Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help from question k. a. Find the FV of $1,000 invested to earn 12% after 5 years. Round your answer to the nearest cent.

Need help from question k.

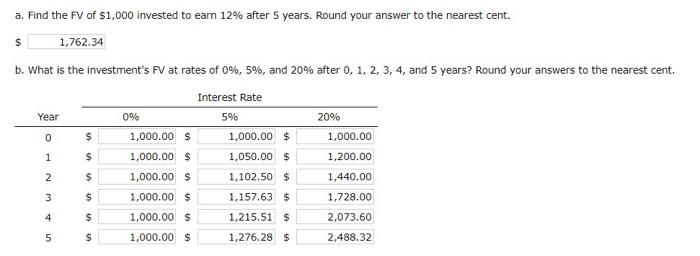

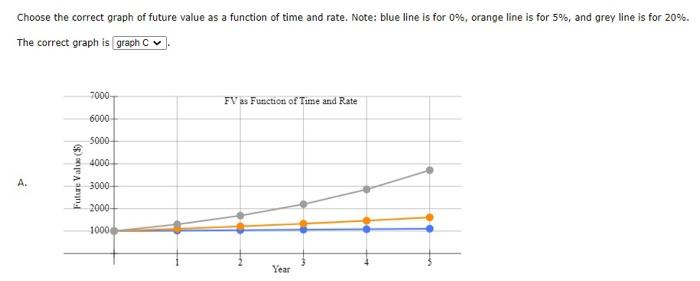

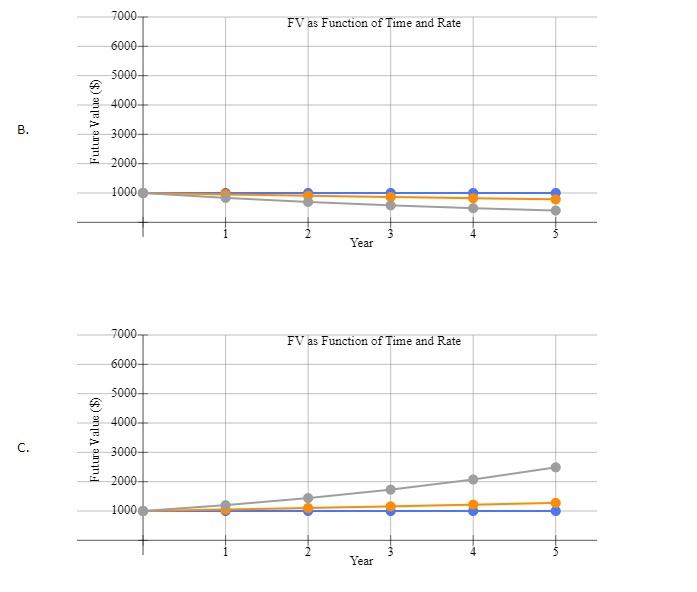

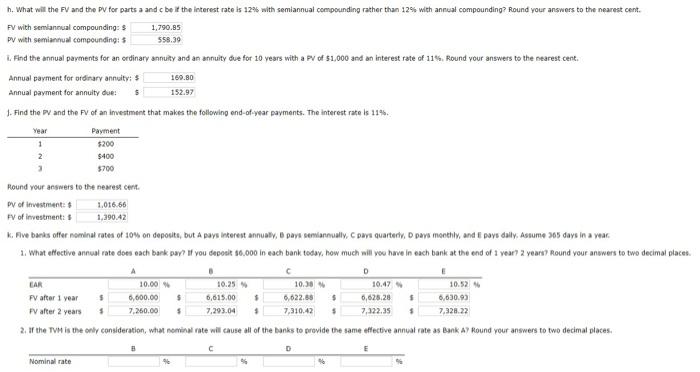

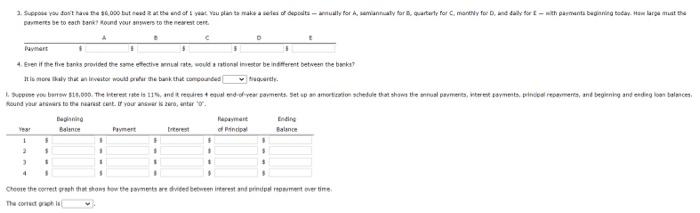

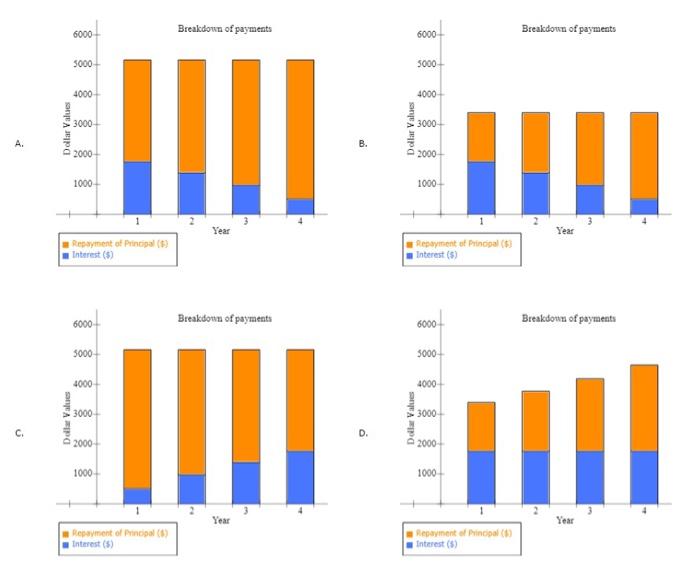

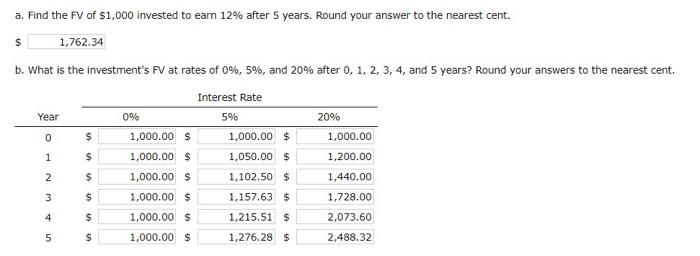

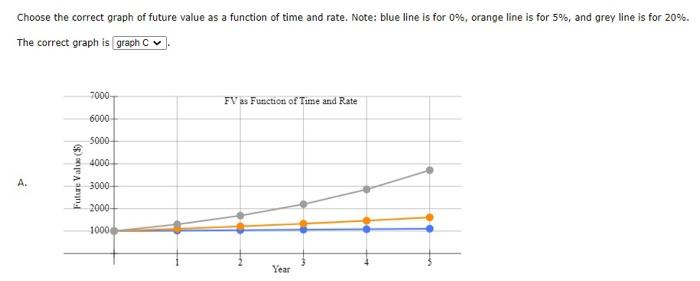

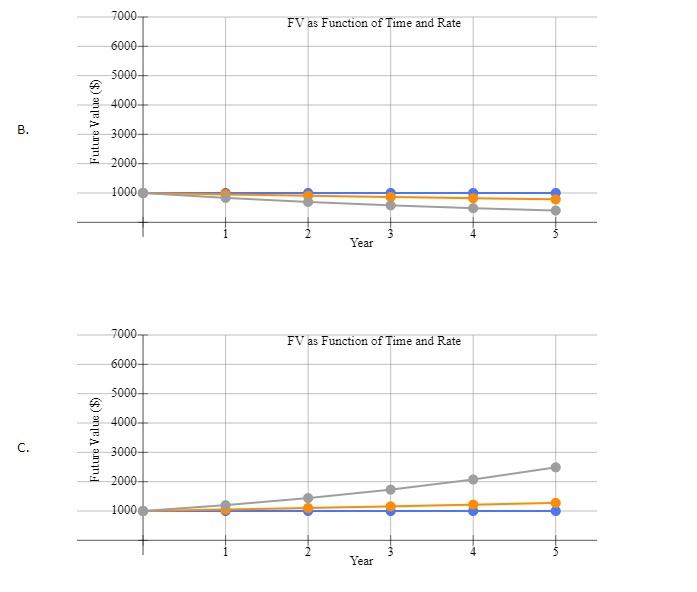

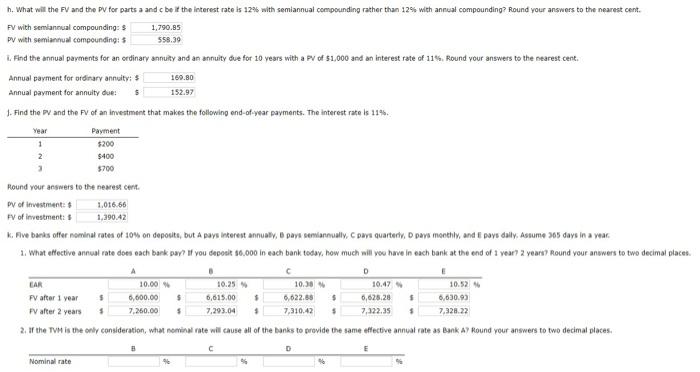

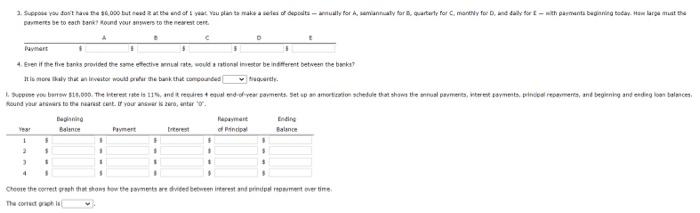

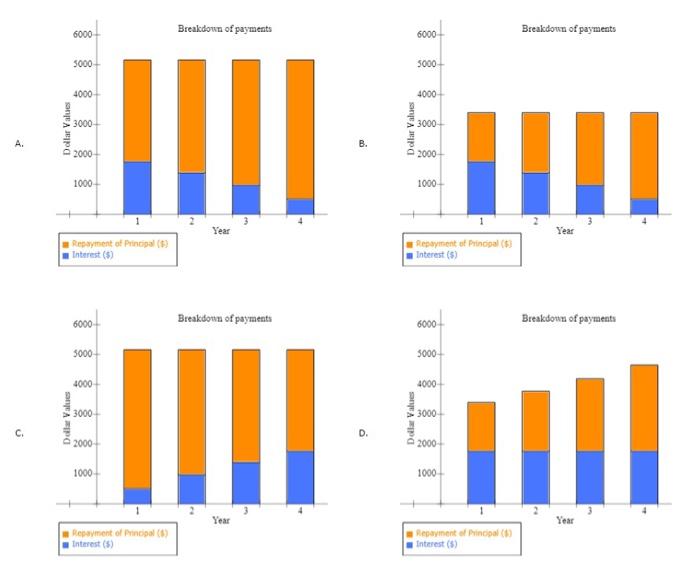

a. Find the FV of $1,000 invested to earn 12% after 5 years. Round your answer to the nearest cent. 1,762.34 $ b. What is the investment's FV at rates of 0%, 5%, and 20% after 0, 1, 2, 3, 4, and 5 years? Round your answers to the nearest cent. Interest Rate Year 0% 5% 20% 1,000.00 0 $ 1 $ 1,000.00 $ 1,000.00 $ 1,000.00 $ 1,000.00 $ 1,000.00 $ 1,050.00 $ 1,102.50 $ 1,200.00 2 $ 1,440.00 3 $ UF 1,157.63 $ 1,728.00 4 $ 1,215.51 $ 2,073.60 1,000.00 $ 1,000.00 $ 5 $ 1,276.28 $ 2,488.32 Choose the correct graph of future value as a function of time and rate. Note: blue line is for 0%, orange line is for 5%, and grey line is for 20%. The correct graph is graph Cv 7000 FV as Function of Time and Rate 6000 5000 4000 A. Future Value (5) 3000 2000- 1000 Year 