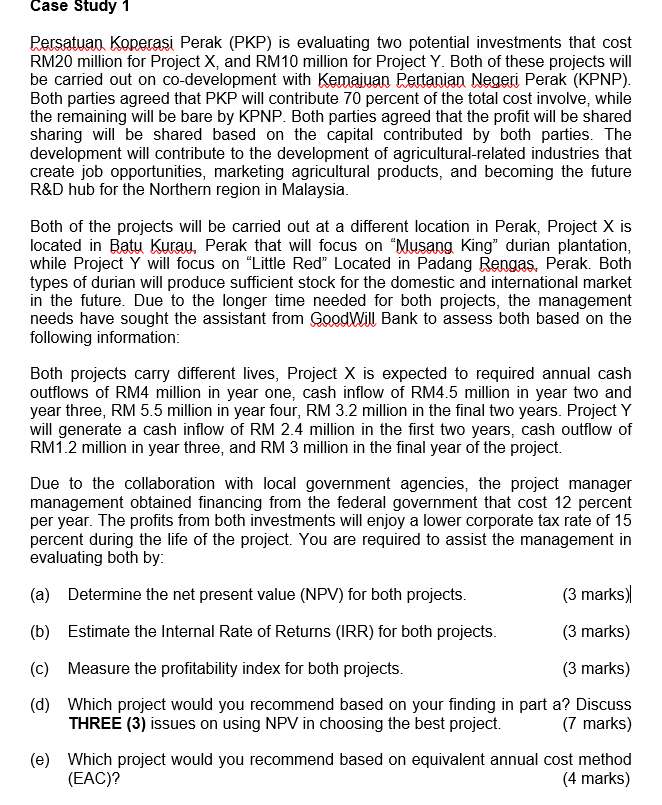

Case Study 1 Persatuan Koperasi Perak (PKP) is evaluating two potential investments that cost RM20 million for Project X, and RM10 million for Project Y. Both of these projects will be carried out on co-development with Kemajuan Pertanian Negeri Perak (KPNP). Both parties agreed that PKP will contribute 70 percent of the total cost involve, while the remaining will be bare by KPNP. Both parties agreed that the profit will be shared sharing will be shared based on the capital contributed by both parties. The development will contribute to the development of agricultural-related industries that create job opportunities, marketing agricultural products, and becoming the future R&D hub for the Northern region in Malaysia. Both of the projects will be carried out at a different location in Perak, Project X is located in Batu Kurau, Perak that will focus on Musang King" durian plantation, while Project Y will focus on "Little Red" Located in Padang Rengas, Perak. Both types of durian will produce sufficient stock for the domestic and international market in the future. Due to the longer time needed for both projects, the management needs have sought the assistant from GoodWill Bank to assess both based on the following information: Both projects carry different lives, Project X is expected to required annual cash outflows of RM4 million in year one, cash inflow of RM4.5 million in year two and year three, RM 5.5 million in year four, RM 3.2 million in the final two years. Project Y will generate a cash inflow of RM 2.4 million in the first two years, cash outflow of RM1.2 million in year three, and RM 3 million in the final year of the project. Due to the collaboration with local government agencies, the project manager management obtained financing from the federal government that cost 12 percent per year. The profits from both investments will enjoy a lower corporate tax rate of 15 percent during the life of the project. You are required to assist the management in evaluating both by: (a) Determine the net present value (NPV) for both projects. (3 marks) (b) Estimate the Internal Rate of Returns (IRR) for both projects. (3 marks) (c) Measure the profitability index for both projects. (3 marks) (d) Which project would you recommend based on your finding in part a? Discuss THREE (3) issues on using NPV in choosing the best project. (7 marks) (e) Which project would you recommend based on equivalent annual cost method (EAC)? (4 marks) Case Study 1 Persatuan Koperasi Perak (PKP) is evaluating two potential investments that cost RM20 million for Project X, and RM10 million for Project Y. Both of these projects will be carried out on co-development with Kemajuan Pertanian Negeri Perak (KPNP). Both parties agreed that PKP will contribute 70 percent of the total cost involve, while the remaining will be bare by KPNP. Both parties agreed that the profit will be shared sharing will be shared based on the capital contributed by both parties. The development will contribute to the development of agricultural-related industries that create job opportunities, marketing agricultural products, and becoming the future R&D hub for the Northern region in Malaysia. Both of the projects will be carried out at a different location in Perak, Project X is located in Batu Kurau, Perak that will focus on Musang King" durian plantation, while Project Y will focus on "Little Red" Located in Padang Rengas, Perak. Both types of durian will produce sufficient stock for the domestic and international market in the future. Due to the longer time needed for both projects, the management needs have sought the assistant from GoodWill Bank to assess both based on the following information: Both projects carry different lives, Project X is expected to required annual cash outflows of RM4 million in year one, cash inflow of RM4.5 million in year two and year three, RM 5.5 million in year four, RM 3.2 million in the final two years. Project Y will generate a cash inflow of RM 2.4 million in the first two years, cash outflow of RM1.2 million in year three, and RM 3 million in the final year of the project. Due to the collaboration with local government agencies, the project manager management obtained financing from the federal government that cost 12 percent per year. The profits from both investments will enjoy a lower corporate tax rate of 15 percent during the life of the project. You are required to assist the management in evaluating both by: (a) Determine the net present value (NPV) for both projects. (3 marks) (b) Estimate the Internal Rate of Returns (IRR) for both projects. (3 marks) (c) Measure the profitability index for both projects. (3 marks) (d) Which project would you recommend based on your finding in part a? Discuss THREE (3) issues on using NPV in choosing the best project. (7 marks) (e) Which project would you recommend based on equivalent annual cost method (EAC)? (4 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started