need help from 13-1 to 13-4

need help from 13-1 to 13-4

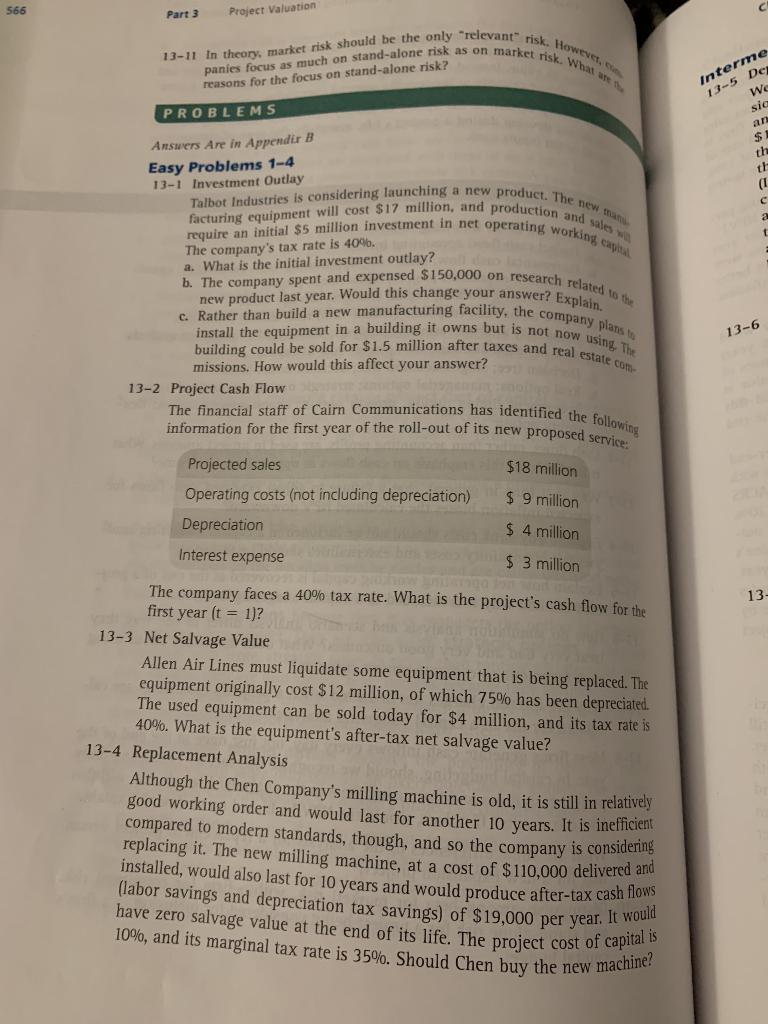

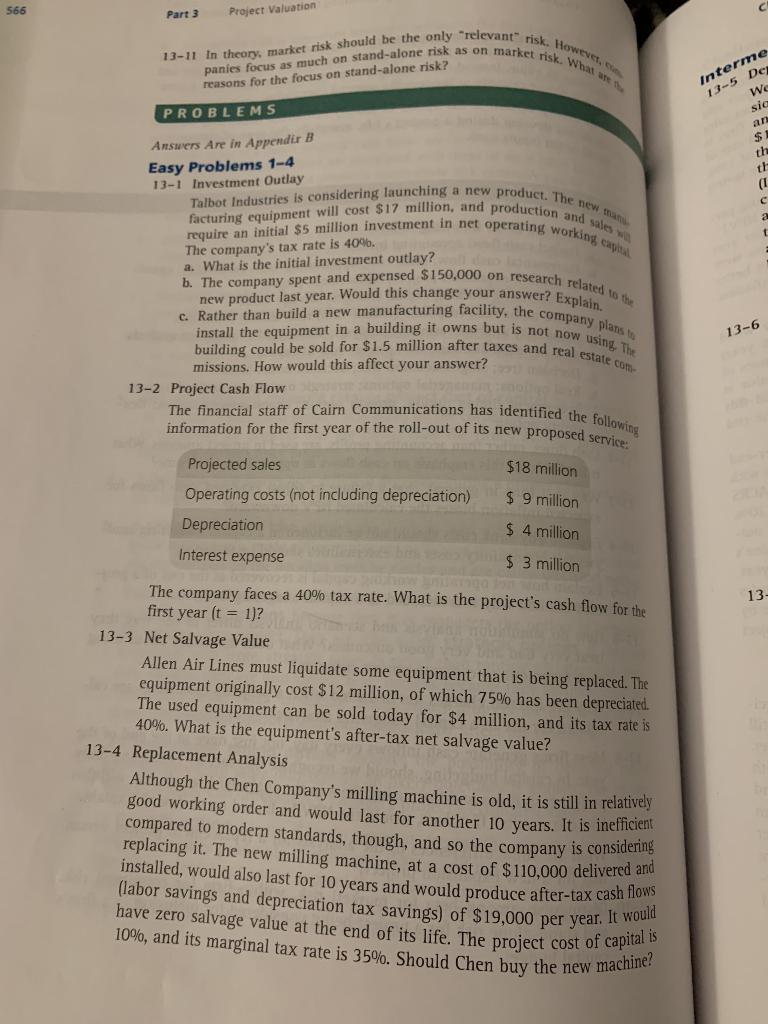

panies focus as much on stand-alone risk as on market risk. What we 10%, and its marginal tax rate is 35%. Should Chen buy the new machine? Project Valuation reasons for the focus on stand-alone risk? Interme 13-5 De we sid an $ th (1 The company's tax rate is 40%. 13-6 13-11 In theory, market risk should be the only relevant risk. However, Talbot Industries is considering launching a new product. The new ma facturing equipment will cost $17 million, and production and sales require an initial $5 million investment in net operating working cap b. The company spent and expensed $150,000 on research related to the c. Rather than build a new manufacturing facility, the company plans to new product last year. Would this change your answer? Explain. install the equipment in a building it owns but is not now using. The building could be sold for $1.5 million after taxes and real estate com The financial staff of Cairn Communications has identified the following information for the first year of the roll-out of its new proposed service: (labor savings and depreciation tax savings) of $19,000 per year. It would have zero salvage value at the end of its life. The project cost of capital is 566 Part 3 PROBLEMS Answers Are in Appendix B Easy Problems 1-4 13-1 Investment Outlay a. What is the initial investment outlay? missions. How would this affect your answer? 13-2 Project Cash Flow Projected sales $18 million Operating costs (not including depreciation) $ 9 million Depreciation The company faces a 40% tax rate. What is the project's cash flow for the first year (t = 1)? 13-3 Net Salvage Value Allen Air Lines must liquidate some equipment that is being replaced. The equipment originally cost $12 million, of which 75% has been depreciated. The used equipment can be sold today for $4 million, and its tax rate is 40%. What is the equipment's after-tax net salvage value? 13-4 Replacement Analysis Although the Chen Company's milling machine is old, it is still in relatively good working order and would last for another 10 years. It is inefficient compared to modern standards, though, and so the company is considering replacing it. The new milling machine, at a cost of $ 110,000 delivered and installed, would also last for 10 years and would produce after-tax cash flows Interest expense $ 4 million $ 3 million 13

need help from 13-1 to 13-4

need help from 13-1 to 13-4