7000 FV as Function of Time and Rate 6000- 5000 4000 Future Value ($) B. 3000 2000 1000 Con Year 7000 FV as Function of Time and Rate 6000- 5000 4000 Future Value ($) C. 3000 2000 1000 Year h. What will the FV and the PV for parts and cbe if the interest rate is 12% with semiannual compounding rather than 12% with annual compounding? Round your answers to the nearest cent. FV with semiannual compounding: 5 1.790.85 PV with semiannual compounding: 5 558.39 L. Find the annual payments for an ordinary annuity and an annuity due for 10 years with a PV of $1,000 and an interest rate of 115. Round your answers to the nearest cent. Annual payment for ordinary annuity: $ 169.80 Annual payment for annuity due $ 152.97 1. Find the and the Pv of an investment that makes the following end-of-year payments. The interest rate is 11%. Payment 1 $200 2 $400 5700 Round your answers to the nearest cent 1.016,66 FV of investment: 1,290.42 k. Five banks offer nominal rate of 10% on depouts, but Apays interest annually, Opava semiannually, Cpas quarterly D para monthly and I pays daly, Assume 385 days in a year 1. What effective annual rate does each bank bar? If you deposit $6.000 in each bank today, how much will you have in each bank at the end of 1 year? 2 years) Round your answers to two decimal places. D CAR 10.00 10.25 10.38 10.47 10.52 PV after 1 year 6,000.00 $ 0,615.00 6,622.63 $ 6,628,28 $ 6.63099 PV after 2 years 7.260.00 $ 7.293.04 $ 7.310.42 5 7,322.35 $ 7.328.22 2. If the TV is the only consideration, what nominal rate will cause all of the banks to provide the same effective annual rate as Bank A Round your answers to two decimal places. B C D Nominal rate B 3. Supone you don't hawe 00 But the end of yeat Yulan take a selepedtsytor Antly forrt, Porcmany D. call fort with patient beginning today. How largest Damer be to each and round your answers to the nearestert Payment + 5 4. Even if the banks provided the same efecte al rate would rational investorbe indifferent between the back Ils moraly the Irwit would the bank that comparare Lebrow $4,000. The Werte is 11 metres i dove parents et amortion schedule that shows the us permettere amets, preparer, and beginning and ording to be Round your answers to the nearest cantU your answer Kentary thing apart Balance rest Principal Balance 1 3 $ 3 4 . Cheere the correct the song how the mettre divided between interest and not over time The control Breakdown of payments Breakdown of payments 6000 6000 5000 5000+ 4000 4000 3000 Dollar Values 3000- Dollar Values A B. 2000 2000+ 1000 1000 1 Year Year Repayment of Principal ( Interest (5) Repayment of Principal Interest (5) Breakdown of payments 6000 6000 Breakdown of payments 5000 3000 4000 4000 3000 Dolar Values Dolar Values 3000 C. D. 2000 2000- 1000 1000 Year Year Repayment of Principal (5) Interest (5) repayment of Principal Interest

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started