Question

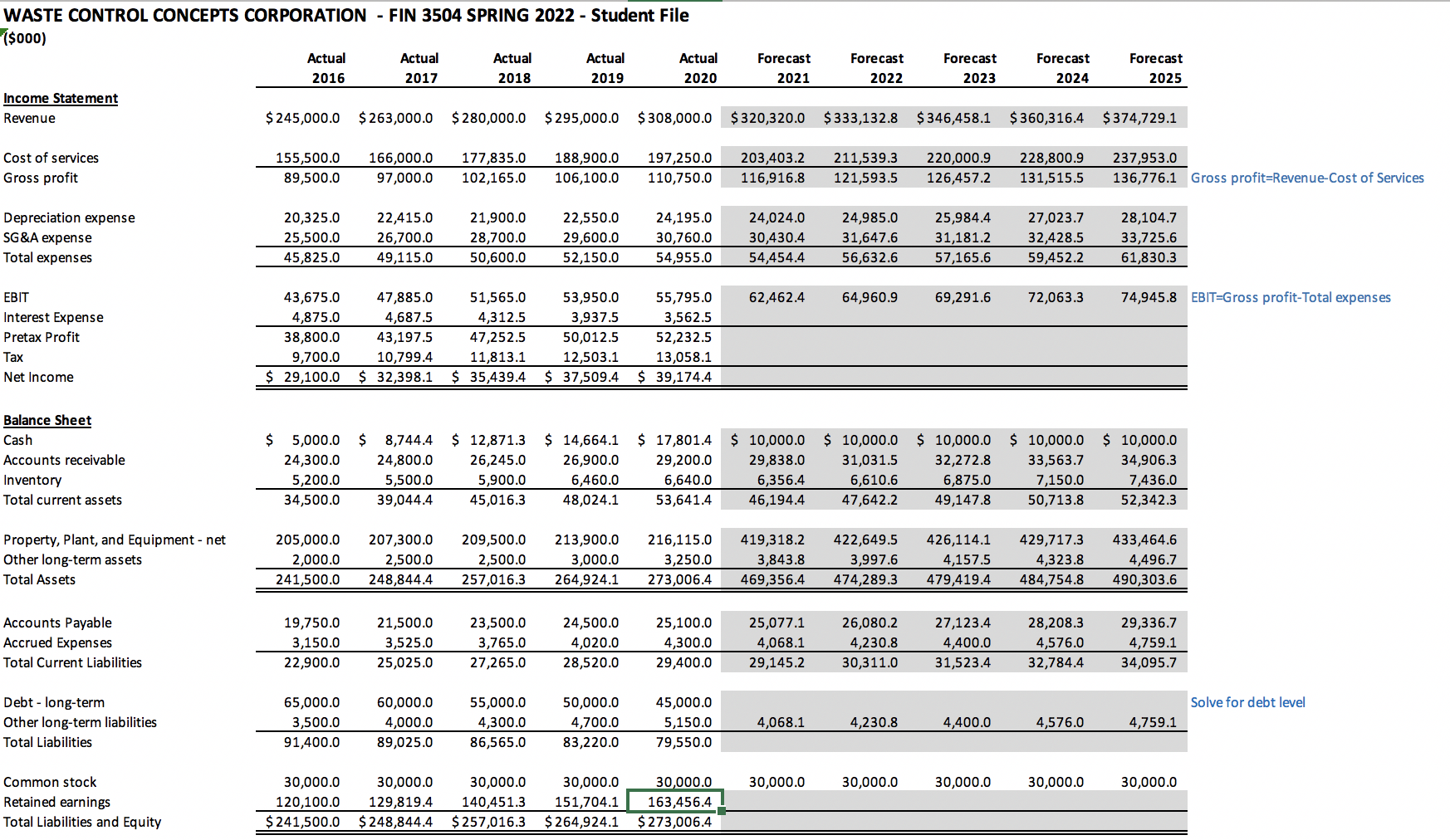

NEED HELP FORECASTING LONG-TERM DEBT LEVELS! 2020 current revenue levels will increase at an annual rate of 4.0% The acquisition of SWC will add $80.0

NEED HELP FORECASTING LONG-TERM DEBT LEVELS!

2020 current revenue levels will increase at an annual rate of 4.0% The acquisition of SWC will add $80.0 million of incremental revenue in 2021 and it will increase at an annual rate of 4.5% thereafter Cost of services (COS) will be 63.5% of revenue every year Depreciation expense will be 7.5% of revenue every year SG&A expense will be 9.5% of revenue in 2021 and 2022 and then decrease to 9.0% thereafter Interest expense for 2021 will be based on the 2021 long-term debt balance, in the following years it will be based on the average long-term debt balance of the prior year and current year. The interest rate over the projection period will be 9.0% Tax rate of 25.0% Balance Sheet Operating cash level of $10.0 million every year Days sales in accounts receivable are 34 days every year Inventory turnover is 32 every year(inventory consists of recyclable materials resold)

FIN 3504 CASE ANALYSIS FIN 3504 SPRING 2022 FORECASTING 6 | P a g e Other long-term assets at 1.2% of revenue every year Days COS in accounts payable are 45 days every year Accrued expense 2.0% of COS every year Other long-term liabilities 2.0% of COS every year Dividend payout ratio to be maintained at 70% every year Maintenance capital expenditures of 8.5% of revenue every year Expansion capital expenditures are the cost of the acquisition in 2021, no expansion capx beyond 2021 WCC has 8 million shares outstanding Common stock balance is assumed to be 30 million for the years of 2021-2025

WASTE CONTROL CONCEPTS CORPORATION - FIN 3504 SPRING 2022 - Student File ($000) Actual Actual Actual Actual Actual 2016 2017 2018 2019 2020 Income Statement Revenue $ 245,000.0 $263,000.0 $ 280,000.0 $295,000.0 $308,000.0 Forecast 2021 Forecast 2022 Forecast 2023 Forecast 2024 Forecast 2025 $320,320.0 $333,132.8 $346,458.1 $360,316.4 $ 374,729.1 Cost of services Gross profit 155,500.0 89,500.0 166,000.0 97,000.0 177,835.0 102,165.0 188,900.0 106,100.0 197,250.0 110,750.0 203,403.2 116,916.8 211,539.3 121,593.5 220,000.9 126,457.2 228,800.9 131,515.5 237,953.0 136,776.1 Gross profit=Revenue-Cost of Services Depreciation expense SG&A expense Total expenses 20,325.0 25,500.0 45,825.0 22,415.0 26,700.0 49,115.0 21,900.0 28,700.0 50,600.0 22,550.0 29,600.0 52,150.0 24,195.0 30,760.0 54,955.0 24,024.0 30,430.4 54,454.4 24,985.0 31,647.6 56,632.6 25,984.4 31,181.2 57,165.6 27,023.7 32,428.5 59,452.2 28,104.7 33,725.6 61,830.3 EBIT 62,462.4 64,960.9 69,291.6 72,063.3 74,945.8 EBIT-Gross profit-Total expenses Interest Expense Pretax Profit Tax Net Income 43,675.0 4,875.0 38,800.0 9,700.0 $ 29,100.0 47,885.0 4,687.5 43,197.5 10,799.4 $ 32,398.1 51,565.0 4,312.5 47,252.5 11,813.1 $ 35,439.4 53,950.0 3,937.5 50,012.5 12,503.1 $ 37,509.4 55,795.0 3,562.5 52,232.5 13,058.1 $ 39,174.4 Balance Sheet Cash Accounts receivable Inventory Total current assets $ 5,000.0 $ 24,300.0 5,200.0 34,500.0 8,744.4 24,800.0 5,500.0 39,044.4 $ 12,871.3 26,245.0 5,900.0 45,016.3 $ 14,664.1 26,900.0 6,460.0 48,024.1 $ 17,801.4 29,200.0 6,640.0 53,641.4 $ 10,000.0 29,838.0 6,356.4 46,194.4 $ 10,000.0 31,031.5 6,610.6 47,642.2 $ 10,000.0 32,272.8 6,875.0 49,147.8 $ 10,000.0 33,563.7 7,150.0 50,713.8 10,000.0 34,906.3 7,436.0 52,342.3 Property, Plant, and Equipment - net Other long-term assets Total Assets 205,000.0 2,000.0 241,500.0 207,300.0 2,500.0 248,844.4 209,500.0 2,500.0 257,016.3 213,900.0 3,000.0 264,924.1 216,115.0 3,250.0 273,006.4 419,318.2 3,843.8 469,356.4 422,649.5 3,997.6 474,289.3 426,114.1 4,157.5 479,419.4 429,717.3 4,323.8 484,754.8 433,464.6 4,496.7 490,303.6 Accounts Payable Accrued Expenses Total Current Liabilities 19,750.0 3,150.0 22,900.0 21,500.0 3,525.0 25,025.0 23,500.0 3,765.0 27,265.0 24,500.0 4,020.0 28,520.0 25,100.0 4,300.0 29,400.0 25,077.1 4,068.1 29,145.2 26,080.2 4,230.8 30,311.0 27,123.4 4,400.0 31,523.4 28,208.3 4,576.0 32,784.4 29,336.7 4,759.1 34,095.7 Solve for debt level Debt - long-term Other long-term liabilities Total Liabilities 65,000.0 3,500.0 91,400.0 60,000.0 4,000.0 89,025.0 55,000.0 4,300.0 86,565.0 50,000.0 4,700.0 83,220.0 45,000.0 5,150.0 79,550.0 4,068.1 4,230.8 4,400.0 4,576.0 4,759.1 30,000.0 30,000.0 30,000.0 30,000.0 30,000.0 Common stock Retained earnings Total Liabilities and Equity 30,000.0 120,100.0 $ 241,500.0 30,000.0 129,819.4 $ 248,844.4 30,000.0 140,451.3 $257,016.3 30,000.0 151,704.1 $ 264,924.1 30,000.0 163,456.4 $ 273,006.4 WASTE CONTROL CONCEPTS CORPORATION - FIN 3504 SPRING 2022 - Student File ($000) Actual Actual Actual Actual Actual 2016 2017 2018 2019 2020 Income Statement Revenue $ 245,000.0 $263,000.0 $ 280,000.0 $295,000.0 $308,000.0 Forecast 2021 Forecast 2022 Forecast 2023 Forecast 2024 Forecast 2025 $320,320.0 $333,132.8 $346,458.1 $360,316.4 $ 374,729.1 Cost of services Gross profit 155,500.0 89,500.0 166,000.0 97,000.0 177,835.0 102,165.0 188,900.0 106,100.0 197,250.0 110,750.0 203,403.2 116,916.8 211,539.3 121,593.5 220,000.9 126,457.2 228,800.9 131,515.5 237,953.0 136,776.1 Gross profit=Revenue-Cost of Services Depreciation expense SG&A expense Total expenses 20,325.0 25,500.0 45,825.0 22,415.0 26,700.0 49,115.0 21,900.0 28,700.0 50,600.0 22,550.0 29,600.0 52,150.0 24,195.0 30,760.0 54,955.0 24,024.0 30,430.4 54,454.4 24,985.0 31,647.6 56,632.6 25,984.4 31,181.2 57,165.6 27,023.7 32,428.5 59,452.2 28,104.7 33,725.6 61,830.3 EBIT 62,462.4 64,960.9 69,291.6 72,063.3 74,945.8 EBIT-Gross profit-Total expenses Interest Expense Pretax Profit Tax Net Income 43,675.0 4,875.0 38,800.0 9,700.0 $ 29,100.0 47,885.0 4,687.5 43,197.5 10,799.4 $ 32,398.1 51,565.0 4,312.5 47,252.5 11,813.1 $ 35,439.4 53,950.0 3,937.5 50,012.5 12,503.1 $ 37,509.4 55,795.0 3,562.5 52,232.5 13,058.1 $ 39,174.4 Balance Sheet Cash Accounts receivable Inventory Total current assets $ 5,000.0 $ 24,300.0 5,200.0 34,500.0 8,744.4 24,800.0 5,500.0 39,044.4 $ 12,871.3 26,245.0 5,900.0 45,016.3 $ 14,664.1 26,900.0 6,460.0 48,024.1 $ 17,801.4 29,200.0 6,640.0 53,641.4 $ 10,000.0 29,838.0 6,356.4 46,194.4 $ 10,000.0 31,031.5 6,610.6 47,642.2 $ 10,000.0 32,272.8 6,875.0 49,147.8 $ 10,000.0 33,563.7 7,150.0 50,713.8 10,000.0 34,906.3 7,436.0 52,342.3 Property, Plant, and Equipment - net Other long-term assets Total Assets 205,000.0 2,000.0 241,500.0 207,300.0 2,500.0 248,844.4 209,500.0 2,500.0 257,016.3 213,900.0 3,000.0 264,924.1 216,115.0 3,250.0 273,006.4 419,318.2 3,843.8 469,356.4 422,649.5 3,997.6 474,289.3 426,114.1 4,157.5 479,419.4 429,717.3 4,323.8 484,754.8 433,464.6 4,496.7 490,303.6 Accounts Payable Accrued Expenses Total Current Liabilities 19,750.0 3,150.0 22,900.0 21,500.0 3,525.0 25,025.0 23,500.0 3,765.0 27,265.0 24,500.0 4,020.0 28,520.0 25,100.0 4,300.0 29,400.0 25,077.1 4,068.1 29,145.2 26,080.2 4,230.8 30,311.0 27,123.4 4,400.0 31,523.4 28,208.3 4,576.0 32,784.4 29,336.7 4,759.1 34,095.7 Solve for debt level Debt - long-term Other long-term liabilities Total Liabilities 65,000.0 3,500.0 91,400.0 60,000.0 4,000.0 89,025.0 55,000.0 4,300.0 86,565.0 50,000.0 4,700.0 83,220.0 45,000.0 5,150.0 79,550.0 4,068.1 4,230.8 4,400.0 4,576.0 4,759.1 30,000.0 30,000.0 30,000.0 30,000.0 30,000.0 Common stock Retained earnings Total Liabilities and Equity 30,000.0 120,100.0 $ 241,500.0 30,000.0 129,819.4 $ 248,844.4 30,000.0 140,451.3 $257,016.3 30,000.0 151,704.1 $ 264,924.1 30,000.0 163,456.4 $ 273,006.4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started